Check Your Credit With A Secure Credit Check From Birchwood Credit

Finding out your credit score may bring on feelings of stress, but it doesnt have to. Understanding your credit situation will help you become financially independent, work towards realistic goals and empower you to feel confident with managing your finances.

Now you can get a complimentary, secure credit report so you can know where your credit stands. Start your Secure Credit Check and take your first step to financial independence.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle.

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, let’s answer the question you are here to find out:

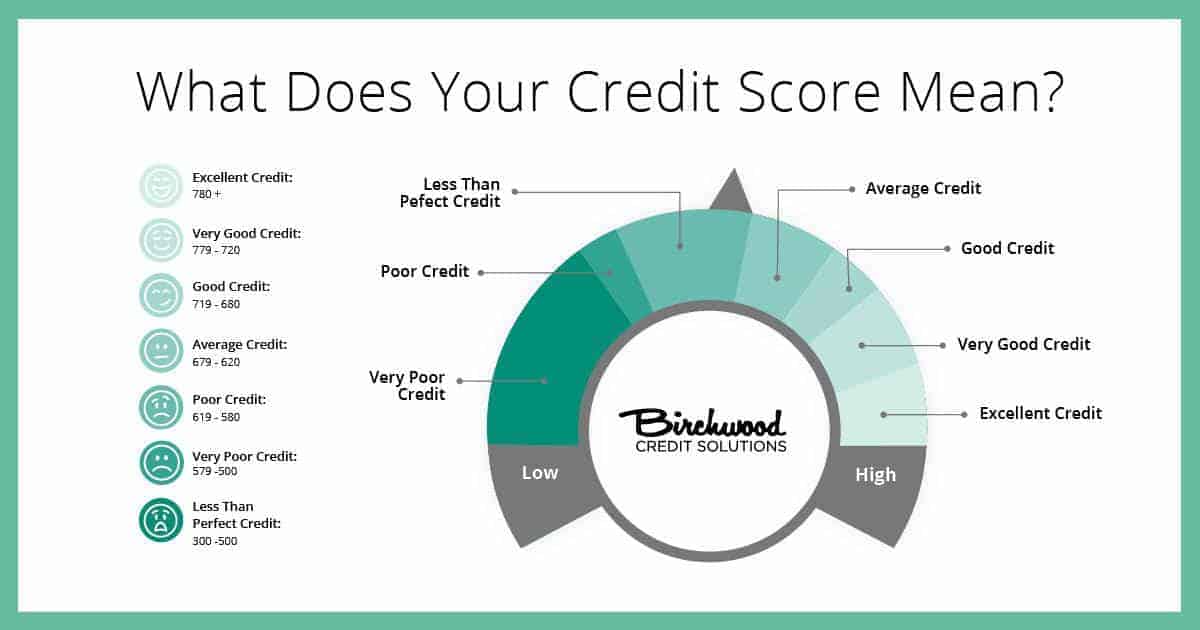

Understanding Credit Score Ranges Is Really Important

Knowing where you fall on a credit score range can be immensely helpful because it can give you an idea of whether youll qualify for a new loan or credit card. Your credit scores can also help determine the interest rates youre offered higher rates could add up to lots of money over time.

Lets take a deeper look at the different credit score ranges and what they can mean for you.

You May Like: Does Paypal Credit Report To The Credit Bureaus

How Can I Get A Good Credit Score

To get a good credit score, you need to know first what your credit score is. It might already be good! You can find out what your credit score is by signing up for your Free Credit Report with TotallyMoney. It only takes a few moments, wonât harm your credit rating, and doesnât cost a penny. If you already know what your credit score is, and it could do with improving, you need to convince lenders that youâre a responsible borrower and that you can you can be relied upon to pay back what you owe. For more on how to get a good credit score, read our guide: â11 tips on how to improve your credit score.â

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Don’t Miss: What Is Syncb Ppc

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Read Also: Does Snap Finance Report To The Credit Bureau

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

How Much Money You Could Save By Moving To A Higher Credit Score Range

FICO provides a Loan Savings Calculator that shows how your credit score range can impact the price you pay for various loans, such as mortgages and auto loans. Sometimes, moving up even one credit score range can make a meaningful difference in both your monthly and overall cost of borrowing.

Here is a hypothetical example of the money a higher credit score range might save you on a $300,000 mortgage .

Don’t Miss: How Do I Get A Repossession Off My Credit

How To Get Your Credit Report In Canada

A credit report is a record of a borrowers credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

Read How to Check Your Credit Score 101 for detailed information on how to get your free credit report.

Fico Credit Score Ranges For 2021

The sheer number of credit scores makes it hard to name a definitive cut-off for good credit. Thats because some credit scorers max out at 750, while others might cap at 850 or 990. A lender whos assessing your creditworthiness for, say, a mortgage, will look at several different scores to get a sense of the likelihood that you will pay back your debt on time.

Check out the chart below to see the consensus FICO credit score ranges. For scores that max out at 850, a score of 670 or higher is generally considered to be good. If youre unsure whether your credit score will get you the lowest mortgage rates, you can always reach out to a mortgage broker directly.

| 2021 FICO Credit Score Ranges |

| FICO Scores |

| Excellent |

Recommended Reading: Does Opensky Report To Credit Bureaus

Drop In Credit Utilization Delinquency Drives Score Growth

Of the five major factors that impact credit scores, payment history is the most important, accounting for 35% of a person’s FICO® Score. Credit utilization, which is the amount of available revolving credit in use compared with credit limits, is the second most important, representing 30% of the score. Updates to these factors can change a credit score, causing it to rise or fall depending on what changes.

In 2020, consumers reduced their the most commonly held form of revolving debtby 14%. This in turn impacted average credit utilization, which dropped 3.5 percentage points, from 28.8% in 2019 to 25.3% in 2020. It’s unclear what drove Americans’ ability to pay down their credit card debt, but the impact has clearly been reflected in the improvement of the average credit score.

| Snapshot: Consumer Credit Utilization |

|---|

What Is A Credit Score

Reading time: 2 minutes

Highlights:

-

A credit score is a three-digit number designed to represent the likelihood you will pay your bills on time

-

There are many different credit scores and scoring models

-

Higher credit scores generally result in more favorable credit terms

A credit score is a three-digit number, typically between 300 and 850, designed to represent your credit risk, or the likelihood you will pay your bills on time.

Here is a general look at credit score ranges:

- 300-579: Poor

- 740-799: Very good

- 800-850: Excellent

There are many different scoring models, and some use other data, such as your income, when calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or a credit card.

Why are credit scores important?

Why is it important to strive for a higher credit score? Simply put, those with higher credit scores generally receive more favorable credit terms, which may translate into lower payments and less paid in interest over the life of the account.

Remember, though, that everyones financial and credit situation is different. Different lenders may also have different criteria when it comes to granting credit, which may include information such as your income.

Read Also: Speedy Cash Repayment Plan

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

How To Get An Excellent Credit Score

If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score.

- Make on-time payments. Payment history is the most important factor in your credit score, so its key to always pay on time. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. .

- Dont open too many accounts at once. Each time you apply for credit, whether its a credit card or loan, and regardless if youre denied or approved, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Try to limit applications and shop around with prequalification tools that dont hurt your credit score.

Read Also: Credit Check Without Ssn

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

Also Check: How To Print My Credit Report Credit Karma

Student Loan Balances Saw Highest Increase

- 14% of U.S. adults have a student loan.

- The average FICO® Score for someone with a student loan balance in 2020 was 689.

- The percentage of consumers’ student loan accounts 30 or more DPD decreased by 93% in 2020.

Student loan balances saw the most significant spike in 2020, with consumers’ average debt growing by 9%. Much of this is attributable to the suspension of federal student loan repayment that was included in the CARES Act and subsequently extended through January 31, 2021. With fewer people actively paying down student debt, average balances will grow as others add new loans.

Student loans saw delinquency rates plunge, with the percentage of accounts 30 or more DPD decreasing by 93% in 2020. It’s important to view this number in context, however, as the automatic accommodations put in place obviously played a major role in the drop.

The CARES Act paused all federal student loan repayment, effectively placing these accounts in limbo. While paused, student loan accounts are being reported as current, although no payments are required. Once repayment begins, delinquencies may begin to climb again.

What Even Is A Credit Score

Before we break down the credit score ranges, let’s cover what a credit score is.

To put it simply, your credit score is a record of how well youâve paid people back who have previously lent you money. Banks and lending institutions use it to determine how risky it is to loan you money.

Unfortunately, what you do wrong has a bigger impact on your credit score than what you do right. So, try not to make any mistakes.

Your credit score is composed of 3 numbers and ranges from 300 to 850. There are also different credit scoring models . The two models that are the most common are FICO and Vantagescore. Also, you can have more than one credit score because there are industry/product specific credit scores like a car and home insurance credit score. If youâre applying for a new car loan, youâll want to make sure you know your FICO Auto Score, because thatâs the industry-specific score used when determining most auto-financing.

If youâre first mortgage, youâll want to know your base FICO Score, as thatâs used most commonly for mortgage-related credit evaluations.

Recommended Reading: How To Report A Death To Credit Bureaus

What Does A Credit Score Mean

A credit score is a number which can range from a low near 300 to a high of 850 or 900 .

If someones score is 580, it means that 580 people out of 850 are likely to repay their debt. If someones score is 780, it means that 780 people out of 850 are likely to repay their debt.

The number represents the odds that a lender will get the money back that they lend someone. The higher the number, the better the odds.

Different Models Could Mean Different Credit Score Ranges

Since different credit scoring models weigh factors differently, you could see your score fluctuate differently depending on which scoring model youre looking at. In one model you might have excellent credit but in another, you might only be considered good.

FICO, for example, says payment history is 35% of your total score. Its the most important part and one missed payment can cause your credit score to take a big hit.

VantageScore, however, doesnt weigh payment history as high. Your total credit usage, like balance and available credit, is the most important factor in calculating your VantageScore.

With credit score ranges, you may not even fit into good or poor. In fact, you could be better than good. For the most part, credit score ranges include:

- Poor : Poor or bad credit gives you little chance of qualifying for any type of credit, including a credit card or loan. This can hurt your chances of borrowing money.

- Fair : Fair credit means there are some highlights to your score and lenders will take notice. While you may qualify for a loan or credit card, youd likely end up paying a higher interest rate due to your low score. You might also need to enlist the help of a cosigner to get lower interest rates.

- Good : Having good credit not only allows you to qualify for a loan but gives you a chance to get a lower interest rate than those with only a fair score. You may also see more choices or a variety of available credit by having a good score.

Don’t Miss: Does Snap Finance Report To Credit Bureau