What If They Dont Comply

If the CRA does not comply, then your next move is to send an intent to file a complaint with the CFPB .

If the first 2 letters do not get the errors removed, then its in your best interest to let the CRA know that you intend to do next.

Heres an example letter:

Full Name

City, State, Zip Code

Dear Sir or Madam/To Whom It May Concern,

Please be advised that if the items are not deleted I will be filing a complaint with the CFPB .

On I requested that inaccurate/erroneous items that were illegally being reported to my credit file with your agency be deleted. You refused to do so and claimed to have verified these items.

On I requested, as required by FCRA 611 , that you provide me with a complete copy of the information that you used to investigate the matter. You failed to provide me with that information and again failed to delete the items.

Federal Law requires you to respond within 15 days. It has been over . Failure to comply with Federal Regulations by Credit Reporting Agencies will be investigated by the FTC and/or the CFPB.

These negative items have caused financial and emotional stress. Your blatant disregard of the law forces me to fully exercise my rights and file a formal complaint with the Consumer Financial Protection Bureau. Please be advised that I will file this complaint if these inaccurate items are not removed immediately.

1. Cell Phone, Account # 1234562. Cable Bill, Account #6543213. Credit Card, Chargeoff, Account # 00120034

Sincerely,

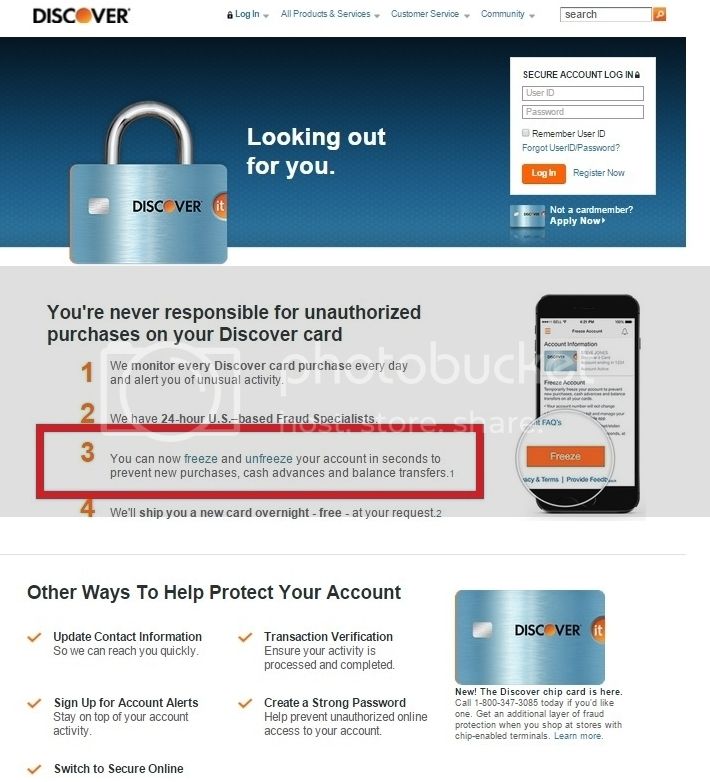

What Is A Security Freeze

A security freeze blocks access to your credit unless you have given your permission. This can prevent an identity thief from opening a new account or getting credit in your name. All consumers can get a free security freeze online, by phone or by mail. A security freeze, also known as a credit or a file freeze, can be lifted temporarily when you are applying for credit, or removed permanently. Parents and guardians can also shield their childrens credit report with a special Protected Consumer security freeze. These freezes can also be used to safeguard incapacitated adults.

How Do I Place A Credit Freeze

To place a credit freeze on each of your files, you must contact each credit reporting agency directly. Instructions are on the company websites:

- Equifax: 1-800-349-9660 or equifax.com

- Experian: 1-888-397-3742 or experian.com

- TransUnion: 1-800-680-7289 or transunion.com

Heres information youll likely need to supply: Name, address, data of birth, Social Security number, and other personal information.

When you set a credit freeze, you will select or be provided a personal identification number associated with the freeze.

Your PIN allows you to unlock your credit file when you want to provide access to lenders when you apply for credit. Its smart to keep your PIN in a secure place. That way, its there when you want to unfreeze your credit.

If you have been a victim of identity theft, you should consider placing a freeze on your credit files.

A credit freeze consists of three actions: You can add, lift, or remove a credit freeze.

- Adding a credit freeze means placing a freeze on your credit.

- Lifting a credit freeze temporarily removes the freeze so you can apply for credit.

- Removing a credit freeze permanently removes it.

You can do all of these actions for free.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

When Do You Need A Pin To Unfreeze Your Credit

Two of the three major credit bureaus have recently changed their policies related to security freezes and PINs. As of 2018, if youre unfreezing your credit reports online through Equifax or TransUnion, you wont need a PIN at all. Youll only need to enter your account username and password.

However, you will need a PIN if youre unfreezing your Experian credit report. Youll also need one if you want to thaw out your Equifax or TransUnion credit report over the phone though it is possible to thaw an Equifax credit freeze over the phone without a PIN, as well explain below.

What Does Freezing My Credit Do

When you freeze your credit, the credit reporting bureaus canât give any information to anyone who makes an inquiry about you. Typically, businesses inquire about your credit when you are trying to, for instance, open a new credit card, buy a car or rent an apartment. The credit check helps the business determine if they want to lend or rent to you, and it can help set your rates and lending terms for loans and credit cards.

When your credit is frozen and the business canât get any information about you, it typically stops the process â which means a fraudster will be unable to open an account while using your identity.

You May Like: Is Chase Credit Journey Accurate

What Are My Choices For Unfreezing Credit

You can temporarily unfreeze credit in two ways:

-

Lift a freeze for a certain number of days. You might do this if you’re shopping for a mortgage or car loan or applying for a credit card.

-

Allow access to a specific creditor.

If you are applying for a loan, you may be able to ask the lender which credit bureau will be used and unfreeze only that one.

Permanently unfreezing your credit is also an option, but NerdWallet doesn’t recommend giving up the protections a freeze gives you. Temporarily lifting a freeze occasionally is much less trouble than unwinding the effects of identity theft.

You have to unfreeze your credit with each credit bureau individually. Experian requires a PIN to lift a credit freeze, while TransUnion and Equifax require that you set up online accounts.

You can unfreeze and freeze your credit reports online or by mail. You need a PIN to unfreeze your Experian credit report. TransUnion and Equifax require that you set up accounts to freeze or lift a freeze online.

Unless you use postal mail, unfreezing your credit reports online takes effect within minutes of requesting it. Freezing and unfreezing your credit reports is free. You can also freeze and unfreeze your child’s credit for free.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Unfreezing Your Credit With Transunion

- Online – You’ll need to create an online account with TransUnion or go through the myTransUnion app.

- Call 1-888-909-8872.

- Mail your written request to TransUnion LLC, P.O. Box 160, Woodlyn, PA 19094.

Unfreezing your credit at one credit bureau won’t unfreeze it at the other two. Unless you know which one your lender plans to contact, you’ll need to make the request at each bureau to ensure there are no glitches when you apply for a loan.

Recommended Reading: Is 672 A Good Credit Score

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How Do I Place Temporarily Lift Or Permanently Remove A Security Freeze

Placing, lifting and removing a security freeze is free. You can place, temporarily lift, or permanently remove a security freeze on your Equifax credit report in several ways.

- Online, by creating a myEquifax account. You can check the status of your security freeze through your myEquifax account as well.

- Call us at 298-0045. You’ll be required to give certain information to verify your identity. You’ll also have the option to receive a one-time PIN by text message or answer questions based on information in your Equifax credit report for identity verification.

- By mail. Please download this form for instructions and mailing address. If you are requesting to temporarily lift or permanently remove a security freeze via mail, you’ll need to provide documents to validate your identity and address. Read more about acceptable documents here. After we receive the request and verify your identity, you will receive confirmation.

To place, temporarily lift or permanently remove a security freeze on your Experian or TransUnion credit reports, please contact them directly.

Recommended Reading: 676 Credit Score Good Or Bad

How To Unfreeze An Experian Report

Experian has a “Freeze Center” dedicated to helping you remove or lift a security freeze.

The credit bureau will grant you an unfreeze online after you fill out the form on its website.

You can specify how long you want the freeze to be lifted, and even allow a specific lender to access your frozen report. If you want to completely unfreeze your file, you can request removal by phone or by mail.

Contact info: Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Read Also: Is 570 A Good Credit Score

Who Can Access My Credit Once It’s Frozen

When you freeze your credit, you limit who has access to your credit report. Fraudsters won’t be able to open new accounts in your name regardless of whether they have access to your social security number and other personal information.

Any banks that you already have relationships with will continue to have access to your credit report. For example, if you request a credit limit increase with the Citi® Double Cash Card, Citi may review your credit report.

Debt collectors and marketers will also have access. If you want to stop getting prescreened credit offers, opt out by going online or calling 888-567-8688.

You’ll still have access to your credit and can check your credit report for free.

How Do I Unfreeze My Credit

You can unfreeze your credit by going to the same credit bureau websites that you accessed to freeze your credit, or by calling the numbers listed above. There will be the option to temporarily lift a freeze for a set amount of time, which can be used if you need to apply for a credit card, mortgage, loan or other financial product.

You also have the option to completely remove the freeze, which we don’t recommend doing unless you don’t have a finite timeline on when your credit will be pulled. If you remove a freeze, reinstate it once the application process is complete.

When you unfreeze your credit, you typically have access to your credit report within an hour, but it may vary. We’ve tested this for all three credit bureaus and were able to apply for a credit card within the hour.

The Economic Growth, Regulatory Relief, and Consumer Protection Act set an official timeline for when credit freezes need to be removed, after a consumer’s request:

- Requests by toll-free telephone or secure electronic means: One hour after receiving the request for removal.

- Requests by mail: Three business days after receiving the request for removal.

You May Like: Does Opensky Report To Credit Bureaus

Wrapping Up: How To Remove A Judgement From Your Credit Report

Most judgments wont make it to your credit report, but you should still handle them right away. If you have a judgment on your credit report, it will knock your score down quickly and a lot and make it hard to get future credit. The best thing to do is to either repair your credit yourself or hire a reputable credit company.

Its a lot easier today to remove judgments since the Fair Credit Reporting Act doesnt allow them, so take the necessary steps to remove them from your credit report today.

Additional Items to Remove from Your Credit Report:

How To Temporarily Lift Your Credit Freeze

Unfreezing your credit report temporarily is useful if you know the specific window when the lender will pull your credit. It will allow lenders access to your report, maintain protection of your credit after they pull it and you wont have to remember to log in again to refreeze your credit.

Heres how to temporarily lift your credit freeze:

To make things easy, you can schedule your freeze removal up to 15 days in advance of when you plan on having your creditor pull your report. So, if you wish to unfreeze more than 15 days from today, just plan to log in closer to the date when you want your credit report unfrozen.

You May Like: Report A Death To Credit Bureaus

Send Your Credit Dispute Letter

You shouldnt just throw these into an envelope and then toss them into the mail.

You need a way to verify if and when they received the letters so that you can be sure that the investigation was completed in a timely manner .

So be sure to take these to the post office and send these as Certified Letters return receipt requested.

Once they receive the items you will be notified that they have received the certified letters. This helps you keep track of things, as mentioned above.

What Happens Next

It will take about 30 days before you receive a response from the credit bureaus, although it could be less or more. Be patient, but dont lose track.

Your response will be that they deleted all the item, some of the items or none of the items. If they deleted all of them, youre done. You need not do anything more from here. Congratulations!

Youve completed the task and will only re-open the investigation if you do contact them regarding errors already deleted. We dont want that, obviously. No need to contact them again if they deleted all of the items.

If they deleted some of them or none of them, then its time to get back to work. Now we can send a new letter regarding the items that were not deleted .

Note: You can move directly to the Method of Verification letter or send out a similar letter to the original. The MoV will have more of a positive effect for you, but if youre patient enough sending out a second letter may be easier.

This right states that:

Full Name

You Can Now Freeze Your Credit For Free Heres Why You Should Do It

Jon Byman

Thereâs no sure-fire way to prevent someone from stealing your identity and damaging your credit in the process. But freezing your credit will go a long way toward making sure youâre protected and giving you peace of mind. And you can freeze your credit for free. You may want to consider doing it as doing so will mean that even if a criminal gets your information, it will be difficult or impossible for that person to open a fraudulent account in your name.

In 2018, a new law made it free to freeze your credit. Prior to the new law, each of the three credit bureaus could charge you if you wanted to put a freeze in place . Then, you often had to pay again to unfreeze or thaw your credit if you wanted to do something that required a credit check, like applying for a new loan. However, after the massive Equifax data breach in 2017, consumer advocates called on Congress to provide free access to credit freezes.

You May Like: How Do I Unlock My Experian Credit Report

Dispute It With All Three Credit Bureaus

You have the right to dispute any inaccurate information on your credit report. This includes even the smallest detail on a judgment.

Look closely at dates, name spellings, dollar amounts, and payment dates. If anything isnt right, appeal the information to the reporting credit bureau and ask them to remove it from your credit report.

Can You Unfreeze Your Credit Report For A Specific Period

Yes. Log in to your online TransUnion account. Instead of choosing Remove Credit Freeze, select the Temporary Lift Freeze option. Choose the dates you want to lift the freeze. When that period ends, TransUnion will automatically freeze your credit report. TransUnion will allow you to set specific dates you want to unfreeze your credit report up to 15 days before you want it to happen. Remember, you can also unfreeze your credit report via phone or mail.

You May Like: What Company Is Syncb Ppc

When Should I Use A Credit Freeze

It’s a good idea to consider a credit freeze in a few situations, including these.

- Youve been the victim of a data breach. If your personally identifiable information has been exposed, cybercriminals could try to open new accounts in your name. A credit freeze can provide an extra layer of protection. Lenders wont be able to access your credit file, making it unlikely that theyll grant credit to anyone using your Social Security number.

- You believe youve been the victim of identity theft. You may start receiving bills for accounts you dont recognize. Or you may receive calls from collection agencies seeking payment on accounts you never opened. These are likely signals that you might be the victim of identity theft. A credit freeze could help prevent criminals from opening more accounts using your personal information.

- You want to protect against identity theft for a child. A provision of the Economic Growth, Regulatory Relief and Consumer Protection Act authorizes parents or guardians of children under 16 to set up a credit report for their child and then freeze it at no cost. This can help you protect against child identity theft.