Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Can I Get A Rewards Credit Card With Fair Credit

You may struggle to get approved for a cash back or travel rewards credit card with fair credit. While you might be able to find a card that earns a limited amount of cash back on purchases, the most-rewarding credit cards generally require good or excellent credit.

If a top-notch rewards card is your ultimate goal, dont be discouraged. You may be surprised by how much good, persistent habits can affect your credit scores.

And thats one nice thing about credit cards. Even the ones that arent the absolute best can help you build credit by reporting your account activity to the three major credit bureaus. This information makes its way into your credit reports and ultimately can impact your credit scores. So, as long as you make on-time payments and follow the other credit-building tips outlined above, you can put yourself in a position to qualify for a better credit card in the future.

Compare offers for on Credit Karma to learn more about your options.

Dealing With Negative Information Which Impacts Your 666 Credit Score

Whether you have too many hard inquiries or have late payments listed on your report, knowing how to deal with negative information on your credit report is crucial in attempting to boost your credit score. Fortunately, this information will be removed with time. Some information on your credit report can even be removed sooner from the original date, if applicable.

Bankruptcies

If you filed a Chapter 13 bankruptcy, your bankruptcy will be cleared from your credit report after seven years. For a Chapter 7 bankruptcy, it will be cleared in ten years. One can try to clear a bankruptcy from their report early; however, it can be a difficult process.

Hard inquiries

One can expect hard inquiries to remain on their report for two years. Initially, they can drop your 666 credit score 5 to 10 points. Fortunately, as time goes on, they affect credit less and less. To potentially remove a hard inquiry earlier, one can dispute the inquiry with the creditor or credit bureau. The latter technique is useful for those who have been a victim of identity theft.

Late payments

Late payments will be taken off your credit report after seven years from the delinquency date. There are ways that one can attempt to remove late payments earlier: requesting a goodwill adjustment from the creditor, volunteering to the creditor to sign up for automatic payments as an exchange for removal of the late payment, or disputing any information in regard to the late payment as inaccurate .

Debt Collections

Don’t Miss: Why Is My Credit Score Not Going Up

How To Get Your Free Credit Report

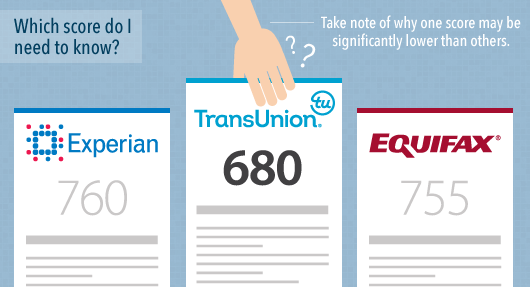

If you want to see your most up-to-date credit score for free, you can now get a free credit report each week from TransUnion, Equifax, and Experian by visiting annualcreditreport.com.

Free weekly reports will be available through April of 2021 in response to the coronavirus pandemic. After April of 2021, youll still be eligible for one free credit report from all three major credit bureaus every year.

You can also track your credit through free credit monitoring services like Credit Karma or Credit Sesame. These wont show your actual credit score, but theyll give you a good approximation based on your payment history, credit utilization rate, and mix of accounts.

One of your credit card accounts may offer free FICO scores or free Vantagescore. Check on the app or website to find out.

| 500 |

Wait Wait Then Wait Some More

You simply have to be patient. Even when you make all the right decisions, itll take some time to see results.

Part of your score relates directly to the length of credit history. But even on more important credit reporting factors such as your payment history and credit utilization ratio, time is your friend.

This is especially true if your past credit behavior has been questionable. With each passing year, your past bad decisions have less of an impact on your current credit information.

So be patient and continue making good decisions to establish a positive credit history, even if you dont see immediate results.

Keep making your payments on time and make sure you dont get any negative entries like a collection account. And let your current credit accounts grow older. The older your accounts, the better your credit score can be.

For example, my oldest credit card is 15 years old, and my average credit card is 8 years old.

Learn More:

Don’t Miss: Which Credit Score Matters The Most

What Is Considered Fair Credit

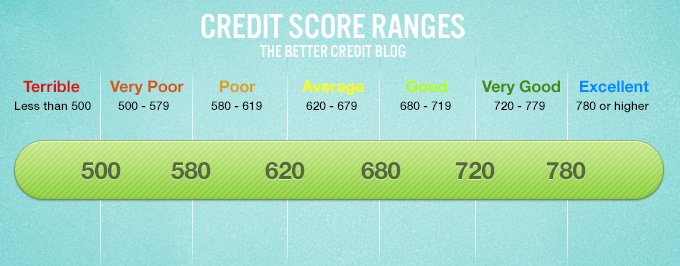

Fair credit, sometimes called “average” credit, is a step up from bad credit but a notch below good credit. It typically means your credit scores fall somewhere between 630 to 689, on a range of 300 to 850.

Credit scores indicate your level of risk to potential lenders and are based on several factors, including your payment history, the amount of;available;credit that youre using, how long youve had credit, and more.

There are good credit cards designed for people with fair credit, but you’re unlikely to get approved for;the best credit cards;until you can improve your credit.

Get your credit score for free

» MORE:;

The Best Mortgages For Buying A House With Lowcredit

If you have a low credit score, or past red marks on your credit report, the first type of mortgage you should look at is an FHA loan.

FHA loans

FHA loans are mortgages insured bythe Federal Housing Administration. This insurance protects mortgage lenders,making it possible for them to lend to borrowers with lower credit scores andsmall down payments.

In fact, the FHA mortgage programwas specifically designed for credit-challenged home buyers. It allows thelowest credit score of any loan program 500 although you need a 10% downpayment if your score is below 580. Those with a score above 580 onlyneed to put 3.5% down.;

Conventional/conforming loans

Conventional loans also allow amodest credit score of 620 with a down payment of just 3%.

However, the cost of privatemortgage insurance can make conventional loans unattractive forlower-credit borrowers with less than 20% down.

Conventional and FHA loans both require mortgage insurance. The difference is that FHA charges the same mortgage insurance premiums for all borrowers, regardless of credit.;

Conventional mortgages, on the otherhand, have steeply increased PMI rates for borrowers with low credit and alow down payment. As a result, FHA financing can sometimes be cheaper forborrowers with credit in the low- to mid-600s.

VA loans

For veterans and active-duty service members, a VA mortgage is normally the best bet.

Recommended Reading: How To Make My Credit Score Go Up

What Credit Card Can I Get With A 666 Credit Score

As someone with fair credit, you may have access to a number of unsecured credit cards. Unlike secured cards, an unsecured card doesnt require you to put down a security deposit.

Thats a plus, but there are other factors to consider. For example, many unsecured cards available to applicants with fair credit may charge an annual fee. These cards may also come with a high variable APR on purchases, which can translate to high interest charges if you carry a balance instead of paying off at least your statement balance each month.

With fair credit, you might be approved for a credit card with a relatively low credit limit though some issuers will automatically review your credit limit after several months of on-time payments. Your credit limit is important, because its directly correlated with your credit utilization rate.

What Is A Bad Credit Score

Having a bad credit score may mean some lenders will be reluctant to give you a loan or other credit product, or, depending on the loan type and lender, they may charge you a higher interest rate compared to someone with a good credit score. This is generally because you would be seen as a higher risk and less likely to be able to repay the credit.

So how low does a credit score need to be to be considered bad? Equifax considers a score below 505 to be below average, while Experian views a score below 549 as below average, and Illion considers a score of 299 or under to be a low score.

You May Like: How To Up Credit Score

Credit Score Credit Card & Loan Options

Some lenders choose not to lend to borrowers with scores in the Fair range. As a result, your financing options are going to be somewhat limited. With a score of 666, your focus should be on building your credit and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can co-sign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

What Makes Up Your Credit Score

The FICO credit score takes into account the information found in your credit report. Some parts of your credit history are more important than others and will carry more weight on your overall score.

Your FICO score ismade up of the following:

- Payment;history:;35% of your total score

- Total amounts;owed:;30% of your total score

- Length of credit;history:;15% of your total score

- New;credit:;10% of your total score

- Type of credit in;use:;10% of your total score

Based on this formula,the largest part of your credit score is derived from your payment history, andthe amount of debt you carry;versus the amount of credit available to you.These two elements account for 65% of your FICO score.

To put yourself in thebest position to qualify for a mortgage, focus on these areas first. Payyour bills on-time whenever possible, and try to reduce your credit utilization ratio.

Your credit utilizationratio compares the total amount of credit available to you against your currentbalances; try to keep it under 30%.

This will improve your FICO scores and mortgage loan terms measurably.

You May Like: How To Read A Transunion Credit Report

Qualifying For A Mortgage With Nocredit Score

Its possible to qualifyfor a mortgage even with no credit history.

Many individuals havepurchased everything with cash, which is a sign of fiscalresponsibility. Thats why most lenders can help you build a non-traditionalcredit report if you have no credit score or history.

The lender will take historyfrom accounts like rent, utilities, and even cell phone bills tobuild a score for you.

As long as youve managed thesetypes of accounts well in the past, theres a good chance you can get amortgage even with no credit score.

Is 665 A Good Credit Score

- Standard Definition: Yes A lot of people think good credit starts at a score of 660 and ends at a score of 719.

- WalletHubs Rating: No Based on the rate at which people with 665 credit scores get approved for credit cards that require “good credit” or better, we believe you actually need a credit score of 700-749 to have good credit.

Of course, lenders always have the last word. And they neither define good credit the same way, nor disclose exactly what they consider it to be. So even if your 665 credit score does count as good credit by in some cases, it wont in others. And thats reason enough to improve your credit score so as to erase all doubt.

Below, you can learn more about what your 665 credit score means as well as what you can do to take it to the next level.

You May Like: Which Credit Score Is Accurate

Cibil Score For Car Loans

CIBIL or the Credit Information Bureau Limited is an organisation that was set up in the year 2000 for the purpose of collecting information about a persons loan and credit cards and maintaining a record of the same for the purpose of developing a database of borrowers. It creates this database by collating information received from banks about a persons borrowing and payments towards loans and credit cards.

Once the information is collected, it is aggregated and processed to relate to a number that ranges from 300 to 900. The minimum CIBIL score for car loans accepted by most banks is 750.

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

Read Also: How To Remove A Delinquency From Your Credit Report

How Long Does It Take To Get A 666 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

What Does A 665 Credit Score Get You

| Item |

|---|

| 88% |

As you can see, most people who are at least 35 years old have a credit score of 650 or higher. And even younger folks nearly have a majority. This just goes to show that people with 650 credit scores come in all shapes and sizes, with diverse backgrounds and differing financial obligations.

As a result, the grades for each component of your credit score, which you can find on the Credit Analysis page of your free WalletHub account, might not exactly match those of another individual with a 650 score. But the sample scorecard below will give you a pretty good idea of what a 650 score is made of.Sample Scorecard 665 Credit Score:

- Payment History: C = 98% on-time payments

- B = 10% – 29% utilization

- Debt Load: A = Debt-to-income ratio below 0.28

- Account Age: B = Average tradeline is 7 or 8 years old

- Account Diversity: C = 2 account types or 5 – 9 total accounts

- Hard Credit Inquiries: A = Fewer than 3 in past 24 months

- Collections Accounts & Public Records: A = 0 collections accounts and public records

These are by no means the only credit-score grades capable of producing a score of 650, nor will they necessarily result in that exact rating. However, this is representative of the type of scorecard someone with a 665 credit score can expect: plenty As and Bs, but no failing grades to be found.

You May Like: What Does Frozen Credit Report Mean

How To Repair A 666 Credit Score

The secret to rebuilding your credit and fixing your 666 credit score isnt anything new and simply involves maintaining good financial habits over the long term.

In other words, theres no silver bullet that will automatically increase your credit score. It took a while for your score to get to this point, and it will take some time for it to go back up.

Fortunately, its super easy to increase your score as long as you follow sensible financial guidelines, including:

- Paying down your debt when the bill is due. If youre 90 days or more behind on some of your payments, you could see a 50-point increase in your credit score once you begin paying on time.

- Regularly using credit cards and paying down the balance each month;

- Maintaining low credit utilization rates;

- Maintaining a lengthy credit history;

- Avoiding taking out, or applying for, a lot of credit in a short period;

- Maintaining myriad types of credit, including credit card, auto, and home.

Another option is to reach out to a professional credit repair company, which can help improve your credit after charging a fee for their services. Compared to credit counseling organizations, credit repair companies start by identifying negative marks on your credit, such as charge-offs, multiple late payments, bankruptcies, and repossessions.

In some instances, the credit repair company might recommend taking out new credit to help improve your score.