Qualifying Credit Score Determined By Lenders

Qualifying Credit Score For Mortgage is used for two purposes:

Lenders will get three credit scores when they pull a tri-merger credit report.

Each credit bureau will yield a different credit score for the mortgage applicant. Lenders will use one of the three credit scores and do not average the three scores. Mortgage lenders will use the middle credit score of the three scores.

If the main borrower has a co-borrower or multiple non-occupant co-borrowers, lenders will use the lower middle credit score of any co-borrower and/or non-occupant co-borrowers. Many consumers monitoring their own credit scores through Credit Karma and/or other third-party credit monitoring service can have credit scores that are quite different than the mortgage credit scores pulled by lenders. The credit scores that lenders use are called mortgage credit scores.

Mortgage credit scores been programmed with unique special algorithms specifically tailoring risk factors of borrowers in obtaining a new home mortgage and their ability to repay. Credit Karma and/or other third-party credit monitoring service providers provide you will consumer credit scores. Consumer credit scores may be significantly different than mortgage credit scores.

Is There A Tri

While the tri-merge brings your reports together in one place, it does not come with one singular score.

When lenders review your tri-merge report, what theyll see are your three individual FICO scores from Experian, Equifax, and Transunion.

The majority of lenders use your FICO score when you apply for a loan.

Though a small percentage of lenders use a different model to analyze tradelines, like the VantageScore.

This score is similar to the FICO, ranging from 300 to 850, but uses its own formula, which can vary a bit.

Interestingly, the credit scores that lenders use to assess your creditworthiness can fluctuate from the scores you see when you use free credit reporting services.

Because a mortgage comes with unique risk factors compared to consumer lending sources like credit cards, some factors are weighed differently when you apply for a home loan.

Regardless, online credit monitoring services can give you a good idea of where your credit stands and how you can work to improve it.

Its smart to use these services as you can regularly check for changes to your score and see tailored ways to improve your credit and access the best loans.

By checking, you can catch identity theft attempts by noticing new accounts opened in your name.

More Than Just A Scoretm

At Certified Credit, we deliver more than just a score. We provide industry-leading information and analytics with the expertise and technology you can rely on to fuel your business.

- Client Acquisition & Retention

- Tenant Screening

“Certified Credit is superior to other providers -with longevity that I count on when doing business.”

– Top Tier Mortgage Lender

You May Like: 627 Credit Score Good Or Bad

What Is A Good Credit Score

In addition to the FICO® score, there is also the VantageScore. The numbers are slightly different for each.

On a VantageScore, anything between 661 and 780 is considered a good credit score. Anything between 781 and 850 is considered excellent.

On a FICO® score, anything between 740 and 749 is considered a good score. Any number between 800 and 850 is considered excellent.

Theres a lot of moving parts involved when looking to purchase a new house. Thats why we are here having a real estate expert on your side to help you through the process can make a big difference! Give me a call and Id be happy to help in your next real estate endeavor!

How Do I Check My Tri Merge Credit Report

If you want a true look at your tri merge credit report, you can sign up for a 3-in-1 . This type of service provides monthly or quarterly tri merge reports, depending on the level of monitoring you select. You also receive alerts about changes in each of the three credit reports. This type of comprehensive credit monitoring is perfect for the credit-obsessed. You know everything thats happening with your credit 24/7. But its also the costliest type of credit monitoring.

For many people, monitoring a single report may be enough. As mentioned above, the three versions of the report should say the same thing. If youre willing to accept the slim chance that one report might have a credit-damaging error or remark that the others dont, you can opt for single-bureau credit monitoring.

On a side note, there is a way you can check all three of your credit reports once per year for free. The Fair Credit Reporting Act is a federal law that regulates credit reporting. It has a stipulation that all consumers are legally permitted to review their credit for free once every twelve months. You can go to annualcreditreport.com and download all three bureaus reports once per year for free with no strings attached.

Recommended Reading: Does Usaa Do A Hard Pull For Credit Increase

Qualifying Credit Score For Mortgage Used By Lenders

This Article Is About Qualifying Credit Score For Mortgage Used By Lenders

Qualifying Credit Score For Mortgage Used By Lenders is the middle credit score on a tri-merger credit report. When a mortgage loan applicant applies for a mortgage, the first thing the loan officer will do is pull a tri-merger credit report. Not all creditors pull a tri-merger credit report from loan applicants.

Auto finance companies, credit card companies, student loan companies, and personal loan creditors normally just pull loan applicants credit from one of the three credit bureaus. However, due to the size of an average mortgage being close to $300,000 and the complexity of the mortgage process, mortgage companies require a tri-merger credit pull versus a single credit bureau credit pull.

All mortgage companies will do a tri-merger credit report and use the middle credit score of the borrowers when qualifying mortgage loan applicants for home loans.

In this article

Qualifying Credit Scores If The Borrower Has Co

If the main borrower has co-borrowers, Fannie Mae allows the middle credit scores of the borrower and co-borrowers to get averaged. In the event if the borrower has a 600 FICO and the co-borrower has a 700 credit score, Fannie Mae will allow the two middle credit scores to get averaged on conventional loans.

You May Like: Navy Federal Auto Loan Interest Rate

How To Order A Tri Merge Credit Report

Did you know we can determine the amount of funding you qualify for with no hard inquiry?

We accomplish this by you submitting a tri merge credit report to us rather than us pulling it.

When you personally order a tri merge credit report for yourself it does not trigger a hard inquiry.

Hard inquiries also known as hard pulls happen when a bank or lender checks your credit to make a lending decision. This happens when you directly apply for a loan, credit card or other type of financing.

In a nutshell a hard inquiry occurs when you give permission to a lender or other entity to view your credit report. Some actions that trigger a hard inquiry that you may not be aware of are actions such as getting new cell phone service, asking for a credit limit increase or submitting a rental application.

When you order a tri-merge credit report from a site such as , there is no hard inquiry to your credit. At Experian, you can check all 3 credit scores and credit reports from Equifax, Transunion & Experian without affecting your credit scores.What is a tri merge credit report?

A tri merge credit report is a single report that merges all the data in your credit reports from each of the three-major consumer credit reporting agencies.

Why do I need a tri merge credit report?

Why is pre-qualification for funding important?

When we pre-qualify you, our underwriters determine how much funding you qualify for and the types of funding you can get without a hard inquiry to your credit.

S To Setting Up Credit Reports

-

Complete a one-time setup form for your firm without leaving NextChapter. Simply go to “Credit Report Integration” in your settings page to get started with this smooth integration.

-

Schedule the bureau mandated 20-minute onsite inspection. Get more information here: Onsite Visit

-

We activate your account for pulling credit reports and importing data into NextChapter.

-

Enter the debtor’s social security number for any case and that’s it! The report will automatically download and the data will import in Schedule F. Experience less data entry as a result.

You May Like: Syncb/ppc Credit Inquiry

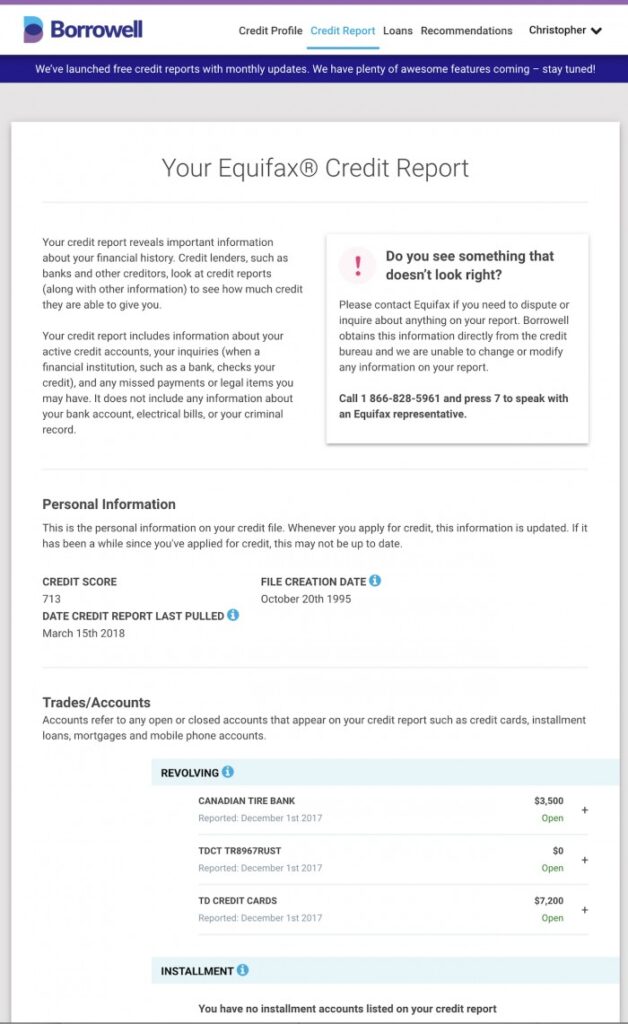

How Do Credit Bureaus Evaluate Qualifying Credit Score For Borrowers

Each of the three credit reporting agencies uses a different way of deriving credit scores. Equifax is the only credit reporting agency that sells FICO credit scores to consumers. Equifax uses the BEACON terminologyto refer to the credit scores sold to other businesses. The Equifax credit score ranges from a low of 350 to a high of 850.

Experian and Transunion have their own credit scores that are based on the FICO credit scoring system. The Experian credit scoring model is known as Experian-Fair Issac Risk Model or PLUS and their low score is 330 and the highest score is 830. The Transunion credit scoring model is known as EMPIRICA and the low score for Transunion is 300 and their highest score is 830.

Both Experian and TransUnion developed their own credit score calculations based on the FICO scoring model.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

You May Like: What Credit Score Do You Need For Comenity Bank

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

How Do Credit Bureaus Work

Each of the three giant credit reporting agencies collects data from consumers independently of one another and they normally share their data among each other. Many creditors report their results to all three credit bureaus.

However, not all creditors report them to all three. Some creditors only report to one or two out of the three credit bureaus. For example, if ABC Bank can report late payment of a consumer to Transunion and Experian but not Equifax. Equifaxs credit report may be higher because the late payment from ABC Bank is not being reported to Equifax.

You May Like: Credit Score Without Social Security Number

How Credit Scores Work During Mortgage Process

Many consumers do not understand why they have three different credit scores. Clients and our viewers often contact us at Gustan Cho Associates and want an explanation and purpose of having three different credit scores.

There are three main credit bureaus in the United States:

- Transunion

- Experian

- Equifax

Each one of the three main credit bureaus has its own way of calculating a consumers credit score. Each consumer will have a different credit score from each of the three credit bureaus. Each consumer will have a different credit score because each bureau has its own algorithms on how they determine each consumers credit score.

Mortgage lenders use the middle scores of an applicant to determine a qualifying credit score for mortgage borrowers. So if Experian yields the middle credit score of the mortgage applicant, the Experian credit score will be used. The qualifying credit score for a mortgage will be the middle credit score. That middle credit score will be used throughout the entire mortgage process until the loan closes. The qualifying credit score is good for 120 days.

What Does A Tri

A tri-merge credit report includes key financial information about you. This includes a list of your open credit card accounts and how much you owe on them. It also lists your open loan accounts including mortgage, personal, student and car loans and the balances on them.

A tri-merge report will also list any late payments youve made on these accounts during the last seven years. A payment is reported as late if youve made it 30 days or more past your due date.

Other negative financial information is included in these reports, including bankruptcy filings youve made in the last 7 or 10 years and foreclosures youve suffered in the last 7 years.

The more negative information in the reports, the less likely lenders are to approve you for a mortgage. Lenders dont want to see high balances on your credit card accounts or late payments on any of your accounts.

One thing this report wont include? Your . Thats because credit scores are never included in credit reports. The most important credit score, the FICO® Score, is maintained and created by the Fair Isaac Company. This company says that more than 90% of lenders use FICO® Scores when making lending decisions. Lenders will pull this score when you apply for a mortgage, but it wont be included in either your individual credit reports or your tri-merge credit report.

Recommended Reading: Synchrony Networks On Credit Report

Qualifying For A Mortgage With A Lender With No Lender Overlays

Home Buyers who need to qualify for a mortgage with a national mortgage company licensed in multiple states with no overlays on government and conventional loans can contact us at GCA Mortgage Group at 262-716-8151 or text us for a faster response. Or email us at Gustan Cho Associates is a national mortgage company licensed in multiple states with zero mortgage lender overlays on government and conventional loans.

GCA Mortgage Group has a national reputation of being a one-stop mortgage shop due to not just offering government and conventional loans but having a wide variety of alternative and non-QM loan programs. Gustan Cho Associates are also experts in non-QM loanssuch as bank statement mortgages, mortgages one day out of foreclosure, mortgages one day out of bankruptcy, asset-depletion mortgages, fix and flip mortgages for real estate investors and commercial loans. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

How Do You Find Your Tri

You cant order a copy of your tri-merge credit report. This report is only offered to lenders. However, you can order copies of your individual reports maintained by ExperianTM, Equifax® and TransUnion®.

You can even do this for free at www.AnnualCreditReport.com. Under federal law, you are allowed one free copy of each of your reports every year. This means you can order your reports from TransUnion®, Equifax® and ExperianTM at no cost every year.

Doing this is a smart move. Studying your credit reports will give you a better idea of what types of mortgages you might qualify for. If your report lists low account balances and no negative information such as missed payments, foreclosures or bankruptcies, youre more likely to qualify for mortgages with low interest rates.

You might also want to order your FICO® credit score before you apply for a mortgage. Unfortunately, you cant get this for free. You can order it for $19.95 from FICO. Your credit card provider or bank might also provide you with free credit scores. Just be aware that these free scores are rarely the same ones that lenders use when making lending decisions. Free scores, though, can give you a general idea of how strong your credit is as they usually dont vary too much from your official FICO® Score.

Recommended Reading: 830 Credit Score

Can You Order A Tri

Merged reports are primarily created and sold to mortgage professionals, and you can’t necessarily order one on your own. However, if you’re working with a mortgage lender or broker, they may be able to share a copy of your tri-merge report with you.

They may even be able to request a merged report with a soft inquirythe type that doesn’t impact your credit scores. However, if you want to get preapproved for a mortgage or you’re applying for a loan, the creation of the tri-merge report could lead to a hard inquiry on all three of your credit reports.

You may also be able to get a copy of a merged credit report if you’re working with a . Some counselors offer first-time homebuyer programs, and reviewing your credit may be part of the preparation process.

While you won’t get a tri-merge report, you can request a free copy of your credit report from each of the three credit bureaus once a week on AnnualCreditReport.com. You’ll receive three individual reports rather than a single merged report, but you’ll be able to have a complete picture of the information being reported to Experian, Equifax, and TransUnion. You can use this information to gain a better understanding of your credit reports and review your account information, such as your payment history and balance information.

Qualifying Credit Score For Mortgage: Case Scenario

For example, lets take a case scenario on how lenders determine a qualifying credit score for mortgage borrowers:

- Transunion credit score is 600

- Experian is 650

- Equifax is 700

The middle score is 650 so the lender will use the 650 as the qualifying credit score for the borrower:

- Some commercial lenders will choose whichever credit bureau they prefer

- For example, there are lenders that will just use Equifax

- Whatever Equifax credit score is, that will be the qualifying credit score for the mortgage borrower

- Some auto lenders will only use Transunion and so will credit card companies

It is up to the specific creditor which credit score they will go by in evaluating credit.

Recommended Reading: Credit Score 611