How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Maintaining Your Credit Score:

You can take the following measures to maintain a good credit score:

- Check your credit score before you start looking for a house. You can rectify any issues that may hamper your chances of approval.

- Maintain a low debt-income ratio by not applying for loans other than your mortgage. Get rid of any large debts you have like, credit card bills or an unsecured loan. Large loans can contribute to maintaining a good credit score only if you make timely payments.

- Avoid submitting multiple mortgage applications at the same time. Multiple lenders pulling your credit report can hamper your score.

What Credit Score Do You Need For The Best Mortgage Rate

A credit score of 700-plus will usually land a borrower a lower interest rate, and while mortgage industry experts say you can still qualify for certain loans with a score under 680, the 700s are where you can expect to pay the lowest rates.

Creditors set their own standards for what constitutes an acceptable score, but these are general guidelines:

-

A score of 740or higher is generally considered excellent credit.

-

A score between 700 and 739 is considered good credit.

-

Scores between 630 and 699 are fair credit.

-

And scores of 629 and below are poor credit.

The lending industry carves up the credit score scale into 20-point increments and adjusts the rates it offers borrowers each time a credit score moves up or down by about 20 points. For instance, if your score drops to 740 from 760, youre likely to see a small bump up in the rate youll be offered.

You May Like: When Does Barclaycard Report To Credit Bureaus

Why Is My Mortgage Credit Score So Much Lower

There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using.

Typically banks, credit card companies, and other financial providers will show you a free credit score when you use their service. Also, credit monitoring apps can show free credit scores 24/7.

But the scores you receive from those third-party providers are meant to be educational. Theyll give you a broad understanding of how good your credit is and can help you track overall trends in your creditworthiness. But they arent always totally accurate.

Thats partly because free sites and your credit card companies offer a generic credit score covering a range of credit products.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back large debts.

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan.

Mortgage lenders, on the other hand, are required to use a unique version of the FICO score almost exclusively.

Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back those large debts.

So theres a good chance your lenders scoring model will turn up a different lower score than the one you get from a free site.

Can You Get A Home Loan With Bad Credit

![What is a good credit score? [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/what-is-a-good-credit-score-infographic.png)

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

Recommended Reading: What Is Syncb Ntwk On Credit Report

How To Get Your Credit Score Ready For A Mortgage

No matter what type of mortgage you seek, it’s always advantageous to apply with the highest credit score you can manage. Meeting the minimum score requirement for a loan is just the start. Lenders also use your credit score to help set interest rates and fees on the loan, and generally speaking, the higher your credit score, the better your borrowing terms will be and the less you’ll pay in interest and fees over the life of the loan.

If you’re planning to apply for a mortgage in the next 12 months, you may be able to take steps starting today to spruce up your credit score so your loan application reflects the best credit score you can get.

Any credit score that helps you qualify for a mortgage you can afford can be considered a good score. Even so, most of us have room to improve our scoresand reap potential savings over the lifetime of a mortgage loan.

How Do I Get A Mortgage If I Have Bad Credit

Bad credit can limit your ability to get a mortgage. You may have options available to you, but the interest rates youâll qualify for wonât be cheap. If you donât want to put off purchasing a new home, there are immediate steps you can try taking to get a mortgage with bad credit. If youâre willing to wait, you should take time to improve your credit score and qualify for better mortgage options. Here are ways you can get a mortgage with bad credit.

Make a larger down payment

If your credit score isnât great, there are other ways to demonstrate your financial stability to lenders. Making a large down payment of 20% or above provides you with more leverage when working with lenders. It shows that you have a sizeable income and demonstrates your budgeting skills. It will also help you reduce your regular mortgage payments, making them more manageable in the long-run. In short, a larger down payment will often make you a more attractive borrower to mortgage lenders.

Use an alternative mortgage lender

If your credit score falls below 600, you will have a very difficult time getting approved from Canadaâs major banks. Youâll more than likely have to work with an alternative lender.

Alternative lenders are more lenient when it comes to credit. However, youâll usually need to make a heftier down payment of between 20% and 35%. Interest rates also tend to be higher with alternative mortgage lenders.

Get a co-signer or a joint mortgage

Improve your credit score

You May Like: Does Paypal Credit Report To Credit Bureaus

Dont Keep Applying For A Credit Report

As mentioned above, its best not to inquire about your credit score too much as this can negatively impact the score. A hard inquiry can actually remain on your credit score for two years.

Dispute errors as soon as possible Staying on top of transactions on your credit cards is important, especially since its 2020 and, unfortunately, stealing information is much easier nowadays. An unnoticed issue could actually be bringing your score down. Let your bank know as soon as you notice something fishy so they can have it taken off your report.

Turn Towards Private Lenders Or Fintech Companies

Traditional banks arent the only financial institutions that can lend you money alternative lenders such as FinTech companies are making waves in the financing world thanks to quick, adaptable processes and leniency when it comes to credit scores.

Because banks have strict standards in place to minimize risk and are subject to a long list of federal regulations, they tend to be slower and have stricter loan options. Private lenders like Happy Loan, on the other hand, are known for their easier approval processes, flexibility and customizable loan options.

Recommended Reading: How To Get Credit Report With Itin Number

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Dont Apply For Any New Loans Unless Absolutely Necessary

We know it may be tempting to apply for another loan to take a trip around Europe next summer, but if your dream is to obtain the mortgage youve always dreamt of, you gotta do what you gotta do! Sometimes this is done by keeping your loan borrowing to a minimum so youre not hurting your bad credit score even more.

Recommended Reading: How To Get Credit Report Without Social Security Number

Make Sure Not To Use Your Credit Limit

Just because you have a high credit card limit doesnt mean you have to use it. Actually, in order to prevent the temptation, ask your bank to lower it. Typically for lenders, an ideal credit utilization ratio is 30 percent. You can easily figure this out yourself by dividing your credit balance by your credit limit.

What Low Credit Score Mortgages Are Available

If youre fed up with renting and want to apply for a home loan with bad credit, government-backed mortgage loan programs may help. Furthermore, if you dont have a credit score, theres still a way to get home loan financing.

- FHA loans: For traditional mortgages, the lowest credit score to buy a house is 500. Besides coming up with 10% for a down payment, youll likely need a solid income history, extra reserves and a lower DTI ratio. The FHA program is more commonly offered as a 580 credit score home loan for borrowers with at least a 3.5% down payment.

- VA loans: Although VA home loans dont have a particular minimum, your credit history is still important. If you have a poor credit payment history, other compensating factors such as extra reserves in the bank or a lower DTI ratio may be required.

- Nontraditional credit loans: Recent college graduates might not have enough credit history for a regular credit score. However, they still may be able to get a mortgage with no credit score by proving on-time payments for bills such as rent and utilities.

- Alternative mortgage loans: Recent foreclosures or bankruptcies may knock your credit score down, and in most cases, applicants must wait two to seven years before applying for a new mortgage unless they apply for an alternative mortgage loan. With a large down payment, alternative lenders may offer home loans to borrowers one day after a major credit event with scores as low as 350.

Don’t Miss: Does Snap Finance Report To The Credit Bureaus

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

What Is A Good Credit Score Range For Buying A Home

If your credit score range is between 740 and 850, you are likely to have the widest range of choices and the most attractive interest rates for your mortgage loan. Most lenders determine mortgage rates by credit score, making it less likely to achieve low interest rates if your FICO® scores are below 740.

You might still be offered a mortgage loan with lower scores, but the terms may not be as favorable. You could also be approved for a lower mortgage amount than the sum for which you originally applied.

The Federal Housing Administration may also be an alternative for first-time home buyers who meet certain criteria. If you are wondering how to buy a home with bad credit, an FHA loan may be the answer for you. Some of the primary requirements for an FHA mortgage include the following:

If you do not meet these criteria, however, you may still be able to obtain a mortgage loan. Some lending companies specialize in providing mortgage opportunities for individuals with worse credit scores the terms and interest rates offered for these arrangements, however, may be too unfavorable for most home buyers.

Read Also: Does Removing An Authorized User Hurt Their Credit Score

So Can You Get A Mortgage With A Credit Score Of 600

Does a poor credit score mean that you wont be able to obtain a mortgage? Not necessarily. The loan may just have to come from somewhere other than a traditional lender . Luckily in Canada, there are other credit unions you can turn to. These types of places can help people with mortgage approval, especially if they cant get it at traditional credit bureaus, like TD Bank, RBC, BMO, etc. Theyre typically owned by individuals and are much more forgiving for people with lower credit scores and a lower income. They can offer lower interest rates and just lower fees in general.

There are also non-bank lenders that can accommodate your specific needs, like Loans Canada, Easy Financial, Fairstone, and many more. We know youve probably asked the question is a non-traditional lender safe? before, and yes, they are safe and secure. Both traditional and non-traditional lenders must comply with the same rules. In fact, in July 2019 in Canada, it was reported that non-bank lenders were the go-to for mortgages rather than traditional lenders. And its important to note that these mortgage loans werent just for those with bad credit scores. They can be a great place to lean on for those who are self-employed, single, going through a divorce, have health problems, and other issues.

Is 750 A Good Credit Score

In the scoring models used by most mortgage lenders, credit scores range from 300 to 850. This score range is further divided into tiers, which can help you understand how lenders and others may view your score. FICO® Scores, the most commonly used score among lenders, break into the following five ranges:

- 300 to 579 is considered “very poor”

- 580 to 669 is considered “fair”

- 670 to 739 is considered “good”

- 740 to 799 is considered “very good”

- 800 to 850 is considered “exceptional”

A score of 750 falls in the very good range and shows that you’ve historically done a good job managing your debt as agreed. When considering you for a loan, lenders use your credit score to help gauge how likely it is you’ll pay back your debt on time. A higher credit score tends to predict a higher likelihood that they’ll recoup their debt without issue.

You May Like: Does Paypal Credit Report To Credit Bureaus

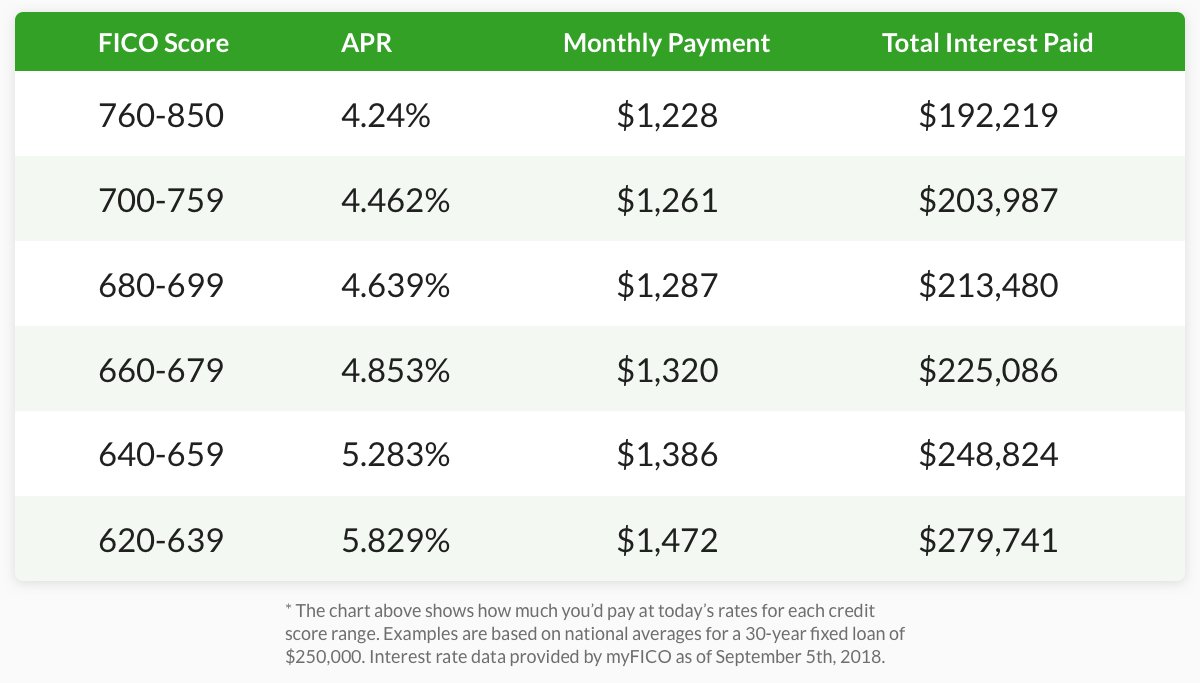

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

The Three Main Types Of Credit:

- Revolving Credit This type of credit allows you to continually borrow and repay money from a credit line. Credit cards and other types of revolving credit have a maximum amount or limit. Keeping the amount you borrow against your revolving credit line under 30% of the maximum and making on-time payments, will help build your score.

- Installment Debt This type of credit is usually borrowed as a lump sum and then repaid over a set period of time in installments. A car loan, financing for furniture or appliances, student loans, business loans, and mortgages are all types of installment debts. Paying these bills on time is important to building a healthy credit score.

- Open Credit This type of credit involves a payment for goods and services that can vary from month to month. Examples of open credit are utilities, insurance payments, rent or lease payments, phone/wifi/data plans, and subscription services. Paying the bills for these goods and services on time will aid in building your credit score.

We are here to help you answer all of your mortgage related questions. If you are ready to buy a new home of refinance you current home, we can be the experts on your team. Reach out to us and speak with a licensed mortgage consultant about your goals.

If you would like to see more articles like this one about mortgage information and home ownership,

Also Check: Experian Temporary Unlock