Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

The Us Credit Score Scale

Whether youre looking at a FICO Score, a VantageScore, or a credit score determined by a different company, youll get a number that falls between 300 and 850. In the US, your starting credit score is usually 300, although it can be lower, depending on the scoring system.

On this scale, 850 is a perfect credit score in USA and 300 is the worst. Typically speaking, anything over 700 is considered a good score. Anything less and banks are unlikely to offer you high credit limits or the most favourable interest rates.

The two most common credit scores are:

- FICO Score

The differences between these scores are:

- The company that generates them.

- The formula used to compile your score.

- Sometimes, the length of credit history needed to develop your credit score in USA .

How To Check Your Own Credit Reports

If you want to check your own credit report, theres a lot of options available. We recommend that you retrieve your credit reports for free using AnnualCreditReport.com. The website does not charge you or force you to sign up for and then cancel a subscription. In fact, its the only government-sanction website that provides a free credit report from each major bureau.

You can get a report from each bureau once per year, free of charge.

If you want to look at your report more frequently than once per year, there are other free options. Some third-party financial management and credit-monitoring tools offer credit report services for free. Other credit card issuers like Capital One let you view your credit report as well.

While the reports dont come directly from the bureau, theyre sufficient to keep track of things and notice any big changes to your credit. I use all three of the options I mentioned above and its helped me grow my credit score to nearly 800 over the course of seven years.

When you do want to pull a copy of your report from AnnualCreditReport.com, use these tips.

You can also request a report by phone by calling 1-877-322-8228 or by mail, by sending a form to:

- Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

Requests made by phone and mail will be mailed to you within 15 days.

Recommended Reading: What Credit Bureau Does Paypal Use

Bank Of America Business Advantage Customized Cash Rewards Credit Card At A Glance

Here are some of the card’s important features:

-

Card type: Business cashback rewards Mastercard

-

How to earn rewards: Earn 3% cashback in one category of your choice and 2% cashback on dining for the first $50,000. All other categories, as well as purchases over $50,000, earn 1% cashback.

-

How to redeem rewards: Request a check or deposit into your Bank of America account or redeem it as a statement credit.

-

Approval bonus: Receive a $300 statement credit when you spend at least $3,000 within 90 days after approval.

-

Annual fee: $0

-

: Intro APR of 0% the first nine statement cycles, then 12.24% to 22.24% variable APR

-

Foreign transaction fee: 3%

-

: Good to excellent

-

Special features:

-

Preferred Rewards business bank account holders can earn up to 5.25% on a chosen category, 3.5% on dining and 1.75% cashback on other purchases.

-

Unlimited rewards

-

$100,000 in travel accident insurance and other travel protections

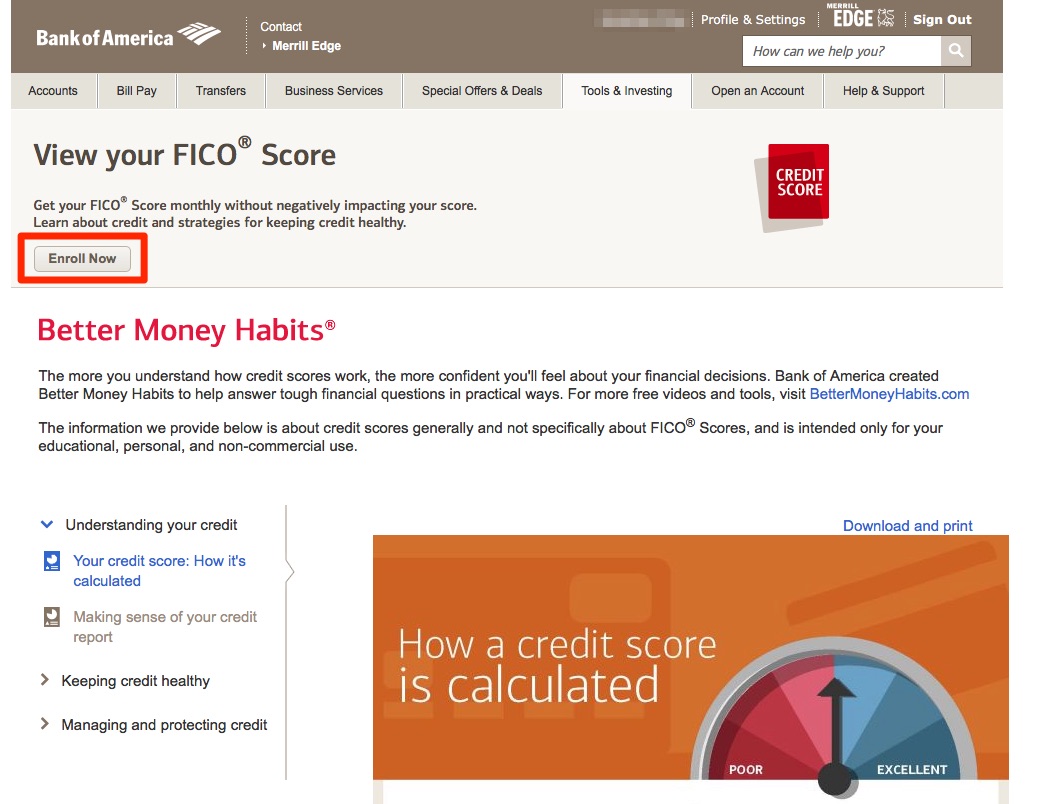

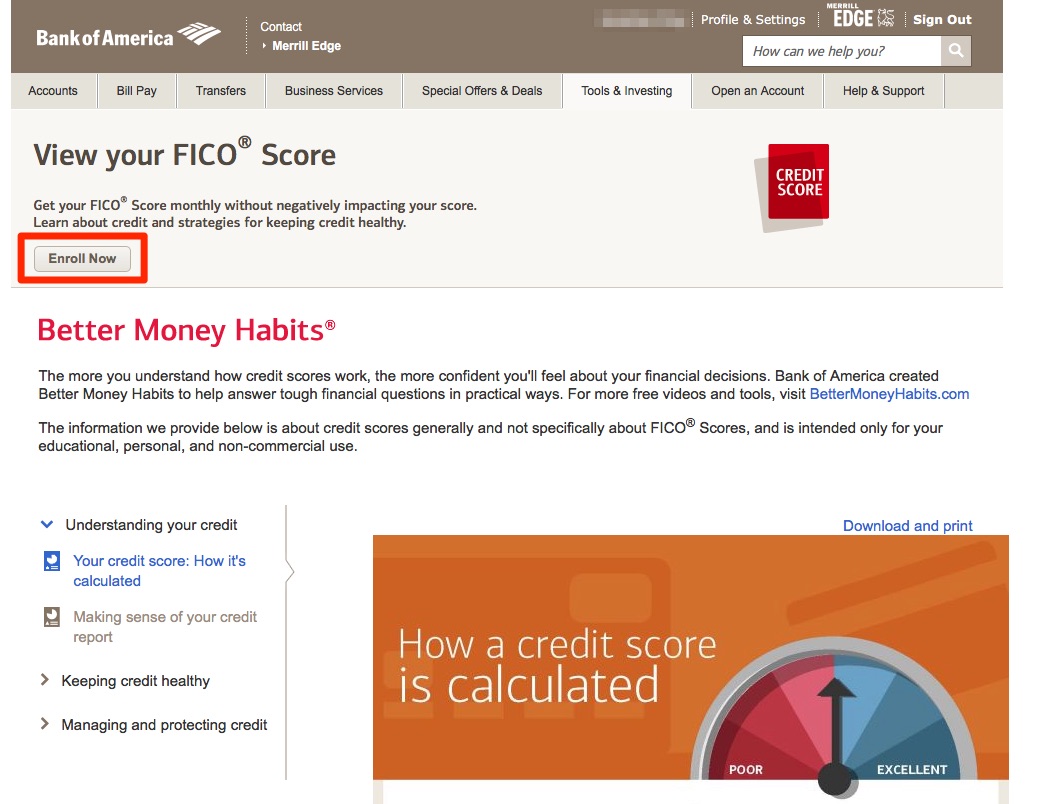

Does Checking Your Credit Score Hurt Your Credit

Its a common myth that checking your credit score hurts your credit, but this is not true. Its likely that this idea grew out of the fact that when your credit is checked by banks or utility companies when youre opening an account, it shows up on your credit report and can result in a 10-20 point ding on your score. When this happens, its known as a hard inquiry or hard pull. The number of these types of inquires youve had in the recent past is also a small part of your credit score.

But when you take a look at your own credit score its what is know as a soft pull or soft inquiry and wont have a negative impact on your credit score.

Also Check: What Credit Score Does Carmax Use

Improving Your Credit Score

Fair credit scores can’t be turned into exceptional ones overnight, and only the passage of time can repair some negative issues that contribute to Fair credit scores, such as bankruptcy and foreclosure. No matter the reason for your Fair score, you can start immediately to improve the ways you handle credit, which can lead in turn to credit-score improvements.

Look into obtaining a secured credit card. A secured credit card requires you to put down a deposit in the full amount of your spending limittypically a few hundred dollars. Confirm that the As you use the card and make regular payments, the lender reports your activity to the national credit bureaus, where they are recorded in your credit files. (Making timely payments and avoiding “maxing out” the card will favor credit-score improvements.

Consider a credit-builder loan. Available from many credit unions, these loans take can several forms, but all are designed to help improve personal credit histories. In one popular version, the credit union places the money you borrow in a savings account, where it earns interest but is inaccessible to you until the loan is paid off. Once you’ve paid the loan in full, you get access to the funds and the accumulated interest. It’s a clever savings tool, but the credit union also reports your payments to national credit bureaus, so regular, on-time payments can lead to credit-score improvements.

Not A Bank Of America Small Business Client

Small businesses choose Bank of America because we’re more than just a bank.

We’re a trusted partner empowering your business to grow and to keep serving your customers.

That’s why we provide tools and advice to actively manage cash flow, payroll, and point of sale services.

And now for the first time, we’ve partnered with Dun and Bradstreet, a leading provider of business data and analytics for almost 200 years to provide free access to a business credit score.

You can enroll and view your business credit score from your Business Advantage 360 online banking dashboard. There’s no need to navigate to an external website.

Business credit scores may be used by lenders, suppliers and underwriters to help make decisions about working with your business, so knowing where you stand can be important.

Several factors like past payment performance and financial information can impact the score. So we’re also providing educational information to help you understand your business’s credit health.

And if your business doesn’t have a score yet, you can still learn how to take the first step in establishing your business credit file on our Small Business Resources site.

A business credit score is not the only factor considered by lenders, including Bank of America, but knowing how your business may appear to others can empower you to take the next step to improve its financial health.

And when you’re ready, Bank of America will be there.

Don’t Miss: Does Removing An Authorized User Hurt Their Credit Score

How Do I Check My Business Credit Score

June 29, 2021 byGuest

Both businesses and individual consumers have credit scores that reflect how theyve historically used credit. Lenders and others use these scores to help determine creditworthiness and make decisions based on what they see. Business credit scores are based on different information than personal credit scores and use a different scoring system.

How Long Does It Take To Build Credit In The Us

Learning about how long it takes to build a credit history in the USA can be a daunting task. It usually takes anywhere between 3 and 6 months to build credit.

You can get a credit score of 700 in about 6 months. However, it is important to note that while building credit takes time, your score can drop drastically with just one mistake. You need to be cautious, and ensure that you make all your payments on time.

You May Like: How To Remove Repossession From Credit Report

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Fico Credit Score Factors And Their Percentages

| FICO credit score factors | ||

|---|---|---|

| The average age of your active credit lines. Longer histories tend to show responsibility with credit. | ||

| 10% | The different types of active credit lines that you handle | |

| New credit | 10% | The new lines of credit that you’ve requested. New credit applications tend to hurt you score temporarily.Learn more about FICO credit score |

When you get your FICO score, you’ll also get a few tips on how you can improve your score and/or find out why your score is lower than it could be.

Knowing where you stand on the credit score range will reveal your chances of being approved on loan applications:

Don’t Miss: Does Carvana Report To Credit Bureaus

Why You Should Monitor Your Credit

Keeping track of your credit won’t affect your approval odds for a new bank account but it will help provide an overall snapshot of your financial health.

In addition to pulling an annual ChexSystems report, make sure you are checking your credit report provided by the three credit bureaus at AnnualCreditReport.com. Any concern you have about your credit history can be relieved by staying on top of it.

To begin, sign up for a service like Experian free credit monitoring, which is free and gives you access to your Experian credit report and customized alerts. Experian Boost also gives you access to your free FICO credit score.

What Makes Up Your Vantage Score

VantageScore uses the following breakdown:

- Payment history: 41%

- Balance: 6%

- Available credit: 2%

While the formula appears largely similar, with payment history and credit utilization holding the greatest importance, there is a critical distinction in the way the two scores create these metrics.

Whereas FICOs numbers generally represent snapshots, VantageScore uses something called trended credit data. This is just a fancy way of saying they consider the trajectory of a borrowers behavior, rather than scoring based only on the current balance or utilization. The reasoning behind this is twofold: consumers should be rewarded for a history of low credit utilization and healthy account balances, and account holders are more likely to make appropriate payments if they have done so in the past.

A further difference between the two is that a FICO score needs more time to develop, at least initially . A VantageScore, on the other hand, is available to people with a more limited credit history.

But regardless of which score used, the general path to credit success is the same: make regular, on-time and appropriately-sized payments, and keep accounts open for a long time. The formulas for FICO and VantageScore may seem complicated, but earning a good credit score doesnt have to be.

Read Also: Does Speedy Cash Check Your Credit

How To Check A Bank Of America Credit Card Application Status

Keep in mind that not all Bank of America credit card applications will result in instant approval. That can be true whether youre applying for the card through the mail, online, or even occasionally on the phone. It can take up to 10 days before you hear whether you were accepted or not.

That can be hard to take when you already have plans for that card if you have an upcoming trip and dont want to take a ton of cash with you, for instance.

If you want to check the status of your application and cant wait one more minute, you can call Bank of America at 432-1000. However, if you have shaky credit and youre secretly worried your application wont be accepted, you might not want the embarrassment of being turned down on the phone by some anonymous customer service representative.

If thats the case, you can check your application status online by using a quick form. The form will ask for your last name, date of birth, the last four digits of your Social Security number, and your ZIP code.

Once you fill out that information, Bank of America will receive notice that youve inquired about your status. That wont guarantee an instant answer, but it cant hurt as an attempt to speed up the process. It also means that once a decision is made youll receive as fast of a confirmation or denial as possible.

How To Request A Bank Of America Credit Line Increase

You can request a credit line increase online by logging into your account. Click on the link/button called Request a Credit Line Increase and simply follow the steps. You will need to supply some information such as your income so be prepared for that.

Note that not everybody will be able to see the request a credit line increase link . If you have not had your account very long you might not see the link. In that case, you can also call the Bank of America customer service phone number at 1732-9194 but read below about how long you should wait before calling.

If you are not instantly approved for the credit line increase then your odds of getting the credit limit increase are probably going to be on the smaller side. It still might be possible to get approved for a credit limit increase but I would not necessarily expect one at that point. Either way, you should hear something in the mail after a few business days.

Tip: Use the app WalletFlo to give you auto-reminders of when to request credit limit increases!

Also Check: How To Remove Repossession From Credit Report

How Much Of An Increase To Request

You might be wondering how big of a credit limit increase is a reasonable request. A lot of people stick to requesting around 25% to 35% of their current credit limit. So if you had a $10,000 credit limit you might request a credit limit increase of $2,500. But sometimes it is possible to get much higher credit limit increases.

Many people will request an amount much higher than they actually want because it is possible that Bank of America will come with a counter offer. So in many cases you may want to request an amount higher than you actually need or want.

Here are some data points to give you an idea of what to expect for your credit line increase:

Bank Of America Mortgage Review

Many borrowers will find much to like about Bank of America.

If you enjoy an online or mobile application, you can pretty much do it all with this lenders website and Home Loan Navigator service.

If you prefer a face-to-face experience, Bank of America has a strong branch network.

Note that not all branches contain loan officers. Bank of America says only 1,800 of its 4,300 bank locations are lending centers. And neither type of center is evenly spread across the country so you may live a very long way from your nearest one.

That said, Bank of America scores better than other big banks for customer satisfaction, including Citi, PNC, Chase, and Wells Fargo.

Yet it gets more serious complaints from customers than some of its peers do, according to the Consumer Financial Protection Bureau . This suggests that Bank of Americas customer service could be a bit hit or miss.

Read Also: What Is Credit Bureau Report

Boost Your Chances Of Getting A Prequalified Offer

If you check CardMatch, the Bank of America site and your mailbox only to find you havent been targeted for the card youre interested in dont worry. You can work to improve your credit score and then try again before submitting your application.

Do this by making consistent, on-time payments on your other accounts and keeping your low. If you have a limited credit history, you can also consider signing up for a or asking a family member to add you as an authorized user on another account.

Who Creates Credit Scores

Those credit reports are a collection of all the information lenders and other creditors provide the bureaus on a monthly basis, about how much credit you’re using as well as your payment behavior and payment history.

Because many scoring models are in use, the same borrower might have different credit scores across different scoring models.

Don’t Miss: What Is Syncb Ntwk On Credit Report