Find Out Who Owns The Debt

Once you have a copy of your credit report, youll be able to see who currently owns the debt. You need to find out if Capital One still owns the unpaid credit card debt or if they sold it to a collection agency.

If your credit report lists the debt as a charge off then Capital One most likely sold it to a collection agency. If its listed as unpaid or as a collection then Capital One probably still has the debt.

Capital One Ventureone Rewards Credit Card

Best for no annual fee travel rewards

- This card is best for: Anyone who wants a no annual fee travel rewards card with an attainable sign-up bonus to boost your first-year earnings.

- This card is not a great choice for: Those who want a higher rewards rate for specific bonus spending categories.

- What makes this card unique? The Capital One VentureOne Rewards Credit Card is a simple, low cost travel card that allows you to earn miles on your daily purchases and boost your earnings with an attainable sign-up bonus .

- Is the Capital One VentureOne Rewards Credit Card worth it? This card is a strong choice for those looking to earn a modest amount of miles while avoiding paying an annual fee. However, those with good credit may see better value from a higher-tier Capital One card or another one of the top travel rewards cards.

Jump back to offer details.

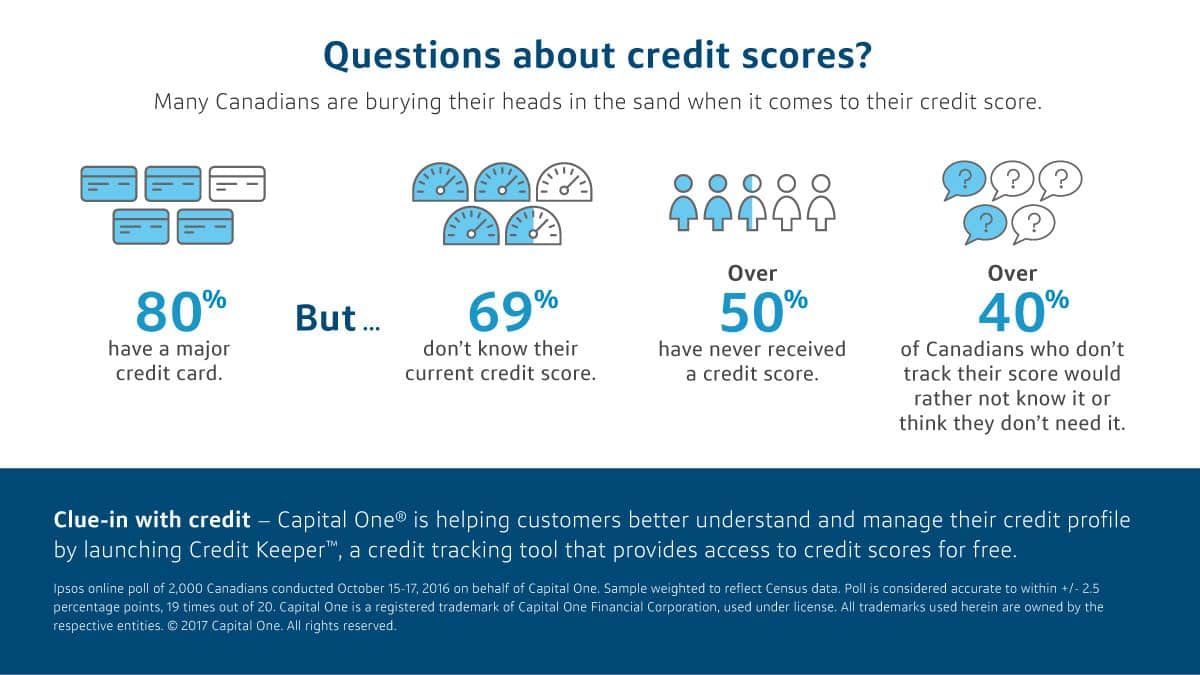

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780, also on a 300â850 range.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

You May Like: Does Paypal Credit Affect Your Credit Score

High Credit Utilization Ratio

Some months are more expensive than others. Having to use most of your business credit limit can cause a large drop in your personal credit score. Repaying your balance will restore your score.

Another unintended consequence is that you may strive to maintain a maximum 30% credit utilization ratio for your business credit card to avoid a personal score drop. This can be a nuisance even when you pay your balance in full each month.

Dont Miss: Does Paypal Working Capital Report To Credit Bureaus

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

You May Like: Aargon Agency Settlement

This Card Is Best For

- Prefers uncomplicated rewards with single rate for all spendingMinimalist

- Resists or refuses an annual fee on principle or due to costAnnual Fee Averse

- Earning a primary or side income from a small businessBusiness Owner

The Capital One Spark Classic is a solid option for small business owners with limited or fair credit, who may have difficulty getting most other cards. Its 1% cash-back rewards are nothing to crow about, but this card mainly provides the opportunity to acquire a credit line while also building a credit history that could help you to graduate to more rewarding alternatives.

The card is especially worth considering for business owners who dont anticipate often , carrying a balance on the card, which could hurt both their personal credit score and that of their business. Having the funds available to pay off what you charge to the account every month and making timely payments will help achieve the goal of building a fine credit record.

Since it lacks an annual fee, Capital One Spark Classic is also an economical choice for those who seek credit-card travel pluses that might otherwise cost you when taking a trip. It provides secondary rental-car insurance coverage, for example, and travel assistance when youre away from home. Its also a decent choice for use abroad, since it doesnt charge a foreign transaction fee, typically of 3%, that many cards impose on purchases made outside the United States.

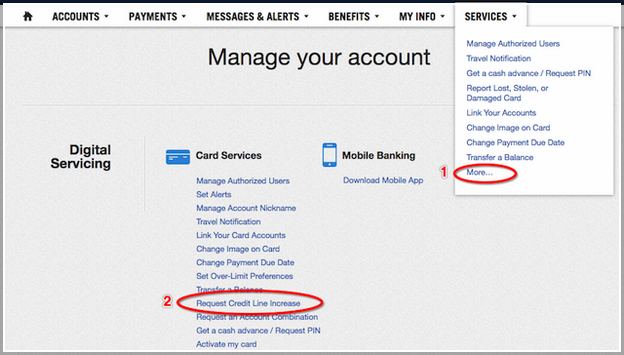

How Long Does A Credit Line Increase Take

If youre requesting the increase online, your credit limit increase may be approved immediately after you provide some information, such as your employment status and annual income. In other cases, it might take a few days to get a response from the issuer.

Similarly, if you call to request an increase, a Capital One representative might give you the decision right away or take a few days to review your account.

Read Also: Does Zzounds Report To Credit Bureau

Read Also: Check Credit Score Without Ssn

Will My Business Credit Card Activity Affect My Personal Credit

Most small business credit cards require the business owner/cardholder to personally guarantee the debt. That means that if the balance isnt paid off through the business, the owner will be on the hook for the entire amount. That also means business account activity may spill over to the owners personal credit reports, depending on each card issuers policy.

Some card issuers only report activity to the cardholders personal credit reports if the owner defaults. Others will report all activity, whether it is positive or negative.

How To Check Your Own Credit Reports

There are a lot of ways to check your own for free.

We recommend that you use AnnualCreditReport.com. This website is sanctioned by the U.S. government and does not force you to sign up for any subscriptions. You can get a free credit report from each credit bureau once per calendar year, free of charge.

If you want to look at your credit report more often, we recommend that you pull one report every four months. That lets you rotate between credit bureaus, getting free reports while getting updates every four months.

Many card issuers, including Capital One and Discover, let you look at your credit report as a benefit of being a cardholder.

While the reports from these other free services dont come directly from a credit bureau, theyre good enough to let you keep track of things and notice big changes. I use all three of the options I mentioned and its helped me improve my credit score to just under 800 in about 7 years.

When you do want to pull a copy of your report from AnnualCreditReport.com, use these tips.

- Enter your information accurately and double-check it. Mistakes might lock you out temporarily.

- Youll be asked verification questions. Some of these are trick questions, so dont be afraid to answer none of the above.

- Save or print a copy of your report as soon as you get it, otherwise, youll lose it if you close the browser window.

- Consider pulling your report from a different bureau every four months. That lets you get consistent updates for free.

Recommended Reading: Does Zzounds Report To Credit Bureau

Get Your Capital One Collections Removed Today

If youre looking for a reputable company to help you with collection accounts and repair your credit, we HIGHLY recommend Lexington Law.

Call them at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

- Top Trending Debt Collection Agencies

-

Heres a list of some of the nations most popular debt collectors that cause damage to your credit.

You May Like:

Monthly Mortgage Or Rent

This information is very important to banks because it will tell them more about your monthly financial obligations. If you have a lower income with a high monthly mortgage or rent, then your odds of getting a good credit limit increase will begin to go down. ;If you dont have a monthly mortgage or rent payment, you can enter $0.

Recommended Reading: Ccb/mprcc On Credit Report

Check All Three Credit Reports

Before you contact Capital One, youll want to find out the extent of the damage. You can request a copy of your credit report from the three major credit bureaus:

- Experian

- Equifax

- TransUnion

Sites like AnnualCreditReport.com can send you a free copy of your credit report without negatively affecting your credit. Youll want to take note of the creditor, the date it was listed, and any other important details.

Whats The Difference Between Authorized Users Co

So what about account co-signers and joint accounts? Here are some more details about how they work:

- Co-signer: A co-signer vouches for someone whoâs applying for their own credit card. The co-signer is telling the credit card company that if the cardholder canât pay, they will. Typically, co-signers donât get a card of their own, donât receive monthly statements and donât have access to the credit card account. And not all issuers allow co-signers.

- Joint accounts: A joint credit card works like a traditional credit card, except the account is shared. Cardholders get their own cards linked to the account. And both cardholders are responsible for paying the balance every monthâno matter who made the original purchases.

Keep in mind that some credit card issuers may provide different levels of access for authorized users. And in some cases, the account holder may be able to make the authorized user a manager of the account, which could mean increased account access.;

You May Like: How To Get A Bankruptcy Off Your Credit Report

Capital One Platinum Credit Card

Best for limited credit history

- This card is best for: Anyone who wants to build their credit history with responsible use and healthy financial habits.

- This card is not a great choice for: Those who want to be rewarded for regular spending or receive a sign-up bonus.

- What makes this card unique? The Capital One Platinum gives those pursuing fair credit an opportunity to prove their creditworthiness so they can upgrade to a better credit card in the future.

- Is the Capital One Platinum Credit Card worth it? If you have fair credit and do not want to pay an annual fee, this card is a solid choice. Just make sure to keep a low balance and always pay your credit card bill early or on time because the regular APR can be unforgiving.

Jump back to offer details.

Amendment To Terms Of Use To Allow Personal Visits

In 2014, Capital One amended its terms of use to allow it to “contact you in any manner we choose”, including a “personal visit . . . at your home and at your place of employment.” It also asserted its right to “modify or suppress caller ID and similar services and identify ourselves on these services in any manner we choose.” The company stated that it would not actually make personal visits to customers except “As a last resort, . . . if it becomes necessary to repossess sports vehicle”. Capital One also attributed its assertion of a right to “spoof” as necessary because “sometimes the number is ‘displayed differently’ by ‘some local phone exchanges,’ something that is ‘beyond our control'”.

Read Also: Aargon Collection Agency Reviews

Will Capital One Remove A Charge Off

A “charge off” means Capital One has sold the credit card debt to a collections agency. If a debt collector is contacting you about unpaid credit card debt, the first thing you should do is have them validate the debt. Unverified debt can be disputed, and with help from Credit Glory, you can get it removed .

Capital One Credit Line Increase Application

After signing into your account, you should see the pop up for entering in your information for a credit line increase request. The pop-up will ask you to input the following details:

- Total annual income

- How much you spend on all of your credit cards each month

- How much you will spend on your Capital One card in a month

- Maximum desires line of credit

Keep in mind that in some cases Capital One might request for you to verify the information that youve input, so consider that when inputting details like income and rent.;

Read Also: How Long A Repo Stay On Your Credit

Expansion Into Auto Loans

In 1996, Capital One expanded its business operations to the United Kingdom and Canada. This gave the company access to a large international market for its credit cards. An article appearing in the “Chief Executive” in 1997 noted that the company held $12.6 billion in credit card receivables and served more than nine million customers. The company was listed in the Standard & Poor’s 500, and its stock price hit the $100 mark for the first time in 1998.

Throughout its history, Capital One has focused on making acquisitions of monolines in various related sectors. In 2005, the company acquired Louisiana-based Hibernia National Bank for $4.9 billion in cash and stock. It also acquired New York-based North Fork Bank for $13.2 billion in 2006. The acquisition of smaller banks reduced its dependency on the credit business alone. Other companies acquired by Capital One include Netspend for $700 million in 2007, Chevy Chase Bank for $520 in 2009, IDG Direction division for $9 billion in 2011, and General Electric’s Healthcare Financial Services Unit for $9 billion in 2015.

During the subprime financial crisis of 2008, Capital One received $3.56 billion in investments from the US Treasury courtesy of the Troubled Asset Relief Program in 2008. The company was forced to close its mortgage division, GreenPoint Mortgage, due to the losses incurred by investors. It paid back $3.67 billion to the US Treasury for the repurchase of the company stock.

Too Many New Credit Cards

Possible the largest downside to being a Capital One authorized user is if you have good credit and plan on applying for one of the best Chase credit cards soon.

You see, Chase discourages card churning with its 5/24 rule. Your application for almost any Chase-issued travel credit card will most likely be declined when you have added at least five new credit cards to your credit report in the last 24 months. This includes accounts where you are an authorized user.

So if you have four new credit cards, you should apply for the Chase Sapphire Preferred or Ink Business Preferred Card first to be your 5th new credit card in the last 24 months. If you are above the 5/24 mark and want a Chase card, the primary cardholder can still add you as an authorized user. However, this too will count as a new card.

Read Also: Fingerhut Guitars

Don’t Miss: Speedy Cash Credit Check

What Credit Bureau Does Capital One Use

So, you have a capital one credit card and youre wondering which major credit bureau the lender is using. A lot of lenders only use one major credit bureau when they pull your credit report.

Other credit lenders can pull 2, even all 3 major credit bureaus, but what about Capital One?

First, theres a lot of different scenarios that can play a role as it pertains to what credit bureaus a specific credit card lender is going to use. For Capital One, there is a few that you need to know .

When it comes to Capital One, they can pull credit reports from all 3 major credit bureaus, which includes TransUnion, Experian and Equifax. This is called the triple pull.

Why does Capital One pull your credit from all 3 when other banks will only use one credit?

Well, lets think about that for a second.

Does it make sense to pull all 3 credit reports versus just one or two? Absolutely, you want to get a complete picture of the person youre going to potentially lend too.

Some lenders only report to one credit bureau. Credit scores can widely differ if your lenders favor one credit bureau versus the next.

Our opinion, Capital One does it to minimize risk and you cant blame them for that.

Were sure it works into their algorithms for choosing people that are worthy of having credit.

This gives Capital One more data to implement into the complete equation, allowing them the opportunity to be more accurate than other lenders as it pertains to determine rates, interest, loan amounts, etc.

Removing Capital One Collections From Your Credit Report

Collections can hurt your credit score and remain on your credit report for up to 7 years regardless of whether you pay it or not. Unfortunately, paying the collection could even lower your credit score.

However, it is possible to have it removed before 7 years, and you may not even have to pay it.

Phone number: 383-4802

Read Also: Cbcinnovis On My Credit Report

Does Capital One Report Authorized Users To Credit Bureaus

Capital One notifies the three major credit bureaus that you are an authorized user for personal credit cards. This reporting applies to the Venture, Quicksilver, Savor, and Platinum card families, including some of the best Capital One credit cards for travel. Your Equifax, Experian, and TransUnion credit report usually update with your new credit account information in a few business days.

This is standard reporting practice for all of the large banks including Chase and American Express. Reports to all three can make sure your credit score is consistent across all three bureaus.

Your credit report will show the account age and credit utilization ratio for that card. This information will affect the primary cardholders credit score more because they are responsible for paying the monthly balance.

However, being an authorized user can either help or hurt your credit score. The answer depends on the age and how you manage your other credit accounts.