How Do Credit Bureaus Work

After collecting your information, credit bureaus record your credit activity in a , which is then used to determine your .

Credit bureaus dont determine your eligibility for the best credit cards and loans. These companies simply gather credit information and sell it to creditors, insurance companies, employers and businesses that have legitimate reasons to access your credit information.

Nevertheless, your credit report and credit score affect lending decisions. So whether or not a lender will approve you for a loan or credit card, how much they lend you, and the interest rate they’ll charge you will depend on your credit history.

Monitor Your Credit Reports For Late Payments

Often, you’ll know when bills are past due and how much you owe. But sometimes there’s a mistake, creditors don’t have your current contact information, or you forget about an account and miss the correspondence.

Monitoring your credit reports can help you stay on top of changes, such as reported late payments, and let you quickly react when you see something is amiss. To get started, you can sign up for free access to your Experian credit report, which comes with credit monitoring and alerts.

Your Lender Does Not Report To All Credit Bureaus

While many lenders report loan activity to all three credit bureaus, some only report to one or two. In fact, some lenders don’t report to credit bureaus at all. If your loan doesn’t appear on one of your credit reports, try checking the other two.

Ultimately, lenders are not required to report their accounts. But be aware: Just because a lender doesn’t report your loan and successful payment history, it doesn’t mean they can’t or won’t report negative information if your car is repossessed or you default on your loan.

Recommended Reading: What Credit Report Does Paypal Pull

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, you’ll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didn’t initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

Onemain Financial Collateral Requirements

Some applicants have high enough credit scores, debt-to-income ratios and other characteristics to qualify for unsecured loans from OneMain Financial. However, others may have to put up some collateral in order for OneMain Financial to approve an application.

- Collateral may include the following:

- Automobiles

| Does OneMain Financial permit cosigners? | No |

After you complete the online application for a loan and receive initial approval, youll have to meet with a loan specialist in a branch to verify your income, expenses, identity, employment and collateral, if required.

Once your information is verified by branch personnel, youll sign your loan documents and receive your money in one of three ways:

- SpeedFunds: If you have a bank-issued debit card, your funds can be deposited into the bank account associated with your debit card.

- Automated Clearing House : You can have your funds deposited directly into your checking or savings account approximately 1 to 2 business days after the loan closing date.

- Check: You can pick up a check in a branch at the time of your loan closing.

Don’t Miss: Is 739 A Good Credit Score

Follow Up After The Investigation

Heres what to expect when the investigation is complete:

- The results of the investigation, in writing, from the credit reporting bureau.

- A free copy of your credit report, if the report has changed.

What about parties who have seen your incorrect information? You can ask the credit bureaus to notify them of the corrections, the FTC says. This includes:

- Notifying anyone who received your report in the past six months.

- Sending a corrected copy of your report to anyone who received it in the past two years.

But what if the investigation doesnt resolve your dispute? If the furnisher continues to report the error, you can ask the credit bureaus to include a statement in your credit file that describes your side of the dispute and it will be included in future credit reports. For a fee, you can usually ask the credit bureau to send a copy of the statement to anyone who has recently received a copy of your report.

Also, if you believe you were treated unfairly or a valid error remains on your credit report, you can file a complaint with the Consumer Financial Protection Bureau. The CFPB is required to forward the complaint to the company with which you have an issue. The CFPB usually will provide you with a response within 15 days.

How long can it take for an error to be corrected on your credit report after the dispute is resolved? Credit bureaus have five business days after finishing their investigation to notify you of the results.

Calculating Your Credit Utilization

To calculate your CUR,;divide your total outstanding balances across all your cards by your total credit limit. Then, multiply by 100 to get the percentage.

For example, if you carried the average credit card balance;of $6,194 on your card and also had the average credit card limit;of $22,751, you would divide the first by the second and multiply by 100. This would give you a CUR of about 27%.

Whether you have a utilization rate near the average 27% or not yet below 10%, there are always small moves you can make to lower yoursand;see a boost in your score.

Recommended Reading: Does Requesting A Credit Report Hurt Score

You May Like: Does Zzounds Report To Credit Bureau

How Are Your Credit Reports Used

The information in your credit reports is used to calculate your credit scores. Credit-scoring models can weigh the same information from the same credit report differently. But the main scoring models, FICO and VantageScore, look at information in five key areas to determine your scores: payment history, credit usage, credit history, credit mix and recent credit.

Your credit reports can also be used by creditors, such as credit card issuers, when theyre considering whether theyll open a line of credit for you. The credit bureau may also use the information on your reports to calculate a credit score for you.

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Do you know the difference between your credit report and your credit score? It may be easy to see these two related items as one and the same. However, if you take a closer look, you may start to understand some key differences between the two.

Also Check: How To Get Credit Report Without Social Security Number

Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year, beginning in January 2020, for the next seven years.

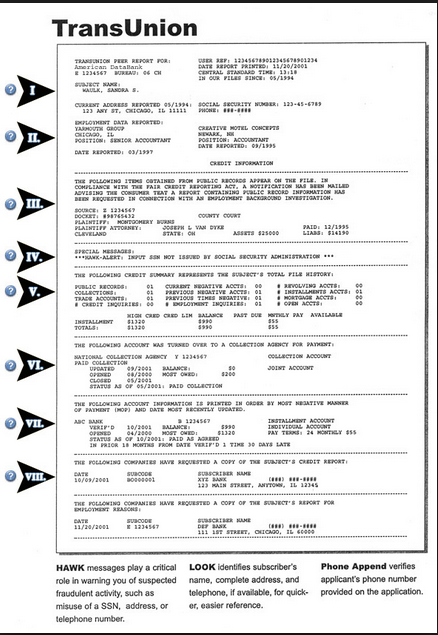

How Do Credit Bureaus Get Your Information

The information that the bureaus collect comes from a variety of sources.

Information reported to the bureaus by creditors Creditors, such as banks and credit card issuers, may report information about their accounts and customers to the credit bureaus. In this context, the creditors are known as data furnishers.

Information thats collected or bought by the bureaus ;For some types of information, the credit bureaus buy the data. For example, a consumer credit bureau might buy public records information from LexisNexis, another credit bureau, and use this information when generating your credit report. Examples of information that a credit bureau may buy include government tax liens or bankruptcy records.

Information that gets shared among the bureaus ;Although they are competitors, sometimes the credit bureaus must share information with one another. For example: When you place an initial fraud alert with one of the bureaus, its required to forward the alert to the other two.

Learn more about protecting yourself from identity theft.

You May Like: What Is Cbcinnovis On My Credit Report

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Onemain Financial Personal Loans: 2021 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You May Like: Why Is There Aargon Agency On My Credit Report

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report.;An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life;

- disability insurance applications.

How To Dispute Inaccurate Information On Your Reports

While its normal to see different credit scores for different bureaus, we recommend periodically;checking your credit reports for errors.

As a consumer, you can request your free credit reports from the bureaus once a year at annualcreditreport.com. You can also sign up for Credit Karma for free to see your Equifax and TransUnion credit reports and VantageScore 3.0 credit scores.

You also have the right to dispute inaccurate information in your reports and with data furnishers. Under the Fair Credit Reporting Act, the consumer reporting company and the company that furnished the information to the credit bureau must conduct a free investigation to verify the information and correct a mistake, if they find one.

Normally, Credit Karma members can dispute information in their TransUnion credit reports with Credit Karmas;Direct Dispute tool.

You may also be able to dispute information over the phone using the number on your credit report or looking up the most recent number on the credit bureaus website. You might prefer mail and electronic disputes though, because youll have a paper trail.

To dispute information with another credit bureau, visit its website or use;the CFPB list;to find its contact information. You may need to submit your dispute by mail or over the phone.

Recommended Reading: Paypal Working Capital Requirements

How To Get A Free Credit Report And Credit Score

Under the Fair Credit Reporting Act, you’re entitled to one free credit report every year from each of the main credit bureaus Experian, Equifax and TransUnion. You can access these reports for free at annualcreditreport.com, which is authorized by federal law.

Other resources, such as Experian, may provide an updated credit report every month. Note that your Experian credit report is free, but you’ll have to upgrade to a paid plan to access your TransUnion and Equifax reports.

You can also check your credit score for free on a monthly basis with many online resources, such as Experian Boost, from Capital One and Discover Credit Scorecard.

Check Your Credit Report

The bottom line to it all is information. To pick up on problems and learn whats going well, you must see your credit report. Every consumer can do that annually at no cost make your request at www.AnnualCreditReport.com but Griffin said fewer than half of the eligible people take advantage of that.

Thats a huge concern, Griffin said. We want people to be educated and know their course. You cant do anything about your credit report unless you know whats in it. Its all part of the education process. Information is powerful and people need to know how to get the right information.

6 Minute Read

Don’t Miss: Paypal Working Capital Phone Number

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

Who Can Be An Authorized User

Becoming an authorized user depends on two things: the account holder and their credit card company.;

First, card issuers set their own policies. So they may have rules about who can be added or how old authorized users must be. From there, a lot of it is up to the cardholder.

As long as theyâre willing, there are many reasons a cardholder might add an authorized user. One is to try to help another person build credit. Parents might do it to teach their children about credit. Or someone could add their partner to help simplify their finances as a couple.

Whatever the relationship, trust is key. Once an authorized user is given access to an account, they typically can use their cardâwith or without permissionâuntil access is revoked. So it might be a good idea to talk about budgeting and spending beforehand.

Recommended Reading: Open Sky Unsecured Credit Card

Why Does This Matter To Consumers

If it were up to a credit card applicant to decide, they obviously would want a card issuer to pull a report that contains the most favorable information most notably their credit score.

However, an applicant has no say in the matter. Therefore, a card issuer could pull your report from Experian, for example, and it shows a credit score of 680, while your Equifax report puts your score at 700 and your TransUnion report puts it at 710.

As such, the Experian report indicating a credit score of 680 might lead to less desirable terms, such as a higher APR for a credit card.

Ted Rossman, industry analyst for CreditCards.com, says which credit bureau is used also might come into play if youve set up a credit freeze with one bureau but not the two others.

Furthermore, he says, one or more credit bureaus might supply inaccurate information such as a late payment on a credit card account when you actually had no late payments that could hinder your ability to get credit.

EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Can A Walmart Credit Card Help Build Credit

Walmart Inc. offers two kinds of credit cards, Walmart Rewards Mastercard, which can be used anywhere Mastercard is accepted, and a Walmart MoneyCard, which is a store credit card.

The Walmart Rewards Mastercard and its in-store credit card are issued by Capital One, and cardholders can earn rewards for shopping at Walmart. When used properly, both cards can help you build your credit history and credit score.

Learn the strategies below to help you build your credit with these two credit cards.

You May Like: Does Klarna Affect Your Credit Score

Don’t Miss: Does Paypal Credit Affect My Credit Score

Something Went Wrong When Reporting The Account

Mistakes are rare, but they do happen. Your information may have been entered into the credit reporting system incorrectly. Or, maybe a technical issue or backlog has delayed your information being posted. It’s also possible that, if you have a co-borrower, the loan could have been reported to their credit file and not to yours.

Follow up with your lender about possible errors or oversights. If your loan shows up on your credit report but contains inaccurate information, you can contact your lender or submit a dispute to the credit bureau in question.

How Long Does Negative Information Stay On Your Credit Reports Ive Heard Seven Years

Positive or neutral information can stay on your credit reports indefinitely, though in practice some credit reporting agencies will remove accounts that are older. Experian, for example, no longer reports accounts that are more than ten years old if the account is closed and there is no activity on it.

Accounts such as credit cards and mortgages can stay on a credit report for many years if they are open and active.

With negative information, however, federal law limits how long that information may be reported:

So how can you be sure that these items will be removed when the time has come?

Each of the credit bureaus hard codes their credit reporting systems to look for the purge from dates. As these dates hit their 7 or 10 year anniversary they will no longer be reported. Unless you believe that an account is being reported past those time limits, there is no need to remind the credit bureaus that an item is to be removed. It is done automatically. Still, its a good idea to check your free credit report each year to make sure that is the case.

Also Check: Does Speedy Cash Report To Credit Bureaus