How To Remove A Fraud Alert

Fraud alerts are placed on credit reports to alert creditors that you have been the victim of identity theft or suspicious activity. These fraud alerts require potential creditors to contact you to verify you have requested their credit services. A fraud alert will stay on your report for 90 days. You can remove a fraud alert from your credit report before 90 days if it is no longer needed.

Contact TransUnion to remove the fraud alert from your credit report. Include your name, Social Security number, current address, telephone number and date of birth in your request. You will need to submit this request in writing. Send your request to TransUnion Fraud Division, P.O. Box 6790, Fullerton, CA 92834.

Request that Experian remove the fraud alert from your credit report. Include your name, Social Security number, current address, telephone number and date of birth in your request. You will need to submit this request in writing. Send your request to Experian Fraud Division, P.O. Box 9532, Allen, TX 75013.

Contact Equifax to remove the fraud alert from your credit report. Include your name, Social Security number, current address, telephone number and date of birth in your request. You will need to submit this request in writing. Send your request to Equifax Consumer Fraud Division, P.O. Box 740256, Atlanta, GA 30374.

References

How To Freeze Your Credit Report After Identity Theft

Freezing your credit report is sometimes necessary. It can help prevent identity thieves from opening new lines of credit and other accounts in your name. Its often recommended when youre dealing with the ramifications of identity theft.

A credit freeze allows you to restrict access to your credit report. When you freeze your credit file, you prevent potential creditors from accessing certain financial and personal information. Creditors are unlikely to let you or an identity thief open, say, a new credit card, if they cant access your credit report. Thats because they wont be able to assess your creditworthiness.

If you need to freeze your credit, you can get a free credit freeze by requesting one at each of the three major credit reporting agencies. More on that later.

How A Credit Freeze Works

When you freeze your credit with the three major national Equifax, Experian, and TransUnionyou’re essentially telling them that you don’t want just anyone to be able to access your credit file. Again, there are some exceptions to who can and can’t see your credit file while a freeze is in place.;

A credit freeze can stay in place for as long as you want it to; it’s up to you to decide when to lift it. Freezing your credit is now completely free, thanks to a 2018 change in the law. Previously, there was a fee to freeze and unfreeze your credit.

Also Check: Does Opensky Report To Credit Bureaus

If Youve Been The Victim Of Identity Theft Or Fraud You Can Contact One Of The Three Major Credit Bureaus To Place A Fraud Alert On Your Credit Reports

A fraud alert is a statement in your that alerts anyone reviewing the reports that you may be a victim of fraud or identity theft. This alerts creditors and lenders that they should perform more-thorough vetting such as calling to check whether youre actually at a particular store trying to take out new credit when verifying your identity before extending credit in your name.

Heres what you should know about the different types of fraud alerts, how to place an alert on your credit reports, when you should place one, and if an alert can affect your credit scores.

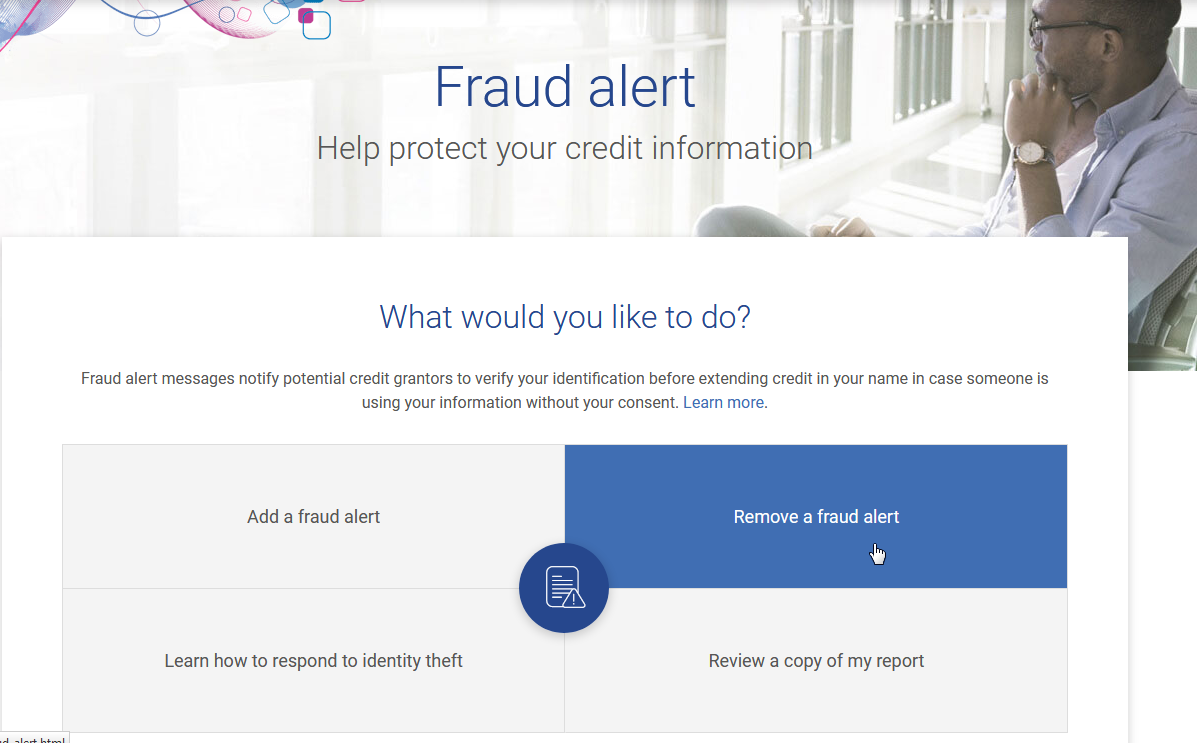

How To Remove A Fraud Alert From Your Credit Report

After one year, the fraud alert expires. You can renew the fraud alert if you feel your protection is still at risk. If you feel its no longer necessary, you can choose to remove it prior to the one-year mark. Removing a fraud alert from your credit report is similar to placing one; contact one of the credit bureaus and request to remove it from your credit report.

Recommended Reading: How Long Does Repossession Stay On Credit Report

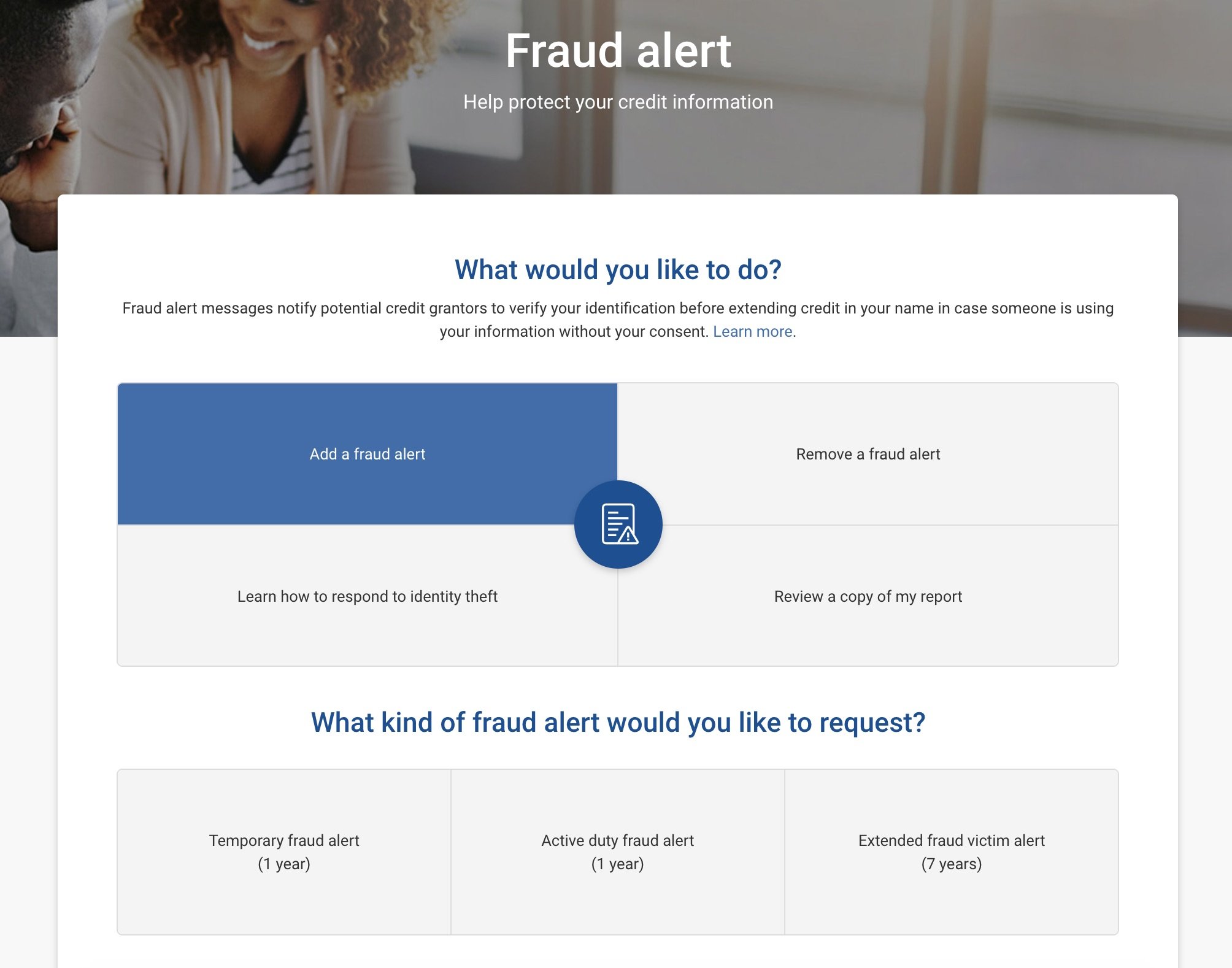

Place One Of Three Fraud Alerts On Your Credit Report

These are the three types of fraud alerts that you can implement on your credit reports:

- Initial fraud alert

- Extended fraud alert

Initial fraud alert

If you suspect your wallet, financial information or credit card number has been lost or stolen, you can ask for an initial fraud alert to be placed on your credit file.

An initial fraud alert lasts 90 days. During that time, it should be more difficult for an identity thief to open accounts in your name because the alert requires a business to verify your identity before a new line of credit is approved.

You can apply for an initial fraud alert by phone, mail, or online, using the contact information above.

The CRA websites noted above will take you to where you can submit your request online or mail a written fraud alert letter.

Remember, initial fraud alerts last only 90 days, but they can be renewed. Youll have to remind yourself to do so. Otherwise, theyll expire. ;Also, requesting such an alert also entitles you to order one free credit report from each credit reporting agency.

Active duty alert

If youre a service member and about to be deployed, you can place an active duty alert on your credit report that lasts for one year and can be renewed for the length of your deployment.

This can be very helpful in protecting your identity while deployed, because a business will have to take extra steps before giving credit in your name.

Extended fraud alert

How To Place A Fraud Alert On Your Credit Report

You only need to contact one of the three main credit bureaus Experian, Equifax and TransUnion when placing a fraud alert. The bureau you contact is required by the FCRA to notify the other two to update their records of you.

After placing the alert, request a copy of your credit report and ensure that all of the information listed is correct. If there is any error, you have the right to dispute it and have it removed. You are entitled to a free copy of your credit report every 12 months.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Why Check Your Credit Report

Your credit report is a record of how well you manage credit. Errors on your credit report can give lenders the wrong impression. If there’s an error on your credit report, a lender may turn you down for credit cards or loans, or charge you a higher interest rate. You may also not be able to rent a house or apartment or get a job.

Errors can also be a sign that someone is trying to steal your identity. They may be trying to open credit cards, mortgages or other loans under your name.

Take a close look at your credit report at least once a year to see if there are any errors.

Will A Credit Freeze Or Fraud Alert Hurt My Credit Score

A credit freeze only restricts who can look at your credit reports. It doesn’t affect your score or stop you from using credit.

A fraud alert is simply an extra layer of security; it doesn’t affect your credit score either. It’s easier to apply for credit if you have a fraud alert, because you don’t have to first unfreeze your credit.

Read Also: Is 584 A Good Credit Score

How To Remove Fraudulent Accounts From Your Credit Report

- 118Shares

Identity thieves may open new credit card accounts in your name if they have access to your personal information like your Social Security number, name and address. We all know it can be extremely frightening and frustrating when criminals commit this kind of identity theft, especially when they open up numerous credit card accounts and max them out thus, committing identity theft and credit card fraud. These imposters typically open new bank and credit accounts, utility and telephone accounts, obtain personal, student, business, and auto loans, as well as make other big credit purchases using stolen information.

When;the;identity;thief;dont;pay these bills, lenders or creditors will come after you and make you clean up the mess the thief has done. Unfortunately, the credit bureaus rely on you, the consumer to do most of the work to PROVE that you didnt open these accounts.; If not done correctly and immediately, your credit score will suffer. Removing fraudulently opened accounts can be a long and drawn out process.; Use the steps below to help get your credit back in shape as quickly as possible.

Department Of The Attorney General

You may be able to prevent others from using personal information about you by placing a fraud alert on your credit report. A fraud alert is a notice that;

remove 90-day fraud alerts on your credit file to help protect you from To order your free credit report, visit www.annualcreditreport.com or call,;

May 17, 2021 You can let the fraud alert expire or contact the credit bureau before its expiration and remove it,;

and remove 90-day fraud alerts on your credit file to help protect you from alerts and fraud alerts, and to pull your credit score and credit file.

Read Also: Syncb/ppc Closed

Errors To Watch Out For On Your Credit Report

Once you get your report, check for:

- mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- errors in credit card and loan accounts, such as a payment you made on time that is shown as late

- negative information about your accounts that is still listed after the maximum number of years it’s allowed to stay on your report

- accounts listed that you never opened, which could be a sign of identity theft

A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account won’t remove the negative history.

Negative information such as late payments or defaults only stays on your credit report for a certain period of time.

A Fraud Alert Wont Freeze Your Credit

Before you place a fraud alert or a on your credit reports, make sure you know the difference between those two types of credit protection offered by all three major credit reporting agencies.

When you place a fraud alert on your credit reports, creditors must first verify your identity before processing a credit application under your name. Thats much different than a credit freeze, which completely blocks creditors from accessing your credit report.

Pintau Studio / shutterstock.com

Also Check: Aargon Agency Settlement

What You Need To Know:

This alert explains things you can do to protect yourself from identity theft: credit freeze; fraud alert; and credit monitoring. The alert also answers frequently asked questions about each.

Also called a security freeze, a credit freeze is something you request from a credit reporting agency to restrict access to your credit report. When a freeze is on your account, any unauthorized third party who attempts to look at your file will see a code or message indicating that your report is frozen.

This makes it more difficult for identity thieves to open new accounts in your name because most creditors will demand to see your credit report before they approve new credit.;

If a creditor cannot see your file, then the creditor should not extend credit.

A credit freeze does not prevent all third parties from seeing your report. Existing creditors, debt collectors acting on their behalf, and government agencies in limited circumstances will have access to your report.

But placing a credit freeze on your account will not affect your credit scorenor will it keep you from getting your free annual credit report, or from buying your credit report or score.

A fraud alert, unlike a credit freeze, will allow creditors to get a copy of your credit report if they take steps to verify your identity. For example, if you provide your telephone number, the creditor must call to verify that you are the one requesting credit.;;

There are three types of fraud alerts:

How To Place Or Remove A Fraud Alert On Your Credit Report

Lets say your Social Security number and other personal data were exposed in a data breach. What do you do? Act quickly is good first stepto do what you can to help protect yourself from identity theft.

Place a fraud alert on your credit reports with the three major credit reporting agencies to thwart would-be identity thieves who may have your personal information. Such fraud alerts wont address all of your identity theft risks, but they may prevent fraudsters from opening more credit accounts in your name.

You May Like: Does Klarna Affect Your Credit Score

How To Remove A Fraud Alert Or Victim Statement

Experian automatically removes fraud alerts once they expire. If you have added a fraud alert to your credit report and would like it to be removed ahead of time, you have two options:

- Option 1: Online

- You can upload the documentation verifying your identity online along with your request to have the alert removed. We document your identity to prevent potential identity thieves from removing the alert to fraudulently apply for new credit in your name.

How To Protect Yourself Against Identity Theft And Fraud

A fraud alert is only one tool that consumers can use to protect themselves. There are also credit freezes, credit locks, and also credit monitoring. If you sign up with a good company like IDStrong.com and have them monitor your credit, you will have one less thing to worry about. Some other ways to protect yourself against fraud and identity theft are:

- Get a copy of your credit report at least once a year and check it for errors and fraud.

- Never give out your personal information to anyone you dont know.

- Keep your computer updated with the latest security patches and antivirus software.

- Never click on links or download attachments in email.;

- Watch out for phishing or other suspicious emails.

- Consider using a VPN to shield your online activities from hackers.

- Carefully monitor your bank and credit card statements each month.

Although you cannot protect yourself 100% from hackers, thieves, and cybercriminals, you can stay alert, use common sense, and respond quickly if you are on top of all these things and know what to look for and what to do.

Recommended Reading: Paypal Credit Hard Pull

How Can I Place A Fraud Alert On My Equifax Credit Report

When it comes to taking measures to help protect your personal and financial information, placing a fraud alert is a good step. There are two types of fraud/identity theft alerts you can proactively or reactively – place on your Equifax credit report: an Identity Alert and a Fraud Warning. ;

Please note that when you place an alert with Equifax, it will only be applied to your Equifax credit report. You will need to contact TransUnion directly to place an alert on your TransUnion credit report.;;;

Identity Alert

With an Identity Alert, you can choose to add a personal statement and phone number to your Equifax credit report. ;If you live in Manitoba or Ontario and are applying for credit, this alert requires lenders and creditors to call you before extending credit. If you live elsewhere in Canada and are applying for credit, lenders and creditors are encouraged — but not legally required — to call you before extending credit. ;;;An Identity Alert stays on your Equifax credit report for six years, unless you request in writing that it be removed. You can update your phone number for free, but we require a request in writing, along with proof of ID and a phone statement .;

You can place an Identity Alert on your Equifax credit report in one of three ways:

; Interactive Voice Response

;;;;Box 190;;;;;Montreal, Quebec H1S 2Z2

Please include a photocopy of two pieces of ID, such as a driver’s license, passport, SIN or health care card, or birth certificate.

How To Freeze Your Transunion Credit Report

TransUnion offers a three-step process on its website to freeze your credit.

The website includes information about freezing the credit of a loved one, including a minor or dependent, spouse, deceased relative, or parent. TransUnion has a mobile app to freeze or lift your credit on the go.

Be sure to opt out, if you dont want to receive unsolicited offers of credit or insurance.

Also Check: Is 779 A Good Credit Score

What Are The Drawbacks Of A Fraud Alert

Activating a fraud alert will cause problems if youre used to walking into an electronics store, signing up for their amazing dont pay anything later credit offer, and walking out of the store with a new big-screen TV.

With a fraud alert active, you have to be available at either your work phone or home phone to approve opening the credit account. No big deal. It will just require a short delay in your instant gratification and a call-back to the credit company authorizing the new account.

If you can live with that, putting a fraud alert on your credit will help protect you in some situations.

NOTE: You want to be cautious if youre just about to apply for a home loan or refinance. Let your broker know that you have a fraud alert in place because youre trying to protect yourself against fraud.

On the plus side, a fraud alert wont cause any problems with your current credit card, bank or credit accounts. Its focused on new credit accounts, not the ones you already have opened.