How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.

What Kind Of Incorrect Information Can Be Displayed In A Credit Report

There are unfortunately a range of errors that could crop up in your credit report.

For example, if you received a County Court Judgement and settle it within the required time, it’s supposed to come off your record. However, in recording that information one of the credit reference agencies in theory might make an administrative error or have not received that information from the creditors.

It’s worth noting, however, that these types of errors are rare. Even so, it’s important to check your credit report, as the consequences could be severe if an error has been sitting there for a long time.

Other errors could be a missed bill payment that you managed to pay on time, or even a credit card’s activity being completely unrecorded, thus giving the impression that you have no financial history.

Wait Up To 45 Days For The Results

After you dispute credit reporting errors with a credit bureau, it typically has 30 days to investigate your claim. It must notify you of the results five days after completing the investigation. However, it can take up to 45 days under the following circumstances:

- Youve submitted a dispute after receiving a free credit report from AnnualCreditReport.com

- During the 30-day investigation window, you submit new materials and documents

Recommended Reading: Carmax Credit Score

To Request A Correction Or Investigation Into The Identity Content Of Your Credit File

This refers to the “Identity Details” section of your credit file.

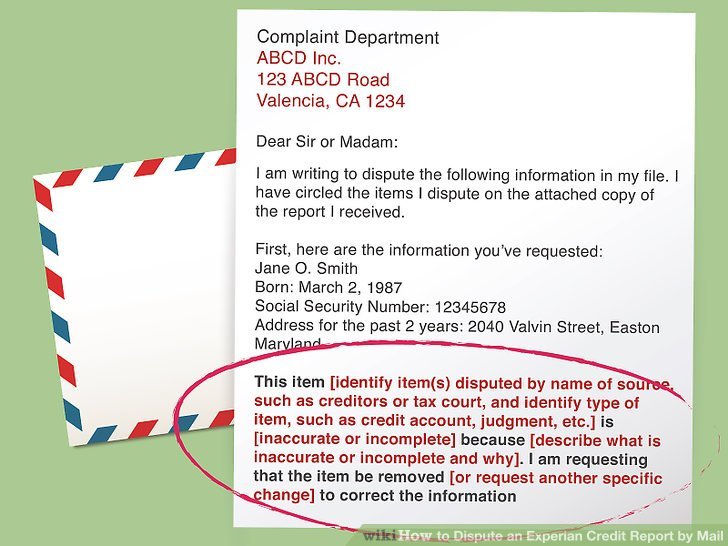

Step 1You will need to write to us and tell us what you would like corrected or investigated. The request for a correction or an investigation normally arises from entries recorded on your credit file by a credit provider or a collection agent .

You do not need to fill in a form but your written request must include the following information:

- Your full name and current residential address

- The Reference Number that appears on the top right hand side of your credit file

- Full details of the corrections or investigation you are requesting

- Attach all of the relevant information and documentation that you have to support your request

Step 2Forward your letter together with the supporting documentation as detailed in Step 1 to:

Email:

Add A Consumer Statement

![Steps To Build Your Credit Score [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/steps-to-build-your-credit-score-infographic-all.jpeg)

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

Don’t Miss: Minimum Credit Score For Carmax

Pay For A Credit Monitoring Service

TransUnion, one of the major credit bureaus, offers a that requires a fee. I have used this service myself.

You can find a lot of other fee-based credit monitoring systems out there.

So why would you pay for credit monitoring when you can get it free?

Paid services have more elaborate tools, but they also have ways to help you recover from identity theft rather than simply detect it.

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

Recommended Reading: Les Schwab Credit Score Requirement

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history, help you create a budget and even a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

- Local consumer protection agencies

- The United States Trustee program

Is The Credit Reference Agency To Blame If There Is An Error

The three credit reference agencies, Experian, Callcredit and Equifax provide lenders with your credit report if you apply for a product with them.

This gives them plenty of power of your ability to get a mobile phone contract, credit card, mortgage and much more.

As a result, having an error free credit report is absolutely important, as any mistakes could damage your credit score.

Read Also: 673 Credit Score Mortgage Rate

Where To Get Legitimate Help

Just because you have a poor credit history doesnt mean you cant get credit. Creditors set their own standards, and not all look at your credit history the same way. Some may look only at recent years to evaluate you for credit, and they may give you credit if your bill-paying history has improved. It may be worthwhile to contact creditors informally to discuss their credit standards.

If youre not disciplined enough to create a budget and stick to it, to work out a repayment plan with your creditors, or to keep track of your mounting bills, you might consider contacting a credit counseling organization. Many are nonprofit and work with you to solve your financial problems. But remember that nonprofit status doesnt guarantee free, affordable, or even legitimate services. In fact, some credit counseling organizations even some that claim nonprofit status may charge high fees or hide their fees by pressuring people to make voluntary contributions that only cause more debt.

Most credit counselors offer services through local offices, online, or on the phone. If possible, find an organization that offers in-person counseling. Many universities, military bases, credit unions, housing authorities, and branches of the U.S. Cooperative Extension Service operate nonprofit credit counseling programs. Your financial institution, local consumer protection agency, and friends and family also may be good sources of information and referrals.

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- SSN

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

Recommended Reading: Transunion Credit Unlock

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Do You Dispute An Inquiry

In addition to errors, like inaccurate bill payment data, accounts belonging to someone else, or outdated account balances, credit reports may show several hard inquiries, or requests for full reports, including from sources you dont know. Experts say unauthorized hard inquiries could be report errors or could signal potential identity theft. Importantly, too many hard inquiries can hurt credit and decrease your score. So, experts recommend you dispute any hard inquiries that you dont recognize.6

Don’t Miss: Does Usaa Do A Hard Pull For Credit Increase

How To Correct Mistakes In Your Credit Report

Both the credit bureau and the business that supplied the information to a credit bureau have to correct information thats wrong or incomplete in your report. And they have to do it for free. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that information on your report. Heres how.

What Happens When You Initiate A Dispute

The Fair Credit Reporting Act says the credit bureau must investigate and correct any inaccurate information, which will usually happen within thirty days. The bureau presents your claim to the creditor that provided the information. The creditor then has to look into it and report back to the credit bureau. If the information does turn out to be wrong, they have to notify ALL of the major credit bureaus so your file can be corrected.

If you initiate the dispute online, youll have a tracking number so you can log in and check the progress of your case. If you do it by mail or phone, keep records of who you speak with or any correspondence you receive. The bureaus recommend you hold off on applying for new credit while the dispute is pending.

No matter what the outcome, when the investigation is complete, youll get the results in writing. If you still have a dispute after the investigation is done, you can ask for a statement of the dispute to be included in your file and in future reports.

Don’t Miss: Does Paypal Report To Credit Agencies

Contact The Creditor Directly

Contact the creditor that furnished the incorrect information, and demand that it tell the credit reporting agency to remove the data from your report. You can use Nolo’s Request to Creditor to Remove Inaccurate Information or write your own letter. If you get a letter from the creditor agreeing that the information is wrong and should be deleted from your credit file, send a copy of that letter to the agency that made the flawed report.

If you already contacted the creditor directly, it doesn’t have to deal with this dispute again unless you supply more information. But if you escalate your complaint, like to the president or CEO, because you believe the dispute was not properly investigated, and you demonstrate a strong basis for your belief, the company is likely to respond.

If the company can’t or won’t assist you in removing the inaccurate information, contact the credit reporting agency directly. Credit reporting agencies have toll-free numbers to handle consumer disputes about erroneous items in their credit files that aren’t removed through the normal reinvestigation process. Go to the Equifax, Experian, and TransUnion websites to find contact information for these three nationwide credit reporting agencies.

Common Errors That Can Impact Your Credit Score

Reviewing your credit report can help you monitor for identity theft and uncover items that could be lowering your score. However, not all errors on your report affect your credit score. Some items, such as an outdated phone number, aren’t worth the trouble of disputing.

Items that could lower your credit score and are worth disputing include:

- Incorrect account statuses, such as a bill reported as delinquent or an account in collections when you’ve always paid on time

- Derogatory marks that are older than seven years

- Addresses you don’t recognize

You May Like: What Credit Bureau Does Sprint Use

How To Dispute Something On Your Credit Report

Wrong information on your credit report? Heres how to dispute it, along with sample letters you can use.

Weve talked before about how important your and credit score are, both in your business and your personal life. Without good credit, its very difficult to get approved for a credit card, a loan, or receive payment terms from a vendor. Many landlords and employers also use credit reports as part of their evaluation process.

It is equally important to periodically check your credit report to make sure it doesnt contain any wrong information that might be detrimental to you. By law, youre entitled to one free copy of your report per year from each of the three major credit reporting bureaus. Many experts suggest getting them at four month intervals so you can cover the entire year. You can order your free credit report online or by phone at 1-877-322-8228.

What to look for on your credit report:

- Payments reported as late or missing that werent

- Accounts listed as open that youve closed

- Accounts that dont belong to you

- Incorrect names or other identifying info

- Bankruptcies reported after ten years

- Other negative credit info reported after seven years

If you find a mistake, its on YOU to contact the credit bureaus to let them know. You can do this online, in writing, or by phone.

Review Your Investigation Results

When our investigation is complete, well send you an email to let you know. You can then log in to review your results and updated credit report. Most dispute investigations at TransUnion are complete within two weeks, but some may take up to 30 days.

If you dont agree with the results, it may be a good idea to contact the lender directly and provide any documentation you have to support your claim. If the lender denies your claim, it must still report to the credit agency that the information is disputed. If the lender confirms your claim, it has to tell the credit reporting agency to update or delete the item.

We dont want an inaccuracy on your credit report to negatively impact your score and keep you from the credit opportunities you deserve. By consistently monitoring your data identity, you can help ensure your credit report shows an accurate and up-to-date picture of your credit health.

Recommended Reading: Factual Data Inquiry

If Youve Spotted An Error On One Of Your Credit Reports You Should Take Immediate Steps To Correct The Inaccuracy

Around 25% of U.S. consumers found errors that could affect their credit scores in one of their credit reports, according to a 2012 study by the Federal Trade Commission. The same study reported that one in five consumers had an error that a credit bureau corrected after the consumer disputed the mistake on at least one report.

An error on your credit reports could lead to lower credit scores and impact your ability to open a new credit account or get a loan. Here are steps you can take to ask the credit bureaus to remove incorrect derogatory marks from your credit.

How To Remove Items From Your Credit Report In 2022

Your credit report is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Recommended Reading: Can A Repossession Be Removed

Errors To Watch Out For On Your Credit Report

Once you get your report, check for:

- mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- errors in credit card and loan accounts, such as a payment you made on time that is shown as late

- negative information about your accounts that is still listed after the maximum number of years it’s allowed to stay on your report

- accounts listed that you never opened, which could be a sign of identity theft

A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account won’t remove the negative history.

Negative information such as late payments or defaults only stays on your credit report for a certain period of time.