Whats In A Credit Report

Your credit report shows details of how you have used debt over time. In addition to your credit score, a lender also looks at what is on your credit report. Some of what credit bureaus record on your credit report include:

- Personal information

- Consumer statements

In Canada, credit bureaus are obligated to provide you with one free copy of your credit report per year if you request it.

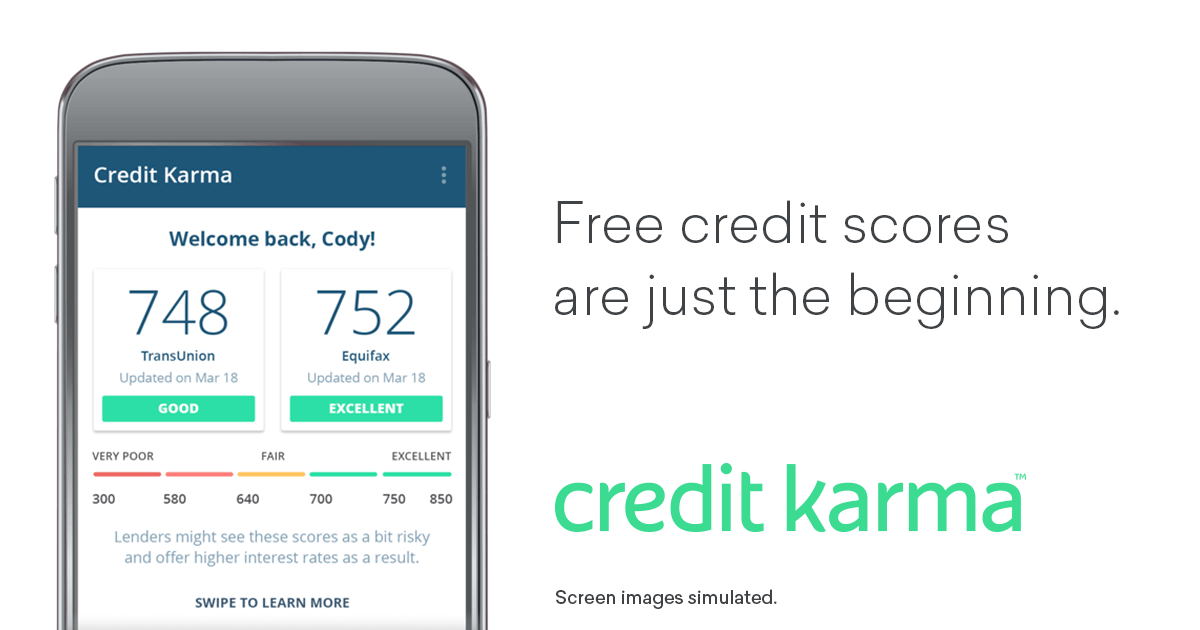

Companies like Credit Karma and Borrowell provide free monthly or weekly credit report updates when you sign up with them.

How To Read A Credit Report From Credit Karma

March 2, 2020 by Danielle R. Drew, CFP

By law, youre entitled to three free credit reports each year. But what about free credit reports on demand? Or free credit scores-updated every few days? It might sound like a scam.

Fortunately, Credit Karma offers everyone no-cost, frequently updated credit reports and scores from two big-name credit reporting agencies. When you , youll get access to your personal data from Equifax and TransUnion.

View it whenever you want as often as you want. And the information you receive can help you catch problems early, improve your credit, and boost your financial knowledge.

Lets take a tour of what youll find when you sign up for Credit Karma.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services.;These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Recommended Reading: How To Remove Inquiries Off Credit

If You Use Credit Karma Will Your Credit Score Decrease

Because Credit Karma makes soft inquiries, your credit score will not go down if you use their services.

Soft inquiries are used as a personal reference. So they do not affect your credit score.

On the other hand, if you use credit karma and apply for a new credit card this would add a hard inquiry onto your credit report. Hard inquiries can affect your credit score, whenever you apply for a new credit line.

When You apply for a new credit line this information is reported to the credit bureaus and usually within a day the credit information is updated inside of credit karma.

Why Your Credit Score Matters

Your credit score isnt something you typically watch like a weather report. Maintaining a good one, however, is as important as having the right winter gear come January.

A good credit score is one of the most important signals of your trustworthiness as a potential client for banks, mortgage lenders and other businesses. Canadian credit scores are calculated by two major credit bureaus: Equifax and TransUnion.

These credit bureaus use factors such as the number of credit cards, loans or total debt you have; your payment history; and how long youve been using credit to calculate a score between 300 and 900. A high score indicates to potential lenders that you have a history of using credit responsibly.

There are many ways to actively;strengthen your credit health and keep your score at its best: You can pay your bills on time, use credit in moderation, or limit the number of hard credit checks placed in your name.

However, there are also potential issues you need to protect against. Its important to understand risks to your credit, such as identity and financial fraud. Although there is no guaranteed protection from fraud and identity theft, its a smart financial habit to put safeguards in place to try to avoid having them affect your credit scores in a serious way.

Read Also: Speedy Cash Credit Check

Is Credit Karma Safe And Legit

As far as I have experienced, yes. I have never had to enter my credit card information or Social Insurance Number. I get the occasional email with credit card offers, but I never bite and that has not been an issue. Free has been free so far.

With regards to the security measures in place to protect your private information, Credit Karma says they use 128-bit or higher encryption to protect the transmission of your data to our site and do not share your personal information with unaffiliated third parties for their own marketing purposes.

That being said, the internet is what it is. If you remember, Equifax was hacked a while back, so there is no iron-clad guarantee when you are online in my opinion.

How Can I Build My Credit Score

The two biggest factors in your credit score are paying on time and managing how much of your credit limits you’re using. Thats why they come first in this list of tips:Pay all your bills, not just credit cards, on time. Late payments and accounts charged off or sent to collections will hurt your score.Use no more than 30% of your credit limit on any card less, if possible. The best scores go to people using 10% or less of their credit limits.Keep accounts open and active when possible that gives you a longer payment history and can help your “credit utilization,” or how much of your limits you’re using.Avoid opening too many new accounts at once. New accounts lower your average account age and each application causes a small ding to your score. We recommend spacing credit applications about 6 months apart.Check your credit reports and dispute errors.

Recommended Reading: Aargon Collection Agency Address

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.;

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like;the ACLU.

How To Dispute A Mistake In Your Credit Karma Credit Report

Mistakes and errors can happen even if you keep a close eye on your credit update. When you encounter an error or mistake in your credit karma report you should immediately file a dispute with the credit bureaus.

You cant do this directly to Credit Karma because they are not credit bureaus. In fact, creditors receive all their information from the three credit bureaus Experian, Equifax, and TransUnion, which is why you should file a dispute directly with the credit bureaus. Letters are the best way to file a dispute and you can get our free dispute letters here.

Don’t Miss: Does Opensky Report To Credit Bureaus

How To Update Information On Your Credit Report

In a Nutshell

The offers that appear on our platform are from third party advertisers from which Credit Karma receives compensation. This compensation may impact how and where products appear on this site . It is this compensation that enables Credit Karma to provide you with services like free access to your credit score and report. Credit Karma strives to provide a wide array of offers for our members, but our offers do not represent all financial services companies or products.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Also Check: Aargon Collection Agency Reviews

Is Credit Karma A Scam

Before signing up, I wondered Is Credit Karma a scam?. But, after researching and using them for many years, I can tell you Credit Karma is not a scam. They are a legit company with a legit business model that has been around for years now.

Power in numbers is reassuring as well. Credit Karma has over 110 million members. And the Intuit purchase of Credit Karma is reassuring, as it is a very reputable company.

Ive never once been charged, never once had my identity stolen, or had any complaints of any kind in the years I have used Credit Karma.

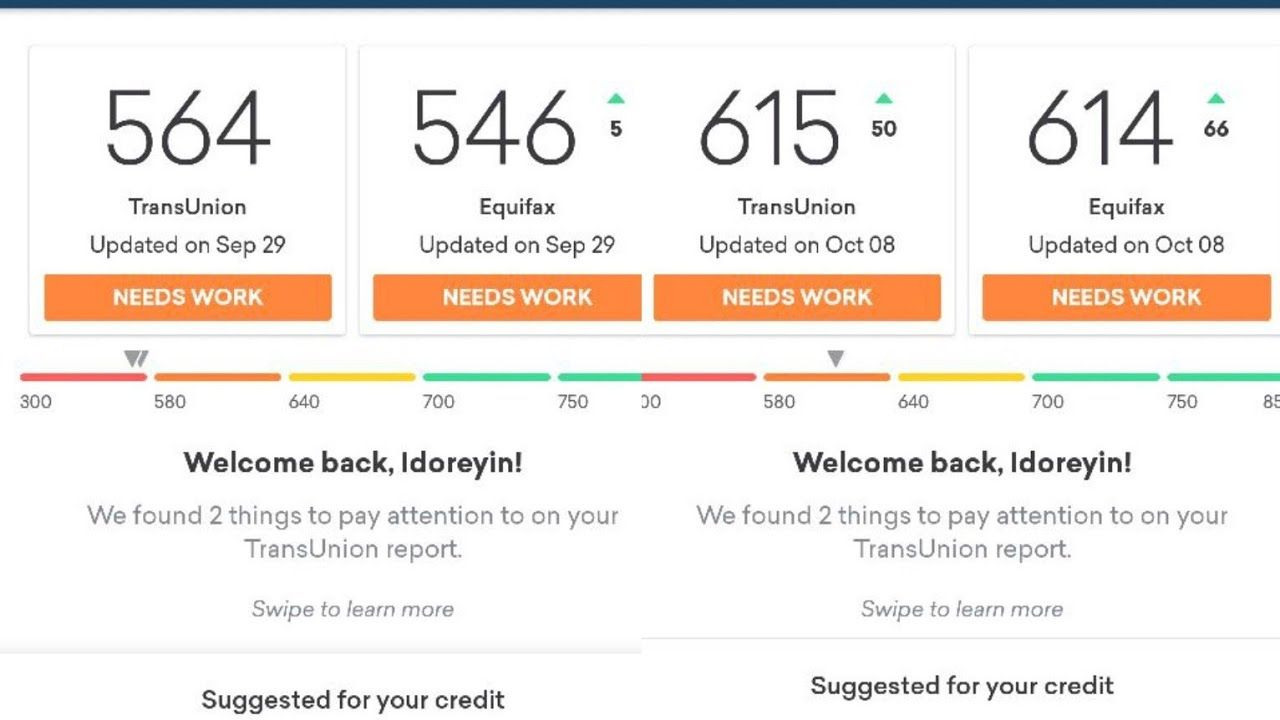

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.;

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.;

You May Like: Does Zzounds Report To Credit Bureau

What Is Considered A Good Credit Score

You should always aim for a good credit score for a number of reasons. But what is considered a good score in credit karma?

Credit Karma regularly uses the 300 to 850 scoring model. According to this model, a credit score between 720 and 799 is considered very good. A credit score above 800 is considered the best.

You should keep in mind that different lenders have different scoring models. This means that your credit score may be considered the best in one scoring model, but maybe very good in another.

The scoring model is entirely up to the lenders. 90% of major lenders tend to use the FICO score and you learn everything you need to know about your FICO score.

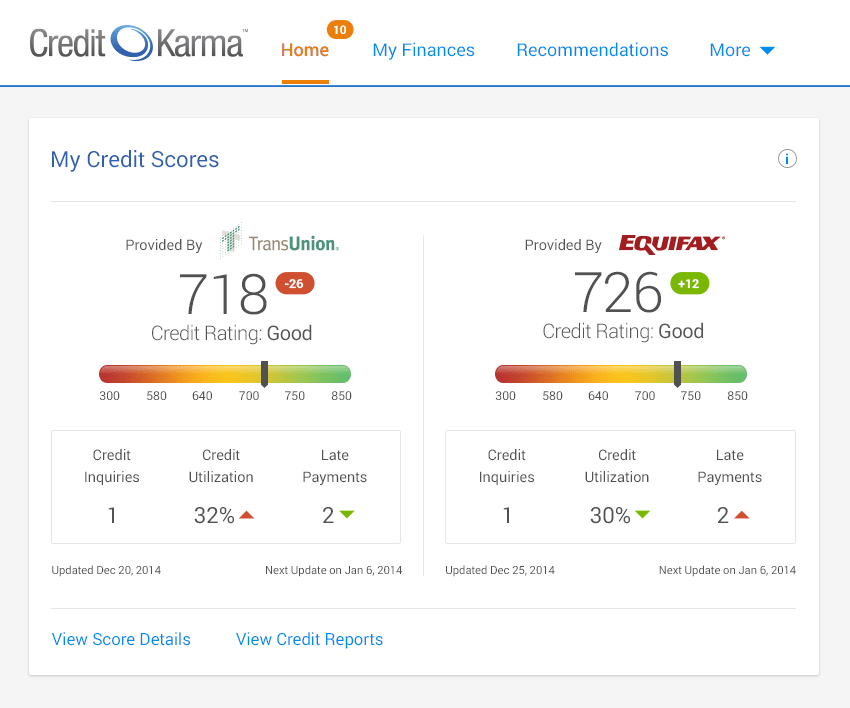

How Does Credit Karma Calculate My Score

The online credit company uses information from two of the three major credit reporting agencies, TransUnion and Equifax, to give you a VantageScore 3.0. While this type of credit score is gaining popularity among lenders, you may not recognize it-and for good reason. The FICO scoring model is by far the most widely used credit score among financial institutions and lenders across the country, with 90% of lenders using this score to net potential borrowers.

The atypical scoring model used by Credit Karma, coupled with the absence of information from Experian, the third of the three major credit reporting agencies, tends to make Credit Karma scores differ from scores pulled by other companies and financial institutions. The credit service is usually within range and a good indicator of your overall credit wellness. You can also get a report with a thin credit history through this model, which is super-helpful for those seeking to build their credit from nothing.

Read Also: Zebit Report To Credit Bureau

Is There Any Other Way To Get My Credit Score

If youre looking for a more relevant credit score, you have several options. You can ask a potential lender to pull your credit, though this might cost you both in fees and in a knock to your credit for the hard inquiry. You can order your free credit report with information from all three credit bureaus once a year, at AnnualCreditReport.com. Lastly, for more frequent monitoring, you can sign up for access to your FICO score and 3-bureau credit report on Experian.com, where packages start at $19.99 a month. There are other similar services out there, but most are not legitimate or are grossly overpriced.

What Is The Fair Credit Reporting Act Or Fcra

The Fair Credit Reporting Act is an important law that gives you the right to know the information that the credit bureaus keep on you and how that information informs your credit scores.

This law includes a number of consumer rights and protections. For example, under the FCRA you have the right to dispute incomplete or inaccurate information on your credit reports. In most cases, the credit bureau must investigate your case and correct or remove any inaccuracies within 30 days.

Also Check: How To Remove Hard Inquiries From Credit Report

Submit Your Request In Person:

Equifax has;four office locations;where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

Do You Have Bad Credit No Credit Or Want To Learn How To Become A Credit Expert

Signup for the #1 DIY Credit Repair Course

The Credit Repair Course includes:

- How to find your credit report and your ACTUAL Credit Score

- A breakdown of how your credit score is calculated

- How to increase your credit score in each category

- The best tools to increase your credit score fast

- How to dispute negative items from your credit report

- The best credit cards for your credit score

- How to use credit cards to leverage your money and business

- How to use credit cards to get free travel, bonuses and rewards

Learn how to fix your credit for life by enrolling in The Credit Repair Blueprint today!

Also Check: Does Klarna Build Credit

What Is My Credit Score And Why Does It Matter

Your credit score is a number lenders and credit card issuers use to help them decide whether to approve your credit application. The higher your score, the better your chances. With a low score, you may still be able to get credit, but it may come with higher interest rates or require a co-signer or security deposit. You also may have to pay more for car insurance or put down deposits on utilities. Landlords might use your score to decide whether they want you as a tenant. But as you add points to your score, you’ll gain access to more credit products and pay less to use them. Borrowers with scores above 750 or so have many options, including the potential to qualify for 0% financing on cars and credit cards with 0% introductory interest rates.

Telling Credit Karma About Your Loans

Before you can use Credit Karma’s tools, you need to enter information about any loans you have beyond credit cards. If you have an auto loan, for example, you provide details about the year, make, model, and current mileage of your vehicle. The site creates a page for that vehicle that displays its current estimated value, as well as links to insurance and loan refinance options. You can also search for a new car and sell or trade your existing one. Credit Karma partners with Carvana for that last capability.

Home loans work similarly. If you supply information about any mortgages you’ve taken out, youll see your estimated home value and loan balance. If Credit Karma thinks you could get a better deal, it displays refinancing opportunities that might be attractive. Due to low interest rates, mortgage lenders are apparently swamped right now. You can turn on the new Refinance rate tracker and get notifications when Credit Karma finds a better rate. Similar tools are available for personal loans.

Two years ago, Credit Karma introduced what it calls a High-Yield Savings Account called Credit Karma Money. Of course, in these days of almost nonexistent interest rates, that yield amounted to 0.13% APY on the day I checked it. The account has no fees, and there is no minimum to open it. You can link one external account to your Credit Karma savings account by providing your online banking username and password.

Also Check: What Credit Report Does Paypal Pull

How Does Credit Karma Canada Work

I signed up for Credit Karma in order to test the Canadian service.; The signup took less than one minute. The system asked for some information, like my address, and social insurance number, and then asked some personal validating questions.;

You can;signup for here.

Within seconds after signing up, and logging in, Credit Karma provided me with my credit score.;

Credit Karma grabs the score from TransUnion, and although the score wasnt that different from the $150 paid yearly service that I subscribe to from Equifax Canada, there was an approximate difference of 50 points between my Equifax and Credit Karma score. Im not sure how they validate these differences, because it appears that they both provide data and pull the reports from the same places. Also, its important to keep in mind that Equifax charges me for the report, whereas Credit Karma provided the report to me for free.

Equifax Canada does offer a credit monitoring service, which is something that I use as a form of personal credit insurance.; Any time a credit report is pulled on my name, or, any changes are made to my report or history, I receive an email, I log into Equifax Canadas website, and I can monitor the changes and reports immediately.

Frankly, I actually like the Credit Karma reporting screen better than Equifaxs screen.; The layout of Equifax is old and outdated and is in desperate need of a refresh. It looks like it was designed in the late 90s.;;