How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

How To Sign Up For Infoalerts

Your TransUnion Credit Score is provided by TransUnion Interactive, Inc. and is brought to you by Scotiabank at no additional charge. Accessing your TransUnion Credit Score will not impact your Credit Score. Scotiabank is not responsible for the TransUnion Credit Score or any of the information provided to you through TransUnion’s Credit Score services.

To access your TransUnion Credit Score, Scotiabank will share your personal information such as name, address and date of birth with TransUnion so that TransUnion can identify you and provide your Credit Score. Your information will not be used or disclosed by TransUnion for any other purposes.

The TransUnion Credit Score service is subject to certain terms and conditions that can be viewed here Terms of Use.

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Also Check: How To Remove A Repossession From Credit Report

Difference Between Cibil Report And Cibil Score:

A CIBIL report, also known as a Credit Information Report is a document listing all your borrowings and repayment histories. The CIBIL score or rating is derived out of this data as well as other variables that affect your financial position.

CIBIL scores have become the benchmark for credit worthiness in India. While CIBIL was the first Indian credit bureau, other international players have also started providing credit scores in recent years such as Experian Credit Information Company India Pvt Ltd. The importance of credit checks should not be undermined.

Alternate Credit Scores Launched By Lexisnexis

On 9 February, LexisNexis Risk View Spectrum and Risk View Optics were unveiled by LexisNexis Risk Solutions. Risk View Spectrum and Risk View Optics are FCRA-compliant credit scores that offer a larger view on consumer credit worthiness. The new tools that are used can improve financial inclusion by finding out more credit-worthy consumers. Over 90% of individuals who do not have a regular credit score can get a score from Risk View Spectrum and Risk View Optics. Lenders can provide better offers to individuals whose credit scores are from Risk View Spectrum and Risk View Optics.

10 February 2021

Read Also: 688 Credit Score Credit Card

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

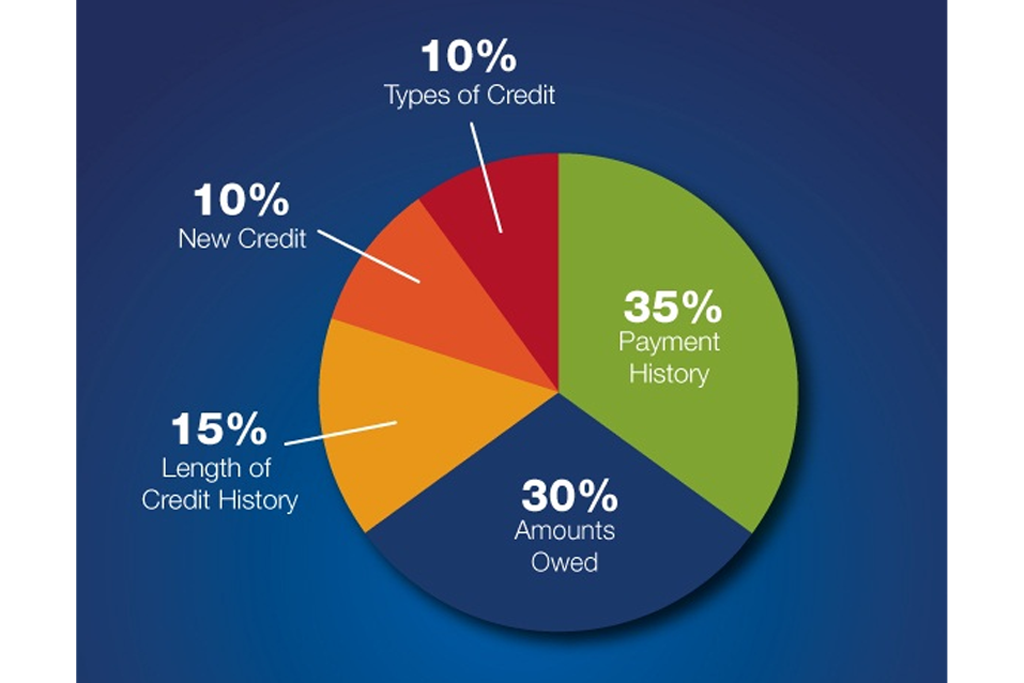

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

How Is My Credit Score Calculated

The score is a three-digit number that lenders use to help them make decisions. Lenders use scores to determine whether or not to grant credit, and if so, how much credit and at what rate. A higher score indicates that the individual is a lower credit risk.To calculate a score, numerical weights are placed on different aspects of your credit file and a mathematical formula is used to arrive at a final credit score. TransUnion calculates your credit score based on many factors in your credit history and payment behaviour, including but not limited to

What are the next steps? GET YOUR CREDIT REPORT & SCORE

- Your track record for repaying your loans and credit card balances

- How much money you currently owe on your credit accounts

- How long your accounts have been open

- The different types of credit you use or credit mix

- How much credit you use compared to the amount of credit you have available

- How often, and how recently you have applied for credit

When you apply for credit, like a mortgage, car loan, a new credit card, apply for a job or want to rent an apartment, companies need a way to gauge your credit worthiness. Your credit report includes a record of your financial reliability.

Also Check: How To Remove A Repo Off Your Credit

Whats The Best Site To Get A Free Credit Report

The best site for free credit reports depends on what you need.

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma.

The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months. You can order them online at annualcreditreport.com.

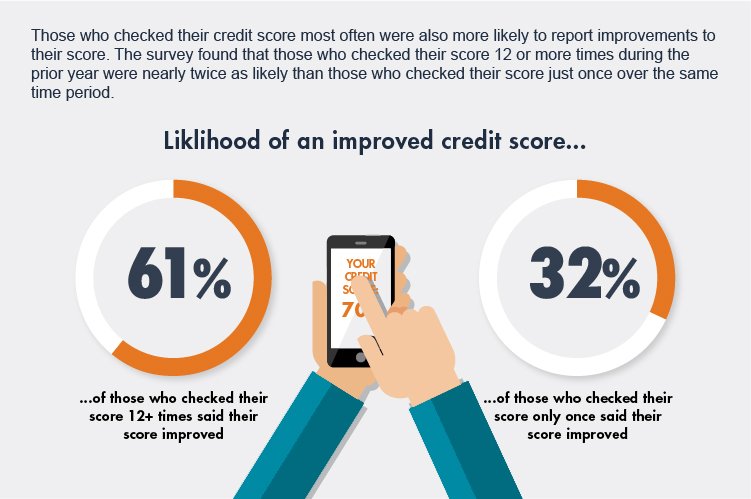

How Often Should You Check Your Free Credit Scores

Checking your free credit scores on Credit Karma isnt a one-time set-it-and-forget-it task. Your scores may be updated frequently as your changes, so checking them regularly can help you keep track of important changes in your credit profile.

Since you can check your free credit scores without hurting your credit, feel free to check as often as you like. If you see your credit scores steadily growing, it can help motivate you on your credit-building journey. And when youre ready to submit a credit application, getting a better idea of your overall credit health beforehand can give you a better sense of where you stand.

You May Like: Can A Closed Account On Credit Report Be Reopened

Skipping Your Payment One Month And Getting Caught Up The Next

If you cant afford to make your payment on a credit account, you might think that theres no harm in skipping the payment one month and getting caught up the next month. The amount owing will be paid after all, so whats the issue?

Unfortunately, this will hurt your credit score and heres why. It will show as a late payment in the current month and will still reflect as a late payment the following month, even if you pay the owing amount.

If you cant afford to make the full payment, a far better approach is to make the minimum payment. If you have revolving credit, such as credit cards and lines of credit, the minimum payment is usually very affordable. Youll make your payment on time and can catch up next month by completing the minimum amount.

Strategies That Will Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

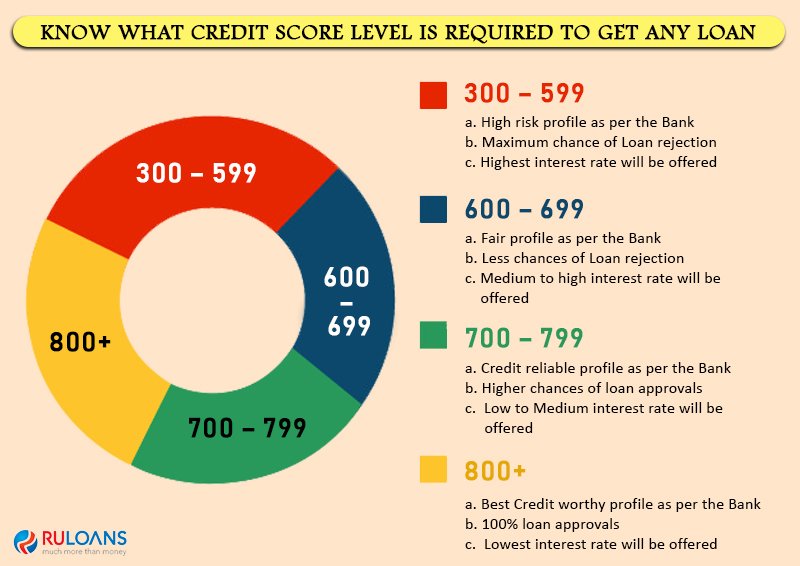

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to improve your credit score, there are a number of simple things that you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

Don’t Miss: Affirm Financing Credit Score Needed

Why Is It Important To Maintain A Good Credit Score

listed down some of the important reasons due to which you must maintain a good credit score:

improves your eligibility for loans: a good credit score improves your eligibility to get a loan faster. a good credit score means that you pay the bills or outstanding amount timely that leaves a good impression of yours on the banks or other financial institutions where you have applied for a loan.

quicker loan approvals: applicants with a good credit score and long credit history are offered pre-approved loans. moreover, the loan that you have applied for gets approved quickly and processing time is zero.

lower interest rate: with a good credit score, you can enjoy the benefit of a lower rate of interest on the loan amount that you have applied for.

you are offered credit cards with attractive benefits and rewards if you have a healthy credit score.

higher credit card limits: a good credit score not only gets you the best of credit cards with attractive benefits or lower rate of interest on the loan you have applied for but also you are eligible for getting a higher loan amount. a good credit score means that you are capable of handling the credit in the best possible manner, therefore, banks or financial institutions will consider offering you a credit card with a higher limit.

Hows Your Experian Credit Score Calculated

The Experian Free Credit Score runs from 0-999. Itâs based on information in your Experian â like how often you apply for credit, how much you owe, and whether you make payments on time.

Youâll lose points for having information on your report that suggests to lenders youâre unlikely to manage credit responsibly, such as previous late payments and defaults. Youâll gain points for things that lenders usually view positively, such as a track record of always paying on time and being on the electoral roll.

Read Also: Comenity Bank Pulls What Credit Bureau

Small Business Loan Disbursals Increased 40% In Fy21

The latest edition of the Sidbi TransUnion Cibil MSME Pulse Report has been published and it shows that loans worth Rs.9.5 trillion have been disbursed by the lenders to micro, small, and medium enterprises for the current financial year.

This number is 40% more than the previous years disbursal of Rs.6.8 trillion. The report suggests that the interventions from the government such as Emergency Credit Line Guarantee Scheme have played a major role in the surge of the credit disbursement to the MSMEs.

11 August 2021

Do Not Remove Old Accounts From Report

Some people tend to remove old accounts or deactivated accounts or accounts with negative history from their credit report to make it look good. Some even try to get their old debts removed from their reports once they pay them. This may not be a very smart thing to do. Agreed that negative things are bad for the score, but they are automatically removed from the credit report after a period of time. Getting old accounts removed may harm your score a lot as they may have a good repayment history. Also, if you have paid your debts, then you should keep them in your report as they will improve your score and also show your creditworthiness.

Recommended Reading: Credit Score Without Ssn

How Is The Credit Score Calculated

a credit score is calculated differently by the various credit information bureaus. general factors on the basis of which your credit score is calculated are mentioned below:

payment history – 35% of your credit score is calculated on the basis of your payment history. your payment history shows how timely youve made the payments, how many times you’ve missed on the payments or how many days past the due date youve paid your bills. so you can score high if you have a higher proportion of on-time payments. make sure you never miss out on payments as this would leave a negative impact on your score.

how much you owe – about 30% of your credit score depends upon how much you owe on loans and credit cards. if you have a high balance and have reached the limit of your credit card then this would lead to a drop in your credit score. while small balances and timely payments would help in increasing the score.

the length of your credit history is accountable for 15% of your credit score. if your history of on-time payments is long then definitely you would have a higher credit score. having said that, at some point, you must apply for a credit card or loan rather than avoiding it so that you also have a credit history for banks review.

how many products you have – the products that you have is responsible for the 10% of your credit score. having a mix of various products like installment loans, home loans, and credit cards help in increasing your credit score.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Don’t Miss: Will Paypal Credit Help My Credit Score

Does Checking Your Credit Score Lower It

When a consumer checks their own credit score, it is treated as a soft credit inquiry that is not reflected on their credit report. For that reason, checking your credit score does not lower it. Instead, are based on five major factors: payment history , amount of debt , length of credit history , amount of new credit and credit mix . We recommend you check your credit score at least once a month.

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Recommended Reading: Does Affirm Help Your Credit Score

Does Credit Karma Offer Free Fico Credit Scores

The VantageScore and FICO modelsdiffer in several ways, but that doesnt mean one is better or more accurate than the other. Lenders may rely on different scoring models when evaluating an application, and other considerations can factor in, too.

We recommend looking at your credit scores as a guide to your credit health rather than as a definitive number that determines whether youll be approved or denied for credit.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Read Also: Does Seventh Avenue Report To Credit Bureaus

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1