Essential Reads Delivered Weekly Your Credit Cards Journey Is Officially Underway Keep An Eye On Your Inboxwell Be Sending Over Your First Message Soon Why Was My Application Declined

As with any credit card application, your credit score and credit report will be key factors in deciding whether youre approved for the Apple Card.

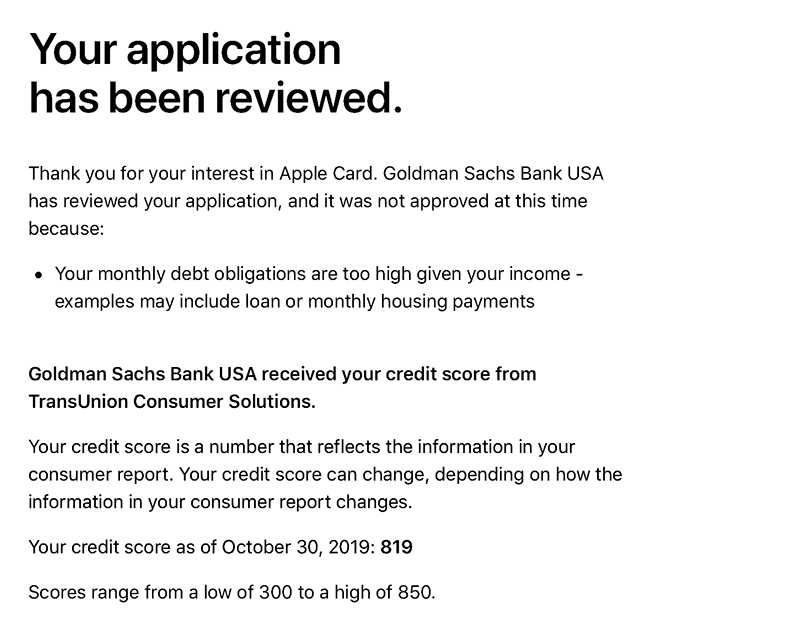

That said, its still possible to be denied for a credit card with excellent credit, and Goldman Sachs considers a number of other criteria when evaluating Apple Card applications, including whether your identity can be verified and your income, banking history and debt obligations.

Heres a breakdown of the reasons you may be denied the Apple Card, according to Apple:

If Your Application Is Approved

You have up to 30 days to accept your offer.;If you accept your offer;and add Apple Card to your eligible iPhone or iPad, you can:

- Use Apple Card to;make purchases;anywhere Mastercard is accepted;and get unlimited Daily Cash.

- Manage your account in the Wallet app or from your Apple Card web account;to make or schedule payments, download PDF statements, and see your balance.

- Set;Apple Card as your default payment card;for Apple Pay, the App Store,;Apple Music, and other Apple services.

- If you have Apple Card Monthly Installments, you can see your plan in the Wallet app or see your plan online.

- Use Apple Card on all of your eligible devices. Learn how to;add your Apple Card to your Apple Watch, iPad, or Mac.

These Issuers Offer Pre

| Yes | Bad |

The only downside to getting pre-approved for a credit card is that you have to do it issuer by issuer. If you dont feel like doing that, you could check for pre-approval with one credit card company and then use the results to estimate your approval odds for cards from other issuers. For example, if you get pre-approved for a card that requires a minimum of good credit for approval, you should have a pretty good chance of getting other cards for people with good credit.

Alternatively, you can , and well give you personalized recommendations for credit cards with high approval odds. These recommendations are based on your credit history and financial goals as well as our analysis of WalletHub application and approval data.

Below, you can learn more about when hard and soft pulls are used for credit cards, including the case of credit limit increases.

Also Check: Is 728 A Good Credit Score

What Other Perks Does The Apple Card Offer

In addition to cash back rewards, the Apple Card offers several features designed to help cardholders manage their finances and build their credit. Use the Wallet app to track your purchases by category or identify spending habits and trends. When you make credit card payments, the Wallets payment wheel will offer recommendations to help you avoid interest charges and pay down your balance more quickly. You can even pay for Apple products in interest-free installments.

You can also share your Apple Card account using Apple Card Family. With this feature, you can share your account with up to five people. Everyone on the shared account can use your Apple Card and view their spending. Account owners and co-owners can see group members activity, set transaction limits and more.;

You can designate a co-owner for the account, too. Like an authorized user, they will share your credit line and information reported to credit bureaus regarding the account. Your account co-owner must be at least 18 years old, while children over 13 can also be added to the account.;

Apple Card Family: 5 Things You Need To Know About Sharing Apple’s Credit Card

Ready to share your Apple Card with a friend or family member? We dig into what you need to know about the new account-combining feature.

Everyone who joins your Apple Card Family can get a titanium Apple Card.;

Two years after the;Apple Card’s;initial release, Apple has been making some big changes. More specifically, Apple unveiled Apple Card Family, an initiative where iPhone owners who are part of the same Apple Family Sharing group can share an Apple Card account . With the relatively new Apple Card Family service, you can invite a child or partner to share your Apple Card account, giving them a digital and physical version of an Apple Card of their own, but leaving you with the bill at the end of the month . Don’t worry, you can set spending limits if necessary.;

When Apple Card Family was first announced, the service didn’t support merging two existing Apple Card accounts into one joint account. In July, however, Apple released;iOS 14.7, which allows existing Apple Card users to combine their accounts. The process takes just a few minutes of your time and is done entirely on your iPhone.;

Get the CNET Now newsletter

If you have questions about Apple Card Family, how it works, what kinds of accounts you can create or how to invite someone, I’m here to answer them. I dug through the support documents and have been using the feature since its release in May. Below I’ll break down the major points.

You May Like: What Is A Good Credit Score For My Age

S Best Soft Pull Credit Cards

John S Kiernan, Managing EditorDec 21, 2020

Soft pull credit cards let you check for pre-approval and request a credit limit increase without a hard credit inquiry. Most soft pull credit cards do not, however, allow you to open a new account without a hard inquiry. With the exception of a handful of secured credit cards that dont check your credit at all when you apply, you cant get a credit card without a hard inquiry.

A hard inquiry is when a lender reviews your credit history in response to your application for credit. And each one does a bit of temporary damage to your credit score, with the impact being most pronounced when you have numerous inquiries in a short period of time. So being rejected for a credit card will make it harder to get approved for your next choice, and you may need to wait a bit before applying again.

Soft credit inquiries, on the other hand, usually happen when you check your own credit or a lender does so for normal account maintenance. They dont affect your credit standing.

Thats why it can be so helpful to see whether you have a good shot of getting a given card with just a soft pull before you put your credit standing at risk and apply for real. Getting pre-approved for a credit card means you have a 90%+ chance of approval if you apply. And most major credit card companies allow you to check which of their cards you can get pre-approved for, using just a soft pull.

Applying For The Apple Card

The Apple Card is only available to qualified Apple users: You need to have an iPhone, iPod or iPad device with the passcode enabled to apply. But, great news for cardholders concerned about their credit scores and approval odds: You can send in an application and find out whether you qualify for the card with only a soft pull to your credit. Once you accept the offer and open the card, Apple will perform the official hard pull to your credit report. While its not quite a soft pull credit card, this flexibility makes applying for the card much less risky for applicants on the lower end of the credit spectrum.

See related: Why was I denied for the Apple Card?

You May Like: Why Did My Credit Score Drop 20 Points

Conditions That Might Cause Your Application To Be Declined

When assessing your ability to pay back debt, Goldman Sachs1;looks at multiple conditions before making a decision on your Apple Card application.

If any of the following conditions apply, Goldman Sachs;might not be able to approve your Apple Card application.

If you’re behind on debt obligations4 or have previously been behind

- You are currently past due or have recently been past due on a debt obligation.

- Your checking account was closed by a bank .

- You have two or more non-medical debt obligations;that are recently past due.

If you have negative public records

- A tax lien was placed on your assets .

- A judgement was passed against you .

- You have had a recent bankruptcy.

- Your property has been recently repossessed.

If you’re heavily in debt or your income is insufficient to make debt payments

- You don’t have sufficient disposable income after you pay existing debt obligations.

- Your debt obligations represent a high percentage of your monthly income .

- You have fully utilized all of your credit card lines in the last three months and have recently opened a significant amount of new credit accounts.

If you frequently apply for credit cards or loans

- You have a high number of recent applications for credit.

If your credit score is low

Goldman Sachs uses TransUnion and other credit bureaus;to evaluate your Apple Card application. If your credit score is low ,4;Goldman Sachs;might not be able to approve your Apple Card application.

Apple Card Financing Options

| Apple TV, HomePod and AirPods | All | 6 months |

To take advantage of the Apple Cards financing program, simply pick out your new device and select Apple Card Monthly Installments as your payment option in the Apple Store app or online at apple.com. If youre already an Apple cardholder, theres no additional application to fill out.

Read Also: How To Print Out My Credit Report

Apple Card: All The Details On Apple’s Credit Card

Apple in August 2019 released the Apple Card, a credit card that’s linked to Apple Pay and built right into the Wallet app. Apple is partnering with Goldman Sachs for the card, which is optimized for Apple Pay but will still works like a traditional credit card for all of your transactions.

There’s a lot of fine print associated with the new Apple Card, so we’ve created this guide to provide details on what you can expect when signing up for the card. Apple first made the card available to a select number of customers in early August before opening up the card to everyone later in the month.

What Credit Score Do I Need To Be Approved For Apple Card

Heads up! We share savvy shopping and personal finance tips to put extra cash in your wallet. iMore may receive a commission from The Points Guy Affiliate Network. Please note that the offers mentioned below are subject to change at any time and some may no longer be available.

If you are like me and excited about what Apple Card is bringing to the credit card market, you are probably about ready hop in the Wallet app and fill out an application. You’re probably looking forward to that gorgeous titanium card, Daily Cash, and all of the budgeting and management tools to help you be more responsible with your credit card. Before you go straight to applying there’s one thing you should do first: make sure you’re in the best position to be approved for it!

Apple and Goldman Sachs haven’t come out with exact numbers regarding what your credit score needs to be in order to be approved for Apple Card, but there are some important things we do know that can help all of us be as prepared as possible in order to get approved. . Here are some of the most common questions surrounding applying for Apple Card.

You May Like: What Credit Report Do Car Dealers Use

If You’re Approved But Your Credit Limit Isn’t Enough To Buy A Device With Apple Card Installments

You can;apply for Apple Card;when you buy a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Installments.;If your application is approved with insufficient credit to cover the cost of the device;you want to buy, you can choose a different device that’s covered by your credit limit. You can also choose a different payment method or;use Apple’s Trade-in program.

Coowners Have Equal Rights

Apple;Card Family CoOwners share their credit lines for a combined limit. CoOwners build credit as equals, can manage the account together, and can set limits for Participants. A CoOwner must be in the same Family Sharing group, and if they dont already have their own Apple;Card, theyll need to apply for;one.

Don’t Miss: How Long Do Inquiries Last On Your Credit Report

How Do I Accept An Apple Card Family Invitation

If you’re on the receiving end of an invite to share an Apple Card, you’ll need to take a few minutes to complete the sign-up process on your iPhone. Once the account owner sends you an invite, you’ll get an alert on your phone. Open the alert, or unlock your phone and open the Wallet app. In the top-right corner you’ll see a notification badge — tap it. Follow the prompts to complete the setup.;

For participants, you’ll only need to accept the Apple Card invite. Optionally, you can enter your Social Security number to start building credit if you’re over 18 years of age.;

For co-owners, you’ll need to go through the complete Apple Card sign-up process that includes a credit check and entering your personal information.;

If you’re combining two existing accounts, you’ll go through a similar process to when you first signed up for the Apple Card. When you receive and accept the invite, you’ll be presented with an account offer containing a credit limit and APR. If you accept it, the person who invited you will receive a notice of their own that they need to review the offer and accept it as well. Once both parties have accepted the offer, it will take a few minutes for Apple to process the change and merge the two accounts.;

Within 30 minutes or so you’ll be able to see past purchases and payment history, and you’ll begin to see any new transactions show up in the Wallet app with the person’s name next to the charge.;

How To Check Your Credit Score For Free Before Applying For Apple Card

For more on Apple Card, check out our hands-on and how-to coverage below:

Read Also: How To Make My Credit Score Go Up

Polishing Your Credit Report

They say you only have one chance to make a good first impression, and nothing could be truer when it comes to your credit. No matter how well-intentioned you are or financially responsible at the core, its the immediate appearance of your credit that a bank or creditor will base its decision on. And if yours isnt the greatest of shape, you could get denied for credit. On top of that, your credit score will take a hit from a hard credit check.

Its time to give your credit a makeover, especially if your goal is to get;approved for credit by Citi, or any other financial providers with high credit standards. Making changes to your credit behavior is a key step since itll reflect positively on your credit report. But youll also want to remain watchful of your actual credit report because it could contain erroneous or outdated info that can inadvertently hurt your credit against your best wishes.

Here are some steps to take:

Where Is Your Apple Card Credit Card Number Located

The titanium Apple Card features a minimalist, security-focused design that doesnt include a credit card number. To look up your Apple card number, open your Wallet app, locate your Apple Card, tap the three dots in the upper-right-hand corner of the screen and select Card Information. Complete the authentication step to prove that its really you,;and the Wallet app will reveal your credit card number.

Read Also: How To Report A Death To Credit Bureaus

Setting And Adjusting Your Credit Limit

After Goldman Sachs approves your Apple;Card application, they assign your initial credit limit using many of the same factors that go into the approval process, such as your credit score and existing credit. Goldman Sachs also looks at your income and the minimum payments tied to your existing debt. When you share your Apple;Card with a CoOwner, our goal is for your combined credit limit to reflect what your credit limits would be individually, added together. If youre interested in increasing your credit limit, you can make a request after youve had your Apple;Card for as little as four months. Simply call or text, and well connect you with an Apple;Card Specialist at Goldman Sachs right;away.

Your Credit Limit

Payments History

See If You’re Eligible

- To be eligible to apply for Apple Card, you must be 18 years old or older, depending on where you live.

- You must be a U.S. citizen or a lawful resident with a valid, physical;U.S.;address that’s not a P.O. Box. You can also use a military address.

- Your device must be compatible with Apple Pay. See which devices are compatible with Apple Pay.;Make sure that your device has;the latest version of iOS,;watchOS, or;macOS.

- You must sign in on your device with your Apple ID and use two-factor authentication.

- If you have a freeze on your credit report, you need to temporarily lift the freeze to apply for Apple Card.;Learn how to lift your credit freeze.

- You might need to verify your identity with a Driver License or State-issued photo ID.5

Also Check: How To Unlock My Experian Credit Report