Factors To Consider In Your Credit Score

After knowing what options you can do to increase your credit score, you also must understand what certain factors affect this rating. In so doing, you get to have a sound plan in achieving what a good credit score is. Upon knowing more about these factors, you will be able to examine your credit record. Thus, you will know which of these factors to improve.

Hard Or Soft Ask Before Signing

Before you sign any paperwork, ask your potential landlord if they are going through a hard or soft credit pull. You want them to say soft because that type of check will avoid impacting your score. It is the type of pull that you get when you check with companies such as . In fact, most landlords are likely to make soft inquiries because they know that you are probably looking at other apartments and don’t want to hurt your score.

However, some apartment complexes and landlords may do a hard pull to check into your past on a deeper level. Try to avoid apartment complexes that follow this hard inquiry process. This type of credit check will immediately cost you a few points on your score and make it more difficult to apply to other kinds of loans in the future. Remember that your landlord has to get express permission from you before doing this check, so if they say they are doing a hard pull, you may want to go elsewhere.

Unfortunately, there is a chance that you are going to find yourself having to get a hard pull. Don’t fret too much if this situation is unavoidable. The damage to your credit score is usually quite minor and goes away in a few months. That said, you should avoid multiple hard inquiries in a short period, such as applying for a personal or a car loan while looking for an apartment.

Q: Does Improving My Credit Decrease My Rent

Your rent is not affected by your credit score unless your apartment complex decides to set adjustable rates. As a result, improving your rating doesn’t really affect your rent. The only time it might is if you reapply for a new lease and your complex is willing to adjust your monthly payments because your credit scores are more favorable than they were before.

Likewise, weaker credit is not likely to affect your rent cost. Remember that you signed a contract with your landlord or apartment complex, and it cannot be changed without justification. A change in credit is typically not considered a just reason to charge rent. However, weaker credit may affect your rate if you sign a new year lease. That fact all depends on the regulations and guidelines of your complex.

Read Also: Aargon Collection Agency Reviews

How Credit Scores Are Created

You already know about the factors used to create a credit score:

- Payment history

- Recent credit changes

There are different credit scoring models used to take all of these factors and morph them into a single, three-digit credit score. Depending on what type of lender is checking the credit score, the best scoring model may vary.

It is normal for an individuals score to vary between credit bureaus because each scoring model puts the weight on something different. This is why some types of scoring models are better than others for loans, while credit card companies may prefer a different model.

Different Types Of Credit

In order to score high, you must have a variety of credit types, including a credit card, student loan, auto loan, personal loan, or other. This factor constitutes 10% of the credit score. This is a reminder that applying for another type of credit is not necessarily bad. If you diversify credit record, you can increase your score.

If you have multiple credit types, make sure that all these accounts are managed well. None of them should have any problem. If one or more of these accounts have missed payments or charge offs, they will negatively affect your credit score.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Getting A Mortgage With A Good Credit Score

When it comes to taking out a mortgage it is important to keep in mind interest rates, taxes, insurance rates, and down payments in addition to the actual cost of the home. Often, calculators on real estate pages do not take into account all the factors, and people may think that they can afford homes which are actually out of their price range. Mortgage companies will also approve loans for more than most people would can actually afford to pay each month. Determine the amount you can afford a month on a house payment, then meet with a mortgage broker to determine what price range you would be looking at in your area . Mortgage lenders can give you a much more accurate picture of what a payment would be on a mortgage than a calculator on a website.

The Difference Between Credit Bureaus

The three main bureaus pull together credit history information to give a credit score to lenders and financial institutions. Why are these numbers different?

As mentioned, each credit bureau has their own information to draw from. Even if they use the same formula for calculating credit score, the information accessible to each may be different.

Before highlighting the differences in how each of the bureaus calculates credit score, it is important to understand how scores are calculated.

Read Also: What Credit Report Does Paypal Pull

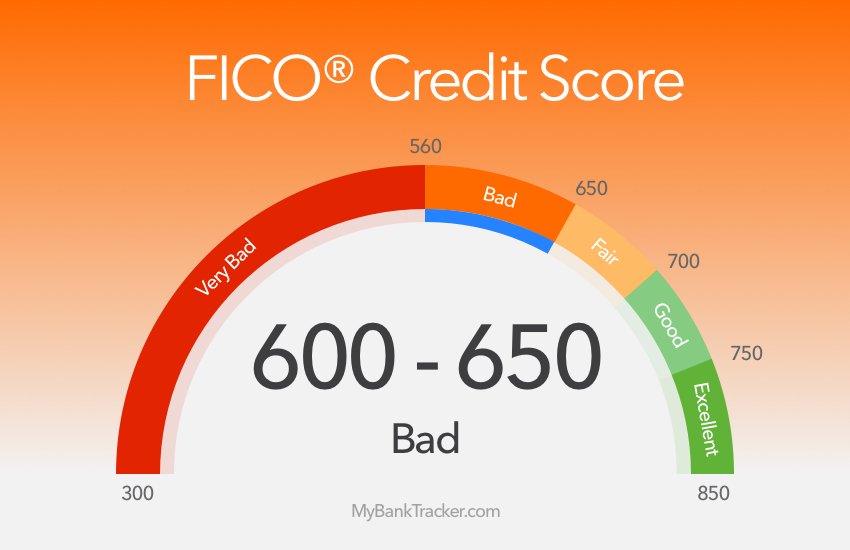

What It Means To Have A 650 Credit Score

A lot of people ask this question:;is 650 a good credit score?;Well, a 650 Credit score is advantageous because in most instances, youre close to the average credit score that most banks or lenders want. This means that you have the chance of getting loans and mortgages based on your credit.

However, some banks and lenders may be a little hesitant on giving you loans as theyre not entirely sure if youll be able to pay back in time without you incurring late fees. Moreover, they may end up charging you more interest rates than they would have if you had a higher credit score.

Apply For And Open New Credit Accounts Only As Needed

Opening a new credit account is beneficial for those who do not have a credit history or do not any credit account. But, for consumers who have existing credit accounts, opening a new one can negatively impact their credit score. Credit age is a huge factor in determining the FICO score. A younger credit account means a lower credit score.

You have to remember that opening a credit account is a huge decision. Before opening a credit account, you have to be sure first that be responsible in using it. You should never take granted even a single card.

You May Like: Is 779 A Good Credit Score

What Credit Score Will Auto Lenders Use Fico Or Vantagescore

The truth of the matter is, although your 650 FICO® score is important in predicting your creditworthiness, theres an industry-specific FICO score that caters to auto financing.

The FICO® auto industry option, or auto enhanced FICO® score, is based on your past auto financing history.

It ranges from 300 to 900 and it weighs factors like:

- Repossessions,

- Whether a car loan or lease was included in a bankruptcy, and

- Whether your loan or lease account was sent to collections.

If youre buying your first car, your classic FICO® score will be pulled. However, if youve owned a car in the past, your auto enhanced FICO® score will likely be used to determine your interest.

How To Get A Loan With A Credit Score Below 650

Here’s the process to get a loan with a credit score below 650:

To start, find out your credit score. Specifically, look up your FICO® Score, the one that’s most widely used by lenders. There are multiple free credit score tools that provide your FICO® Score, including:

The next step is finding potential lenders that fit your credit score. A good place to start is the best personal loans for fair credit. Fair credit includes scores from 580 to 669 under the FICO® Score system. If your score is near the low end or below that range, look at personal loans for bad credit.

Once you have the lenders, it’s time to go rate shopping. Most lenders have a prequalification option on their websites. After you enter some basic information, the lender runs a soft credit check on you, which doesn’t affect your credit score. It then shows you the loan amount and interest rate that you’re prequalified for.

Use the loan amounts and interest rates offered to choose a lender. After you’ve picked one, apply for your loan.

Don’t Miss: Transunion Credit Report Without Ssn

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

Q: Will Paying Rent On Time Increase My Credit Score

Paying your rent on time every month is always considered a positive activity. However, it will only affect your credit in specific circumstances. For example, your landlord has to send this information to the credit bureaus for it to count. Once reported, it will stay on your report and continue to build up positive payments.

As a result, those with a 650 credit score may be able to boost their score simply by being a responsible renter. Therefore, it is wise to talk to your landlord about their rental payment reporting policies. If they aren’t able or willing to report consistent rental payments to credit bureaus, it might be wise to look for a different apartment. After all, it would help if you were trying to boost your score in any way possible.

Don’t Miss: Aargon Agency Settlement

Dont Take On Too Much Credit

This is a tough one. Many lenders promote holding their card and send you have prequalified letters to prospective clients. Be careful because applying for numerous credit cards or other financial vehicles within a short space of time can be seen negatively by the credit bureaus. Every time a lender asks to check your credit or pull a report on your credit, thats a hit on your credit file. And too frequent checks can make it seem like there is a problem, making you a less attractive prospect.

How To Buy A House With A 650 Credit Score

As yall know, I purchased my first home in 2017, and going through the process to work with my credit score and improve it was eye opening. If youre buying a home soon, now is the time to get acquainted with your credit score and find tools to make the most of it! Todays guest feature will help you!

A credit score is a three-digit number that is arrived at after your credit report has been calculated. This is what lenders use to evaluate whether you deserve to get a loan or mortgage. In addition to that, itll also determine the interest youll be charged on a loan. The better your credit score, the higher your chances of getting approved.

A good credit score in the United States ranges between 690 and 720. Above that youre in the;excellent;category. Credit scores above 700 are usually considered unique and exemplary. They can attract very good offers on loans and mortgages. In other places, a credit score of even 580 may be considered good. So it all depends on your location.

Also Check: How To Get Credit Report Without Social Security Number

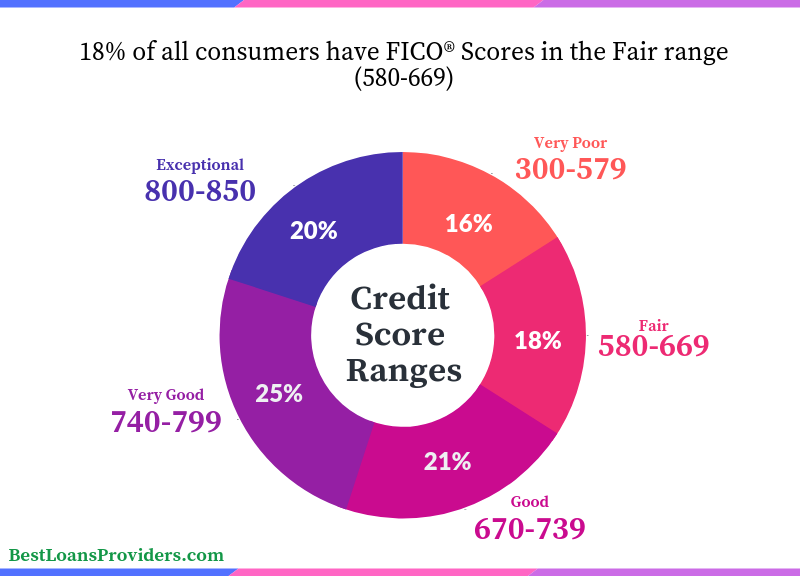

What Is The Average Credit Score In America

The average credit score in the U.S. is at an all-time high of 711. This coincides with what the Consumer Financial Protection Bureau defines as “prime.”

About 1 in 5 American adults either have no credit history or are unscorable. As a result, these individuals will have difficulty obtaining new lines of credit.

In the eyes of lenders, credit scores fall into several buckets, which indicate how risky it may be to extend credit to an individual. Outside of playing a role in approvals for a loan or credit, these scores can also impact an individual’s lending terms. Perhaps the most important terms among those are interest rates.

The higher an individual’s credit score, the lower their quoted APR will typically be.

FICO credit scores break down in the following manner:

- 800 to 850: Exceptional

- 300 to 579: Very poor

This means the average credit score of 711 is in the good range.

Though the average credit score has generally improved since 2005, slight dips were seen around the Great Recession that ended in 2009. A large number of people declaring bankruptcy or defaulting on their loans would have caused their credit scores to plummet, which in turn would have affected the overall average.

Start Paying Off Your Debts

It might be easier said than done, but paying off your debts will automatically increase your credit score. Doing so showcases strong financial choices and impresses credit bureaus. Just as critically, it expands your available credit limit and ensures that your score increases even further. Make sure that you focus on debts you can pay to make this an easier process.

Don’t Miss: Zzounds Financing Review

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.

Improving Your Credit Score Right Now

Being right on the threshold with a 650 credit score requires taking a few steps to immediately improve your credit score. Thankfully, there are steps that you can take today that will boost your credit score more than a few points. While these aren’t miracle cures for a confusing credit situation, they can help you get the kind of score you need to get a high-quality car.

These tips can also help to set you up with a long-term plan for managing your credit. It is never too late to start carefully addressing this financial situation and to take steps to pull your credit out of the fair range and into the good.

Start With a Free Credit Report

Checking your credit score can help improve your rate by helping you spot errors and mistakes that decrease your score. You can dispute these errors and improve your rate quickly and efficiently.

After checking your score, make sure that you sign up with a credit tracking company that will spot potential errors and work to address them. What is particularly lovely about this step is that most credit bureaus are likely to boost your score by a point or two just because you checked.

That’s because they see that you are taking it more seriously and are looking to manage your credit.

Make Your Payments on Time

Read Also: 739 Credit Score Good Or Bad

Be Prepared And Know Your Credit Before You Apply

For that reason, before applying for a mortgage, it’s smart to take a careful look at your own credit reports from all three national credit bureaus . Doing so can help you spot and correct inaccurate entries that make a poor impression , and can also help you anticipate and prepare for questions lenders may have about your credit history. You can get a free credit report from Experian, TransUnion and Equifax at AnnualCreditReport.com.

include:

If you review your credit reports and find any inaccurate entries, you can and should address them immediately by filing a . Depending on the nature of the issue, you may need to provide the credit bureau with backup documents, such as a receipt or statement documenting a payment mislabeled as late. Disputes can take a few weeks to process, and lenders are often reluctant to consider loan applications while disputes are pending. If your credit reports require correction, it’s wise to avoid submitting a mortgage application until your dispute is resolved.