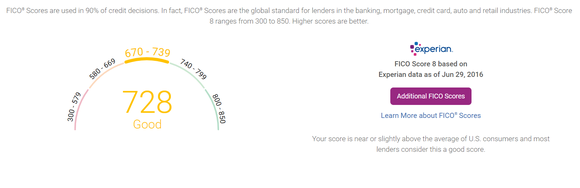

Summary: Financing A Car With A 728 Fico Score

It is when applying for loans that the distinction between an excellent and good credit score truly comes to fore. For example, when applying for a loan that is more than how much you earn, then you will need a credit score of at least 680 and it is not different when it comes to an auto loan.

It is practically impossible to secure some loans without a very good credit score. Imagine the interest on a $200,000, 30-year, settled rate contract. If you have a credit score of 760 to 850, you will have to pay an interest rate of 3.083 percent according to FICOs interest number cruncher as of October 2012.

What Is A Good Credit Score In Canada

To have what is considered a good credit score in Canada, you want to aim for a credit score above 700. Even though good technically starts at 660, getting your credit score above 700 is going to open up many new options for you. People with a good credit score in Canada have access to far better interest rates across all credit products, plus a better chance of getting approval for the credit products you apply for.

Dealing With Negative Information Which Impacts Your 728 Credit Score

If your credit score is a negative in your life, then there are several things you can do if you want to improve it.

Firstly, you can enhance your 728 credit score by simply paying all your bills on time. Making late payments, partial payments or trying to negotiate with lenders all work to drive your score lower. To make sure you can pay your bills on time you should ensure that you have a monthly budget. Stick to it, pay your bills first and your credit score will improve over time.

In addition to paying your debts on time, taking on as little debt as possible in the first place will keep your credit score in good health. Lenders can only lend you so much. If you have a lot of debt your repayment capacity will decrease and your credit score will follow. Again, budget so you do not need to borrow.

If you do need to borrow then make sure you pay off the debt as quickly as possible. Dont just make the minimum repayment, this again will aid an increase in your credit score.

Another aspect of your 728 FICO score is one not many people know about. Every time you apply for credit that application is logged.

The more applications you make the more it looks like you cannot manage your finances and always need a constant stream of loans to meet your day to day obligations. So again, if you do need credit, only apply when your going to draw it down and make as few applications as possible.

Recommended Reading: How To Help Credit Score

What Is The Average Credit Score In America

The average credit score in the U.S. is at an all-time high of 711. This coincides with what the Consumer Financial Protection Bureau defines as “prime.”

About 1 in 5 American adults either have no credit history or are unscorable. As a result, these individuals will have difficulty obtaining new lines of credit.

In the eyes of lenders, credit scores fall into several buckets, which indicate how risky it may be to extend credit to an individual. Outside of playing a role in approvals for a loan or credit, these scores can also impact an individual’s lending terms. Perhaps the most important terms among those are interest rates.

The higher an individual’s credit score, the lower their quoted APR will typically be.

FICO credit scores break down in the following manner:

- 800 to 850: Exceptional

- 300 to 579: Very poor

This means the average credit score of 711 is in the good range.

Though the average credit score has generally improved since 2005, slight dips were seen around the Great Recession that ended in 2009. A large number of people declaring bankruptcy or defaulting on their loans would have caused their credit scores to plummet, which in turn would have affected the overall average.

Why Do Lenders Check Your Cibil Score Before Approving Your Loan

Since CIBIL score measures your overall creditworthiness, a lender is certain to check your score when reviewing your loan application for a variety of reasons. They are:

-

To check your credit history and past record

-

To see whether you are capable of repaying debts

-

To review your credit balance and understand the risk level of your profile

-

To judge whether you qualify for the loan

-

To decide on the loan amount to offer you and interest rate applicable

Don’t Miss: How To Get A Debt Collection Removed From Credit Report

How To Improve Your 728 Credit Score

A FICO® Score of 728 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 728 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

53% of consumers have FICO® Scores lower than 728.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Build Your Credit Mix

We generally dont recommend taking out a potentially expensive loan just to build your credit scores. But its true that having a mix of different types of credit can benefit your scores over the long term. Types of credit include revolving credit and installment credit .

But theres a wrinkle: Applying for new credit can lead to a hard inquiry on your credit reports, which can have a negative impact on your scores. While this impact is typically minor, too many hard inquiries in a short time period can be a red flag to lenders. Thats why its important to have a general sense of how likely it is that youll be approved before you apply for a credit card or loan.

Read Also: Will Paying Off Collections Help My Credit Score

Soft And Hard Credit Checks

Whether youre applying for a bank loan, apartment rental, or credit card, someone is bound to ask you for a credit check at some point in your life. There are two types of checks in Canada, with the first being a soft check. This is when you or another person checks your credit score for non-lending purposes. Despite what you may have heard, the good news is that it doesnt negatively impact your credit score.

However, a hard check can cause your credit rating to drop. It occurs every time you apply for a credit card or loan, and having too many hard checks in your credit history during a condensed time period can knock off 7-10 points. Knowing this, just be careful about applying for too many credit products at once.

Average Credit Score By State

Finances look very different across all 50 states, and the average credit score looks pretty different, too. While Mississippi has the lowest average credit score, Minnesota has the highest credit score at 720. Here’s the average credit score in each US state and the District of Columbia, according to data from Experian.

| State | Average credit score in October 2020 |

| Alabama | |

| 719 |

Recommended Reading: How Long Do Inquiries Last On Your Credit Report

Can You Get A Personal Loan With A Credit Score Of 724

Most lenders will approve you for a personal loan with a 724 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

How To Get Your Credit Report In Canada

A credit report is a record of a borrowers credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

Read How to Check Your Credit Score 101 for detailed information on how to get your free credit report.

Don’t Miss: Does Zzounds Report To Credit Bureau

What Is A Good Credit Score To Avail A Home Loan

To avail a home loan, you need to ensure that you have a CIBIL score at least above 650. Since a home loan is a secured loan, lenders have the option of seizing your home if you are unable to repay the loan. This is why a slightly lower credit score is allowed. However, it is in your best interest to maintain a good credit score so you can get a larger loan amount at nominal interest.

You can maintain a good CIBIL score by following these simple steps:

-

Pay your EMIs on time to create a proper track record

-

Avoid having a credit card that you dont use; cancel dormant credit cards

-

Manage your credit cards carefully by setting payment reminders or limit your use to one credit card

-

Avoid re-applying for loans or credit cards that you did not get approved for in quick succession

-

Dont make too make loan applications in a short span of time

-

Choose lengthy loan tenors with care and try to make part-prepayments when you can

Breakdown Of A Credit Score Rating

So far, this article has only discussed two of the credit score groups which you could move into Good credit score group and Excellent credit score group but there are a range of others that you could fall into if you do not manage your debts very well. These are fair, poor and bad.

A fair credit score would fall into the 650 699 range, if you fall into this bracket it means that you have likely missed a small number of payments on a debt. In general, around 15% of people fall into this category. A poor score means that you have missed several payments over an extended period or have missed a payment on multiple occasions. In can also mean you have a lot of debt at present and would be unlikely to be able to repay any further loans, about 20% of people have this rating.

At the bottom of the scale is a bad score, here you are likely to have had a legal judgment registered against you or in a worst-case scenario been declared bankrupt at some point. The main factor driving you credit score is how well you have managed to make repayments and as shown above these drive your credit rating which is especially true in this case. If you are in this bracket you are in the 8% of the borrowing population.

Read Also: Does Having More Credit Cards Help Your Credit Score

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that you have undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

Read Also: Does Having A Overdraft Affect Credit Rating

Can I Get A Mortgage & Home Loan W/ A 728 Credit Score

Getting a mortgage and home loan with a 728 credit score shouldn’t be very difficult. Your current score is a mid-to-high credit rating.Â;

The #1 way to get a home loan with a 728 score is to complete minimal credit repair, and simply apply and wait for approval.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history; the amount of debt you have; and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

You May Like: How To Get A Bankruptcy Off Your Credit Report

So Can I Lease A Car With A 728 Credit Score

There are two kind of leasing deals namely the normal deal and the promotional deal. A promotional car lease deal is one offered via auto makers and their merchants temporal period . The arrangements are vigorously promoted and can be seen on car organization sites.

As a rule, these extraordinary arrangements depend on lessened costs, and helped lease-end residual value. Besides, there might be mileage confinements and up-front installment to be required. When you will try to lease a car with 728 credit score, keep in mind that only people with good or excellent score point are entitled to this promotion the reason being that most car companies go on loss because some people do not fulfill the lease agreement most of the time.

How To Get A 727 Credit Score

While theres no exact formula to achieve a specific score, you can aim to get within a general score range. Even taking the different credit scores and definitions of good credit into account, there are general principles that can help you build and maintain healthy credit. Sticking to these principles over time can raise your scores, making you a better credit risk in lenders eyes.

Here are some actionable tips to help you stay on top of the important factors that can affect your credit.

Read Also: How To Get Credit Report Without Social Security Number