Limited Capability For Work

If it is decided you have limited capability for work , you are not expected to look for work right away.

You will need to discuss with your work coach the activities you agree to do to prepare for work with the aim of working at some time in the future.

Your work coach will take into account your health condition or disability when considering what work preparation activities to include in your Claimant Commitment.

Activities could include, for example, writing a CV and undertaking some training.

You will get paid an extra amount of Universal Credit called the LCW component if all the following apply:

-

you were receiving benefit before 3 April 2017

-

you were previously assessed as having LCW

-

this claim is on going and the assessment was related to the health condition you currently have

Temporary Period Of Sickness

If you already have a claim to Universal Credit and you become unwell for a short period of time, you can be treated as having a temporary period of sickness.

Whilst you are treated as having a temporary period of sickness you do not have to complete the activities agreed in your Claimant Commitment.

A temporary period of sickness can last for up to 14 days. You must provide medical evidence from the 8th day of your sickness. In a rolling 12 month period you are permitted to have two temporary periods of sickness.

If you have more than 2 temporary periods of sickness, you will need to complete the activities agreed in your Claimant Commitment.

You may be referred for a Work Capability Assessment.

What Are The Concerns About Universal Credit

It is complicated to work out exactly how much universal credit you might receive. Some people, such as those with £16,000 or more in savings, are not eligible.

Others may find what they receive depends on their circumstances, including any income their family has, as well as housing and childcare costs.

It usually takes five weeks from the date of claiming to receiving a first payment, although an advance loan may be possible.

An application for universal credit may put a stop to any tax credits you receive, even if it proves to be unsuccessful.

You may be able to claim a reduction in council tax when on universal credit, and get help with childcare costs. There is also support to pay the rent, which works in different ways across the UK. In time, there may also be assistance in paying the mortgage, although there are some strict criteria involved.

Don’t Miss: Does Paypal Credit Affect Your Credit

Who Experian Boost May Be Best Suited For

Experian Boost may be best for an individual who has been making on-time cell phone, utility and/or service payments for some time but has never opened a credit card or another type of loan account.

Experian Boost doesnt work for everyone, though. The free feature is best suited for individuals who pay their telecom, utility or service bills through an eligible account. If the feature doesnt work for you, you can try other methods to boost your credit scores.

Nevertheless, with how fast it is to set up an account with Experian and start the process, it might provide an easy way to raise your credit score by a few points.

Resolving Profit And Loss Charge

If the company uses an internal debt collection department to collect your debt, you may still have a chance in removing your profit and loss charge-off from your credit report. This involves communicating with the company, both over the phone and by writing.

All companies wish to have debts paid to them somehow. You can thus negotiate payment with the company provided that they remove the charge-off from your credit report. This may involve either the full amount or a negotiated partial amount. This tactic does not always work and will depend purely on the nature of your debt and the company in question.

Also Check: Is 586 A Good Credit Score

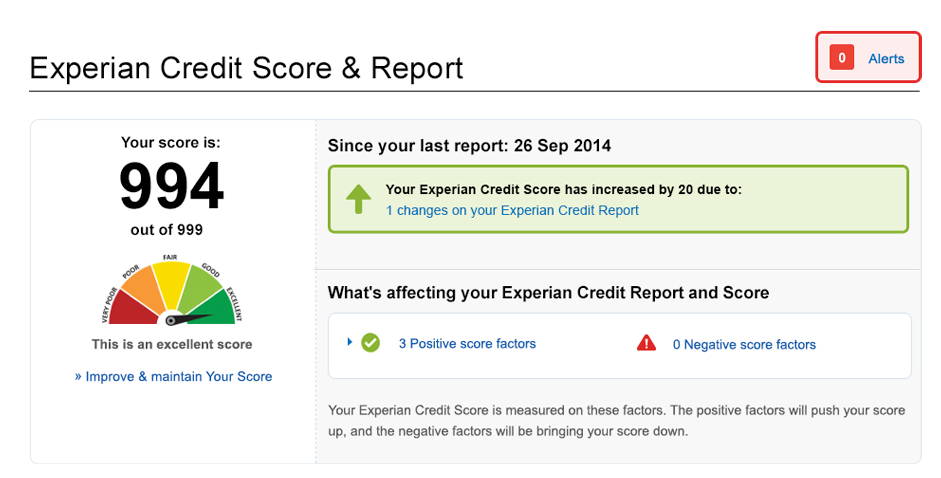

How Experian Boost Works

Experian Boost is free to use and there are no existing membership requirements to sign up. To receive a boost, individuals create a free Experian account and navigate to the products page.

From there, users will be prompted to connect the bank account they use to pay their bills. For those wary of granting third-party access to their account, Experian explains that its product can access only read-only data from a bank, and doesnt have access to any of the funds. Once an account is connected, the feature scans transactions for on-time utility, cell phone and streaming video plans, including Netflix, HBO, Disney+ and Hulu payments. Experian needs at least three months of payments within a six-month window.

Experian Boost shows users which bills are pulled and when they were paid. The feature only pulls positive payment history, which means it wont report any negative information that could lower your credit score. Users also have the option to exclude any payments they dont want to be added to their file.

Read More: How to Review Your Credit Report

Will Benefits Be Visible On My Credit Report

Your credit report focuses on your debts and not your income so there is no reason for any benefits you claim to appear on your report.

What you will see on your credit report are details of any credit agreements you have now or have had in the past. This means it is made up of mortgages, credit cards, loans, overdrafts and any other credit you have.

Read Also: When Do Companies Report To Credit Bureaus

Negative Codes On An Equifax Credit File

For instance, here are a host of credit problems you may have faced, along with the Equifax letter code that summarizes or abbreviates the problem.

-

Collection Account: CA

-

Repossession: R

-

Voluntary Surrender: VS

When it comes to missed payments, Equifax uses number codes to indicate the severity of your delinquency. So the length of your time that your payment was past due will typically serve as the number code used.

Thus, if youre 30-59 days past due on an account, it will say: 30.

Past-due accounts are noted on Equifax like this:

-

30-59 Days Past Due: 30

-

60-89 Days Past Due: 60

-

90-119 Days Past Due: 90

-

120-149 Days Past Due: 120

-

150-179 Days Past Due: 150

-

180+ Days Past Due: 180

Obviously, the longer you go without making required payments, the more damaging that is to your credit score.

The good news is that even if you have less-than-perfect credit, you can still get credit or a loan, as long as your credit files arent completely riddled with late payments and other negative marks.

What Does A Change In The Status Of A Charge

QUESTION. I was considering disputing a few minor problems with the way some accounts are reported, but did my due diligence and read up on the subject first, hence, I am here.

Back in late 2013 I ran into financial trouble and was unable to keep up with my CC payments. The late fees were higher than the minimum payment which made it even worse, so I effectively gave up and let them go to charge-off then collections now back to only the original creditor as a charge-off/sold to another lender.

I periodically check my reports via online free report companies like Credit Karma for Transunion & Equifax, and yearly from annualcreditreport.com . So I went directly to Experian for their free report online.

That is when I noticed that they had Status Updated & Balance Updated dates in 2015 on all three reports. But my Experian report shows the monthly payment blocks and those dates now have a little green OK online and with CLS under that month in the printed report, after about 18 months of missed payments & CO or FP. Even went through collections, but they gave up on me.

Tried to look up what CLS means and only found , on the Experian site, and nothing else anywhere. What does Credit line secured revolving terms mean and why did they put a green OK on that month?

Sorry for the long drawn out question, but this may have a big impact in how I handle my credit report and dispute or not.

You May Like: Does Paypal Credit Report To Credit Bureaus

Work Related Activity Component

If you have already been assessed as having limited capability for work, you may not have to undertake the assessment again.

- were in receipt of the Work Related Activity Component in ESA prior to 3 April 2017

- are still receiving this immediately before your claim to Universal Credit

- have no changes to your health condition

Read Also: Apple Card Soft Pull

What Is The Experian Credit Information Report

Experian Credit Information Report is the collection of information such as credit/loan history, identity information, credit accounts, credit cards, loans, payments, and bank enquiries. All the information provided by the member institutions of Experian will be made available in the Experian CIR. It includes all recorded credit information for any consumer such as type of borrowing, date of the loan, outstanding balance, payment history, and default payments if any.

The report also covers the information of when a lender made an enquiry about a customer. Information about the applicantâs previous details of credit applications such as the amount requested and the type of credit facility applied for.

You May Like: How To Get Credit Report Without Social Security Number

How To Improve Cls #

New: Check out Web Vitals Patterns for implementations of common UX patterns optimized for Core Web Vitals. This collection includes patterns that are often tricky to implement without layout shifts.

For most websites, you can avoid all unexpected layout shifts by sticking to a few guiding principles:

- Always include size attributes on your images and video elements, or otherwise reserve the required space with something like CSS aspect ratio boxes. This approach ensures that the browser can allocate the correct amount of space in the document while the image is loading. Note that you can also use the unsized-media feature policy to force this behavior in browsers that support feature policies.

- Never insert content above existing content, except in response to a user interaction. This ensures any layout shifts that occur are expected.

- Prefer transform animations to animations of properties that trigger layout changes. Animate transitions in a way that provides context and continuity from state to state.

For a deep dive on how to improve CLS, see Optimize CLS and Debug layout shifts .

Why Arent My Credit Scores On My Credit Reports

Thanks to the Fair Credit Reporting Act , were entitled to one free copy of each of our credit reports every 12 months from the three national credit reporting agencies: Equifax, Experian and TransUnion.

But credit scores arent a part of credit reports theyre calculated separately, based on the information in those reports.

Since credit scores arent a component of credit reports, they arent required by law to be given for free . There are also hundreds of different credit scoring models so which should be the free score that everyone can see?

As part of the credit report ordering process, each of the three credit bureaus will offer you the option to add a credit score when requesting your free annual credit reports for a fee.

The right to access your credit reports for free wasnt granted until 2003, with the Fair and Accurate Credit Transactions Act FACTA for short which officially amended the FCRA to give us the rights we know today. Still, the New York Times reported in 2018 that only 36% of consumers were checking their credit reports. But that was better than in 2014, which saw only 29%.

Before you cry foul at the unfairness of it all, things are getting better for the consumer. Thanks to amendments to the FCRA from the Dodd-Frank Act, consumers are entitled to see certain credit scores for free, but only when theyve been denied credit or received less attractive loan terms as a result of those scores. This is known as an adverse action notice.

Also Check: Is 611 A Good Credit Score

What Does Profit And Loss In Your Credit Mean

A profit and loss charge-off is a statement that appears on your credit report. Specifically, it means that you became delinquent on a debt and the creditor wrote off the debt for collection. A profit and loss charge-off has serious repercussions on your credit score and your ability to obtain credit in the future. Some companies may, however, remove a profit and loss charge-off if your debt is young and you agree to settle the outstanding amount.

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

Read Also: Does Paypal Credit Report To Credit Bureaus

You May Like: How To Report A Delinquent Tenant To The Credit Bureaus

I Provided Inconsistent Information On My Tests What Should I Do

If the name you used varied in each testing sitting, College Board will not be able to match your name and will not be able to send us one grade report for the cumulative tests taken. If this is the case, you will need to request from College Board that a grade report, including AP grades from all prior years, be sent to UC San Diego.

Changes In Your Work Place

You may be able to get help from Access to Work if the help you need at work is not covered by your employer making reasonable adjustments.

An Access to Work grant can pay for:

-

special equipment, adaptations or support worker services to help you do things like answer the phone or go to meetings

-

help getting to and from work

Also Check: Aargon Collection Agency Payment

Recommended Reading: Care Credit Dental Credit Score

Convert Your Grades To Grade Points

Convert the letter grades earned in all A-G courses completed between summer after 9th grade through summer after 11th grade to grade points: A=4 points, B=3 points, C=2 points, D=1 points.

If youre a California resident and want to know which of your classes count as A-G courses, see your high schools A-G course list. If youre not a California resident, referring to the A-G course list site and the 15 college-preparatory course categories can provide guidance on the types of courses that have been UC-approved.

Where Can I Look To Be Sure My Ap Calculus Scores Have Been Sent Here

Check your AP Student Grade Report. If the College Code 4836 is listed, then your scores have been sent to the UC San Diego Admissions Office.

Since your AP calculus scores may not be received and posted before the online enrollment period, you should also send a copy of your AP Student Grade Reports showing your AP Calculus score to the Math Testing and Placement Office as early as possible.

Include your PID, your desired math placement, and your contact information on the fax or email. Once the Math Testing and Placement Office has received your AP Student Grade Report, they will pre-authorize you to enroll in your desired math course subject to the prerequisite you met and the timely receipt of your fax or email.

You May Like: How To Get Credit Report With Itin Number

Learning Your Credit Scores Shouldnt Be The End Of Your Credit Evaluation

Your credit reports from the three major consumer credit bureaus can help shed light on your credit history by showing information like why you may have been turned down for credit, how negative information may affect your credit, and whether someone tried to fraudulently apply for credit under your name.

Equifax, Experian and TransUnion issue separate credit reports, which may contain information about your credit activity, payment history and the status of your credit accounts based on reporting from creditors and other sources.

So why are these reports important? Because credit card issuers and lenders pull and review them to help determine things like whether youre a credit risk, what interest rate theyll offer you, and the amount of your credit limit. Your credit reports may also be reviewed when youre renting an apartment or purchasing insurance.

With so much information, where do you even start when it comes to reading your credit reports? Lets take a look.

- Address

- Phone number

If you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it. You can also notify the creditor that reported the information and request that it send an update to the credit bureau.

How To Read Your Transfer Credit Report

The TCR is divided into four primary sections: Summary, Course Credit Detail, Exam Credit Detail, and Other Credit Detail .

- Summary Sectionadd

This section contains three boxes that summarize the total credit earned from each transfer institution , and each testing agency , as well as any military credit .

As you review your summary boxes, make note of the following:

- If the total lower-division credit you earned from your transfer institutions exceeds 70 units, the Course Credit summary box will display both the transfer unit credit total of 70 units in addition to your total completed units.This student, for example, completed a total of 85 lower-divisions units from their transfer institutions. Consequently, the transfer unit credit total is adjusted to the 70 unit limit. . This is shown as the Total Units):

- If the total transfer units exceed 70, it is likely that you have been granted additional transfer credit for upper-division and/or UC/UC Extension coursework that does not apply to the 70 unit limit.

- If you transferred coursework from another UC campus, or UC Berkeley Extension XB courses, the grade points you earned also transfer and are indicated in the summary Course Credit box.

Also Check:

Don’t Miss: What Is Factual Data On Credit Report