How You Can Easily Build And Improve Your Credit Score With Grow Credit

Grow Credit enables U.S. residents to easily build and improve their credit over time. By paying off small-scale subscription bills through our free and virtual Grow Credit Mastercard, its simpler than ever to start your credit history off in the right way, and make sure that your credit score goes in the direction you need it to.

It doesnt matter if youve already got lines of credit open, or if Grow Credit will be your first, though: as long as payments are made in good time, Grow Credit will help your credit scorewhatever it may beto rise.

Check out this short explainer video on how Grow Credit works in action.

Ready to apply for a Grow Credit Mastercard yourself?

Itll take mere minutes if you have the following:

-

A bank account

-

An email address

-

A physical U.S. address and resident status

-

A minimum income of $1,200 per month

-

An account balance of at least $100

-

And age 18+

Apply via our iOS and Android apps, or through our website now! And for those who want to completely take control of their credit score, we offer two premium plans . Read more about our plans here.

Its time to grow with Grow Credit.

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Can You Get A Personal Loan With A Credit Score Of 637

Very few lenders will approve you for a personal loan with a 637 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

You May Like: Does Sprint Report To Credit Bureaus

But What Is A Good Credit Score

The answer isnt as simple as you might think.

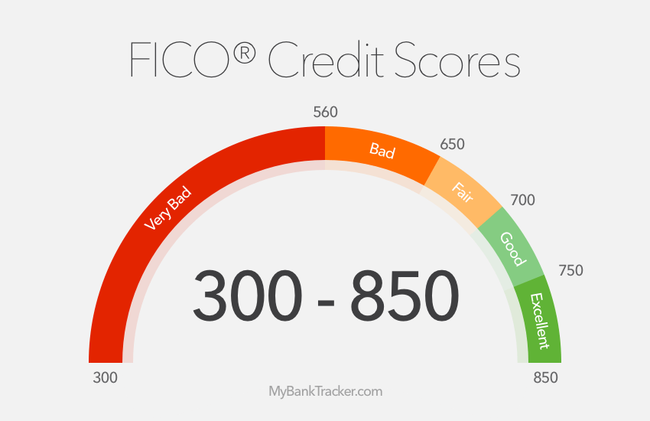

As you can see above, there are a few different credit scoring models in use today, and each one has its own definition of a good credit score.

For example, FICO® scores range from 300 to 850, while VantageScore 3.0 scores range from 300 to 850.

According to FICO®, a score of 670 or above is considered good, while a score of 800 or above is considered excellent. However, VantageScore considers a score of 700 or above to be good.

Generally speaking, a good credit score is one that will allow you to qualify for the best interest rates on loans and credit cards.

However, there is no one-size-fits-all answer, as your credit score will also depend on other factors, such as your income, employment history, and credit history.

If youre not sure where your credit score stands, you can check your credit report for free at AnnualCreditReport.com. This website is the only one that is authorized by the federal government to provide free credit reports.

You can also check your credit score for free on a number of websites, such as CreditKarma.com and CreditSesame.com.

Keep in mind that a good credit score is just one factor in the lending decision. Lenders will also consider your income, employment history, and credit history when making a decision.

So even if you have a good credit score, you may not be approved for a loan or credit card if you dont meet the other lending criteria.

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

Read Also: Does Credit Score Affect Mortgage Rate

Who Calculates Your Credit Score

Your credit score is calculated by a credit bureau. There are four main credit bureaus in South Africa: Experian, TransUnion, Compuscan and XDS. At ClearScore, we show you your Experian credit score, which ranges from 0 to 705.Each credit bureau is sent information by lenders about the credit you have and how you manage it. Other information, such as court judgments against you or whether you are undergoing debt review, are also sent to the credit bureaus and form part of your credit report.

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

You May Like: Why Is My Credit Karma Score Lower Than Fico

How Will A 637 Credit Score Affect You

Mortgage, auto, and personal loans are somewhat challenging to get with a 637 credit score.

Whether youre looking for a personal loan, mortgage, auto, or credit card, credit scores in this range can make it difficult for you to get approved for unsecured credit.

It could even prevent you from renting an apartment or landing specific jobs.

And if some lenders choose to work with you, they typically charge high fees and steep interest rates.

But dont panic it is not the end of the world.

Credit repair is one of the best ways to rebuild your credit score and open up more opportunities.

Can You Buy An Apartment

You can even buy an apartment with this credit score since your credit score meets the minimum credit score for acquiring a conventional loan or FHA loan to purchase the apartment. The only drawback is that you pay higher interest rates when making your monthly installments because your credit score makes you a high-risk borrower.

Recommended Reading: How To Get Closed Accounts Off Of Your Credit Report

Fha Loan With 637 Credit Score

FHA loans only require that you have a 580 credit score, so with a 637 FICO, you can definitely meet the credit score requirements. With a 637 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Also Check: How To Get A 700 Credit Score In 30 Days

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

A 637 Credit Score Can Be A Sign Of Past Credit Difficulties Or A Lack Of Credit History Whether Youre Looking For A Personal Loan A Mortgage Or A Credit Card Credit Scores In This Range Can Make It Challenging To Get Approved For Unsecured Credit Which Doesnt Require Collateral Or A Security Deposit

| Percentage of generation with 300639 credit scores |

|---|

| Generation |

| 27.3% |

Poor score range identified based on 2021 Credit Karma data.

Your credit scores are numbers calculated by credit bureaus, like FICO and VantageScore. Lenders use scores as at-a-glance information to help decide how risky they think you might be to lend to.

If your credit history includes signs of past credit challenges, such as late or discharged payments or accounts in collections, or little to no credit at all, you may find it more difficult to be approved for new credit. And if you are approved, you may find that approval comes with high rates and fees.

Building your credit scores can help. That said, theres no specific credit score that will guarantee approval or better terms or offers. Not only do you have multiple credit scores that are calculated using data from several possible , but its not always clear which score a lender might choose to check or what its criteria might be for approval.

We recommend thinking of your credit scores as a gauge to help you understand what lenders see when they check your credit. Understanding the factors that go into your scores can help you learn which ones to focus on to improve your overall credit picture in lenders eyes.

Heres what you need to know about building your credit and how to navigate credit applications in the meantime.

| 101% |

Ranges identified based on 2021 Credit Karma data.

Also Check: How To Interpret Equifax Credit Report

Factors That Make Up Your Credit Score

What Minimum Credit Score Do You Need To Buy A Car

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Buying a car is a huge financial step, and knowing your credit score can help you enter the buying process on strong footing. A 2022 report released by credit bureau Experian shows average credit scores of people financing cars rose slightly from the previous year. The report also found:

-

On average, the credit score for a used-car loan or lease was 669, according to the data, while the average score for a new-car loan or lease was 736.

-

Nearly 65% of cars financed were for borrowers with credit scores of 661 or higher, the report shows. Borrowers with scores between 501 and 600 accounted for about 15%, while roughly 2% of financing went to people with scores below 500.

-

Having a larger down payment, shopping around for financing and bringing in documents showing a good payment history on other big purchases may help you offset damaged credit.

-

A lower credit score wont keep you from securing a car loan, but it might spike your interest rate, leading to higher payments.

You May Like: When Does Mortgage Report To Credit Bureaus

How Mortgage Lenders Pull Credit

When you apply for a mortgage, lenders pull your credit report from all three major credit bureaus: Transunion, Equifax, and Experian.

Whether you get approved for the loan and the terms of your loan will depend on the result of those reports.

Lenders qualify you based on your middle credit score.

For example, if your scores are 720, 740, and 750, the lender will use 740 as your FICO. If your scores are 630, 690, and 690, the lender will use 690 as your FICO.

When you apply with a spouse or co-borrower, the lender will use the lower of the two applicants middle credit scores.

Expect each bureau to show a different FICO for you, since each will have slightly different information about you. And, expect your mortgage FICO score to be lower than the VantageScore youll see in most free credit reporting apps.

In all cases, you will need to show at least one account which has been reporting a payment history for at least six months in order for the bureaus to have enough data to calculate a score.

Compensating Factors Can Help If You Have Bad Credit

You dont need perfect finances across the board to secure mortgage approval. You can often qualify if youre weak in one area like credit score but stronger in other parts of your financial life. These offsets are known as compensating factors.

If your credit score is weak but you have a stable income, a lot in savings, and a manageable debt load, youre more likely to get mortgage-approved.

Similarly, you have a good chance at loan approval if you have a higher credit score but youre only average in those other factors.

The key is to understand that lenders look at your personal finances as a whole not just your credit score.

Also Check: Does Balance Transfer Affect Credit Score