Tips To Preserve Your Credit Score When You Refinance

Smart homeowners compare rates from several different lenders when theyre refinancing. If you want six quotes, does that mean your credit score takes six hits?

Luckily, no getting multiple rate quotes wont ding your score multiple times. FICO says its score allows for rate shopping.

But, you have to be smart about how you shop to protect your score and that means getting all your quotes within a few weeks at most.

Comparison shop during a focused period

To protect your credit score when you refinance, you have to all your rate-shopping applications within a focused period. If you take several months to apply for quotes, each may be seen as a separate hard inquiry.

For FICO, a focused period typically means getting your rate quotes within 30 days.

More recent versions of the FICO scoring model allow a 45-day period for rate shopping. But dont take chances. Many lenders use older versions of FICO to calculate your score.

So, provided you make all your rate-shopping applications within a single 30-day timeframe, your score should take just one standard hit of around five points or less the same as someone who doesnt shop around.

Other steps to protect your credit

Experian raises an important point for refinancing homeowners: You need to be absolutely sure you make every payment on your original mortgage on time.

Not all mortgage lenders are paragons of efficiency. And if your new one pays just a day late, your credit score will likely be dinged by a late payment.

Rate Shopping For Refinance Applicants

Refinance applicants have the most to gain when shopping for a mortgage rate. They certainly shouldnt be shy about it.

Apply online or over the phone with five to 10 lenders. Choose the best rate and fee structure until youve received your best deal.

Lenders love refinance applications: they close quicker and are much easier to process than most home purchase ones. Use that to your advantage.

Theres no penalty for applying for even dozens of lenders within a 14-day window. Thats plenty of time to receive multiple quotes and choose the best one.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: What Company Is Syncb Ppc

You Can Shop Around For A Mortgage And It Will Not Hurt Your Credit

Within a 45-day window, multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry. This is because other creditors realize that you are only going to buy one home. You can shop around and get multiple preapprovals and official Loan Estimates. The impact on your credit is the same no matter how many lenders you consult, as long as the last credit check is within 45 days of the first credit check. Even if a lender needs to check your credit after the 45-day window is over, shopping around is usually still worth it. The impact of an additional inquiry is small, while shopping around for the best deal can save you a lot of money in the long run. Note: the 45-day rule applies only to credit checks from mortgage lenders or brokers’ credit card and other inquiries are processed separately.

What Is The Mortgage Rate

The lender will give you the money you need to solve your problems. Maybe you want to buy a house. In this case, the money you borrowed will help you accomplish that goal.

But, why would a bank give you money? Whats in it for the bank? There is a chance that you will not be able to pay the bank back. And yet, the bank still gives you the money. Why would a bank take that risk on thousands of dollars?

There should be some kind of benefits in there for the bank for this much risk.

Yes, the bank will charge you every month for the money you borrowed. These charges that you will be paying every month until the maturity date of the loan is called a mortgage rate.

In other words, a mortgage rate is an interest charge you pay every month on a mortgage. The lender will take the risk of losing the money on you to make that interest. This is how they make money.

Also Check: Credit Score 626

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Compare Quotes From Multiple Lenders Without Fear

How to get the best mortgage rate? Get multiple quotes from competing mortgage lenders. Give them all the same information your loan amount, down payment, loan type, and estimated credit score. The lenders will probably offer you a worksheet, a scenario, or a Loan Estimate . These will show you the rate and terms they offer.

You can even simplify the process by telling all the lenders what interest rate you want and simply choose the one with the lowest costs, or tell them all what costs you want to pay and choose the lender with the lowest rate. But theyll all want to know your credit score to give you an accurate quote.

The lenders will probably come up with different scores and different offers. If you find one lenders scoring model puts you in a lower credit tier, you dont have to accept that. You can have as many credit pulls as you like within 14 days, and maybe as many as 45 days.

Also Check: How To Report A Death To Credit Bureaus

What Are Todays Mortgage Rates

When youre shopping for a mortgage, you should really shop for a mortgage. Thankfully, the credit bureaus make this less frightening by providing credit score protection to mortgage rate shoppers nationwide. You wont affect your FICO when youre only after lower mortgage rates.

Get todays live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

Popular Articles

Step by Step Guide

How Your Mortgage Rate Is Set

Interest rates are set partly based on your riskiness as a borrower. The riskier you are to a lender, the higher your interest rates will be. Mortgage lenders use credit scores to determine whether you qualify for the mortgage and to determine risk and the likelihood that you will default on your mortgage loan. The higher your credit score, the lower the risk that youll default on your loan, and the lower the interest rate youll qualify for.

A high credit score demonstrates responsibility with your previous credit obligations. Youve made your payments on time, youve kept your balances low, and youve avoided major credit blunders like debt collections and charge-offs.

A low credit score, on the other hand, is the result of falling behind on credit card payments, keeping high balances, and perhaps having major delinquencies on your credit record.

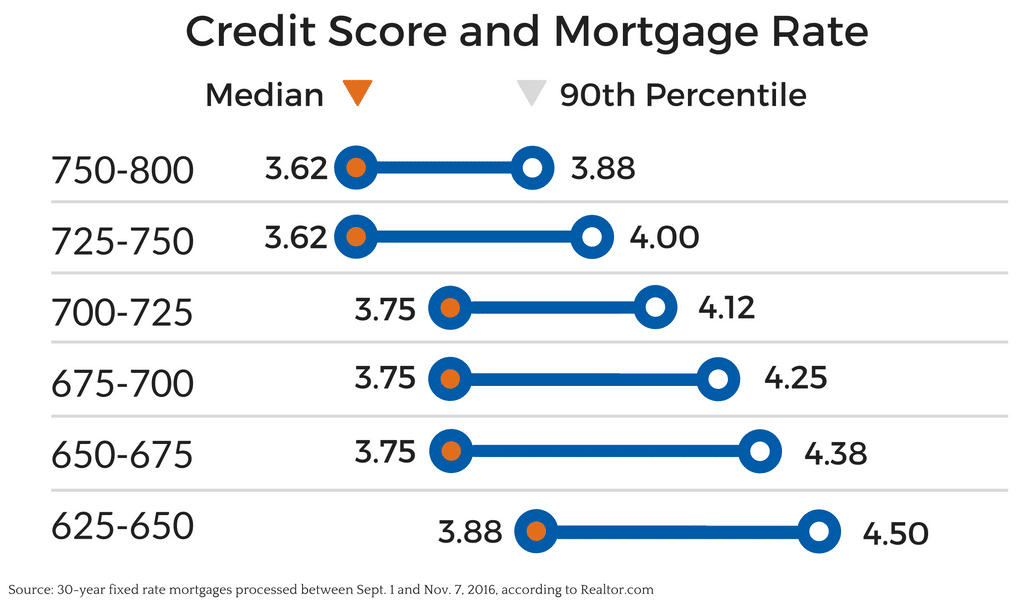

This chart illustrates the relationship between credit scores and interest rates, and how one impacts the other:

Recommended Reading: Syncb Ppc

What Is A Good Mortgage Interest Rate

In general, you can consider a good mortgage rate to be the average rate in your state or below. This will vary depending on your credit score better scores tend to get better mortgage rates. Overall, a good mortgage rate will vary from person to person, depending on their financial situation. In 2020, the US saw record-low mortgage rates across the board, and it’s expected they’ll stay low throughout 2021.

Shop Around And Get Multiple Quotes

Your credit score will certainly affect the FHA mortgage rate you receive from lenders. But different lenders might interpret your qualifications in different ways.

They dont offer the same pricing across the board. There is no industry-wide standard. Different banks and mortgage companies have different comfort levels, when it comes to risk. They have different approval and underwriting procedures.

In short, they are different businesses with different practices.

So its possible to be offered different mortgage rates from different FHA lenders, even though they are looking at the same credit scores. This is why its so important to shop around and get multiple offers.

You dont have to shop around, and a lot home buyers and borrowers skip this step entirely. But you could benefit from it.

Recommended Reading: How Accurate Is Creditwise Credit Score

Why Your Credit Score Matters To Lenders

Along with a low debt-to-income ratio and a strong financial history, youll need a high credit score for the lowest mortgage rates. Why?

Youd probably hesitate to lend money to a friend who usually takes forever to pay you back or doesnt pay you back at all. Lenders feel the same way about mortgages. They want to lend to people who have a record of on-time payments to creditors.

Lenders rely on credit scores as an indication that a borrower will meet obligations. A higher credit score, experts say, reassures lenders that they will be paid back.

Your credit score is calculated most often with the FICO scoring model and is derived from the information on your credit reports, which are compiled by credit reporting companies. Your reports include a history of your payment habits with borrowed money.

» MORE:Check your credit score for free

Your credit score is one of the most important parts to qualify, but it is a part, says Michelle Chmelar, vice president of mortgage lending with Guaranteed Rate in New York. You have to have the whole package: income, sufficient assets and credit.

How Lenders Use Credit Scores

A higher score increases a lenders confidence that you will make payments on time and may help you qualify for lower mortgage interest rates and fees. Also, some lenders may reduce their down payment requirements if you have a high credit score.

On the other hand, a credit score under 620 could make it harder to get a loan, and your interest rates may be higher. Lenders differ, but they generally consider 670 or above to be a good credit score.

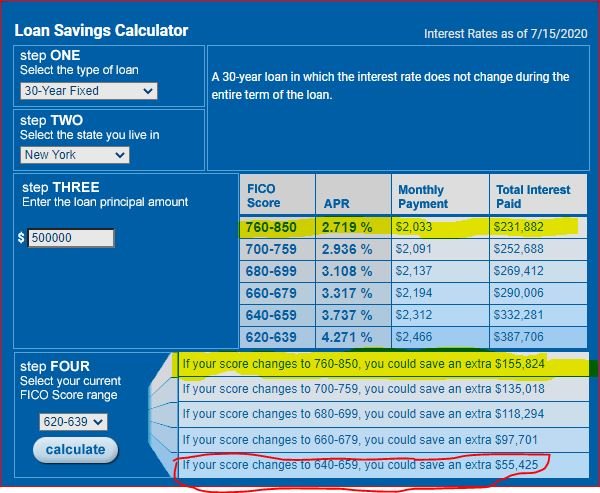

If you plan to get a $300,000, 30-year fixed-rate mortgage, improving your credit score in this example could save you more than $93,000 in interest payments over time.

This example is provided for comparison purposes only and does not constitute a commitment to lend nor is intended to guarantee that you currently qualify for the example APRs above.

Don’t Miss: Syncb/ppc Account

Conventional Mortgage Rates And Credit Scores

To get the top and best mortgage rates on conventional loans, a credit score of 740 or higher is required:

- For every 20 point drop, the mortgage rate will be higher

- The higher rate a lender charges due to a lower credit score are called a price adjustments

- Normally, with conventional loans, there are price adjustments for every 20 points

- FHA loans are not as credit-sensitive as conventional loans unless credit score falls below 600

- To get the best FHA mortgage rates, borrowers need is a credit score of 680 or higher

- With FHA loans, the mortgage rate will be the same whether the credit score is 680 or 740

- However, if credit scores fall below 640 mortgage rates will be higher

If credit scores are below 600 borrowers can expect to pay over 1.0% in mortgage rate higher than if credit scores were at 640 or higher.

Does A Mortgage Help Your Credit Score

Yes. Having a mortgage on your credit report actually helps your score. Paying on time, diversifying your debt with installment based debt, and extending your credit history all put you on a path towards good credit. So dont think of a mortgage as something that can put your credit in danger, but an investment in the future of your credit score. Just make sure you keep your mortgage, as well as your other debts, in good standing and youll be in great shape.

Also Check: How To Unlock My Experian Credit Report

Factors That Influence Your Credit Score

Each credit-reporting agency uses their own proprietary formula to calculate credit scores. Your credit score is calculated based on the following factors:

- Past Payment History Late or missed payments, overdue accounts, bankruptcies, and any written off debts will all lower your credit score

- New Credit Requests How recently and how often youve applied for new credit

- Types of Credit Having a mix of credit is best, such as a credit card, an auto loan and a line of credit

How Your Credit Scores Affect Mortgage Rates

Modified date: Mar. 2, 2021

Its no surprise that your credit scores are instrumental in getting approved for a mortgage. Even so, you may not realize just how many ways your credit scores affect mortgage rates and all aspects of the mortgage application process.

Your credit scores affect the kinds of mortgages you can be approved for, how much you can borrow, the mortgage rates youll pay and even how much youll pay for private mortgage insurance.

When it comes to conventional financing at least, you will be required to have a credit score of at least 620 in order to be eligible for a loan. The higher your credit score is beyond that, the better the terms will be.

This is why its so important to understand your credit score in the months before you apply for a mortgage. If you do have impaired credit history, youll want to work to improve your credit scores before you even apply. And if you already have good credit, youll want to keep it as high as possible by avoiding taking on other new debt.

Lets take a look at some of the ways your credit scores affect mortgage rates

Whats Ahead:

Also Check: Does Paypal Credit Report To Credit Bureaus

Qualifying For A Lower Mortgage Rate

It may be helpful to improve your credit score before applying for a mortgage so you can qualify for a lower mortgage rate and save tens of thousands of dollars over the life of the mortgage. The money you save on your mortgage is well worth the time and effort to improve your credit score.

If you have a low credit score, review your credit reports to see the items that are affecting your credit score. You can raise your credit score by making timely payments on all your bills, paying down your credit card debt, removing errors from your credit report, and paying off outstanding delinquent balances. In some cases, just a few points can make a big difference in your mortgage rate.

Continue to monitor your credit score in the weeks leading up to your mortgage application to see how your credit score improves.

Mortgages Can Improve Your Credit

The calculation of your credit score is a bit of a mystery. FICO publishes general guidelines to help consumers understand their score, but nobody knows the specifics of the calculation. However, the types of loans you have do play a role in your score.

If your credit report contains nothing but a bunch of credit card loans, your score wont be as high. This mix of revolving debt to installment debt accounts for about 10% of your score.

If you pay a credit card a little late, the effect on your score wont be massive. If you dont pay your mortgage on time, expect your credit score to reflect that. If it happens, make the payment as quickly as possible. If its a little late, your mortgage company may not report it to the credit bureaus.

Also Check: Is Creditwise Accurate

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.