How Do I Convert My Vantagescore To Fico Score

4.8/5ConversionconvertFicoVantagescoreFICO

Accordingly, why is my vantage score higher than FICO?

If you’ve had late payments on your credit cards, they will have about the same impact on both your FICO and your VantageScore. But if you’ve had late payments on your mortgage, you might find you have a higher FICO score than VantageScore.

Beside above, what is a Vantage credit score? A VantageScore is a jointly developed by the three major bureaus to predict how likely you are to repay borrowed money. bureaus Experian, TransUnion and Equifax came up with the algorithm to produce VantageScore in 2006, competing against the better-known FICO scores.

In this regard, is Vantage score lower than FICO?

While VantageScore and FICO now use the same 300-850 range, VantageScore tiers run about 50 points lower than FICO tiers.

Do any lenders use VantageScore?

Lenders issuing credit cards and auto loans are among those who use the VantageScore. It’s likely the score is from one of two sources: FICO or VantageScore.

What Scores Are Needed To Qualify For The Best Refinancing Or Loan Rates

FICO credit scores are often divided into five categories from worst to best as follows:

- Very poor : It is essentially impossible to get credit with these scores.

- Fair : These are subprime borrowers and generally qualify for the worst rates.

- Good : These applicants qualify for better rates, and it is assumed only about 8% of them are likely to be delinquent.

- Very good : These applicants usually qualify for better-than-average rates.

- Exceptional : Anyone with a score in this range should have no problem qualifying for the best rates.

The VantageScore scale runs as follows:

- Very poor : Applicants are unlikely to be approved for any credit.

- Poor : Applicants may qualify for some of the worst rates and may have larger down payments.

- Fair : These applicants are usually approved for credit but dont get the best rates.

- Good : These applicants stand a good chance of getting more competitive rates.

- Excellent : Those in the top range qualify for the best rates and offers.

Lets Start With Your Fico Credit Scores

In the old days, banks and other lenders developed their own score cards to assess the risk of lending to a particular person. But the scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various credit card, mortgage and auto lending decisions.

Read Also: Why Is There Aargon Agency On My Credit Report

Why Is Your Credit Score Lower Than Credit Karma Told You

February 23, 2021 by First Residential Mortgage

Did you recently try applying for a mortgage or another loan after you looked up your credit score using the free tool provided by Credit Karma?

Perhaps you faced an unwelcome surprise. The lender might have turned you down or offered you a lower rate than youd projected.

There is a specific explanation for why this happensand you are not the only borrower to have this experience.

Lets find out why the credit score that was pulled while processing your application for a mortgage was lower than the score Credit Karma pulled up online.

As CNBC explains, Consumers tweeted about going to apply for a credit card or loan thinking they have good or excellent credit, only to soon find that the credit score that the card issuer or lender pulled was lower than what they saw on Credit Karma.

Here is what is going on here. Credit Karma pulled up your VantageScore credit score. But the lender pulled up your FICO credit score.

Most customers know they have a FICO score, but many do not know they also have a VantageScore credit score as well as other credit scores.

Why Does My Credit Score Differ

Scores vary between systems because they look at different factors to determine your creditworthiness. TransUnion, Equifax, and Experian all use the VantageScore 3.0 credit scoring model. VantageScore looks at data compiled by the three credit bureaus, with a primary focus on your total credit usage, credit card balances, credit mix, and payment history. Less influential factors in determining your VantageScore are the age of your credit history and new accounts.

On the other hand, FICO scores primarily look at your payment history and how on time you are with payments on your loans and credit cards. Your total debt is also an important factor, especially when it’s compared with your credit limit. For example, if the balance on your credit card is $3,000 and the credit limit is $4,000, that will impact your FICO score.

Financial experts typically recommend that your credit usage is below 30 percent of your credit availability. So, if you have a $4,000 credit limit, your balance should remain below $1,200.

FICO scores also give more importance to the duration of your credit history. Therefore, if you have old credit cards that you dont often use, closing them could hurt your FICO score. As most banks and lenders will look at your FICO score when deciding whether to give you a loan, you may want to pay closer attention to it than other scores.

Also Check: What Is Syncb Ntwk On Credit Report

Similarities Between Fico And Vantagescore

Both the FICO Score and VantageScore models use a credit score range from 300 to 850. Both consider the same general factors when assessing your creditworthiness: your payment history, how much credit youre using, the length of your credit history, the different types of credit you have and whether youve recently applied for new credit.

Comparing Nates Credit Scores On Credit Karma Vs Wells Fargo

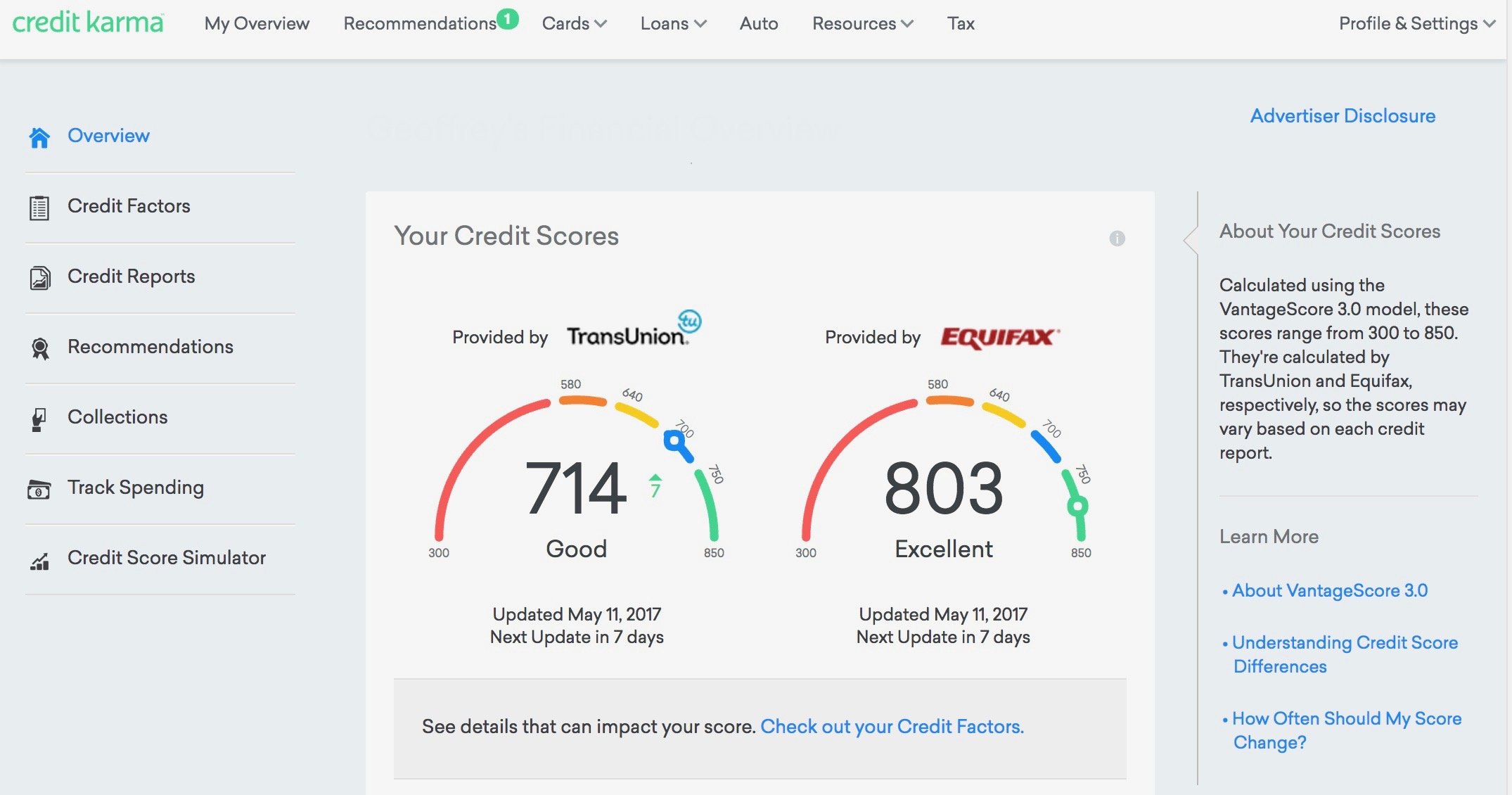

As an example, we experimented to see how accurate Credit Karmas scores were for our Co-founder, Nate Matherson. Here is a screenshot from Nates Credit Karma account:

Also on July 9th, 2019, Nate applied for a personal line of credit from Wells Fargo. Here is a screenshot from Nates Wells Fargo loan application:

As you can see in the examples above, Nates Experian FICO Score 9 was 25 points higher than his VantageScore from Transunion and 20 points higher than his VantageScore from Equifax.

In Nates case, Credit Karma was accurate enough to say that he had an excellent credit score, but wasnt perfect.

Interested in viewing your free credit score with Credit Karma?

- Receive alerts when changes to your reports occur

- View a breakdown of factors that are currently affecting your score

- Make better decisions with personalized recommendations

You May Like: Does Acima Report To Credit

How Accurate Are Sites Like Credit Karma Credit Sesame And Mint

- How Accurate Are Sites Like Credit Karma, Credit Sesame, and Mint?

It seems like so many websites these days want to tell you about your credit score or offer credit monitoring. But if knowing your credit score is truly important to you, who do you trust? How do you know if what they tell you is accurate?

In this article, we break down how some of the most popular credit score sites work, where they get their information, and how this compares to how credit bureaus calculate your creditworthiness.

You Can Access Perks And Enjoy The Best Rewards

Its no secret that the best rewards credit cards require at least good credit. And McClary says there are other perks, as well.

With a good credit score, you can also take full advantage of the best introductory offers and reward incentives on new credit cards, says McClary. Some higher tier credit cardholders are able to receive special invitations to exclusive events, free access to online streaming services and even free swag.

One of CNBC Selects best credit cards for sports fans, movie buffs and adventure seekers is the Capital One® Savor® Cash Rewards Credit Card, which delivers a competitive 4% cash back on dining and entertainment, 3% at grocery stores and 1% on all other purchases. Currently, new cardholders can also earn a one-time $300 cash bonus once they spend $3,000 on purchases within the first three months from account opening.

Read Also: What Credit Score Do You Need For Amazon Prime Visa

Why Is My Credit Score Different When Lenders Check My Credit

The credit score you see and the one your lender uses may be different for several reasons.

To start, its important to understand that credit scores are based on the information found in credit reports maintained by the three major credit bureaus. If those reports differ, a credit score based on one report may not be identical to a score based on another.

Another reason the scores differ might be because theres more than one credit scoring model, and theres no guarantee the one youre using to check your own credit is the same one your lender relies on. Plus, each model regularly releases updated versions of the scores it producesand there are score versions that are specific to certain industries. For example, when you check your for free, you might receive a score calculated using the VantageScore® 3.0 model, but your mortgage lender might use the FICO® Score 2 to assess your credit.

Well explain more about the differences between credit scoring models below, as well as other reasons your score may differ. Whats important to remember, though, is that the same positive behaviorpaying bills on time, limiting credit card debt, maintaining a long credit historywill typically lead to a good or excellent credit score across the different models and versions and credit bureaus.

Heres what you need to know about the various credit scores you have, and which are most important to keep an eye on when youre seeking new credit.

Learn More About Your Credit Score

A 600 FICO® Score is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and reduced fees. You can begin by getting your free credit report from Experian and checking your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Don’t Miss: Repossession Credit Repair

Vantagescore: The Credit Score Credit Karma Shows You

When you look up your credit score on Credit Karma, the website reports a specific type of credit score, which is your VantageScore. This score is not the one that determines what you qualify for when you apply for a mortgage, and it is calculated differently than your FICO score.

Here is how influential different financial factors are when calculating VantageScores:

- Payment history: extremely influential

- Age and type of credit: highly influential

- Percentage of credit limit used: highly influential

- Total balances and debt: moderately influential

- Recent credit behavior and inquiries: less influential

- Available credit: less influential

VantageScore ranges that are possible include:

- Excellent: 750 to 850

- Needs work: 300 to 639

Why Do Credit Scores Matter

Ultimately, your credit score is important in many ways. To give just a few examples:

- Your credit score determines the types of loans you can get

- It determines the mortgage interest rates you pay

- It affects how large of a house or how expensive of a car you can afford

- Insurers in most states use credit scores to set premiums for auto and homeowners coverage. Policyholders with bad credit scores often pay more

- Landlords use credit scores to decide who gets to rent their apartments

- Cell phone companies might require a deposit if your credit is too low

Whether youre looking for a mortgage or any other financial product, your credit score makes a big difference. Thats why its so important to know yours before you apply.

Read Also: Credit Report With Itin Number

Places To Get Your Fico Score And Credit Report

Fortunately, you can receive your FICO score from many credit card providers and banks, including GOFreeCredit.com .

Just make sure you read the fine print to find out which credit score the service is offering, or you could wind up in the same boat as checking your score through Credit Karma. Credit bureau Experian also allows people to get a free copy of their Experian credit report and FICO credit score. It takes just a few minutes, although you will need to answer a few security questions, usually related to finances and work history.

You can obtain free copies of your credit reports from all three credit bureaus once per year at the website AnnualCreditReport.com. You can order your FICO score through the service, as well. Also, any time you are turned down for credit, you are eligible for a free copy of your credit report through AnnualCreditReport.com.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the very poor credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this very poor credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A very poor credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

You May Like: How To Remove A Repo From Credit

Something Was Recorded On Your Credit Report

Think back on your payment history have you missed a credit card payment in the last few months? Were there any bills that you may have missed in previous months?

Missed payments are typically not reported to the credit bureaus until theyre at least 30 days late, so your score wont be impacted until after that time. Your score will be hurt by a payment thats more than 30 days late, but a delinquency, referring to a payment that is over 30 days late 60, 90, or even 180 days can devastate your score.

Derogatory marks such as tax liens, charge-offs, collections, foreclosures or bankruptcies have drastic impacts on your credit too, and it may take weeks or months for them to show up on your report. If youve experienced any of these, it may take time for your score to change.

How Many Points Off Is Credit Karma

The only possible answer is, a few if any. Your credit score can vary every time it is calculated depending on whether the VantageScore or FICO model is used, or another scoring model, and even on which version of a model is used. The important thing is, the number should be in the same slice of the pie chart that ranks a consumer as “bad,””fair,””good,””very good,” or “exceptional.”

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

An Account Has Closed

When you pay off a loan, your credit score could be negatively affected. This is because your credit history is shortened, and roughly 10% of your score is based on how old your accounts are. If youve paid off a loan in the past few months, you may just now be seeing your score go down.

Your score could be negatively impacted by a closed credit card, too. Not only is your credit history shortened, but your credit limit would also decrease and your credit utilization ratio would be impacted.

Often youll be the one authorizing a credit card to close, but card companies can close them without your knowledge. The Equal Credit Opportunity Act allows creditors to close a card due to inactivity, delinquency or default with no notice. If they close an account for any other reason, they only have to give you 30 days notice after closing the account, so you could have a closed credit card that you dont know even know about.

How To Improve Your Credit Score

When you work to improve your credit score, you might hope to see an overnight improvement. Unfortunately, it can take months or years to see serious progress towards your target credit score. If you have credit mistakes in your past, they might hold you back for a few years.

At some point, your past mistakes will have less weight on your credit score but it important to know this as you work to improve your credit score.

The best place to start is by paying down your debts. Whether you try the snowball method or the avalanche method, find something that will motivate you to pay down your debts. In addition to paying down your debt, make sure that you are making on-time payments to your debts.

Dont let a missed due date tank your credit score. If you cant remember to make payments on time, then set up autopay for your accounts to avoid any problems.

If you need help building your credit score, then our may be able to help. It will walk you through the steps of building a better credit score, no matter where you are starting from.

If you are taking action to improve your finances, dont stop with your credit score! You can make progress in multiple areas of your personal finance. Dont let your past financial decisions hold you back from creating a worry-free future.

Sarah

You May Like: How To Check Credit Score Without Ssn