Here Are 10 Ways To Increase Your Credit Score By 100 Points

How To Improve Your Credit Score In 30 Days Or Less

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

* * *

How To Increase Your Credit Score

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Your credit score is key to so many areas of your financial life. A good credit score means you’re more likely to get approved for the best credit cards and loans, and you won’t have to pay an arm and a leg for them.

Even if you don’t plan on taking out any loans or credit lines, it has wider-ranging effects too. For example, you may need a certain credit score in order to rent an apartment. If your credit score isn’t top-notch, you may also be required to put deposits down on utility accounts, or even be denied for certain jobs.

Luckily, increasing your credit score isn’t too difficult, even if you’ve run into problems in the past. You just need a basic understanding of how credit scores work, the discipline to follow through with a few good financial habits, and a little bit of time.

Also Check: Does Sprint Report To The Credit Bureaus

Become An Authorized User

If you have a mystifyingly benevolent parent with impeccable credit, ask to be added to his/her account as an authorized user. This will not only help your credit utilization but it should also lengthen your credit history. Remember, this card is strictly for a credit boost, so do not under any circumstances, use the card when it arrives in the mail.

Can Lenders Find Out About Coronavirus Payment Holidays

At the start of the coronavirus pandemic, lenders were offering coronavirus-related payment holidays on mortgages, credit cards, loans and more to customers struggling to make repayments. If you applied for one, here’s how taking one might have impacted your credit file:

For more information on the help currently available, and whether it’ll affect your credit file, see our Coronavirus finance & bills help guide.

Read Also: Syncb Qvc

Improve Your Score So You’re In The Excellent Range

The average credit score is 675 which is still considered good but not excellent. A 675 may get you approved for credit cards and loans but at potentially higher interest rates, which means you’re paying more money.

Generally speaking, an excellent score will put you in the 700 range. Ideally, you should strive for a 750 score or higher so you can get the best interest rates.

Check your credit score before you report your rent so you can track improvements. Sign up for a free credit monitoring service like Credit Karma or Credit Sesame and check your credit score once a month.

Consider Consolidating Your Debts

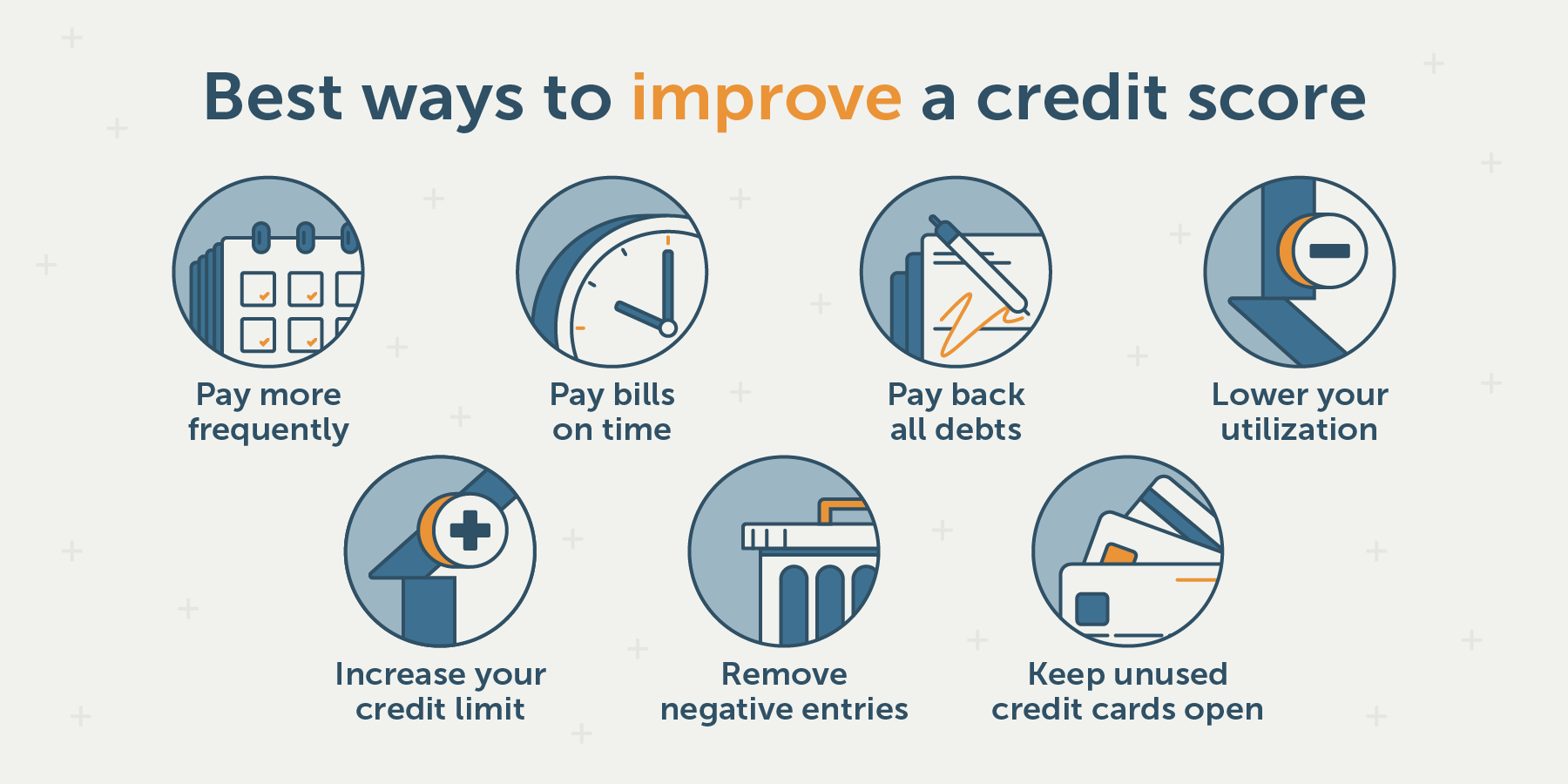

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and, if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

You May Like: What Is Creditninja

What Are The New Models Of Scoring And How Does It Affect Your Credit Score

Fair Isaac Corp. and VantageScore are the leading credit scoring companies in the US. Although they both provide credit scores that lenders and creditors use to evaluate loan applicants, they use different processes and criteria when calculating the scores.

VantageScore released its first credit scoring model in 2006. Its most recent version is 4.0, which was launched in 2017. Meanwhile, FICOs first base scoring model was developed back in 1989 but the latest version is FICO Score 9, which was launched in 2014.

Aside from credit score consistency and payment history, VantageScore 4.0 adds a few more factors to their credit scoring model. It added trended credit data and negative data suppression. Trended credit data shows your credit behavior and tradeline over the past 24 months, including your credit balances, limits, payments, and so on. Negative data suppression refers to the removal of negative items on your credit report. VantageScore 4.0 also uses machine learning technology for consumers with limited credit histories.

Several adjustments were made to the current credit scoring model used by FICO. Under FICO 9, unpaid medical bills wont affect your credit score that much compared to non-medical debts. It has also made some changes to how it treats paid collections.

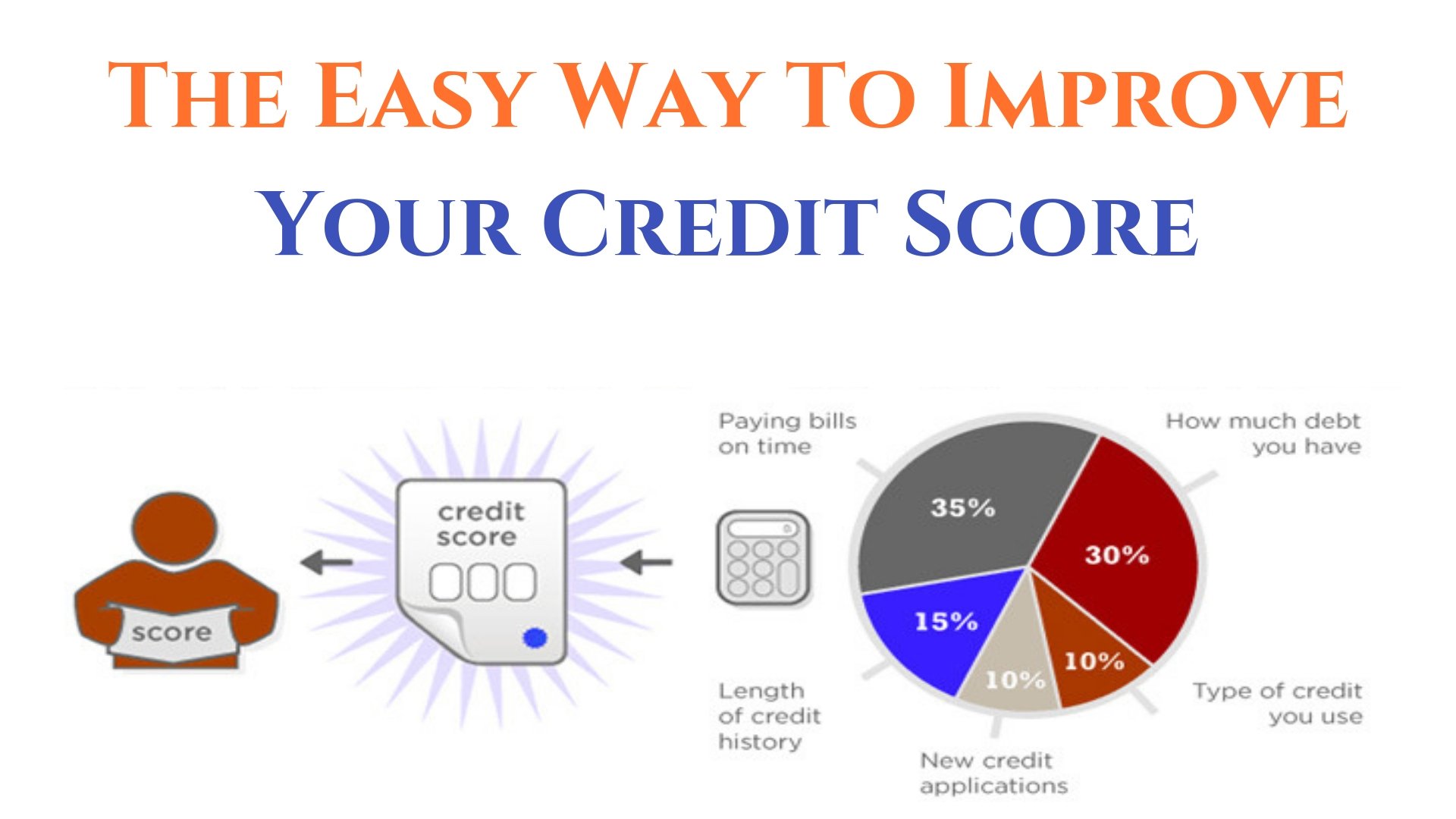

A new scoring model, FICO Score 10 Suite, is expected to roll out before the end of 2020. Older FICO credit scoring models take into account five major factors:

- Payment history

How Is Payment History Calculated

How is a payment defined as on-time or late for the purpose of calculating your credit score?

Payments are reported to the three major consumer credit bureaus as on-time if they are made on or before the date they are due.

Many people wonder what happens if you missed credit card payment or missed credit card payment by one day. Does a one day late payment affect credit score? Fortunately, most lenders also provide a 29-day grace period after the payment due date before reporting a payment as late to the credit bureaus. If you make your payment during this grace period, your payment will be reported as on-time, exactly the same as if you had made it on or before the due date.

The examples below illustrate two different payment patterns and how each would be reported on your credit report and used to calculate your credit score.

Example 1:

All payments made on-time: payments made on or before the due date.

Example 2:

Payments made on-time, except April payment made 17 days late and August payment made 29 days late .

Key:

Payment reported as On-time

X Payment reported as Late

Note that while a payment made after its due date may still be reported as on-time to the credit bureaus, a lender may charge you a late-payment fee for payments made after the due date or after a late fee grace period and a lender may increase your interest rate or decrease the amount of credit available to you.

Example 3:

You May Like: Can A Repossession Be Removed From Credit Report

Get Credit For Rent And Utility Payments

Rent reporting services can add your on-time rent payments to your credit reports. Rent payments are not considered by every scoring model VantageScores include them but FICO 8 does not, for example. Even so, if a would-be creditor looks at your reports, rent records will be there, and a long record of consistent payments can only help.

Experian Boost also can help, but in a more limited way. You link bank accounts to the free Boost service, which then scans for payments to streaming services and phone and utility bills. You choose which payments you want added to your Experian credit report. If a creditor pulls your FICO 8 using Experian data, you get the benefit of that additional payment history.

Impact: Varies.

Time commitment: Low. After initial setup, no additional time is needed.

How fast it could work: Boost works instantly rent reporting varies, with some services offering an instant “lookback” of the past two years of payments. Without that, it could take some months to build a record of on-time payments.

The Late Payments Dropped My Credit Score By 80 Points

Thats right my FICO score dropped 80 points! Although I really didnt care as much as I usually would, I just bought a new house and car. I wasnt going to be using my credit file again for a while. I knew whenever I needed my credit I could probably get them deleted.

Before I wrote this article, I wanted to try the methods I posted here to see if I could get my own late payments removed from my credit report.

You May Like: Credit Score To Qualify For Care Credit

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Consider Leaving Unused Credit

Unless having too many cards presents a challenge for you in terms of overspending, there really isn’t any harm in keeping unused credit-card accounts open and, in fact, it could be to your advantage.

Because closing a credit card means you no longer have however much credit that account was offering, the closure may lead to an increase in credit-utilization ratio and remember, lenders like to see that number at 30% or lower.

Also Check: Does Sezzle Affect Credit Score

Does Paying Off Collections Improve My Credit Score

Historically, paying off your collections does not improve your credit score because a collection stays on your report for seven years. Newer ways of calculating credit scores no longer count collections against you once they have a zero balance, but it is not possible for you to predict which method your lender will use to calculate your score.

Benefits Of Paying Your Bills On Time

Getting in the habit of paying your bills on time can pay off in lots of ways:

- Help improve your credit scores. Making all your debt payments on time can go a long way toward helping you build good credit. Lenders view steadily rising credit scores as evidence that you pose less of a risk as a borrower, so as scores increase over time, you gain access to a wider array of loans and credit cards, with potentially higher loan amounts and credit limits and lower interest rates and fees.

- Avoid penalties from your lender. Loan contracts and cardholder agreements typically spell out fees or penalties you must pay if you miss a payment due date by as little as one day. On a first offense you might be able to get a lender to rescind the penalty , but those fees can really add up. And credit card penalties are added to your purchase balance, so they can cost you interest charges as well. It’s far less costly to just make your payments on time.

- Worry less. If you don’t have a system for ensuring payments are made on time, you can spend a surprising amount of energy fretting about whether you’ve made this or that payment already this month, scrambling to transfer funds in the eleventh hour, and otherwise sweating over the state of your bills. We all experience anxiety over things we can’t control, and taking charge of a manageable task like bill paying can make your life a little calmer and less stressful.

Read Also: Experian Viewreport

Faqs On Credit Payment History

Timely payments will always have a positive impact on your payment history. If you have paid all your bills on time and much before the due date, you can expect a clean payment history, which in turn will help boost your credit score.

This depends on various factors, including the number of late payments, amount you owe, and how late your payments were , among others. If you have been a serial defaulter, the black mark will reflect on your report for at least 7 years. In cases of bigger financial fiascos, such as bankruptcy, can leave negative impact on your score for at least 10 years.

You can write a goodwill letter to your creditor depending on the relationship you have. If your lender agrees to adjust, your report wont reflect the late payment. Alternatively, you can file a dispute in case you see any discrepancies in the payment data.

You can write to any of the major credit bureaus requesting them to send your credit report. If you specifically want to check your credit score, you can do that on third-party websites like BankBazaar.

Practice paying on time so that your credit history doesnt take a hit. That way, you can put your name in the good books of financial institutions. Also, spend less using your credit cards, so that the debt accrued is on the lower side.

Your Credit Utilization Has Changed

Your credit utilization ratio is the amount you owe on your credit card relative to your credit limit. It influences your credit score, so a change in either of the two can cause your score to adjust.

Have you charged more on your credit card lately? If so, your credit utilization may have increased, which can negatively impact your score. Typically, having less than a 30% credit utilization can keep your credit in top shape.

Check to see if your credit card company has increased or decreased your total limit. Often credit card companies will tell you if youre eligible for a change in credit limit, but they could alter it without you knowing. If your spending habits remained the same, an increase in your credit limit would decrease your credit utilization ratio, which can positively impact your score. A decrease in your credit limit would increase your utilization ratio thus, your score could go down.

You May Like: Usaa Credit Card Approval Score