Help Your Customers Build Business Credit

By reporting those payments to commercial credit agencies you can help your clients build positive business credit references that help them build strong business credit scores. Your customersgood payment histories will be reflected in their credit scores. Not all companies report to these agencies, and as business owners learn about the importance of establishing strong business credit, they often seek out and do business with companies that report.

Re: Requesting Credit Bureaus To Add Positive Accounts To Your Report

I don’t think you will get anywhere with the CRAs. They will only include information on your CR that is sent to them by lenders. If they lender does not report the TL then there is no way the the CRA can list it. As far as the law goes, it states that all information that is listed on your CR must be accurate, it doesn’t state that any information has to be listed at all.

504EQ FICO 819, TU08 778, EX “806 lender pull 07/26/2013All Scores 760+, Newest goal 800+

Whats In Your Credit Report

There are three major credit bureaus that produce and sell credit reports: Equifax, Experian, and TransUnion.

You have a separate credit report from each of these companies, giving you three different credit reports in all. For the most part, the information in each report will be similar. But you might notice some differences because not all lenders report to the same credit bureaus.

Your personal and financial information will be laid out differently in each of your three reports there is no uniform formatting for credit reports. But theyll each contain the same general types of information about you and your credit history.

The following types of information will be included in your credit reports:

- Personal Identification Information

- Consumer Statements/Alerts/Disputes

In addition to the list above, youll also see a description of your rights as a consumer and contact information for the credit bureau.

Example Credit Reports

Before jumping into your own credit reports, you may find it useful to browse some simple examples. Follow the links below to get an idea of how your credit reports might look, although your reports may have updated layouts.

- Current and previous addresses and phone numbers

- Current and previous employers

- Other identifying information

Take a close look at your data to make sure everything is correct. Check the spelling, and make sure all numbers are accurate.

An example Personal Information section from a TransUnion sample credit report.

You May Like: Does Paypal Credit Report To Bureaus

Accounts That Are Inaccurately Reported

If your credit report contains negative accounts that should be positive, you can use the to have the information corrected. For example, your credit report may show that you were late on a payment that youre certain you paid on time. To correct credit report errors, you need to send a dispute letter to the credit bureaus citing the error and providing a copy of any proof that shows the information is indeed incorrect.

The bureau will investigate and revise your credit report if the investigation supports your claim. If not, you can follow up with a dispute directly with the business that reported the error.

How Credit Is Reported For Apple Card Account Co

Each co-owner will be reported to credit bureaus as an account owner, so each person is reported in their own name. The shared Apple Card will be reflected on each account owners credit report as a jointly owned account.4 Credit reporting for each co-owner may include both positive and negative payment history on their shared Apple Card, as well as the credit line amount and credit utilization. Each individual’s personal credit history includes information that’s unique to them, so Apple Card usage and payment history can impact each person’s credit score differently.

If you combine your account with an existing Apple Card account owner

- You can only co-own an account with a member of your Family Sharing Group.

- The credit limit for each person will be combined. Both co-owners will see the combined credit limit for the shared account on their credit reports.

- Each co-owner will maintain their pre-merge Apple Card payment history on their individual credit profile.

- Each co-owner will maintain their Apple Card account origination date on their individual credit profile, which can be helpful to maintain the age of their credit history.

- After the accounts have merged, the credit profile for both account owners will include their shared payment and credit activity for Apple Card going forward.

If you want to co-own an Apple Card account with someone who doesnt have an existing Apple Card

If you want to close a co-owned Apple Card account

Also Check: How To Get Repossession Off Credit

Pay Attention To Credit Utilization

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

What Types Of Things Can I Report To The Credit Bureaus

Some types of financial accounts are almost always automatically reported to the credit reporting agencies. These include, for example, mortgages, auto loans, student loans, personal loans, major credit cards, and most other revolving credit accounts. You can find out which of your accounts are currently being reported to which credit bureaus by reviewing your credit reports. Youâre entitled to a free credit report from each of the three credit reporting agencies every 12 months. Due to COVID-19, you can access all three of your reports for free each week through April 2022.

If you have an account that isnât listed on your credit report, you can contact the lender and request that they report your account and payment activity to the credit bureaus. Keep in mind that not all report to all three bureaus. So, each of your three credit reports could contain different information.

The credit reporting bureaus will also accept payment and account information about nontraditional accounts. Recurring expenses, such as rent payments, are an example of a nontraditional account. An officially recognized data furnisher must report the information for it to be accepted by the credit bureaus.

Recommended Reading: Does Carvana Report To The Credit Bureaus

What Are The Advantages Of Reporting My Own Payment Information

Many of the more traditional ways to improve your credit, such as getting a credit-builder loan or opening a secured credit card account, require you to take on new debt. But self-reporting your payment activity to the credit bureaus allows you to boost your credit without taking on any additional debt. Instead, self-reporting allows you to use the monthly bills youâre already paying to help build your credit history and increase your credit score. If you already have to pay rent each month â likely your biggest monthly expense â why not use it to help build your credit?

Payment history accounts for 35% of your under the FICO 8 credit scoring model, which is currently the model most often used by lenders. By self-reporting your nontraditional accounts, you can increase the number of positive accounts that appear on your credit report. Positive accounts are active accounts that are in good standing and have established, on-time payment records. This can be especially helpful if youâre just getting started and your credit history doesnât contain much information. Positive accounts can also help counteract negative items in your credit report. The longer you keep self-reporting, the stronger your scorable payment history will become, which should help your credit score continue to rise.

Date Of Birth And Social Security Number

First of all, make sure your date of birth and social security number are listed. These two basic items help creditors verify your identity and they may not approve your request for credit if they cant confirm this basic information. Your current and previous addresses should also be listed unless you own property and are at risk of being sued.

In that situation, you run the risk of having collections target your property to repay past debts. But if youre free and clear of any delinquent accounts or threat of litigation, your updated address indicates stability and continuity. These are important attributes when applying for credit.

Also Check: When Does Usaa Report To Credit Bureaus

Tips To Increase Your Credit Score

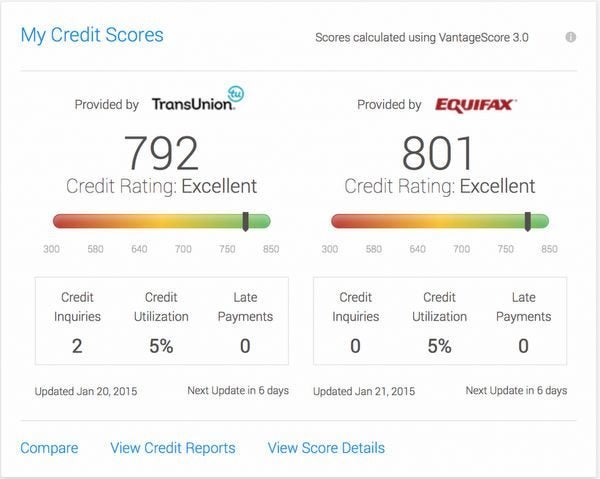

If you are like many consumers and dont know your credit score, there are several free places you can find it. The Discover Card is one of several credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar, but not identical. Same goes for online sites like Credit Karma, Credit Sesame and Quizzle.

The Vantage Score comes from the same place that FICO gets its information the three major credit reporting bureaus, Experian, TransUnion and Equifax but it weighs elements differently and there could be a slight difference in the two scores.

Once you get your score, as Homonoff suggested, you might be surprised if its not as high as you expected. These are ways to improve the score.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: What Company Is Syncb Ppc

Keep Credit Cards Open

If you’re racing to improve your credit profile, be aware that closing credit cards can make the job harder. Closing a credit card means you lose that cards credit limit when your overall credit utilization is calculated, which can lead to a lower score. Keep the card open and use it occasionally so the issuer wont close it.

What If You Have No Accounts

You need open, active, positive accounts to build a positive credit history. If you dont already have open accounts, start by applying for the types of credit cards or loans for people with no credit or bad credit, like a secured credit card or retail store credit card. If you cant get approved on your own, a relative or friend may be willing to co-sign for you or make you an authorized user on one of their credit cards to help boost your credit. If the primary cardholder has a positive payment history, you might see a boost in your credit score.

However, beware of schemes that claim to help you improve your credit score by adding you as an authorized user to a stranger’s account. Such a tactic may cause you legal troubles.

Also Check: How Long Does A Repossession Stay On Your Credit Report

What Is A Credit Score

A credit score is a numeric summary of your credit history, a commonly used method for lenders to predict the likelihood that you will repay any loans they make to you.

There are no exact cutoffs for good scores or bad scores, but there are guidelines for each. Most lenders view scores above 720 as ideal and scores below 630 as problematic.

Consumers are becoming more aware of how raising their credit score improves their financial outlook and Homonoffs study has evidence of it. She found consumer behavior improved dramatically when people were aware of their credit score.

Many people thought they had a great score, but then found out they overestimated it, she said. They realized they had to start changing credit behaviors, so they stopped making late payments, they paid off cards with a balance and their scores improved.

The FICO credit score is used by 90% of the businesses in the U.S. to determine how much credit to offer a consumer and what interest rate to charge them for that credit.

FICO uses five major components in the equation that produces your credit score. Those five include:

Privacy And Security Issues

You have to provide your social security number to be added as an authorized user on the other persons account. Your social security number lands in the hands of the person who adds you to their accounts. The way the process works, you dont know who this person is or how private they will keep your personal information.

Whenever you give out your Social Security number, theres a risk that your identity can be stolen. Dont think that just because you already have bad credit, that additional damage cant be done if your identity is stolen.

Recommended Reading: 766 Credit Score Mortgage Rates

What To Do If Information Is Missing

If youve spotted missing payment information from a credit report, your next steps may depend on your credit scores and what type of information is missing.

VantageScore® Solutions and FICO®, which create widely used credit-scoring models, both list payment history as the most important factor in determining a consumers credit scores.

Having multiple accounts, including credit cards and installment loans, with a long history of on-time payments can help you build good credit. Missing payments can hurt your scores.

Contact Your Mortgage Lender And Ask If They Report To Experian

If your mortgage account does not appear on your credit report, the first thing you should do is contact your mortgage company and ask them if they report to Experian. If your lender confirms that they do report to Experian, you can request that they contact their Experian representative for help in determining why the account is not appearing in your report. Ask them to review the identifying information on the account to ensure that the account is being reported under the correct name and Social Security number.

You also can contact Experian and explain the situation so that it can be researched. You can reach Experian by phone at 888-EXPERIAN, or by mail at:

Experian P.O. Box 9701 Allen, TX 75013

Simply explain that you have an account that’s not appearing on your report and that the lender has verified it is in fact being reported. Be sure to include your complete identification number, including your Social Security number, so that Experian can locate your credit information.

Unfortunately, if your lender does not report, you won’t be able to have your account added. When you apply for credit in the future, ask the lender if they report account history to one or more of the national credit reporting companies. If they don’t, you might consider applying elsewhere to ensure your positive account payments help you build a strong credit history.

Don’t Miss: How To Report A Death To Credit Bureaus

Become An Authorized User

If you have a relative or friend with a long record of responsible credit card use and a high credit limit, consider asking if you can be added on one of those accounts as an . The account holder doesnt have to let you use the card or even tell you the account number for your credit to improve.

This works best for if you have a thin credit file, and the impact can be significant. It can fatten up your credit file, give you a longer credit history and lower your credit utilization.

How To Add Something Positive To Your Credit Report

There are a lot of scam artists out there with empty promises to improve your credit score through some sort of manipulation. Dont believe them. Only errors can be corrected and you can do that yourself. If youre already making regular on-time payments, is there anything else you can do to raise your credit score? Can you add something positive to your credit report without resorting to fraud?

Also Check: Does Paypal Report To Credit Bureaus

Adding Positive Credit To Your Own Report

The three major credit-reporting agencies — Equifax, Experian and TransUnion — store data on you and on your credit accounts to compile your credit report. Typically, they get their information from the companies that do business with you. However, there are some instances where you can directly add your own information to your report.

How Apple Card And Apple Card Family Is Credit Reported

Learn how Apple Card reports your credit based on your particular role on the account.

Your credit report contains a detailed record of your credit history that is maintained by the credit bureaus. Information within your credit report can be used by lenders for evaluating your credit applications. If an account is reported to the credit bureaus, a lender must provide accurate information about your performance on the account. This includes whether you are paying your bills on time, how much of your available credit on the account is being utilized, and age of the account.

If you have an Apple Card account, this information is reported by Goldman Sachs Bank to each of the three major credit bureaus Equifax, Experian, and TransUnion1 on at least a monthly basis. Your Apple Card will appear as a separate trade line on your credit report labeled APPLE CARD – GS BANK USA or GS BANK USA. It may take up to 45 days from the time of activity for that information to appear on your credit report. Some personal credit monitoring services may take longer to refresh your information after the credit bureaus have published it.

If you choose to , it’s important for everyone to understand how they are uniquely reported based on their role on the account.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus