Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

How To Quickly Boost Your Credit Score

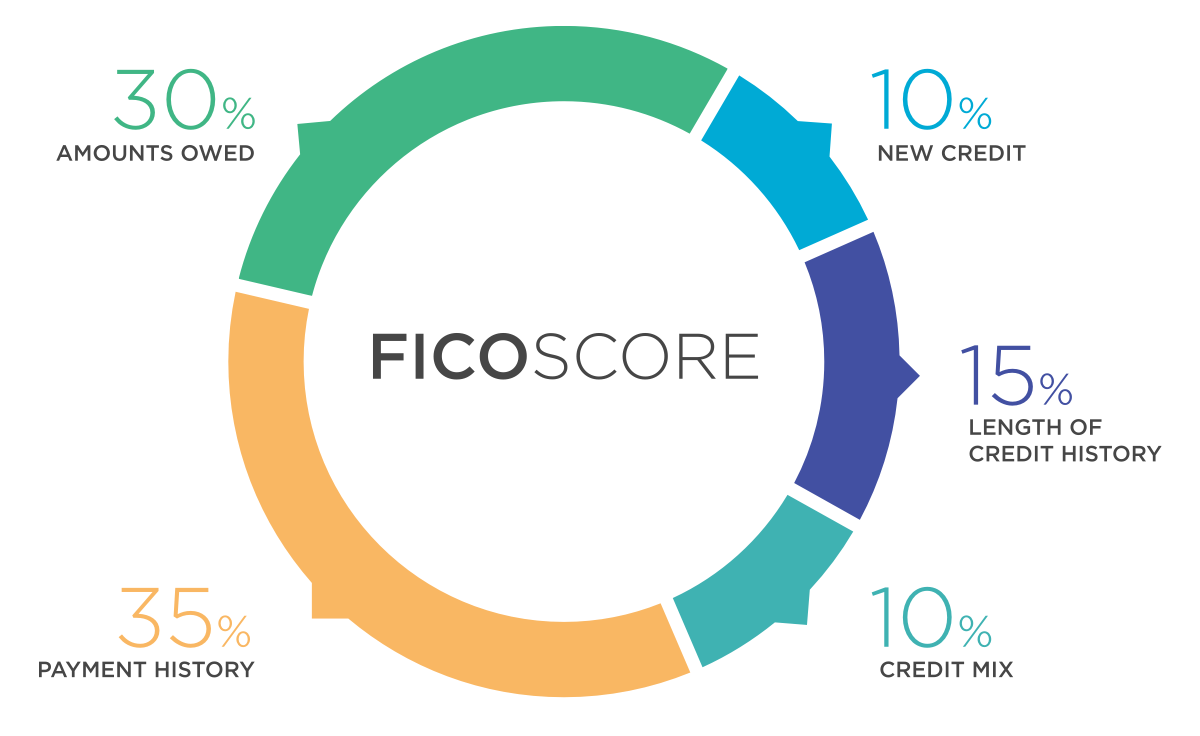

- Pay your bills on time. According to the Credit Bureau Experian, your payment history is the most important factor in your credit score.

- Reduce your debt. The second most important factor that affects your creditworthiness is the size of your debt.

- Inquire about the rental.

- Correct any errors in your report.

Common Problem: Insufficient Credit On A Credit Report

New tenants often wonder the same thing: what credit score do you need to rent an apartment? These same tenants might not have any idea what their credit score is, and that can lead to some confusion for both prospective tenants and you, their future landlord.

What happens if their credit report comes back and says they have insufficient credit history to create a credit score?

More often than not, a designation of Insufficient Credit means the tenant does not have enough tradelines or credit-impacting accounts. We often see this with students or younger people, older people with no credit activity in years , and a spouse who has nothing in their name.

In these situations, it will be up to you to determine whether or not you can prove the tenants financial risk through other means.

Read Also: Does Balance Transfer Affect My Credit Score

Staying Out Of Subprime

Bruce McClary, vice president of communications at the National Foundation for Credit Counseling, says that a subprime FICO scoreat which a borrower is offered no credit or very expensive creditis similar to Experian’s range, with “good” starting at 660 or 670.

“Certainly if someone’s score dips below 600 on the FICO scale, thats a critical situation,” says McClary. “Many lenders wont lend to you, and those who will are going to offer you credit at the highest possible cost or interest rate.”

With a FICO score of under 600, you might be able to get a or subprime bank loancalled a signature loanbut it could charge up to 36 percent interest, the highest allowable by law, McClary says.

Katie Ross, education and development manager for the Boston-based American Consumer Credit Counseling, a nonprofit that offers guidance to consumers nationwide on budgeting, credit, debt, and related issues, plants the boundary between fair and good at 600. “What matters most is that you manage your credit so that it’s above the fair credit score range,” she says.

How To Find The Best Credit Cards If Your Fico Score Is 650 To 699

A FICO Score between 650 and 699 is where options do begin to open up. One type of card that is less important is a secured credit card. These are much more common and are often completely necessary when your credit score is below 650, and especially when its below 600. In the average credit score range, you should be able to find unsecured cards with very little effort. What you wont find are the cards with the best terms. For example, you wont qualify for the lowest interest rates, nor will you be eligible for the cards with the most generous rewards programs. But you can still get a card with an adequate credit limit, and at least some cash back rewards. And if you pay your balance off monthlyas we will recommend throughout this guidethe high interest rate wont matter so much.

You May Like: Verizon Late Payment Credit Report

Average Tenant Credit Score Ranges

What is the average number you can expect to see when checking into what should be considered an acceptable credit score for renting?

Here at RentPrep, we run a lot of for the landlords who use our services. This gives us some insight into what you might see from renters. We are not the only ones who have insight into acceptable credit scores, however.

These are some of the most popular numbers used as a measure of what is an average credit score for tenants in America.

649

This is the exact average score we have seen in one year of data among all of the reports weve completed. This means if the score is lower than 649, it should be at least a little concerning. According to Experian, an acceptable credit score to rent an apartment is around 638.

These numbers are based on the data we have here at RentPrep. We run thousands of credit checks every month and this is a result of our findings. Understand that this is not based on all renters, but it is based on renters of landlords who run background checks.

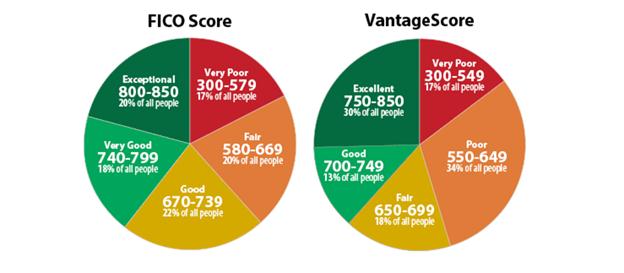

673 699

According to an article from ValuePenguin, the average credit score of Americans in a 2021 report was 688 for the Vantage scoring model and 711 for a FICO model. Keep in mind that this is not industry-specific it takes into account everybody and not just renters. Renters statistically have a lower credit score than homeowners.

662

What Is Transunion Credit Report

TransUnion credit report. The TransUnion Credit Report is a comprehensive report containing key data, including current and past consumer phone numbers, as well as 24-month payment history for each business line. The database contains more than 20 million Canadian consumer credit reports that are regularly updated and checked.

Read Also: Vantagescore Meaning

How Can I At Least Get A 700 Credit Score

- Leave the accounts open. Keep track of your open credit accounts.

- Pay your bills on time. Pay all bills you have on time.

- Do not increase. You must use your balance to increase your account, but increasing the number of cards and depositing a minimum balance is not good.

- Open new accounts in moderation.

- Pay off the debt.

Whats a good credit score to buy a car

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

Read Also: How To Remove Hard Inquiries On Credit Report

What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

You May Like: Will Klarna Build Credit

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

The Difference Between Credit Bureaus

The three main bureaus pull together credit history information to give a credit score to lenders and financial institutions. Why are these numbers different?

As mentioned, each credit bureau has their own information to draw from. Even if they use the same formula for calculating credit score, the information accessible to each may be different.

Before highlighting the differences in how each of the bureaus calculates credit score, it is important to understand how scores are calculated.

Recommended Reading: Paypal Credit Minimum Score

Upgrade Bitcoin Rewards Visa Credit Card

Our pick for: Crypto rewards + flexibility

This card earns rewards in the form of Bitcoin when you pay your bill . It works like a combination of a credit card and a personal loan, allowing you to make purchases and then pay down your balance in equal monthly installments at a fixed interest rate. Read our review.

How To Improve Your Credit Score

If you have an average credit score or worse, its worth taking steps to improve your score over time. Heres are some moves you can make:

- Pay your bills on time every single month. Late and missed payments are the single biggest factor affecting your score.

- Lower your credit utilization. Credit utilization is measured by how much of your credit limit you use. For example, if you have a $10,000 limit and debt of $5,000, youre utilizing 50% of your available credit. If possible, aim for 30% or less overall and on individual credit cards.

- Check your credit report. You can check your credit reports from each of the three credit bureaus once a year for free through annualcreditreport.com . Reviewing your credit reports can help you spot any errors that may be having a negative impact on your score so you can take steps to correct them.

- Consider a secured card. If you have poor or bad credit, building a credit history with a secured card can be a good way to start. Choose a secured card that reports to all three credit bureaus for the best chance having your good payment behavior improve your credit standing.

Related: Should You Worry About No Credit Score?

Read Also: Syncb Ppc Closed

Is It Possible To Max Out Your Credit Score

Your creditworthiness is of course very important, but once you reach an average or a maximum of 700, you reach a point of diminishing returns. If your account continues to grow, that’s great. Make sure you don’t miss out on other opportunities to maximize your credit.

Types of credit scores]How many different types of credit scores are there? There are two main credit scoring models used to calculate a credit score. The agencies use credit scoring models to convert your credit report into a three-digit score that indicates your creditworthiness. Currently, the three major credit reporting agencies use two main models: FICO and VantageScore.What are three different credit scores?The three majâ¦

How To Turn A 673 Credit Score Into An 850 Credit Score

There are two types of 673 credit score. On the one hand, theres a 673 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 673 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

Read Also: Les Schwab Credit Score Requirement

How To Build Your Credit

Here are some basic steps to help build your credit score:

- Always make payments on time.

- Pay down debts.

- Reduce the number of hard inquiries on your credit report.

- Avoid opening many new loans all at once.

- Keep your first credit card open so you can take advantage of the long credit history.

Great credit opens the door to financial opportunities, better interest rates and more. You can work to improve your credit score and get to a higher credit range. You took the first step today by learning what can improve your credit score. Now, you only have to start implementing these new financial habits.

Your best credit score is an accurate & fair one start working to repair your credit with Lexington Law

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Also Check: How To Report Tenant To Credit Bureau

Is A 700 Credit Score Good Enough To Buy A Home

A credit score of 700 is considered good and excludes an important element needed to qualify for the purchase of your dream home. Other factors that determine whether you can buy your dream home include the definition of your dream home, the price, the amount of the down payment, and the debt-to-income ratio . A good credit rating is not enough to guarantee the purchase of your dream home.

How To Get A Tenants Credit Score

Landlords who havent used credit scores as a screening factor before or are new to the rental industry might not be sure how to find out this private information about their tenant. Do you simply ask your tenant to tell you their credit score? Can you trust this information?

No that is not the right way to find out a tenants credit score.

Here at RentPrep, we offer two services that provide tenant credit score information. Our credit check is a pass/fail based system that provides you a range to choose from. This does not provide the specific credit score.

We also offer our SmartMove reports for those who would like to see the specific credit score with a full credit report.

If you want to learn more about how credit scores can and should be used during screening, this complete review can help. This will give you insight into different ways to run a credit score, the benefits of each method, and how you should consider this as you move forward with business.

Also Check: 580 Credit Score Personal Loan