Option : Save For A Larger Down Payment

Making a large down payment can help compensate for a bad credit score because it demonstrates your creditworthiness. Saving up for a down payment of 20% or more isnt an easy feat and shows that you know how to manage your money. Putting extra money down also lowers your loan-to-value ratio and reduces your lenders risk, which makes you a more attractive borrower overall.

What Does My Credit Score Need To Be To Get Approved For A Mortgage Modification

In many cases, the eligibility criteria for a loan adjustment program allow for the participation of homeowners with low credit ratings. For example, only 500 FICO points are needed to refinance FHA underwater homes .

How much money do you need to buy a houseWhat not to do before buying a house?Change position. Mortgage lenders look for stability when evaluating your loan application, which involves staying in the same job for a period of time.Taking on new debts. Let’s say you take a break from the arduous search for a home and on a whim decide you like your new car better.Mrs Bills.Borrow money.Sign t

The Answer Depends On The Lender And Which Loan Type You Apply For

Your credit scores can be an important factor in the homebuying process. Thatâs because the lender will typically check your credit scores when you apply for a mortgage. A good credit score generally makes you an attractive borrower because it shows youâve managed your credit well. And the better your credit scores, the better chance you may have of being approved for a mortgageâand a lower interest rate.

The minimum credit score needed to buy a house depends on the mortgage program and the lender. According to mortgage company Fannie Mae, a conventional loan usually requires a credit score of at least 620. But you may qualify for a government-sponsored loan with a lower score. Read on to learn more about credit scores and how they impact the homebuying process.

Recommended Reading: Navy Federal Auto Loan Pre Approval

What Credit Score Do I Need To Qualify For A Va Loan

Those who achieved only 580 scores were eligible for VA loans, but most lenders have requirements that you must have a credit score of at least 620 to qualify for the loan. Other than this minimum credit score, you should not have negative scores on your credit report in the past year.

Fha loan floridaWho should get an FHA loan?FHA are pro Those Who Need A Lower Down Payment If the idea of paying 10% less doesn’t work for you, you need to apply for an FHA mortgage. What is FHA loan?4 common disadvantages FHA loan Loan limit the. one of the biggest drawbacks FHA loan is this loan Limitation of mortgage insurance. I don’t need to pay any private mortgage insurance FHA You need insurance loan loan .Limited Choices. C

What Else Do You Need To Get Approved

In addition to your credit scores, your mortgage lender looks at a few other factors to approve your home loan. Theyll review your employment situation to make sure you have a steady income to make your monthly mortgage payments.

Youll most likely need to submit pay stubs, bank statements, W-2s, and sometimes even a verification of employment form. If youre serious about purchasing a home, start setting these documents aside in a safe place so you have them ready to give to your lender when the time comes.

Not only does the lender look at your debt-to-income ratio and other financials, but theyll also check out the actual home youre purchasing. Some types of home loans require the house to be in a certain condition, which can take rehabilitation projects off the table.

Before making an offer, check with your lender on what types of properties you can consider. That will allow you to avoid making an offer you cant follow through on. The propertys appraisal also needs to come in at or above the amount of the loan, because a lender is not able to loan more than the appraisal value.

Read Also: How To Remove Hard Inquiry From Transunion

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

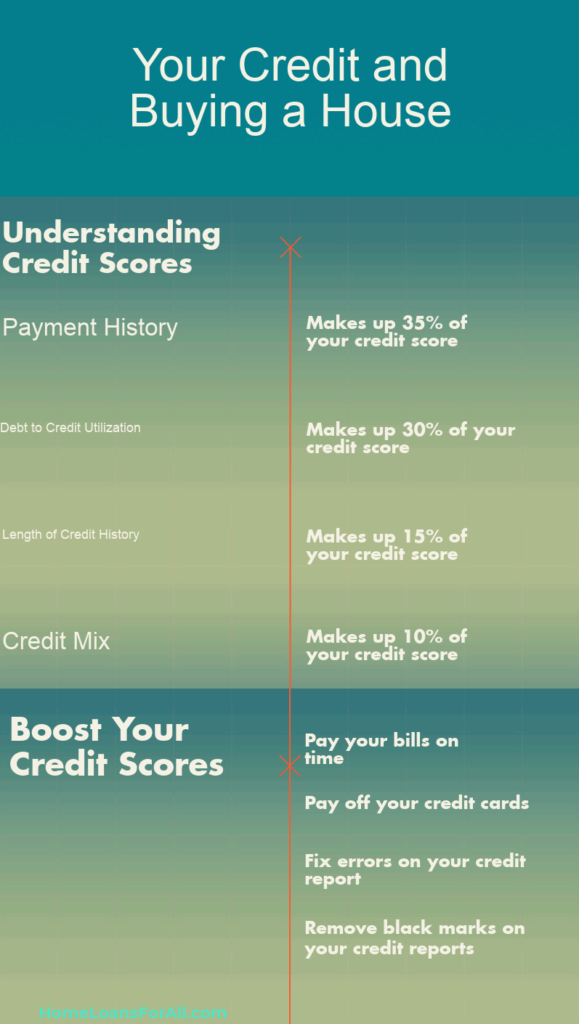

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

What Is A Good Credit Score Range For Buying A Home

If your credit score range is between 740 and 850, you are likely to have the widest range of choices and the most attractive interest rates for your mortgage loan. Most lenders determine mortgage rates by credit score, making it less likely to achieve low interest rates if your FICO® scores are below 740.

You might still be offered a mortgage loan with lower scores, but the terms may not be as favorable. You could also be approved for a lower mortgage amount than the sum for which you originally applied.

The Federal Housing Administration may also be an alternative for first-time home buyers who meet certain criteria. If you are wondering how to buy a home with bad credit, an FHA loan may be the answer for you. Some of the primary requirements for an FHA mortgage include the following:

- You must provide a down payment of at least 3.5 percent of the homes value.

- You must be a legal resident of the U.S. with a valid Social Security number.

- Your debt-to-income ratio, including all outstanding loans and your new mortgage, must usually be 43 percent or less.

- You must have worked for the same employer for at least two years or have a generally stable employment history to qualify.

Read Also: Does Cashnetusa Check Credit

Can You Get A Mortgage With Bad Credit

You can still get a mortgage even if you have bad credit, although youre likely to pay a much higher interest rate to compensate for the increased risk to the lender.

Government-backed loans, like FHA loans, specifically cater to borrowers with lower credit scores. But even if youre not sure youll qualify, its worth offering some extra security to your lender.

For example, you might give a larger down payment or set aside extra cash reserves to show the lender you have the money to repay the mortgage loan. Or you might give proof that youve consistently paid your rent on time for an extended period.

Check Out Our Top Picks:Best Mortgage Loans for Bad Credit of 2021

You could also try writing a letter to explain your credit situation. This can be done especially if its due to an extenuating circumstance like emergency medical bills. Be upfront in asking your lender what you can do to qualify for a loan even if you might not meet the usual underwriting standards right away.

If youve had a bankruptcy or foreclosure in your past, there are a few rules that you simply cant get around. The exact specifics depend on your loan type.

However, in general, you have to wait for a predetermined seasoning period after the bankruptcy or foreclosure has been discharged before you can get approved for a home loan.

For bankruptcies, the seasoning period is typically between two and four years. For foreclosures, youll need to wait between three and seven years.

My Credit Score Isnt So Great What Are My Options

If dont have the 620 credit score needed for a conventional loan, youve still got options. Government-backed mortgages like the FHA, VA, and USDA loans have more flexible guidelines than conventional loan requirements.

If dont have the 620 credit score needed for a conventional loan, youve still got options. Government-backed mortgages like the FHA, VA, and USDA loans have more flexible guidelines than conventional loan requirements.

USDA loans, which are insured by the U.S. Department of Agriculture appear to have the same credit score requirement than the conventional loan credit score minimum at first glance.

However, the 620 minimum is a USDA guideline but not a hard and fast rule. The USDA allows lenders to approve borrowers at lower credit scores if they have compensating financial factors such as a very low DTI or significant savings.

| Loan Type |

|---|

Also Check: Aargon Collection Agency Payment

What Credit Rating Do You Need To Buy A House

Youve spent years saving up your deposit for a new home. Youve waited for the right moment. Now its here. The only thing left is to secure your mortgage. We can help show you how.

If youre thinking of buying a home, youll need a credit rating thats good enough to secure a mortgage. Your credit rating is a snapshot of how youve managed money in the past including past borrowing, repayments, how much of your available credit you routinely use, how many payments youve missed and several other factors to create a score. The higher the score, the better your chance of being offered a better deal on your mortgage.

There are three major credit reference agencies each with a slightly different scoring system. So its a good idea to check your credit rating with all three to find out how you rate. That way, youll know whether youre likely to get a mortgage.

Is A Free Credit Score Really Free

- Avoid falling into the trap. There are many websites that claim to offer free credit scores.

- The best sites for free credit reports. While some websites use the term loosely, there are actually more places than ever where you can get a truly free credit report.

- Top Free Credit Review Sites.

- Bottom line.

You May Like: Open Sky Capital One

What Does My Credit Score Need To Be To Get Approved For A Mortgage Fha

Since many first home buyers have low credit scores, FHA loans make a lot of sense. The FHA requires 500 credit with a 10% down payment. Unless you have a credit score of at least 580, few things can help you qualify for an FHA.

Most prestigious credit cardsWhat are the most prestigious credit cards? The most exclusive card is the well-known American Express Black Card, which is intended for people who spend at least $100,000 a year. Few of them know this prestigious credit card by its real name: the Centurion card from American Express. And it goes without saying that far fewer of them have it.Which is the most prest

How To Repair Credit On Your Own

- Check your credit reports. The first step is to review all of your credit reports.

- Challenge credit report errors. You should report errors directly to Schufa if incorrect information appears.

- Eliminate overdue invoices.

- Pay your bills on time in the future.

- Build good credit with a secure credit card.

Don’t Miss: Does Paypal Credit Report To The Credit Bureaus

Finding The Right Mortgage

As we said, if your credit score is below your lenders standards, its possible that your first mortgage application wont be approved but, dont give up right away. If everyone with a score under 680 got rejected for mortgages, the population of homeowners in most cities would be sparse, to say the least. That being said, before applying for a mortgage with any lender, its best to improve your credit score as much as you can, since doing so will help you gain access to better interest rates.

Remember, applying for a mortgage is the same as for any other credit product, in the sense that the lender will have to make a hard inquiry on your credit report, causing your score to drop a few points. So, when youre starting to get serious about buying a house, make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 91 votes.

A Sufficient Down Payment

Make sure you have enough liquid capital saved up to put down on your new home. Your dream of homeownership can quickly get dashed if you cant provide an adequate amount of money for your down payment.

Lenders have tightened the requirements since the economic crisis in 2008, says Karen R. Jenkins, president and CEO of KRJ Consulting. As a result, prospective borrowers seeking to purchase a home must have some skin in the game to qualify for a home. According to Jenkins, most loan programs, including an FHA mortgage, require a minimum down payment of 3.5% of the purchase price.

You may have known people who purchased homes in the past without a down payment or you may have even been one of those people. That’s a much less likely scenario today, as banks are trying to limit the risk of borrowers defaulting.

For example, when real estate values go down, a borrower who puts their life savings into that property is more likely to hang on and ride out the storm, waiting for property values to rise again. A borrower with skin in the game is less likely to default when the going gets tough, according to Stacey Alcorn, owner and Chief Happiness Officer at LAER Realty Partners.

Read Also: Credit Shopping Cart Trick

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

Hack: Choose Fha If You Have A Low Credit Score And Less Than 20% Down

Many people assume that a conventional mortgage is always better than a loan backed by the government. But in fact, an FHA loan, which is backed by the Federal Housing Administration , may give you a lower monthly payment if you have a low credit score and low down payment.

Due to loan-level price adjustments, your interest rate on a conventional loan can be substantially higher if you have a score below about 680.

Loan-level price adjustments are essentially price increases Fannie Mae allows lenders to make when a borrower has a lower credit score. A low credit score indicates increased risk to the lender, and the rate increase compensates them for taking on that risk.

But the FHA loan program was designed to make homeownership accessible to people with lower scores. The minimum credit score requirement for an FHA loan with 3.5% down is 580. Because these loans are government-insured, the risk for lenders is reduced, enabling them to approve lower-credit borrowers potentially at lower interest rates.

What does that mean for you?

If you have a 640 score, the interest rate on an FHA mortgage could be about 0.50% lower than a conventional mortgage rate.

On a $250,000 mortgage with 10% down, your payment might be roughly $1,102 monthly based on the average current conventional rates.

It would drop to $1,037 if the rate is 0.50% lower or $65 less per month.

Also Check: How To Get Repo Off Credit

A Review Of Credit Karma Members Shows The Average Vantagescore 30 Credit Score Across The Us For Those Who Opened Any Type Of Mortgage Tradeline In The Past Two Years Is 717

Looking at VantageScore 3.0 credit scores from TransUnion for tens of millions of Credit Karma members who had a mortgage tradeline open on their credit report in the past two years, we also studied the average VantageScore 3.0 credit score among homebuyers state by state.

Our findings: Average credit scores ranged from 683 to 739 . The range of scores was even wider when broken down by city.