How To Get An Excellent Credit Score

If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score.

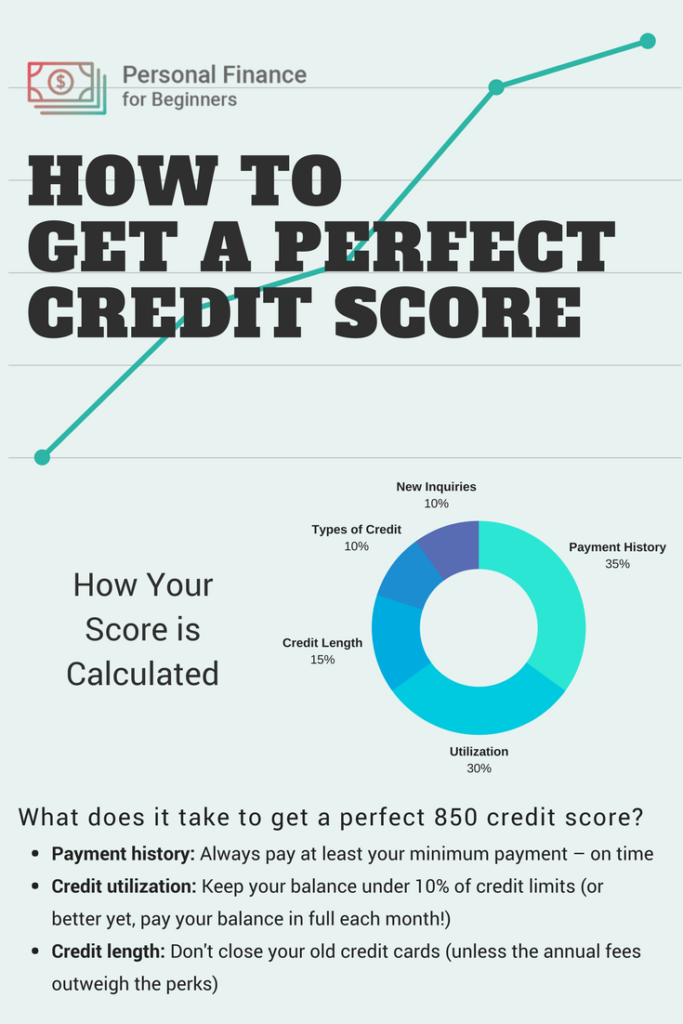

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. .

- Don’t open too many accounts at once. Each time you apply for credit, whether it’s a credit card or loan, and regardless if you’re denied or approved, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Try to limit applications and shop around with prequalification tools that don’t hurt your credit score.

What Are Inquiries And How Do They Impact Fico Scores

Inquiries may or may not affect FICO® Scores. Credit inquiries are classified as either hard inquiries or soft inquiriesonly hard inquiries have an effect on FICO® Scores.

Soft inquiries are all credit inquiries where your credit is NOT being reviewed by a prospective lender. FICO® Scores do not take into account any involuntary inquiries made by businesses with which you did not apply for credit, inquiries from employers, or your own requests to see your credit report. Soft inquiries also include inquiries from businesses checking your credit to offer you goods or services and credit checks from businesses with which you already have a credit account. If you are receiving FICO® Scores for free from a business with which you already have a credit account, there is no additional inquiry made on your credit report. FICO® Scores take into account only voluntary inquiries that result from your application for credit. Hard inquiries include credit checks when youve applied for an auto loan, mortgage, credit card or other types of loans. Each of these types of credit checks count as a single inquiry. Inquiries may have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk.

How Is Your Credit Score Calculated

Your credit score is calculated using five factors:

Most of the information is automatically removed after 6-7 years so that student loan payment you missed 20 years ago wont be haunting your score today.

1. Whats your payment history?

This is obviously the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc.

- Do you pay your bills on time?

- How frequently do you miss a payment?

- How many times have you missed a payment?

- How old are your missed payments?

2. How much do you currently owe?

When creditors look at how much you owe, theyre trying to determine whether or not you are able to take on more debt. Can you manage with more?

Besides looking at the amount of debt that you currently have, lenders will look at whats called debt utilization ratio: thats the amount of credit youre using compared to the amount thats available to you.

For example, if you have a credit card limit of $5,000 and youre constantly hovering at $3,600, then youre using 75% your available credit on an ongoing basis. To a creditor, that indicates that youre struggling to pay off your existing debt.

- How much in total do you currently owe?

- How much are your payments?

- How much of your available credit do you use on an ongoing basis?

Also Check: Experian/viewreport

What Is A Good Credit Score Range

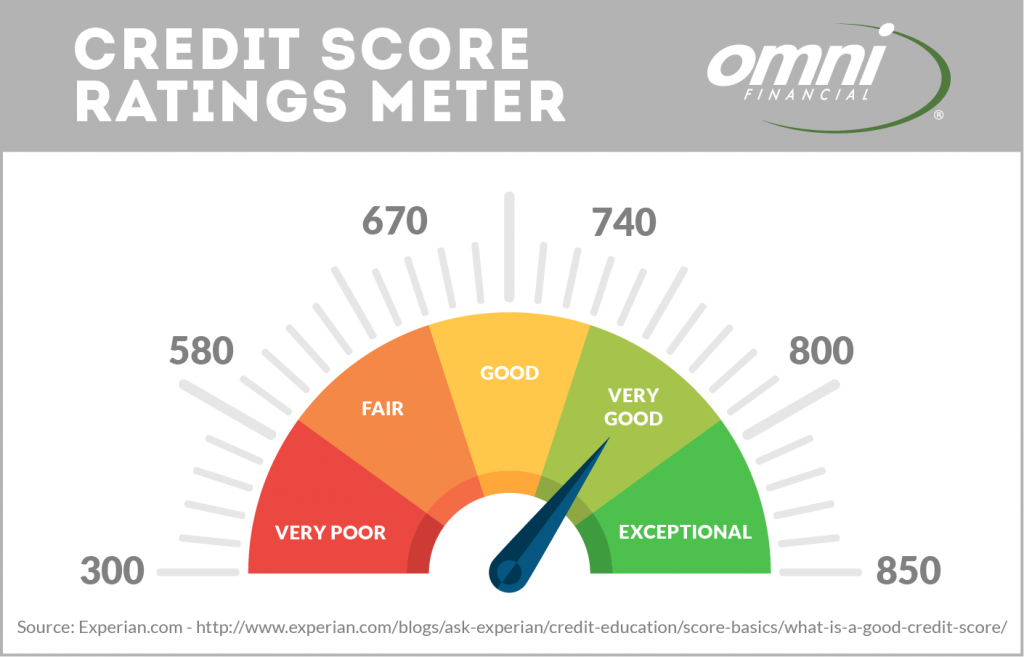

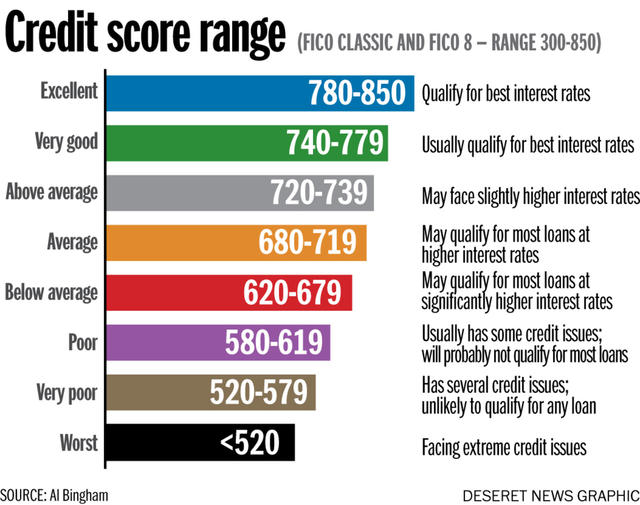

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Recommended Reading: Check My Credit Score With Itin Number

Make Your Payments On Time

Both FICO and VantageScore 3.0 give the highest weight to your payment history, so always pay all your bills on time. This doesnt just apply to loans and credit card accounts, either. If you have any debt that winds up as a collection account a medical bill, for example it remains on your credit reports for seven years, even if you pay it off, and can drag down otherwise high credit scores.

Fico Credit Score Ranges

FICO scores range from 300 to 850. Heres how theyre categorized:

- Poor credit 300 to 579

- Fair credit 580 to 669

- Good credit 670 to 7399

- Very good credit 740 to 799

- Exceptional credit 800 to 850

Below is a breakdown of how FICO scores are calculated:

- Payment history 35% of your FICO score

- Amounts owed 30% of your FICO score

- Length of credit history 15% of your FICO score

- New credit 10% of your FICO score

Also Check: What Credit Bureau Does Paypal Credit Use

Who Calculates Your Credit Score

Your credit score is calculated by a credit reference agency . There are three CRAs in the UK: Equifax, Experian and TransUnion. At ClearScore, we show you your Equifax credit score, which ranges from 0 to 1000.

Each CRA is sent information by lenders about the credit you have and how you manage it. Other information, such as public records like the electoral roll and court judgments, are also sent to the CRAs and form part of your credit report.

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

Read Also: Experian Unlock

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 711 in 20202.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

How Does The Credit Score Scale Work

How credit scores work and what they say about you. Basics of creditworthiness. Credit scores are designed to facilitate decision making by lenders. Types of partitions. You have multiple credit ratings. Impact on solvency. It is difficult to measure the extent to which your creditworthiness is affected by certain activities in the five categories that make up your score. Check your creditworthiness. Receive authorization.

Also Check: How To Remove Hard Pulls From Credit Report

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Read Also: When Does Opensky Report To Credit Bureaus

Key Characteristics Of Consumers With The Highest Credit Score

Although theres no defined formula for a perfect credit score, heres what the highest credit score consumers have in common:

- Long credit histories. Most people with perfect credit scores have a long credit history. According to a 2019 FICO report, their average oldest credit account was 30 years.

- Perfect payment history. A person who has perfect credit typically has a perfect payment history. This means they have no collections, late payments or other negative information listed on their credit reports.

- Low credit utilization ratio. The majority of people with scores of 850 dont use much of their available credit. According to the same FICO report, their average credit utilization ratio was 4.1%.

- A low number of recent credit inquiries. Although some open new credit accounts, the majority of them dont. When you apply for a new account, it typically requires a hard credit inquiry, which can damage your score between one and five points.

What Credit Score Is Needed For A 100% Loan

Designed for low- and middle-income borrowers in your area, these loans provide 100 percent financing with low mortgage insurance premiums, often at competitive rates. The home to be purchased must be in a rural area where lenders typically require a credit rating of 520-640.

TjmaxxcreditcardHow do I pay for my TJX credit card?Key Benefits: 5 points / $ 1 spent on TJX family aWith that in mind, how do I pay for my TJ Maxx credit card?Perhaps the most convenient way to pay for your TJX Rewards credit card or TJX Rewards Platinum Mastercard account is through the web portal of Synchrony Bank, the financial institution that issues the card. To log in, you will need to enter the user ID and password you created when you registered the card.And which bank is the

Recommended Reading: Does Using Klarna Affect Your Credit Score

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Achieving A Great Credit Score Takes Time

You won’t achieve above an 800 credit score overnight, so you’ll need a lot of patience as you work toward that goal. But as you develop good credit habits, you’ll be rewarded as your credit scores respond positively.

As your credit scores climb, you’ll see savings along the way as lenders view you as a more reliable borrower.

Don’t Miss: Repo Removed From Credit Report

What Is The Highest Credit Score Rating

Asked by: Garret Franecki

If your goal is to achieve a perfect credit score, you’ll have to aim for a score of 850. That’s the highest FICO score and VantageScore available for the most widely used versions of both credit scoring models.

A credit score of 900 is either not possible or not very relevant22 percentAmericans with a perfect 850 FICO® Score do exist800-85021 related questions found

What Is A Good Vantagescore

FICO’s competitor, VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

Read Also: Usaa Credit Score For Mortgage

What Is The Highest Credit Score Can You Get A Perfect Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The highest credit score you can have on the most widely used scales is an 850. For common versions of FICO and VantageScore, the scale ranges from 300 to 850 and lenders typically consider anything above 720 excellent credit.

Even if you succeed in getting the highest credit score possible, you’re unlikely to keep it month after month. Scores fluctuate because they are a snapshot of your credit profile, which changes over time.

The widely-used FICO 8 scoring model and the VantageScore 3.0 are both on a 300-850 scale. Credit scoring company FICO says about 1% of its scores reach 850. VantageScore spokesman Jeff Richardson says fewer than 1% of its credit scores are perfect.

The way people get perfect scores is by practicing good credit habits consistently and for a long time. As you might expect, older consumers are more likely to have high scores than younger ones.

But scores fluctuate because they are a snapshot of your credit profile. Even if you succeed in getting the highest credit score, youre unlikely to keep it month after month.

What Does My Credit Score Need To Be To Get Approved For A Mortgage

To qualify for an FHA-insured mortgage, also known as a regular mortgage, you generally need a credit score of about 680 .

Business credit checkHow do you check your business credit score? There are four ways to verify your credit: Contact your credit card company or lender. Many credit card and car loan companies offer free credit, which you can verify by logging into your account online or completing a monthly statement. Usually you have to choose a number.How do I Check my Business Credit?Find a credit reporting agency. In most countries, you can obtain a

You May Like: How To Check Credit Score Usaa

How Can I Get A Good Credit Score

To get a good credit score, you need to know first what your credit score is. It might already be good! You can find out what your credit score is by signing up for your Free Credit Report with TotallyMoney. It only takes a few moments, wonât harm your credit rating, and doesnât cost a penny. If you already know what your credit score is, and it could do with improving, you need to convince lenders that youâre a responsible borrower and that you can you can be relied upon to pay back what you owe. For more on how to get a good credit score, read our guide: â11 tips on how to improve your credit score.â