How To Use Sezzle Online

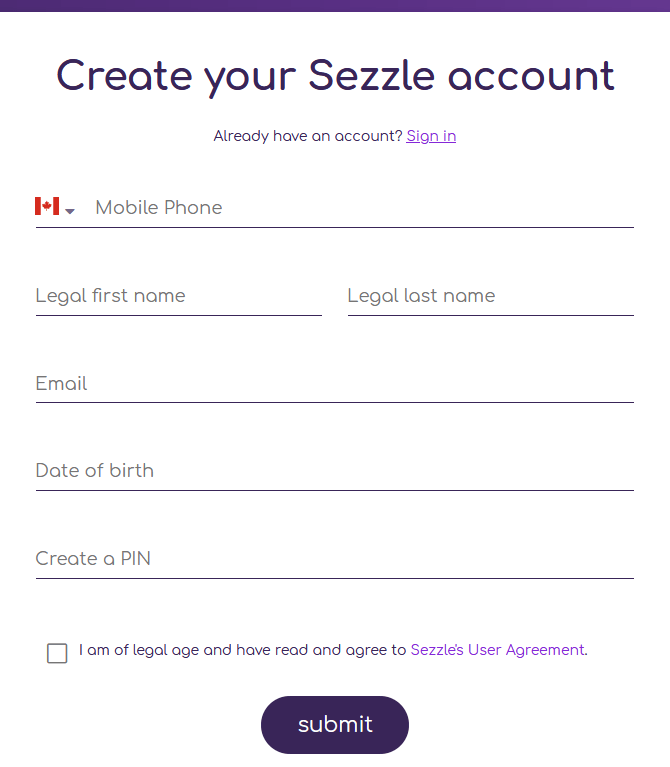

When you’re shopping with one of Sezzle’s participating online retailers, simply select Sezzle as your payment method, then either sign up or log in to your Sezzle account.

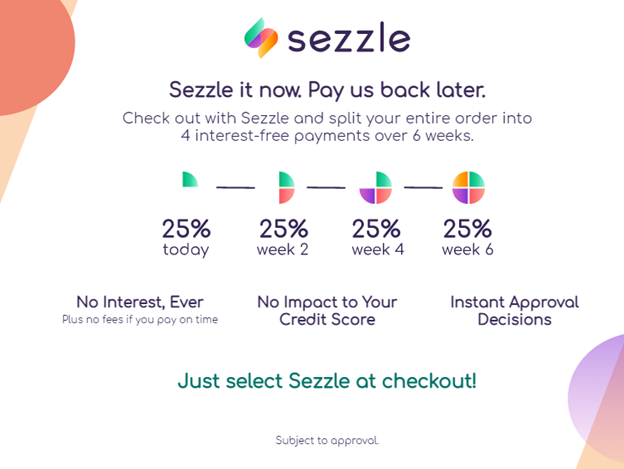

The company will run a soft credit check and let you know instantly if you’re approved. You’ll make your first payment, which is 25% of the total purchase amount, at the point of purchase, then your next three payments will be charged to your payment method automatically over the next six weeks.

Does Sezzle Report Your Activity To Credit Bureaus

For Sezzle’s standard service, there is no credit reporting involved. But if you want to use the program to build your credit history, you can sign up for Sezzle Ups revolving line of credit.

Through Sezzle Up, Sezzle reports your payments and balance to the three national credit bureaus monthly. As long as you make your payments on time, the reporting should improve your credit score. But if you miss a payment for 30 days, Sezzle will report it and your credit score can suffer as a result.

To qualify for Sezzle Up, you have to use Sezzles BNPL service at least once.

How Buy Now Pay Later Plans Work

Think of it as layaway in reverse. Rather than making payments over time and eventually gaining possession of the item, you get it now and continue making payments afterward. Generally, once you sign up with a third-party BNPL, you make your first payment, your item ships, and you make the rest of the payments as per the agreed-upon schedule.

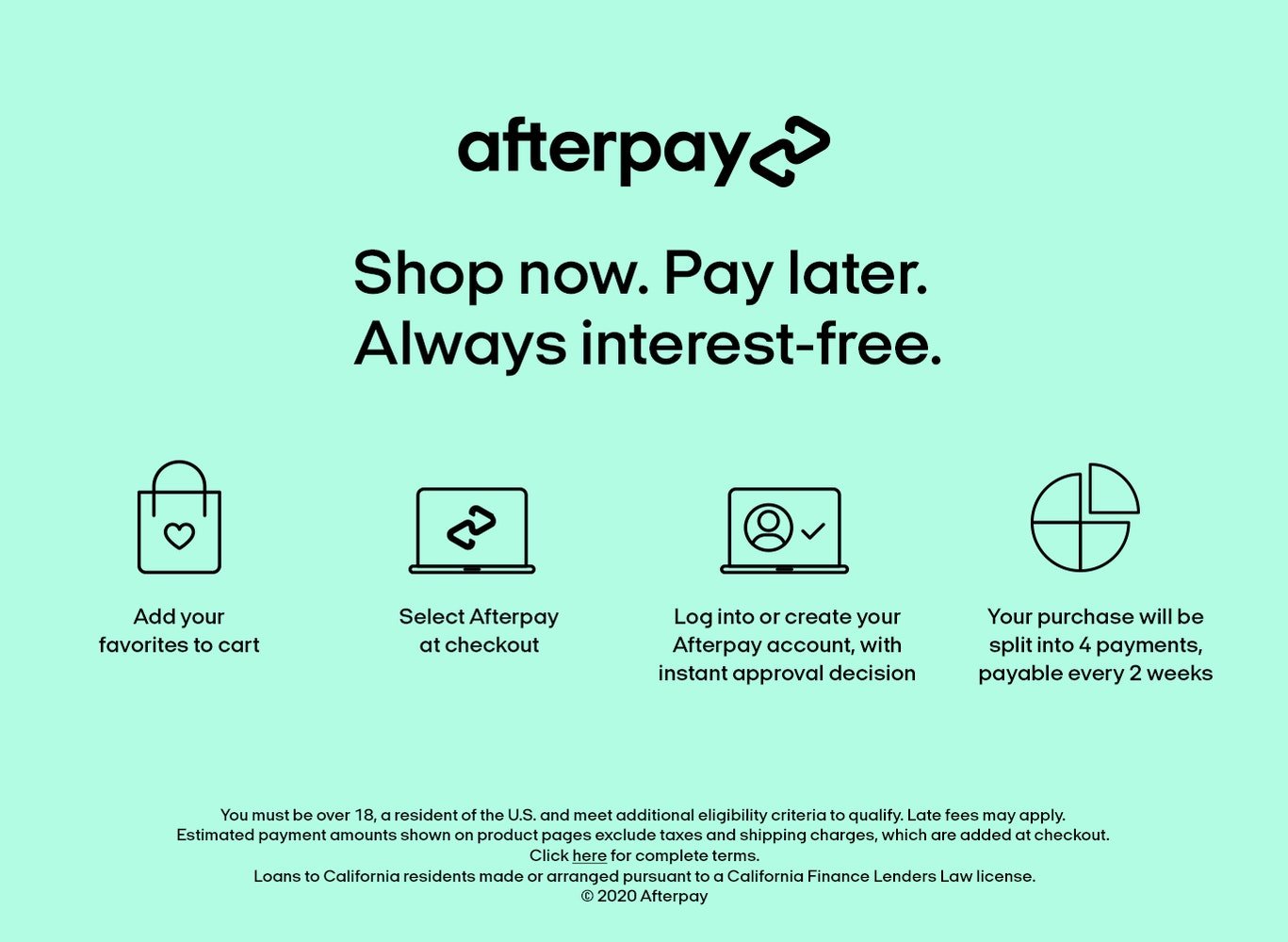

Which service you can choose depends on where youre shopping, since the BNPL partners with the merchant directly. But make sure to read the fine print, as each companys terms differ slightly. Afterpay, for instance, has no interest and no late fees, but caps the amount you can spend at first, gradually upping your limit as you prove yourself reliable. Other services charge interest and some charge fees for late payment.

Don’t Miss: Does Snap Report To Credit Bureaus

When Do I Make My First Payment

We collect your first payment when you place the order with the merchant. You’re always notified of the amount upfront, which could be as little as 25% of your total order cost.

The remaining payments will be spread out over your repayment schedule – you can always view the dates and amounts by logging into your Sezzle Shopper Dashboard, which you can access by clicking here.

Tricky Refund And Dispute Process

Unfortunately, youll have to contact the merchant directly for any canceled orders, returns or exchanges. If you dont receive an order, you can log into your account and click Get Help to email Sezzles team. If you encounter a situation that Sezzle considers a disputable issue, you can ask it to open a dispute with the merchant. You should get a response within three business days advising you of next steps.

But Sezzles website doesnt promise itll help, and it isnt clear about what Sezzle will do for you if it opens a dispute on your behalf.

Don’t Miss: Shopify Capital Complaints

Apply Without Affecting Your Credit

Sezzle allows you to apply for a loan with a soft credit check that doesnt hurt your credit scores, and the app offers instant approval but you may not qualify for every purchase. Your eligibility depends on your Sezzle history, past orders and more.

If youd like Sezzle to report your payment history to the credit bureaus, you may join Sezzle Up to opt into reporting. Developing a history of on-time payments could help you build a strong credit profile.

What Happens If I Miss A Payment

Sezzle gives its users 48 hours to correct a declined payment. Once a second payment is declined, Sezzle charges a $10 fee.

If extenuating circumstances prevent you from making your payment on time, you can reschedule it free of cost. After that, youll need to pay an additional $5 per succeeding rescheduled payment.

Recommended Reading: Credit Score 672

How To Build Credit Without A Credit Card

Knowing how to build a positive credit score is a crucial life skill.

We need good credit to do a range of important things, from getting a cellphone contract to buying a house.

Regularly using and then paying off a credit card is one of the most reliable ways to build credit. However, credit cards arent an option for everyone. Sometimes, events in your credit history can make it harder to get hold of one. Some people simply dont like them. Whatever the reason, the question of how to build credit without a credit card is an important one. Here are some tips:

Work with a Certified Data Furnisher to Report Your Rent and Utility Payments

Rent is the largest monthly expense for more than 25% of Americans. Over 60% of those under 35 years old are renters however, fewer than 1% of Americans see their positive rental payment history in their credit files.

LevelCredit has worked on rent reporting for years, and weve got it down to a fine art. LevelCredit users improve their credit scores by an average of 29 points in just two months, with subprime users seeing 51 point average increases.

And, we can also report your payments for your utilities: water, electricity, and more. We can connect your rental and utility payments directly to your credit file, and unlock one of the easiest ways to build credit without a credit card.

Unlock Other Kinds of Alternative Credit Data

Keep an Eye on Your Loan Payment History

Use a Credit-Builder Loan

Manage Your Student Loans

What You Need To Know About A Sezzle Loan

Sezzle is a buy-now, pay-later financing option for online purchases. When you have a Sezzle account and shop online at a participating merchant, youll have the option to choose a Sezzle loan as your payment method. You can shop through Sezzles app or website, or through the merchants online storefront.

With a mission to empower the next generation, the company says most of its customers are Generation Z and Millennials. Sezzle offers interest-free loans with the ability to opt in to a feature. The company operates in the U.S. and Canada.

Here are some other features to consider before you take out a Sezzle loan.

Recommended Reading: Does Klarna Report To Credit

Does Bnpl Require A Credit Check

Ordinarily, consumers who apply for loans or other forms of credit are subject to a hard credit inquiry, which allows lenders to view the consumer’s before making a decision. Each hard credit inquiry can knock a few points off your credit score. Soft credit pulls, on the other hand, have no impact.

Some BNPL providers conduct a hard credit check when you apply, while others don’t. The list of providers that use soft or no credit checks includes:

A hard credit check may be required if you’re using a special financing option offered by a buy now, pay later service. For example, Klarna requires a hard credit check if you’re applying for one of its six-month, 12-month, or 36-month installment loans. Otherwise, you may be able to avoid a hard credit checkand any harm to your credit scorewith BNPL financing.

Sezzle Does Offer An Upgraded Account Called Sezzle Up With A Feature To Build Your Credit Access To Your Limit And A Boost As Well As Exclusive In

Does sezzle do a credit check. The Sezzle Virtual Card allows you to purchase from select retailers online and in-store with only 25 of the order total due up-front. To help prevent fraud and verify your identity we do run a soft credit check or soft inquiry when you sign up with Sezzle. However Sezzle do still look at your credit score as part of a risk check.

You can reschedule a payment once per order for no added charge. And you can join Sezzle Up if youre working on your credit scores and want to have your activity reported to the credit bureaus. 18052021 Does Sezzle check your credit.

When you use your Sezzle Virtual Card the total order amount will be divided into four equal payments spread out over six weeks total. Sezzle doesnt qualify as a credit product per United States regulations Reg Z so there is no hard credit check processed. Sezzle is not a credit card but works in a similar fashion.

15062021 Sezzle will not have an impact on your credit they do not perform hard credit checks. 11022021 Sezzle may also be a good choice if you want to finance a purchase without a hard credit check. One of the great benefits of using Sezzle is our ability to evaluate customer limits and potential approvals with every purchase attempt.

The company does confirm your identity and run a soft credit check but that doesnt affect your credit score. A standard Sezzle account doesnt report to the credit bureaus. Your credit score is not affected by this soft credit check.

Also Check: Does Klarna Report To Credit

Buy Now Pay Later: Are Installment Plans A Budget Win Or Finance Fail

By Courtney Reilly-Larke on December 18, 2020

With options to buy now and pay later popping up, we ask the million-dollar question : Whats the real cost?

As the past year or so continues to meld into one long, sweatpants-clad day, its no surprise Canadians have turned to online shopping for much-needed boosts of morale. If youre clicking add to cart for sport, youve probably noticed that when you reach the checkout page, instead of finding just your total, there is a new option to pay in installments through a third party, from the likes of buy now, pay later companies including PayBright, Afterpay, Sezzle, Uplift and others. So, instead of purchasing that $200 parka in one swift hit to your credit card, you can pay it off in four scheduled payments of $50.

Will I Lose Access To Sezzle Up If I Do Not Continue Paying By Bank Account

Keep your bank account as your default payment method for scheduled payments. You will not lose access to Sezzle Up if you keep your bank account as default for scheduled payments but you may also use alternate payment methods to pay off orders. You can establish secondary payment methods any time by logging in to your dashboard and navigating to Settings > Payment Methods.

You May Like: Does Paypal Credit Report To The Credit Bureaus

Do Bnpl Services Report To The Credit Bureaus

- payment history

- balances owed

Those are some of the most heavily weighted factors used in calculating your FICO credit score. But this information isn’t reported automatically lenders have to share it with the credit bureaus, and not all do.

If a buy now, pay later provider chooses to report your account activity to one or more of the three major credit bureaus, that information can show up on your credit reports, and in turn, affect your credit score.

Sezzle, for example, offers a buy now, pay later option that includes credit bureau reporting for consumers who opt into it. If they make all their payments on time, that will help them build a good credit history, but if they’re late in paying, it could damage their credit score.

Afterpay, on the other hand, doesn’t report payment history to the credit bureaus at all, so it won’t affect credit scores one way or the other.

Consumers who hope to use BNPL as a credit-building tool will want to choose a service that reports to the credit bureaus and of course, keep up with their payments. Consumers who know from past experience that they don’t always pay their bills on time may want to choose one that doesn’t.

Klarna May Be A Good Option If You:

Need to buy a big-ticket item. If you cant pay the full price of your purchase at checkout, but can save enough to make on-time payment, using Klarna is a way to get your item now and pay later.

Are new to credit and do not qualify for a credit card. You may find Klarna easier to qualify for than a credit card. The company considers your credit score in addition to other factors, but theres no minimum score required.

Have a credit card but dont have a high credit limit. Taking a Klarna loan is better than maxing out a credit card, which can lower your credit score and incur penalty interest rates.

Want to use the Pay Now feature. The Pay Now option for Klarna requires no financing, but you could get access to lower prices on the items you want.

Recommended Reading: Syncppc

Buy Now Pay Laterwhere Have You Been All Our Lives

The troves of social media memes echoing the sentiment dont lie: According to Statistics Canada, e-commerce sales hit a record $3.9 billion in May 2020a 110.8% increase from May 2019. And it looks like our mall-free shopping habits are here to stay: 44% of Canadians say COVID-19 has shifted their payment preferences to digital and contactless shopping for the long term. These buy now, pay later programs were timed nicely, no?

While installment payment options have seemingly popped up overnight, you may be surprised to learn that buy now, pay later services have been available for a while.

PayBright, a Toronto-based service that launched in Canada in 2017 and has partnered with over 7,000 merchants, from Wayfair and Endy to Sephora and Hudsons Bay, was recently bought out by Affirm, an American BNPL, for a cool $340 million. The U.S. company Sezzle also launched on this side of the border in mid-2019 and has over 1,000 retails partners, including brands with online shops, like Matt & Nat, Knix and Frank and Oak. Afterpay, the one with the most self-explanatory name, launched in Canada in August 2020, after success in Australia, New Zealand, the U.S. and the United Kingdom. As retailers continue to partner with BNPL programslike Apples partnership with PayBrightother financial companies, like banks, are entering the game.

So, is it wise to buy that full-price parka now and pay it later? Heres what you need to know before you buy in to the installment plan trend.

Whats The Catch With Installment Plans

Between interest rates, the cost of borrowing and potential late fees, whats the real cost? The short answer issurprise!it varies, depending on the service provider.

Afterpay never charges interest under any circumstances and it will immediately freeze your account if you miss payments to prevent you from making further purchases. If a customer goes late, we send them several reminders and try to work with them to collect repayment, says Melissa Davis, Afterpays head of North America. Afterpay never reports non-payments to credit bureaus. It should be noted that 95% of our customer payments are made on time.

PayBright, on the other hand, charges interest rates between 0% and 29.95% APR, depending on the retailer, and some of their plans include a processing fee with each payment. And while Sezzle charges no interest, they do charge a fee for a missed payment, failed payment or if youve rescheduled your payments for the second or third time.

Of course, theres always the issue of potential fees and penalties through your financial institution if your payment fails, like pesky NSF fees if there isnt enough money in your account to cover your outlay.

Read Also: Does Opensky Help Build Credit

Seriously How Much Interest Is Charged On Buy Now Pay Later

According to the Better Business Bureau, the third-party BNPL company makes money by charging retailers a small percentage of each sale made through their service and, in some cases, collecting late fees and interest from customers directly. Interest rates on these types of services range between 0% and 30%, depending on the retailer and your credit history. The payment period can last as little as a couple of weeks or as long as 39 months.

How does those annual percentage rates compare to the card in your wallet? Credit card interest rates range from around 8% to 20% . Also, if you pay your credit card balance on time, you are not charged interest.

What Is The Checkout Process Like With Sezzle

Checking out with Sezzle is fast and easy. Heres how it works:

Select Sezzle at checkout.

Log into your account. Or, create an account and add your payment method.

Keep your phone nearby! Well send a one-time password to your mobile phone to help you check out securely.

Understand your order. Once approved, youll see a breakdown of your order, including how much is due upfront and how much is due with each future payment.

Complete the rest of the checkout process as normal. Youll receive an email from Sezzle confirming your order. If you have questions about your order, or you want to check on payment amounts and due dates, simply log into your Sezzle dashboard.

Read Also: Does Klarna Affect Your Credit Score

Is There A Credit Limit

Whether you’re using the standard Sezzle payment service, Sezzle Up, or the Sezzle Virtual Card, you will have a credit limit based on the total amount of a purchase. First-time customers are generally limited to $50 to $200.

With Sezzle Up and the Sezzle Virtual Card, you’ll be able to see your limit, so you’ll know how much you can purchase.

Sezzle Offers A Different Kind Of Option

Of course, Petal isnt alone in pioneering new consumer-friendly credit businesses. Similar services exist for people with little to no credit history or those who are fee-averse, but still want the flexibility of plastic.

Among them is Sezzle, which is like a layaway plan that’s available all year-round instead of just at the holidays!

Sezzle allows you to pay 25% at the time of the transaction at a variety of participating merchants. The remaining 75% is broken out across three additional payments scheduled every two weeks.

If you pay your Sezzle balance in full over four equal installments, there are no fees at all.

However, there two fees you might face if you cant come up with the money as agreed. The first fee is a $10 failed payment fee if a scheduled payment fails to process. The second type of fee is a $5 rescheduling fee if you need to adjust your next payment date because youre short on cash.

Like Petal, Sezzle wont perform a credit check on you before accepting you as a customer. But unlike Petal, the downside with Sezzle is that it doesnt yet report to the credit bureaus so it wont help you build a credit history at this time.

You May Like: Syncb Ppc Credit Card