What Personal Details Do Not Affect My Credit Score

Now that you have an idea of what goes into your score, it’s good to know what doesn’t factor into your score. A recent survey from the Consumer Federation of America found that out of 1022 adult respondents, 40% believed marriage status influenced credit scores, while 43% thought age also played a part.

Your score is a representation of how you manage financial responsibility, not a testament to you as an individual. Things like age, ethnicity, religion and marital status are excluded in the calculation of your score. Your employer, salary and occupation are likewise not included in the equation.

How Credit Karma Makes Money

Credit Karma’s business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you .

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them.;Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links.

Your personal data is valuable stuff to advertisers, and they pay more to target it. With more than 100 million users, this is a healthy revenue model for Credit Karma.

The Importance Of Knowing Your Score

As we mentioned above, you shouldn’t go through life without knowing your credit score. This number is updated regularly. It goes up or down usually every month, but it may even be changed more frequently based on who’s reporting.

Knowing your score means you’re more likely to make better decisions about your finances. Having a lower score may make you more cautious about applying for new credit as there’s a good chance you’ll be denied. If you have a lot of inquiries and very few accounts, your score drops, and lenders may refuse to grant you a new account. On the other hand, knowing you have a higher credit score makes you a more attractive applicant to .

Keep in mind that checking your credit score isn’t the same as checking your . Your credit report provides a detailed history of your financial life, including any accounts you have, how often you’ve paid them on time, any delinquencies, bankruptcy reports, flags and messages, write-offs, and inquiries. The report also includes the dates of any changes to your credit history. You can use this history to account for and report any discrepancies.

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. You’ll have to pay them if you want your credit score. But why pay when you can get your score for free?

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

Read Also: Cbcinnovis Inquiry

Fico Vs Vantagescore: Which Is Better

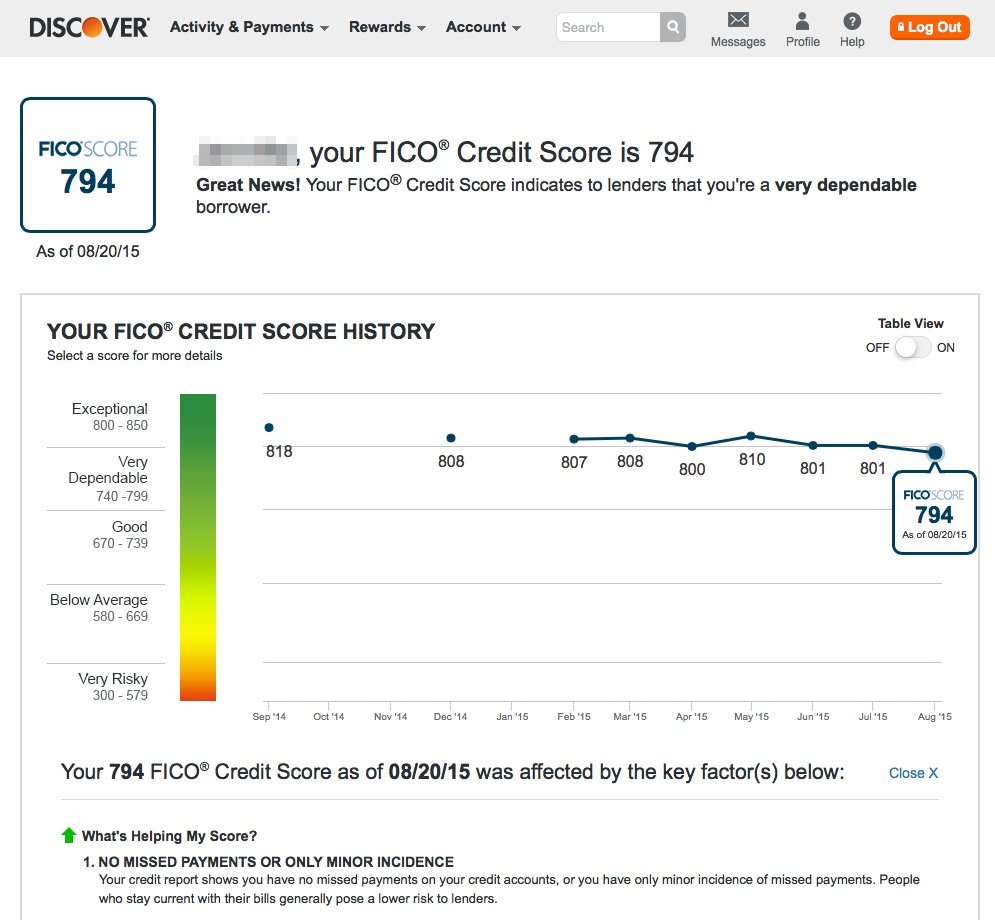

VantageScore and FICO are both software programs that are used to calculate credit ratings based on consumers’ spending and payment history. FICO, for Fair Isaac Corp., is the older and better-known model, having been introduced in 1989. VantageScore, released in 2006, was developed by the three leading consumer credit agencies, Experian, Equifax, and TransUnion.

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most-often-used base model, and which of its many versions is used.

The key point is, your score should be in the same range on any or all of those models. You should not have a “good” VantageScore and only a “fair” FICO score.

What To Look For When You Review Your Credit Report

Monitoring your credit report is even more important during uncertain economic times since fraudsters like to take advantage of these situations.

You should keep an eye out for common credit report errors and signs of fraud when checking your credit report, such as:

- New accounts that you didn’t open

- Identity errors

- Incorrect reporting of account status

- Data management errors

- Balance errors

If you notice any errors, dispute them as soon as possible. Check out our step-by-step guide on how to dispute a credit report error.

Learn more:

Also Check: How Long Does A Repossession Stay On Your Credit Report

Can I Get A Mortgage With A 544 Credit Score

Can I get a mortgage with a 544 credit score?

Can I get a mortgage with a 531 credit score?;Conventional mortgage lenders will most likely decline your application with a credit score of 531 as the minimum credit score is around 620.

Is 544 a low credit score?;Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 544 FICO® Score is significantly below the average credit score.

Is a 600 A bad credit score?;Your score falls within the range of scores, from 580 to 669, considered Fair. A 600 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

You May Like: Aargon Collection Agency

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

How Rate Shopping Can Impact Your Credit Score

Oct 8, 2019 When you apply for a mortgage or car loan, lenders will make a hard pull of your credit report. These hard inquiries will often lower your;

The Difference Between FICO Score and Credit Score. Different types and versions of credit scores can enter the car credit report lenders will pull to determine;Which FICO score do auto lenders use?Which auto lenders use TransUnion?

You May Like: Why Is There Aargon Agency On My Credit Report

Fill Out One Online Submission Form

If youre requesting through the website, youll have to fill out one submission form, regardless of whether you want one, two, or all three of your allotted credit reports. The form will ask for your name; your current address; your last address if youve lived at your current address for less than two years; and your Social Security number.;

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Recommended Reading: What Credit Report Does Paypal Pull

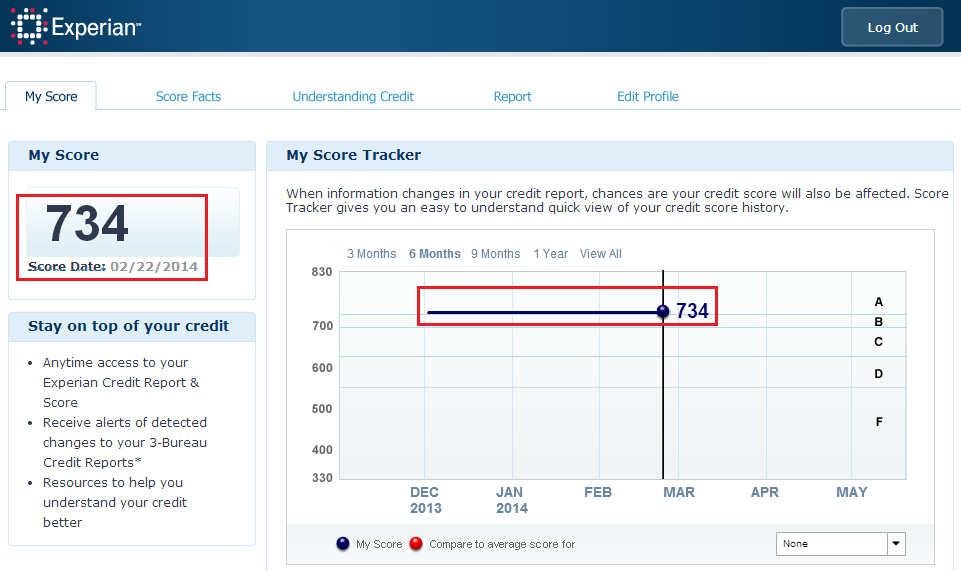

Will My Score Be The Same At All Three Credit Bureaus

The three major credit bureausTransUnion®, Experian and Equifaxare responsible for collecting and maintaining consumer credit reports in the U.S. These reports are then provided to subscribers, such as landlords, mortgage lenders, credit card companies and others who are deciding whether or not to extend you credit.

It can be confusing when your score seems high but you still get denied for a new line of credit. Chances are you’re not looking at the same score as your bank or finance company. Subscribers dont work with every credit reporting agency, so the credit report information included in one report might be slightly different from that in another.

Check your credit scores and reports from each bureau annually to ensure all the information is accurate. By law, you’re entitled to one free annual credit report. You should also use a credit monitoring service year-round. TransUnion offers some of the latest and most innovative credit monitoring services, like;Credit Lock and Instant Alerts. These services will help you spot inaccuracies, potential fraud and other blemishes that could lead to higher interest rates.

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.;

Don’t Miss: Can You Have A Credit Score Without A Social Security Number

Re: How To Increase My Transunion Credit Score

You need to get your credit card balances paid down. You need to have one card reporting less than 9% of the total of your credit card credit lines. One card MUST report a zero balance.

Utilization of credit cards plays a huge part in maximizing your scores.

What are the balances and credit lines for your 2 credit cards?

EQ 653 6/21/12EQ 817 3/10/20 – EX 820 3/13/20 – TU 825 3/03/20

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

Read Also: Why Is There Aargon Agency On My Credit Report

How To Get A Free Transunion Credit Report

Once a month, you can order a free credit report from TransUnion Canada. The document is referred to as a Consumer Disclosure and you can order it online, by mail, phone, or in-person.

Online: Visit TransUnion and enter your information including name, address, date of birth, and social insurance number .

You may be required to answer a few random questions to confirm your identity, after which you can access your credit report.

Mail: Download and complete the request form and mail it to Consumer Relations Centre, 3115 Harvester Road, Suite 201, Burlington, Ontario L7N 3N8.

Attach a copy of your government-issued ID such as your drivers license, passport, or birth certificate. Also attach one copy of a document showing your address such as a recent utility bill, credit card statement, Notice of Assessment, or T4 slip for the current year.

Phone: You can contact TransUnion by phone at 1-800-663-9980 and follow the automated interactive voice response.

In Person: Visit one of their provincial offices in Newfoundland, Nova Scotia, Ontario, and Prince Edward Island.

A second option for obtaining your free TransUnion credit report is via Credit Karma Canada. Credit Karma is a financial technology company with operations in Canada and the United States.

They offer free access to free credit scores and reports from TransUnion. You can learn more about their service in this .

What Can I Do If I Believe The Information In My Credit Report Is Inaccurate

Write to the credit bureau immediately and describe the error in as much detail as possible. The agency must investigate your request and correct the error if one is found. If a correction is necessary, the agency must inform every business that has recently received your report that a correction has been made. If the dispute is not resolved, you have the right to file a brief statement describing the nature of the dispute with the credit reporting agency. This statement, or an accurate summary of the statement, must be included in any future credit report concerning you. Since the reports from the three major credit bureaus may contain different information about you, it is a good idea to obtain a report from each of them. Additionally, you should contact the company that provided the incorrect information. It may verify the mistake and write a letter on your behalf requesting that the credit reporting agency fix the error.

Read Also: Does Capital One Report Credit Limit

You May Like: Credit Score 584

Keep Up With Credit Repayments

Firstly, if you want to improve your credit rating, you should keep up with your credit repayments and pay on time. Missed repayments suggest that youve struggled to manage your credit and pose a higher risk to the lender. Missed and late repayments remain on your record for 6 years, affecting your credit applications for a long period of time.

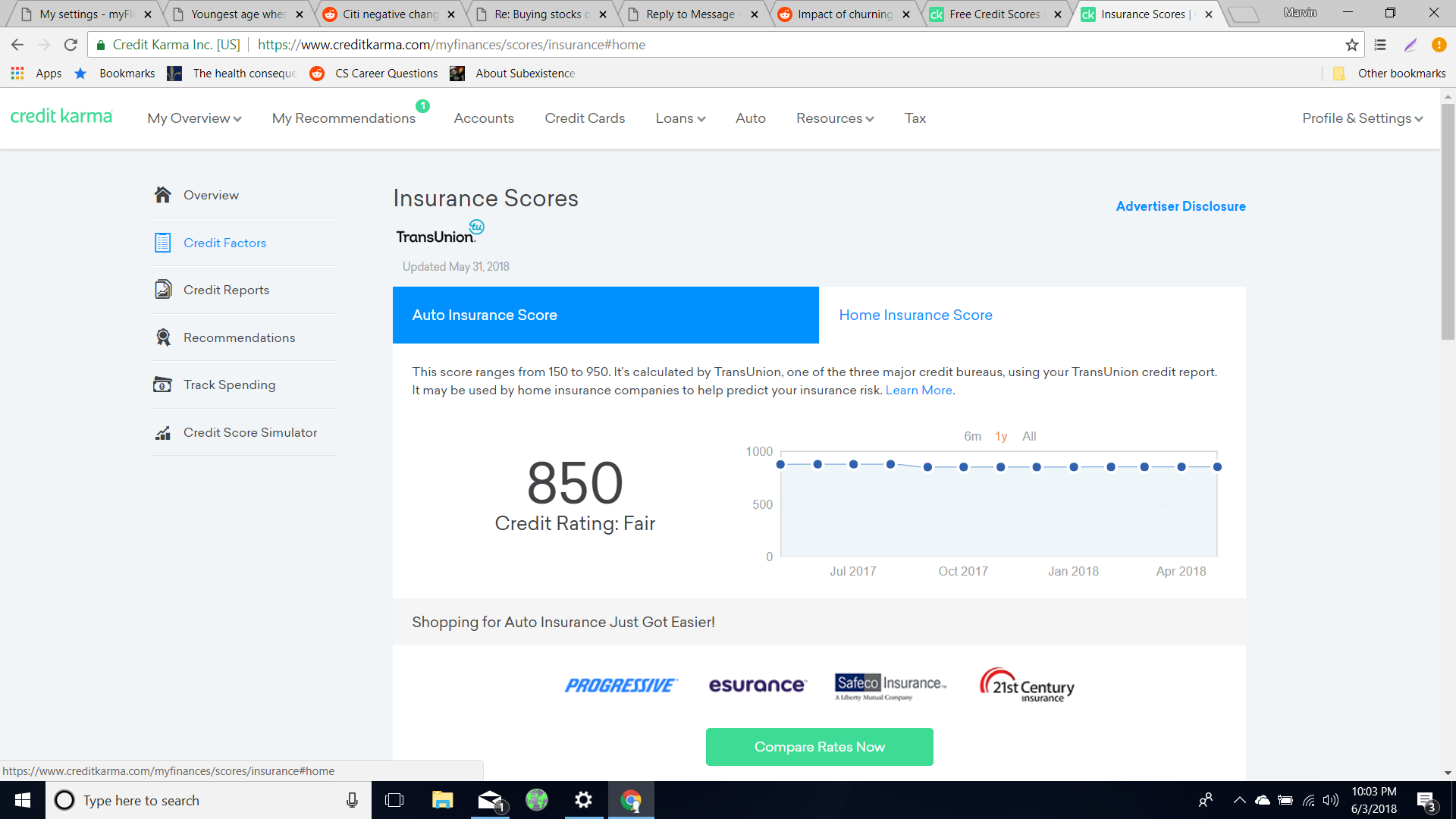

Wallethub: Best For Credit Alerts

WalletHub provides you with credit reports from TransUnion and the TransUnion VantageScore. To register, you’ll need to provide your personal details and the last four digits of your Social Security number , and you’ll have to answer a few questions to verify your identity. The site also asks other questions, such as your annual income, monthly expenses, and credit card debt to complete the registration.

The dashboard shows all of your credit accounts and balances while the credit alert section gives you a report card-style letter grade on the factors that influence your score. For example, the site warns you if your debt load is too high relative to your income or if;your is too high and hurting your score.

Drop-down menus provide additional details, such as your credit;utilization ratio. An easy-to-read version of your credit report shows all of your current and closed accounts, and any negative items, like collection accounts.

A menu bar across the top of the page provides information about financial products and services, such as checking accounts and car loans. WalletHub earns money from some of these companies, which advertise and pay for premium placements on the site.

Also Check: Why Is There Aargon Agency On My Credit Report

It’s Easy To Be In Control

Sign up for MyCredit Guide at no charge to see your detailed TransUnion credit report, updated weekly upon log in, get alerts, and use the credit score simulator.

Already enrolled to MyCredit Guide? Log In Here

Articles about Credit

Here is how to check your credit score for free and get the most accurate picture of your credit.

Enroll with MyCredit Guide to get a free credit report that you can access at anytime or you can request a copy of your credit report 3 credit bureaus once a year.

Learn about credit score ranges from FICO and VantageScore, and how they classify Excellent, Good, or Poor credit score.

Tips to Improve Your Credit Score

The better your credit score, the better chance you may have to secure a mortgage for a house or get approved for that premium credit card. Watch this short video from American Express to learn how to improve your credit score.