The Credit Score Is A Window Into Ones Soul

Just like how employers screen the first cut of applicants based on grades, landlords do the same with credit scores. If youre one of those job applicants who purposefully omits their GPA on their resume, like the seven applicants who included a report but had no score, youre going to be looked at with suspicion.

Your other criteria will be highly scrutinized to the point where the landlord/employer will find reasons not to choose you.

Dont provide a credit report without a credit score. If you do, it will drive your landlord NUTS! Spend the time to find out what your credit score is before you even bother applying.

Landlords dont have time to go through every single line-item in your credit report. They want that credit score and any explanations you care to add. ;

The credit score is the first thing landlords look at in a tight rental market.Having a credit score is MUCH better than having a credit report with no score.;Dont let landlords start wondering what else you may be hiding!

Finally, if you dont want to provide your credit score or credit report, thats fine as well. Just know that your landlord has every right not to accept you as a tenant.

Nobody is forcing anybody to do anything on both sides. If you want a tenant bad enough as a landlord, you may let things slide. If you want the apartment bad enough as a tenant, youre going to do everything possible to prove you are a credit worthy person.

Use Credit Monitoring To Track Your Progress

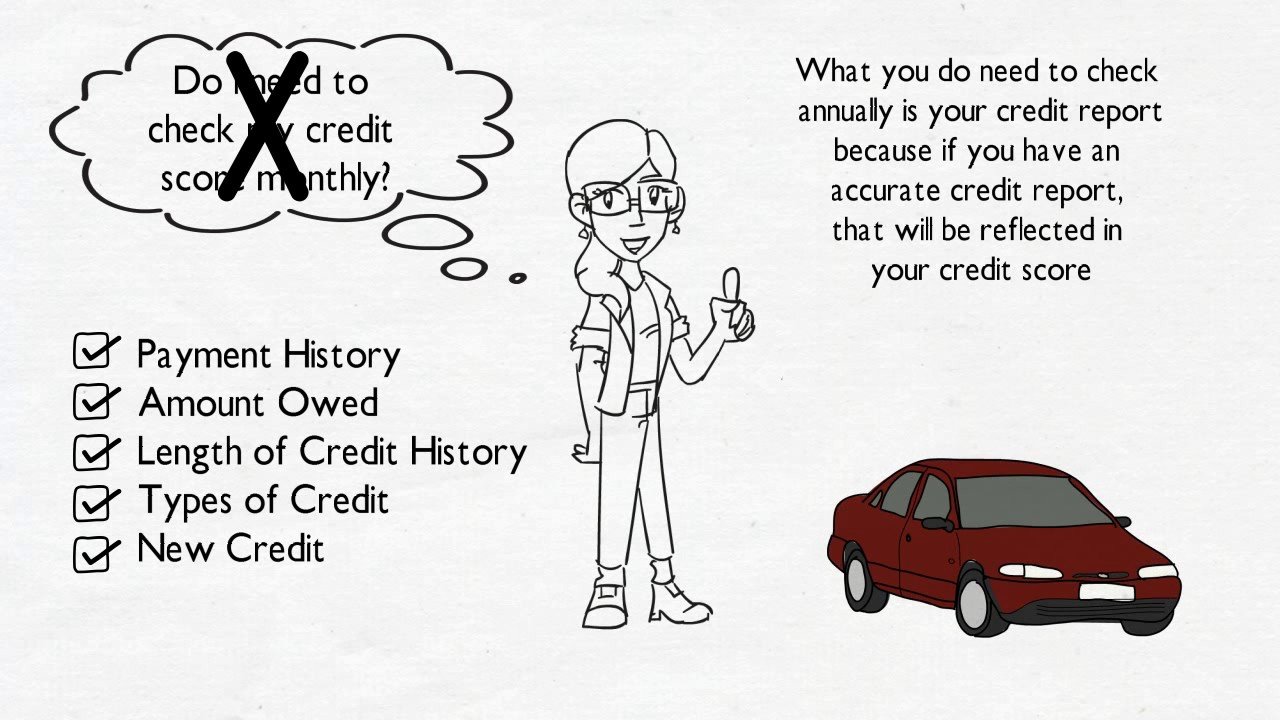

are an easy way to see how your credit score changes over time. These services, many of which are free, monitor for changes in your credit report, such as a paid-off account or a new account that youve opened. They typically also give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Tips To Improve Credit History

To earn those savings, here are some steps you can take to improve and maintain a positive credit history:

- Pay bills consistently and on time

- Maintain reasonable amounts of unused credit

- Apply for credit only when needed, keeping credit inquiries to a minimum

- Check credit reports annually, disputing any errors that hurt your report

Read Also: Is 524 A Good Credit Score

How Lenders Decide Whether To Give You Credit

When you apply for a loan or other type of credit, such as a credit card, the lender has to decide whether or not to lend to you. Creditors use different things to help them decide whether or not you are a good risk.

On this page you can find out:

- how your credit rating is decided

- what information a creditor can find out about you to help them decide whether to lend to you

- what you can do if you are refused credit, including how to correct wrong information on your credit reference file

- how to get a copy of your credit reference file

- how fraud can affect your credit rating

- how to get credit if youve got a low credit score.

To find out more about taking out a loan or other types of credit, see Further help and information.

Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

Read Also: Speedy Cash Late Payment

What Does A Cifas Marker On My Credit Report Mean

Cifas is a national fraud prevention service. It can place Protective Registration and Victim of impersonation warnings on your credit file.

Protective Registration

This;is a paid service for people who have recently been victims of financial fraud. It indicates to any lender that youre potentially vulnerable to fraud so that theyll make extra checks every time you apply for a financial product. While this can protect you, it can increase how long credit application approvals can take. It will stay on your credit report for two years.

Find out more, and apply, on the;Cifas website

Victim of impersonation

This;is filed by your lender for your own protection if youve been the victim of identity fraud. It will stay on your report for 13 months.

If one of these is on your credit report, it gives potential lenders a fraud warning. It tells them youve been a victim of fraud in the past, or could be particularly vulnerable to fraud in the future.

What Info Is On My Credit Report And Why Does It Matter

Your credit report reveals whether youve been paying your bills on time and it matters because it could affect your ability to borrow money.

If youve got a credit card, personal loan, mobile phone plan or utility account, theres probably a credit reporting agency out there that has a file with your name on it.

Heres a rundown of what info is likely to be on your report, how it could affect your ability to borrow money, how you can get a copy of your report and flag potential errors if you happen to find any, and some other things youll want to be across.

Recommended Reading: Experian Boost Paypal

Landlords Perspective When Evaluating Credit Scores

If there are nine applicants with 760 credit scores, $80,000 in liquid assets, who all make over $150,000 income, why would anybody choose another applicant with a 680 credit score, with the same income and assets?

Sure, the applicant with a 680 credit score might be really thoughtful and nice, but so are the other applicants! You cant risk going with a lower credit score applicant unless thats all youve got.

One of the applicants was a third year cardiologist who made $320,000 a year. Unfortunately, he only had a 675 credit score because he whiffed on his medical school payments! No thank you buddy!;I dont care how much you make if you dont pay your bills!

What Does A Credit Score Mean

A credit score is a number which can range from a low near 300 to a high of 850 or 900 .

If someones score is 580, it means that 580 people out of 850 are likely to repay their debt. If someones score is 780, it means that 780 people out of 850 are likely to repay their debt.

The number represents the odds that a lender will get the money back that they lend someone. The higher the number, the better the odds.

You May Like: Credit Score Without Social Security Number

Open A Store Credit Account

Many stores offer credit accounts. Most are reported as revolving credit, the same as a credit card. Home Depot offers project loans. Many local home improvement stores also offer credit accounts, and some are available with the payment of a deposit in lieu of good credit. Staples office supply store has several credit products, including a personal credit account administered by Citibank. Before applying for store credit, be sure the vendor reports to the credit bureaus.;

Also, keep in mind that;some are better than others for people with poor credit scores, while others can help individuals recover from poor credit.

Federal Employment Credit Check Laws

The;Fair Credit Reporting Act; is federal legislation that sets the standards for employment screenings, including credit checks.

Under the FCRA, here are some things employers must do when conducting a credit check on a potential or current employee:

The;Equal Employment Opportunity Commission; oversees how employers can use information from credit checks. Employers are prohibited from illegally discriminating when using financial information to make employment decisions. For example, an employer can’t use one standard for female candidates and a different standard for male candidates.

If you suspect that an employer has used credit checks to negatively impact candidates because of race, ethnicity, disability, age, or gender, you can report the organization to the EEOC.

Recommended Reading: Aargon Collection Agency Address

Why Would An Employer Look At Your Credit

An applicant’s credit history can;flag potential problems an employer would;want to avoid:

-

Lots of late payments could indicate youre not very organized and responsible, or dont live up to agreements

-

Using lots of available credit or having excessive debt are markers of financial distress, which may be viewed as increasing the likelihood of theft or fraud

-

Any evidence of mishandling your own finances could indicate a poor fit for a job that involves being responsible for company money or consumer information

The National Association of Professional Background Screeners worked with HR.com on a nationwide survey of 1,528 human resources professionals about screening checks. The results showed 25% of the HR professionals use credit or financial checks while hiring for some positions, while 6% check the;credit of all applicants.

» SIGN UP:Get your free credit report and see where you stand

Build Credit Without Debt

Millions of people dont have credit scores because they havent used credit, or havent used it recently enough to generate scores. Two ways to build credit include:

-

Apply for a , which places the money you borrow into a certificate of deposit or savings account that you can claim after you make 12 monthly payments. Many credit unions and community development financial institutions offer credit-builder loans, as does online lender Self Lender.

-

Apply for a secured credit card, which gives you a line of credit equal to the amount you deposit with the issuing bank, also helps build credit.

Once you have a score, you can use a credit score simulator to see what actions might help and hurt it.

Read Also: Does Paypal Credit Do A Hard Pull

What Is An Employment Credit Check

In addition to;employment history and criminal background checks, some employers also;run credit checks;on applicants and use;that information to make hiring decisions. A;National Association of Professional Background Screeners ;survey reports that 31% of employers ran credit checks on some applicants, and 16%;checked all applicants’ credit. Most background screenings occurred after a;conditional job offer.

Most often, employers check;the;credit;of;those;applying;for jobs that deal with money. For example, positions in banking, accounting, and investing often require credit checks.

Why Would A Potential Employer Look At Your Credit

More than half of employers conduct background checks during the hiring process only, and the No. 1 reason is to protect their employees and customers, says the 2018 HR.com report.

For security purposes, the credit report can be used to verify someone’s identity, background and education, to prevent theft or embezzlement and to see the candidate’s previous employers . For employers, it is a big picture snapshot of how a potential candidate handles their responsibilities.

“Credit reports indicate whether or not you’re responsible,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “And, they also indicate if you’re in financial distress. These are attributes that are important to employers. For example, would you want to hire someone in your accounting department who can’t manage their own obligations?”

If an employer is running a credit check on you, it is most likely only after they already made a decision to hire you, and it is usually the last thing they check. Since pulling credit checks cost employers both time and money , credit checks aren’t necessarily used to weed out a big pool of potential applicants and not all applicants will have their credit checked.

Employers are more likely to run a credit check for candidates applying for financial roles within a company or any position that requires handling of money .

You May Like: Comenitycapital/mprcc

Setting Limits Teaches Healthy Spending

CoOwners have the option of setting spending limits and managing controls for Participants to help them spend safely and learn smart money habits. Owners can even receive real-time spending notifications. Participants 18 and older can order their own physical card, and Owners or CoOwners can order them for Participants under age;18.

Why Do Lenders Pull Your Credit

Whether youre doing something as small as applying for a store credit card or as big as securing a loan for a home, lenders have to judge your creditworthiness. You can think of it as a judgment of how likely you are to be able to make the payments on the line of credit or the loan.

In the days before financial institutions shared information with credit bureaus, the bank may have had nothing to go on in making credit decisions besides any past loans it may have personally given you or other subjective instincts like looking at the kind of clothing you were wearing.

The good news is its no longer like that. Instead, now we have three credit bureaus Experian, Equifax and TransUnion®. Lenders report information to these bureaus in order to keep an accurate track of your history with credit.

In 1989, Fair Isaac Corporation developed the FICO® Score to quantify information in your credit record.. There are various models that exist, but typically, when lenders look at your credit, theyre looking at one of the models from FICO®.

When lenders pull your credit, they look at both the information on your report and your FICO® Score. This helps them get an idea of your credit record, which impacts not only whether youre approved, but also the types of rates and terms you can get. Those with the best credit qualify for the best offers.

You May Like: Does Paypal Credit Affect My Credit Score

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you don’t need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you don’t use it. Check your credit agreement to find out if there is a fee.

How Long Information Is Kept By Credit Reference Agencies

Information about you is usually held on your file for six years. Some information may be held for longer, for example, where a court has ordered that a bankruptcy restrictions order should last more than six years.

If information is held for longer than it is supposed to be, you can ask for it to be removed.

In England and Wales, for more information about bankruptcy, see Bankruptcy.

Read Also: Is 739 A Good Credit Score

Dispute Errors On Your Credit Report

If your credit report has wrong information, you can dispute the error so that it is fixed. Here is how to dispute an error:

First, write a letter to the credit reporting companies that have the wrong information to ask them to fix the information. Include all of the following:

- Your name and address;

- The specific information in your credit report that is wrong;

- Why that information is wrong;

- Copies of any receipts, emails, or other documents that support why the information is wrong; and

- Ask that the information be deleted or corrected.

You may use the Federal Trade Commissions sample dispute letter to credit reporting companies and attach a copy of your credit report with the wrong items circled. Send the letter by certified mail or priority with tracking, and keep a copy of the letter and receipt.

If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file and in future credit reports.

Why Is Credit Important

When consumers and businesses can borrow money, economic transactions can take place efficiently and the economy can grow. Credit allows companies access to tools they need to produce the items we buy. A business that couldnt borrow might be unable to buy the machines and raw goods or pay the employees it needs to make products and profit.

Also Check: Does Klarna Affect Your Credit Score

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

How Long Does It Take To Build Credit

The exact time it takes to build a credit score depends on the individual borrower. In general, it will take at least six months because the first account must be at least six months old to register on your FICO credit score.

During the process of building a credit score, be patient. Always strive to make your payments on time, keep your credit card utilization ratio below 30% and check your credit score at least once per quarter to evaluate any changes in your score.

Don’t Miss: Zzounds Financing Review