What Documents Do You Need To File Bankruptcy

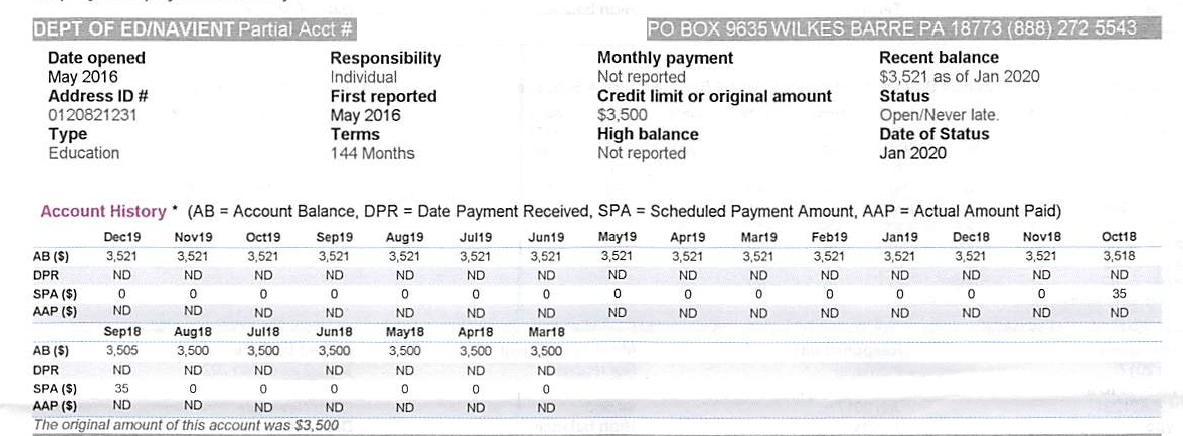

Before filing for bankruptcy, consumers should collect several financial documents including: Tax Returns Paycheck Stubs Debt Statements If you discharged debts in bankruptcy, heres how they should be listed on your credit report. In short, yes. Not only will a bankruptcy filing remain on your credit report for seven to ten years, but you can expect information about the debts discharged in bankruptcy to continue to appear on your credit report, too.

How Do Bankruptcies Work

The type of bankruptcy that you qualify for will determine how your debts are paid back and how much time you have to do so. Income is a primary factor in deciding to file Chapter 7 or Chapter 13.

For example, when filing for Chapter 7, you must meet the appropriate income requirements and pass The Chapter 7 Means Test. This type of bankruptcy involves liquidation of assets to pay back a portion of the debt. On the other hand, Chapter 13 bankruptcy is a reorganization of assets. The debtor has enough income to repay a pre-set amount via monthly payments.

How Long Does A Bankruptcy Stay On Your Credit Report

How long a bankruptcy stays on your credit report depends on which bankruptcy filing you opted for in the first place.

- Chapter 7 bankruptcy can remain on your credit report for 10 years

- Chapter 13 bankruptcy stays on your credit report for 7 years

Chapter 13 bankruptcy leaves your credit report sooner because it involves a plan where you pay your debt to a trustee over a set time period. Chapter 7, on the other hand, means that you liquidate your assets, pay what you can, and get rid of whats called dischargeable debts..

Dischargeable debts include such things as medical bills, collection accounts, credit cards, personal loans, utility bills, some judgments, and some older tax bills and penalties.

Non-dischargeable debts include things like alimony, child support, federal student loans, and debts that belong to someone else.

You May Like: How Accurate Is Creditwise Credit Score

Can You Get Credit After A Bankruptcy

Myth: You cant get a credit card or loan after bankruptcy.

The truth: Credit cards are one of the best ways to build credit, and there are options out there for those with a checkered credit history. Secured credit cards, which require an upfront security deposit, have a lower barrier of entry but spend and build credit just like a traditional card.

Similarly, there are loans availablesuch as passbook, CD or that are secured with a deposit or collateral and help you build credit as you pay them off. Like secured credit cards, these loans are much easier to come by because the lender is protected in the event you cant pay. Do note that you may need to get permission from the court to take on new debt during a Chapter 13 repayment plan.

Can I Apply For Credit

After your bankruptcy has ended, there is no restriction on applying for loans or credit. Its up to the credit provider to decide if they will lend you money.

Your credit reportwill continue to show your bankruptcy for either:

- 2 years from when your bankruptcy ends or

- 5 years from the date you became bankrupt .

It can take time to rebuild your credit rating.

For more information regarding your credit report, contact a credit reporting agency. Information about credit reporting agencies is available at ASIC’s MoneySmart.

Also Check: Les Schwab Credit Score Requirement

Rebuilding Credit Scores After Bankruptcy

You can start repairing your credit as soon as your Chapter 7 bankruptcy case is closed. Understanding how a credit score is calculated can also help you improve it after bankruptcy.

- Payment history

- Amounts owed

- Length of credit history

- New credit

Your payment history has the biggest influence on your credit score. Therefore, you need to ensure that all future payments are made on or before the due date. This includes mortgages, rent, car loans, utilities, and all other payments to creditors.

The second largest influence on your credit score is the amount owed. Using more of your available credit can lower your credit rating. Filing a Chapter 7 bankruptcy can help improve this factor by reducing the amount of money you owe.

In the future, try to keep balances on credit cards to no more than 30% of the available credit line to avoid a decrease in your credit rating.

These are some other ways you can improve your credit rating after bankruptcy:

Also, beware of credit repair scams after filing Chapter 7. There are less-than-reputable companies that claim they can quickly fix credit scores after bankruptcy. However, these companies cannot do anything that you cannot do for yourself. Some may even sell your information or use illegal or unethical methods to boost credit scores.

How Bankruptcy Affects Your Credit

Filing for bankruptcy makes it challenging to receive credit cards or lower interest rates because lenders will consider you risky. These consequences could occur immediately, affecting any short-term needs such as getting affordable interest rates or approval from prime lenders. Rebuilding your credit as soon as possible is paramount. One way to increase your credit score is to pay all your bills on time each month, creating and sticking to a budget and not incurring more debt. You should also avoid overuse of credit cards and failing to pay balances in full each month. Having a good credit score gives consumers access to more types of loans and lower interest rates, which helps them pay off their debts sooner.

Recommended Reading: Credit Score With Itin Number

Check Your Credit Report After Bankruptcy Discharge

Theres no way around itfiling for bankruptcy will tank your credit score, and for good reason. While it may have been the best solution for your debt situation, it will take time to rebuild your credit again. One of the first steps you should take after declaring bankruptcy is to check your credit reports and make sure the debts you discharged through bankruptcy are showing a zero balance. If they arent, you will need to take action to fix it.

But Ive Never Missed A Payment I Just Have No Hope Of Ever Paying Off My Debt

If youâre one of the few that has been able to stay current with all debt payments, but need to reorganize your financial situation through a Chapter 13 bankruptcy, your credit score will go down initially.

But, thatâs not the end of the story. Once your bankruptcy discharge is granted, your debt amount will go down significantly! And guess what helps build and maintain good credit? A low debt-to-income ratio.

Debt-to-income ratio?!

Put differently, the best credit rating is possible only if your total unsecured debt is as low as possible. A bankruptcy discharge eliminates most, if not all of your debt. Itâs the one thing you can do that your current debt management methods canât accomplish.

Doesnât bankruptcy stay on your record for 10 years?

Well, yes, under federal law, the fact that you filed bankruptcy can stay on your credit report for up to 10 years. This is true for all types of bankruptcy. But, Chapter 13 bankruptcy stays on your credit report for only seven years from the filing date.

According to Experian, thatâs because unlike a Chapter 7 bankruptcy, Chapter 13 involves a repayment plan that pays off some amount of debt before a bankruptcy discharge is granted.

Don’t Miss: What Is Attcidls On My Credit Report

After Six Years From The Date Of Discharge Start Checking

If your bankruptcy was discharged, and its been more than six years since it was discharged, submit your Certificate of Discharge. It may take them a few week to update your credit reports. I would allow at least a month, maybe more. Then request a new copy of your credit report and see if its still showing up. Better yet, when submitting your certificate of discharge, request that a new copy of your credit report be sent to you once all of the updates have been done. By mail, you should be able to get it for free. If you get it online, you get it instantly, but you have to pay for it .

If its only been slightly longer than six years since your bankruptcy was discharged, it may take a few more weeks or even months for it to drop off your credit report. But if you absolutely cant wait then call or send in a correction form to see if you can speed up the process.

What Is A Credit Report

Your is created the first time you apply for credit or borrow money. It will contain information such as details about your credit cards and loans, including when you opened your accounts, how much you owe, when you make or miss payments, and if you go over your credit limit. A credit report also contains personal information such as if you have ever filed for bankruptcy.

You May Like: Is 766 A Good Credit Score

Rebuilding Your Credit Score

Your ability to borrow is dependent on more than just one item on your credit report. A past bankruptcy is one factor, but a potential lender will review other factors including your income, work history, living situation, and other credit you have re-established.

If you want to rebuild your credit rating after bankruptcy, it is recommended that you do the following:

How Long Will Bankruptcy Affect My Credit File

Your bankruptcy will appear on your credit report for six years, or until you’re discharged if this takes longer. Lenders look at your credit profile when you apply for credit, so you’ll probably struggle to borrow money while bankrupt. Whatâs more, you must tell lenders about your bankruptcy when applying to borrow over £500. Employers and landlords may ask to look at your credit information before employing you or letting you rent property.

If you do find someone who’ll lend money to you, they may charge you a higher interest rate as they’ll see you as a high-risk customer. Even after your bankruptcy has been cleared from your profile, lenders can ask if youâve ever been bankrupt .

You can see what’s on your credit profile by getting your Experian Credit Report.

Recommended Reading: Does Paypal Bill Me Later Report To Credit Bureau

Tips For Credit Rebuilding

Ironically, the only way to fix your credit score is to start borrowing money again. If you are in a consumer proposal, think carefully about the purpose of this process, and how to avoid new problems with your credit. Even though it feels good to be offered new credit, or be accepted for a new card, be sure not to overextend your ability to make regular payments. Go slowly. You do not need to borrow large amounts to rebuild your credit. Making all your payments on time is the key. In addition, pay attention to the interest rates and fees charged on credit products you apply for as there are some lenders who may not have your best interests in mind.

Here are some tips for rebuilding your credit.

How Bankruptcy Appears On Your Credit Reports

Bankruptcy is a type of public record that can be listed on your credit reports. As long as its listed on your reports, the bankruptcy may negatively impact your credit. According to the Fair Act, a Chapter 7 bankruptcy may stay on your reports for 10 years from the date you file. A discharged Chapter 13 bankruptcy typically stays on your reports for seven years from the date you file, but it could remain for up to 10 years if you dont meet certain conditions. Both types have the same impact on your credit scores. However, its possible that a future lender could view one type more favorably than the other. This type of public record may lower your scores significantly. If your credit was healthy before the bankruptcy, it may be hit harder than someone with poor credit. Ultimately, how a bankruptcy affects credit can vary, partially because of the different factors that make up each persons credit.

Also Check: How To Remove Repossession From Credit Report

Can I Get Credit While In A Consumer Proposal

You may wish to ask your Trustee about this. While in a consumer proposal, you can apply for a secured credit card through select financial institutions. With a secured card, you make a small security deposit, and then utilize the credit card to make purchases and then promptly pay them off. By doing this, the credit card company will report that you are utilizing the credit and paying as agreed and note the account as an R1. Check the cost of the card, as service charges are greater than with standard cards. Also, do not confuse secured credit cards with pre-paid VISAs and MasterCards prepaid cards have no effect on your credit report and do not help you rebuild.

Using a secured credit card and making regular payments on it while in a consumer proposal can cause a slight improvement in your credit rating, but you will see quicker improvements once your consumer proposal is paid off. Also, you will have access to better interest rates on borrowed money after your consumer proposal is completed. Becoming debt-free by successfully completing your consumer proposal will have a significant impact on your capacity to obtain credit.

Understanding Chapter 13 Credit Reporting

During a Chapter 13 bankruptcy the creditors are not required to report anything to the credit reporting agencies. Even though a debtor is making payments in their plan, those payments may not be reported to the credit reporting agencies.

On the other hand, some creditors will zero out the debtors balance after the bankruptcy filing. This, however, is not guaranteed. But whether or not a creditor zeros out a debtors balance will not impact the fact that they cannot attempt to collect on the debt while the debtor is in bankruptcy.

Lastly, your credit report is not entirely important at the moment. Generally speaking a debtor is not able to obtain new credit while in Chapter 13 bankruptcy without the permission of the bankruptcy trustee. Because of this their credit rating during bankruptcy is not as important as their credit rating after their bankruptcy discharge.

You May Like: Does Speedy Cash Check Your Credit

First Things First: Dont Panic

Many people consider bankruptcy when looking to relieve debt stress. However, the damage may not be as bad as you think. You also have options to rebuild your credit.

A Chapter 7 bankruptcy involves the collection as well as the liquidation of non-exempt assets. The non-exempt assets proceeds are then distributed to your unsecured creditors. This is generally a faster process than a Chapter 13 bankruptcywhich calls for a 3-year to 5-year repayment plan. There are a few differences when looking at these two types of bankruptcy, including what happens to your credit when you file bankruptcy.

Both Chapter 7 and Chapter 13 cases will be reported under the public record section of your credit report. This same section of your credit report is where court cases involving creditor judgments are listed.

A bankruptcy case will be reported in the public records section for 7-10 years, depending on the bankruptcy case filed. The creditors listed in your bankruptcy case will still show up on your credit report. These accounts will be labeled Included in Bankruptcy.

- Chapter 13 bankruptcy shows up for 7 years

- The bankruptcy will be deleted from the public records section 7 years from the filing date of the bankruptcy case

- Chapter 7 bankruptcy shows up for 10 years

- The bankruptcy will then undergo deletion from the public records section 10 years from the filing date of the bankruptcy case

Do I Have To Get My Credit Report From All Three Cras

As there is no requirement under data protection law for lenders to report such data to all the CRAs, it is up to the lender to decide which CRA they wish to use, if any.

While we appreciate it is frustrating you may have to obtain three copies of your credit reference file. You may want to consider obtaining one report first as it could be that all accounts appear on there and you wont have to obtain the other two. You could ask your lenders which CRAs they use to help narrow this down. You may find that they all use one, or even all of, the CRAs.

You May Like: Does Affirm Show Up On Credit Report

Do I Need To Keep In Contact With My Trustee

Normally you don’t. In some cases, your trustee continues to manage your bankruptcy, even after it has ended. For example, your trustee has claimed your house as an asset and they havent sold it yet.

Your trustee may still request you to:

- provide information about your financial situation

- make any outstanding compulsory payments.

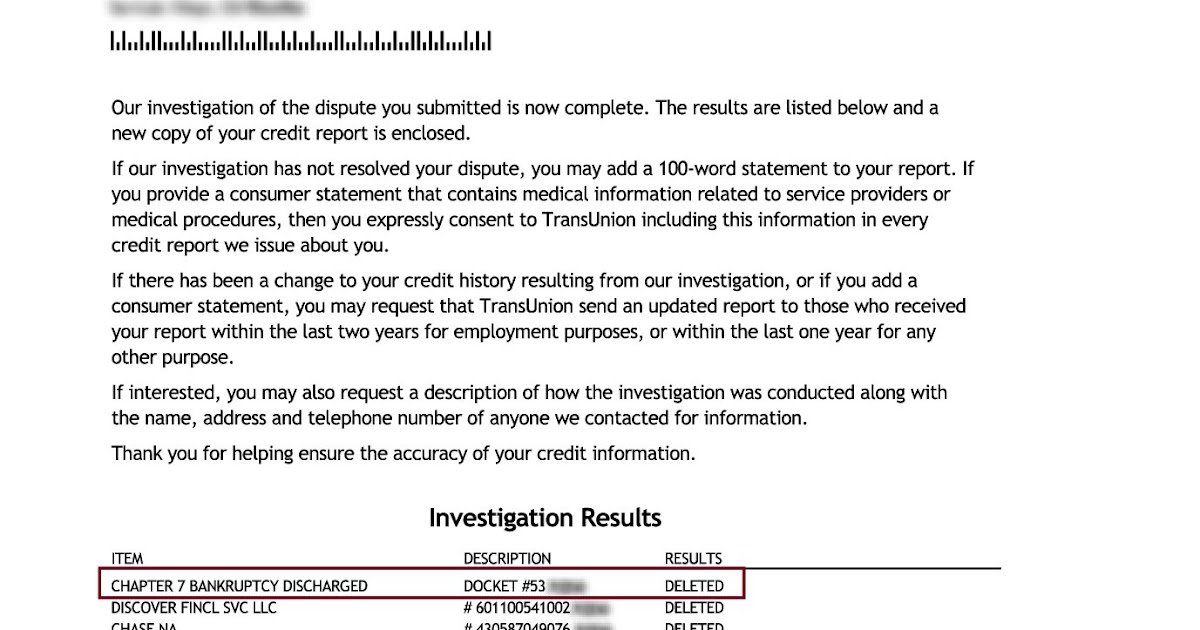

How Can I Dispute Inaccurate Bankruptcy Information

It’s always a good idea to look over your credit report a month or two after the discharge to make sure that the bankruptcy and any accounts included in the bankruptcy have been updated and are being reflected accurately. You can get free copies of your credit reports from all three bureaus at AnnualCreditReport.com. You can also request your free credit report and FICO® Score 8 directly through Experian.

If you notice that the bankruptcy listing itself has not been updated to show that it has been discharged, or if there is an account that should be showing discharged but has not been updated, you can dispute the information using Experian’s online Dispute Center. Simply indicate which account you believe is appearing incorrectly and why. If you have documentation, such as the schedule of creditors that were included in your discharge, you can upload a copy of those documents as well.

You can also contact the lender directly to ensure that their records have been updated to reflect your bankruptcy discharge and to request that they update the account with each credit reporting company that they report to.

Read Also: How Accurate Is Creditwise Credit Score