Raise Your Credit Score In Days Not Months

When it comes to getting approved for a mortgage application, the better your credit score, the easier it is to get a mortgage loan.

Your credit score is an important factor in getting lower interest rates and favorable loan terms when buying a home.

But what if your credit score is low, or youve recently repaired bad credit?

The time it takes to pay down balances and fix errors can seem like an eternity before it hits your credit report. This is especially true when waiting to begin the process of qualifying for a home loan, with down payment in hand.

This is where a rapid rescore can help.

How To Add Missing Mortgage Payment History To Your Credit Report

What if your mortgage information isn’t on your and you’ve checked all the possible reasons above? Start by contacting your mortgage company to verify that they report to the credit bureaus. Individuals cannot report information to credit reporting agencies, so the only way your mortgage payment history can be added to your credit report is if your lender reports it.

If the lender has been reporting to the credit bureaus and they have the correct information about you, such as your name, Social Security number and other identifying details, ask them to contact the credit bureaus to find out why the mortgage isn’t appearing in your account.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

You May Like: Does Qvc Report To Credit Bureaus

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

The Positive: Reporting On

When you regularly report rental payments to the credit bureau, most of these payments will be standard, on-time payments. When the credit bureaus receive this information, it shows that a positive tradeline is active on the account.

If credit reporting is something that you are thinking about doing, its important to learn about the benefits for yourself and for your tenants. With this information, you can build stronger relationships with all of your tenants.

Recommended Reading: Dispute Verizon On Credit Report

Lenders Not Required To Report

In general, a lender is not required to report payments you make on your mortgage to any of the three credit bureaus. If the lender does report your payments, it must report them accurately and timely. The lender also must respond to any credit disputes. Small banks or credit unions may choose not to report to all three credit bureaus if maintaining accurate reporting and responding to disputes is cost prohibitive or beyond their resources. In general, if your mortgage is with a large bank or mortgage company, it will report your payment history monthly. Since lenders rely on accurate information to make loans and qualify borrowers, it’s in their best interest to support and participate in voluntary reporting. Additionally, the lender can use the reporting as leverage to get you to make payments on time.

Multiple Credit Inquiries Can Affect Your Credit Report

When you refinance, youll generally want to shop around with different lenders to find the best loan terms possible. However, remember that when you apply for a loan and the potential lender reviews your credit history, it results in a hard inquiry on your credit reports. Hard inquiries remain on your credit reports for 24 months and may affect your credit scores, depending on your credit history and borrowing habits. To help minimize the number of hard inquiries on your credit reports, start by researching lenders and rates online and then make a short list of the ones with which youll apply.

Before you start shopping, it may be worth your time to pull a copy of your credit reports to get a sense of how you’ll look to potential lenders. You can get six free copies of your Equifax credit report each year when you sign up for a myEquifax account. You can also get your free weekly credit report through www.annualcreditreport.com. These reports are included in the free weekly Equifax credit reports currently offered on www.annualcreditreport.com through April 2022. If you see something that appears to be inaccurate, you can dispute the information you believe to be inaccurate or incomplete. Review all the information on your credit reports for accuracy before you begin applying for a refinance.

Review all the information on your credit reports for accuracy before you begin applying for a refinance.

Also Check: Ntwk Synchrony

You Ask Bev Answers: Why Do Credit Scores Look Different To Consumers Than Lenders

Reading time: 3 minutes

In a time of great uncertainty, a voice of knowledge and reassurance can make all the difference. Beverly Anderson, President of Global Consumer Solutions at Equifax, answers your questions based on her years of experience in the consumer finance industry. You can post a question for Bev on Equifax’s Facebook page. Bev regrets that she cannot answer every question individually.

Question: Why are credit scores different when they are pulled by consumers vs. when they’re pulled by lenders?

Answer: There are a few reasons that the you see when you check on your own may vary from what a lender sees when evaluating you for a credit account. However, it’s important to understand that these discrepancies don’t necessarily mean that either set of scores is inaccurate.

It’s a common misconception that every individual has a single, unique credit score that represents their level of risk when applying for new accounts. In reality, there’s no limit on the number of credit scores that may accurately reflect your financial information and payment history. This is because individual consumer reporting agencies, credit scoring companies, lenders and creditors may use slightly different formulas to calculate your credit scores. They might also weigh your information differently depending on the type of credit account for which you’ve applied.

How Do I Prevent My Credit Score From Being Damaged By My Unpaid Taxes

Since a low credit score can not only affect your financial health but your personal life, its best that you go through a few necessary steps to make sure that your unpaid income taxes dont have such a significant impact on it. After all, the majority of lenders wont want to lend to a would-be borrower with a long record of not paying their debts, financial instability, and poor credit.

If you owe money in income taxes, here are a few things you should do:

Contact the CRA Immediately and Work Out a Payment Plan

If you already owe a lot of money, chances are that the CRA has already contacted you and warned you about the consequences of not paying your taxes. If you havent yet, its very important that you inform them right away and start working out a payment plan as soon as possible. If you can prove that you dont have sufficient funds to pay them in full, you can negotiate a multi-year plan, which youll need to adhere to until your debt is paid off in full. The longer you wait, the more youll owe and the worse the consequences will be.

Manage Your Finances Properly by Saving and Spending Responsibly

Look into Taxpayer Relief Provisions

Consider Financial Hardship Provisions

Any one of these options, while they might not be easy or quick, is far better than filing for bankruptcy. Since your credit score is such a valuable tool for your financial future, its best not to let it get too out of hand.

Recommended Reading: Ccb Mprcc On Credit Report

Does Owing Taxes To The Cra Affect My Credit Score

Home \ \ Does Owing Taxes to the CRA Affect My Credit Score?

Join millions of Canadians who have already trusted Loans Canada

Tax Season is over, and summer is underway. For most that means taking it easy, spending a bit of money, and doing as much as possible before the cold winter weather rolls around again. For others, it means buckling down, working hard to save as much money as possible, and getting ready for next year. If youre a taxpayer, it should be no secret by now that not paying your taxes comes with a slew of consequences that could significantly, and negatively, affect your financial life.

So, what happens to your credit history, report, score, and rating when you fail to pay your taxes? Does the Canada Revenue Agency even report your unpaid taxes to Canadas credit bureaus? And, if they do, what kind of impact would that have on your financial health afterward? In the article below, well talk a little bit about the tax collection process in Canada and just what would happen if you forget to, or avoid filing, your income taxes.

Want to know how to get a free copy of your credit report in Canada? .

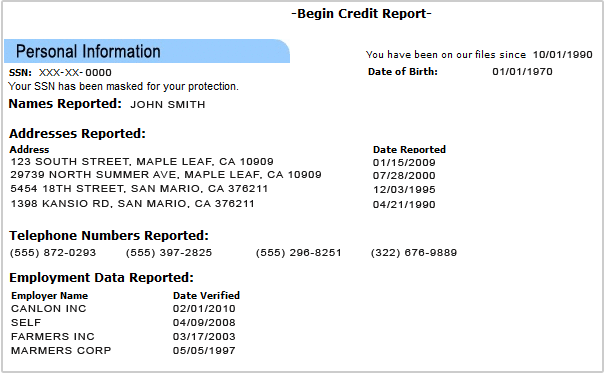

What Does A Tri

A tri-merge credit report includes key financial information about you. This includes a list of your open credit card accounts and how much you owe on them. It also lists your open loan accounts including mortgage, personal, student and car loans and the balances on them.

A tri-merge report will also list any late payments youve made on these accounts during the last seven years. A payment is reported as late if youve made it 30 days or more past your due date.

Other negative financial information is included in these reports, including bankruptcy filings youve made in the last 7 or 10 years and foreclosures youve suffered in the last 7 years.

The more negative information in the reports, the less likely lenders are to approve you for a mortgage. Lenders dont want to see high balances on your credit card accounts or late payments on any of your accounts.

One thing this report wont include? Your . Thats because credit scores are never included in credit reports. The most important credit score, the FICO® Score, is maintained and created by the Fair Isaac Company. This company says that more than 90% of lenders use FICO® Scores when making lending decisions. Lenders will pull this score when you apply for a mortgage, but it wont be included in either your individual credit reports or your tri-merge credit report.

Don’t Miss: Free Tri Merge Credit Report With Scores

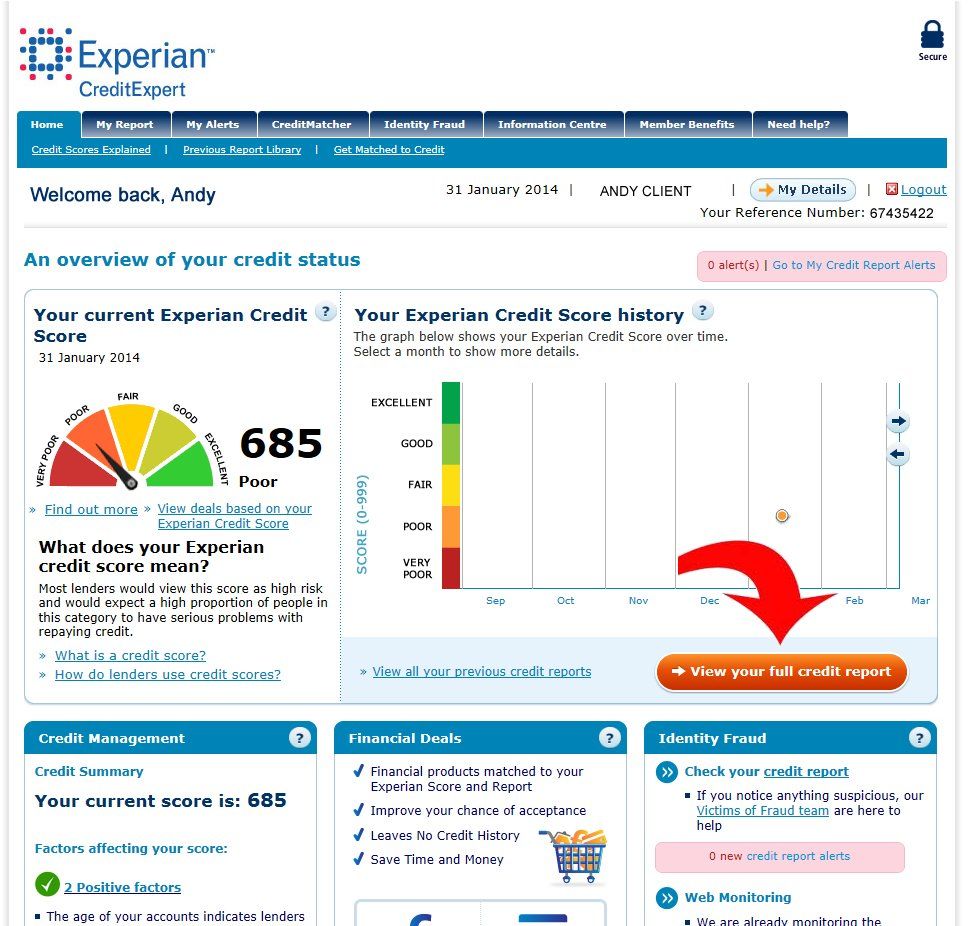

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

How Does A Mortgage Affect Your Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When it comes time to buy a house, few people can afford to pay entirely in cash.

Most opt for a mortgage, or a home loan. Like all major lines of credit, a mortgage will appear on your credit report. This is probably a good thing: A mortgage can help build your credit in the long run, provided you pay as agreed. Heres why.

Also Check: How To Get An Eviction Off Your Credit

How To Report Tenant Payments To The Credit Bureau Directly

While many landlords would prefer to avoid the cost of rental payment reporting by reporting it directly, this is not possible at this time.

You must use a third-party reporting site to get this information to the appropriate parties. For now, youll have to stick with this system!

Landlord Tip: Search for local collection agencies or attorneys that specialize in debt collection. Be sure to ask specifically if they report to the credit bureaus. Most agencies and attorneys work on a contingency basis meaning they get paid if they collect on the debt. This means there should be no out of pocket expenses for the landlord.

Why Doesnt My Mortgage Appear On My Credit Report

A home is the biggest purchase most Americans ever makeand a home mortgage is the biggest loan most of us will ever take out. So shouldn’t your mortgage show up on your credit report? Generally, it willbut there are some situations where your mortgage may not appear on your report. Your mortgage may not show up on your credit report if your lender doesn’t report to credit bureaus, if your mortgage is new and hasn’t been reported yet, or if there’s an error on your loan paperwork, among other reasons.

To understand why your mortgage might not show up, it’s important to know how credit reports work. A is a record of how you use credit, based on factors such as the amount and type of debt you carry and whether you pay your bills on time. Each of three major credit reporting agenciesExperian, TransUnion and Equifaxcompiles a credit report on you based on information provided by your creditors and other sources. Whenever you apply for a loan, credit card or other type of credit, lenders can look at this report to assess your creditworthiness.

Read Also: Sync Ppc On Credit Report

What Is Your Credit Score

Experian, TransUnion, and Equifax are commonly known as the three National Credit Bureaus. The three National Credit Bureaus are attached to that adjective because they are the largest and are traditionally known for setting the standard in credit reporting and scoring practices. Its important to note here that these are for-profit businesses and they make money by offering to sell your scores to banks and lenders across the nation for marketing purposes. But thats not always a negative practice because, with so many lenders in the market, they have to compete for your business and not the other way around.

Today, we do know that your score is based upon various factors in your financial history. Its not an even distribution among the factors, meaning some are weighted heavier than others. Here are the approximate components of your credit score:

Interpreting your credit score from the three National Credit Bureaus

Your credit score from the three National Credit Bureaus is a three-digit number between 300 and 850. Use the table below to see where your credit score falls.

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

You May Like: How To Check Your Credit Score With Itin