You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

Read Also: Why Is There Aargon Agency On My Credit Report

Transunion Vs Equifax Credit Scores: Why The Difference Between Scores

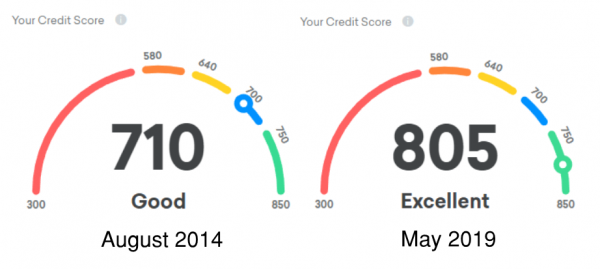

I must admit, Im a terrible personal finance blogger because had never checked my credit score until a few months ago. I remember knowing my credit score when I first applied for a mortgage a few years ago but never checked it again because I always thought that it cost money to check your credit score. Enter Transunion vs Equifax, they helped changed my personal finance life! In this post I will explain the difference between Transunion and Equifax, and why are my Transunion and Equifax scores so different?

This post may contain affiliate links. Please see genymoney.cas disclaimer for more information.

I also didnt know there were two different credit bureaus and I didnt know there was a difference between the scores! So recently, I checked both my Equifax and Transunion scores. There was a big difference between Transunion and Equifax. I have always wondered why there was a difference between the two scores.

Make Sure Your Credit Report Is Up

Keep an eye out for inconsistencies and errors in your credit report. About 20 percent of customers had errors on their credit report in a study done by the Federal Trade Commission in 2012. According to a repeat study conducted in 2015, customers who reported an unresolved error still believed the report contained errors. Borrowers are legally entitled to one free credit report per year from credit bureaus.

Online marketplaces have also simplified the monitoring of credit history. There could be errors in your report if you provide incorrect information, fail to update the description, or update essential details. Having a negative credit score as a result of these errors can be devastating. You can report and rectify errors as soon as they occur.

Read Also: What Credit Report Does Target Pull

Improving Your Transunion Credit Score

Your TransUnion credit score affects your ability to obtain credit. This score represents your ability to pay back your creditors and your credit history. For instance, when you are late paying your payments on a credit card, this credit score drops.

Your best option for improving your TransUnion credit score is to review your TransUnion credit report. During this review, establish which debts belong to you. Establish which debts are older than seven years and are not included in a bankruptcy. Establish whether any of your debts possesses incorrect information. Once you have gathered all of the required information, create reports for each of these debts. TransUnion investigates all debts for which you create a discrepancy report. Once the credit reporting agency establishes that these debts do not belong to you, are too old to list, and/or contain incorrect information, the listing is updated.

Evaluate all debts that are negatively affecting your TransUnion credit score. Collection accounts, as well as, the original debt affect your TransUnion credit score. All debts for which you have multiple late payments also lower your TransUnion credit score. Create a list of these debts with contact information for each creditor.

Consult your budget and determine the amount of money you have available to payoff collection accounts. Establish the amount of money you could pay extra on debts that are behind. Use this amount to establish a budget for paying off these debts.

% Comes From Payment History

Are you late on your payments? Are you not even paying your minimums by the due dates? This will definitely negatively impact your credit score.

Tip #1: Pay your bills on time. Paying the minimum is a must, but paying in full every time is highly recommended and much better for your long term finances. By doing this, you will avoid having to pay interest on any money borrowed.

Also Check: Does Opensky Report To Credit Bureaus

Equifax Vs Transunion Credit Score

Transunion and Equifax credit scores are often not the same. Here are some reasons why your credit scores from these Canadian credit bureaus may be different.

Different algorithms: They use different models to calculate your score.

Reporting by lenders: Some lenders report to both credit bureaus, some report to only one and some do not report at all.

Different dates: Credit scores are always evolving. If you are comparing credit scores processed on different dates, chances are they will be different.

What Can I Do If I Believe The Information In My Credit Report Is Inaccurate

Write to the credit bureau immediately and describe the error in as much detail as possible. The agency must investigate your request and correct the error if one is found. If a correction is necessary, the agency must inform every business that has recently received your report that a correction has been made. If the dispute is not resolved, you have the right to file a brief statement describing the nature of the dispute with the credit reporting agency. This statement, or an accurate summary of the statement, must be included in any future credit report concerning you. Since the reports from the three major credit bureaus may contain different information about you, it is a good idea to obtain a report from each of them. Additionally, you should contact the company that provided the incorrect information. It may verify the mistake and write a letter on your behalf requesting that the credit reporting agency fix the error.

You May Like:

Recommended Reading: Cbcinnovis Credit Check

Lower Your Credit Utilization Rate

The fastest way to get a credit score boost is to lower the amount of revolving debt youre carrying.

The typical guidance from personal finance experts is to use no more than 30% of your credit limit, which applies both to individual cards and across all cards. For example:

- On a card with a $500 credit limit, spend no more than $150.

- On a card with a $700 credit limit, spend no more than $210.

- On both cards , spend no more than $360.

How much will this action impact your credit score?

Reducing your balances is the single most effective way to boost your credit score. Provided you have no derogatory marks on your credit reports, such as late payments or delinquencies, you are guaranteed to see a big jump in your scores quickly if you knock down your balances to $0 or close to zero.

Still, if your utilization is currently over 30%, and simply paying the debt off immediately isnt a viable option, there are a few other ways to lower your credit utilization rate.

What Do Cibils Credit History And Report Mean

You must ask yourself when you want a loan? What is my CIBIL score? What are my chances of being approved for credit? Using your credit history, your bank will determine whether you are credit-worthy.

Does a credit report record that is my CIBIL score? Credit history is a record of a borrowers repayment history. A borrowers credit history is obtained from various sources, such as banks, credit card companies, collection agencies, and government agencies. Credit scores are computed by applying mathematical algorithms to credit information to predict your creditworthiness.

To obtain a satisfactory CIBIL credit score, you usually need to use credit for 18 to 36 months.

You May Like: Does Klarna Run Your Credit

Inspect Your Credit Report And Score

As per the Federal Trade Commission, about 1 in 5 consumers have errors in their credit report that negatively impacts their credit score. Thats a big number and is why you should routinely request your free credit report annually and read it through for any errors.

Companies like Borrowell or Credit Sesame also provide it for free on a weekly or monthly basis along with your credit score. Checking your own credit score does not impact it as it is deemed a soft inquiry.

Errors on your report could include wrong personal information, inaccurate status e.g. late payments that were made on time, hard inquiries you did not authorize, negative information that has expired e.g. collections, bankruptcy, open debts that have been paid in full, etc.

You can dispute any errors on your credit report and ask that they are removed. The credit bureaus will investigate your claim and respond within 30 days.

Used Credit Vs Available Credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

You May Like: Itin Credit Report

Create Credit History By Choosing Different Forms Of Credit

If you havent borrowed funds in the past, you wont have a credit history, and as a result, your CIBIL score will be low. So, ensure that you borrow a healthy mix of credit, both secured and unsecured loans, of a long and short tenor to build a strong credit score. This will help you access low interest rates and higher loan amounts in the future whenever you choose to apply for a personal loan.

These are some habits that you can weave into your life to improve your credit score over time. However, it is essential to note that these steps will not lead to an immediate change in your score. After implementing them, it will take around 6 months to a year for your credit score to improve.

Bajaj Finserv brings to your pre-approved offers on all of its financial products such as business loans, home loans, personal loans, etc. With pre-approved offers, not only is the process of availing a loan simplified but it helps you save on time as well. You can check your pre-approved offer by simply adding some basic details.

*Terms and conditions apply

Work On Paying Down High Credit Card Balances

Your credit card balances play a huge role in your credit score. In particular, it’s important to have a low . That ratio is your current card balances compared to your credit limits.

The ideal credit utilization ratio is 20% or less. If you have $5,000 in total credit limits, you should aim for a total balance of $1,000 at most.

For an example of how much credit utilization matters, one personal finance writer’s by 32 points when she went over 50% credit utilization.

If your credit utilization is higher than 20%, put as much of your extra cash as possible toward your credit card debt. Once you pay down those balances, you should see your credit score go up in one or two months.

Read Also: Attcidls

How To Improve Your 600 Credit Score

Think of your FICO® Score of 600 as a springboard to higher scores. Raising your credit score is a gradual process, but it’s one you can begin right away.

83% of U.S. consumers’ FICO® Scores are higher than 600.

You share a 600 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

Customise Your Credit Limit

Your credit utilisation ratio has a significant impact on your credit score. The more you are able to restrict your credit usage as per the allotted limit, the better it is for your credit score. Reaching the limit has the opposite effect as it lowers your credit score. One way of tackling this is to get in touch with your lender and customise your credit limit based on your expenses.

Don’t Miss: Does Paypal Credit Help Credit Score

Cibil Score Improvement: How To Increase It Fast

There is a range of 300 to 900 CIBIL scores. Scores between 300 and 549 are considered low, while 550 to 700 are considered average scores. You may find it easier to obtain loans if your credit score is top-notch, but this can also backfire.

CIBIL requires a 700 or higher score for a personal loan. It is crucial to keep an eye on anything below 700. The situation is not hopeless, however. You cannot change your credit score overnight, but you can make significant and minor changes in your financial habits.

The following tips can help you raise your CIBIL score:

Keep Old Credit Alive

The length of your credit history influences your credit score. Do not cancel old credit cards in good standing even if you rarely use them now. Keep these cards and use them every now and then to show some activity on your credit profile.

Cancelling old lines of credit also lowers your total credit limit and this hurts your credit utilization ratio.

Related: KOHO Visa: Earn 2% Cash Back on Debit Purchases

Read Also: Which Business Credit Cards Do Not Report Personal Credit

Report Old Debts To The Credit Bureaus

Keeping records of your good old loans on your credit report increases your credit score. In the end, repayment of debt within the agreed time frame improves your creditworthiness, as well as your income potential.

Keeping your good accounts open for as long as possible is another way to improve your credit score. The most common tactic used by business enterprises is this one. Credit accounts are kept as active as possible to boost credit scores.

How Credit Scores Are Determined

Information found in your credit report is used to determine your credit scores, which might include the following:

- Your history of debt payments

- Hard inquiries6 on your credit score from new credit applications

- The amount of debt you currently have on your credit accounts

- The age of your credit accounts

- The amount and type of loan accounts you have open

- The percentage of available credit you’ve utilized

- If and when you had a foreclosure, declared bankruptcy, or had debt sent to collections

It’s common to see varying credit scores when you look at different sources. Credit Karma and other services might display different credit scores, like TransUnion VantageScore, which is different from the TransUnion FICO score that’s used for your Apple Card application. Your credit report and the timing of when your credit score is updated can affect your credit score.

For information about credit scores from TransUnion, please click here.

Also Check: What Is Syncb Ntwk On Credit Report

Cibil Credit Scores: Why Are They Important

Loan applications are heavily reliant on the CIBIL score. Banks and financial institutions generally check an applicants credit score and report before approving a loan application. In some cases, a bank may not even consider an application if the CIBIL score is low. Credit-worthy applicants with a high CIBIL score will be investigated, and the lender will take other details into account.

When it comes to CIBIL scores, the higher your score, the higher your chances of getting approved for a loan are. Loan/credit card approval is solely a matter for the bank, and CIBIL does not in any way decide if the loan or credit card should be approved.

Scores over 700 are generally regarded as good.

What To Look For When You Review Your Credit Report

Monitoring your credit report is even more important during uncertain economic times since fraudsters like to take advantage of these situations.

You should keep an eye out for common credit report errors and signs of fraud when checking your credit report, such as:

- New accounts that you didnt open

- Identity errors

- Incorrect reporting of account status

- Data management errors

- Balance errors

If you notice any errors, dispute them as soon as possible. Check out our step-by-step guide on how to dispute a credit report error.

Learn more:

Also Check: Credit Score With Itin

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Make Timely Payments On Credit Cards

To improve your credit score, you should pay your outstanding credit cards. If you pay the necessary amount due as shown on your credit card statement, you might avoid charges for late payments. Approximately 5% of the billing amount is expected in this minimum amount. Eventually, this will lead to a mountain of debt when interest and taxes are added.

Paying your dues on time not only prevents interest from piling up but also improves your credit score over time.

Also Check: Speedy Cash Repayment Plan