Getting Your Free Credit Report And Score

Getting your free credit report and score

Since the acquisition of Compuscan in 2019, Experian provides free credit reports and free credit scores on My Credit Check and My Credit Expert, which are our easy-to-use, online portals that allows all South African citizens with valid South African ID numbers to access their credit information via their personal extensive credit reports.

Whether you are a first-time credit report user or not, My Credit Check and My Credit Expert will help you understand your credit data, show you how to monitor accounts, manage debt, and improve your credit profile.

You can access your personal credit reports through either the My Credit Check or My Credit Expert portals.

- My Credit Check

- The My Credit Check portal, available at www.mycreditcheck.co.za, references data from the Experian Sigma database, which is the historical Compuscan bureau database.

- Your My Credit Check credit report and credit score are generated from the Experian Sigma database.

Note: Your credit score based on the Experian Sigma Database may be different to the one based on the Experian Database because the formulas and variables used to create the scores differ. Currently, these two databases and the scoring models are kept separate.

My Free Report And Score Frequently Asked Questions

How do I get my free credit report?

Experian offers South African consumers free unlimited access to their My Credit Check and My Credit Expert credit reports and credit scores.

- Visit www.mycreditcheck.co.za for your Experian Sigma credit report.

- Visit www.mycreditexpert.co.za for your Experian credit report.

What is Experian Sigma?

The My Credit Check portal references data from the Experian Sigma database, which is the historical Compuscan bureau database. Your My Credit Check credit report and credit score are generated from the Experian Sigma database.

Can anyone view my free credit report?

Your credit report cant be viewed by just anyone! The information contained in your credit report is confidential, and companies and individuals who wish to view your report may only do so for a prescribed purpose. The National Credit Regulator has set out specific guidelines in accordance with the National Credit Act that deal with prescribed purposes. Experian prides itself on protecting your privacy and we always comply by the rules and regulations provided by the NCR.

Is my free credit report stopping me from getting a job?

Do I need to check my free credit report if I pay all my debt on time?

Yes. It is important that you check your credit report regularly to ensure that the information is being reported to the credit bureau correctly. Also remember to use your credit report to detect any fraudulent activity against your record.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Read Also: What Is Syncb Ntwk

Does Checking My Credit Report Hurt My Credit

No, checking your credit report does not hurt your credit. And checking your credit score doesn’t hurt your credit either. These actions are considered “soft pulls” which don’t affect your credit score. Actions, such as applying for a credit card, which require a “hard pull,” temporarily ding your credit score.

Learn more: Check your odds of getting approved for a credit card without hurting your credit score.

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report. An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life

- disability insurance applications.

Don’t Miss: When Does Open Sky Report To Credit Bureau

Important Disclosures And Information

Bank of America credit cards are issued and administered by Bank of America, N.A. Better Money Habits, Merrill Lynch, U.S. Trust, Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation. All other company and product names and logos are the property of their respective owners.

Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

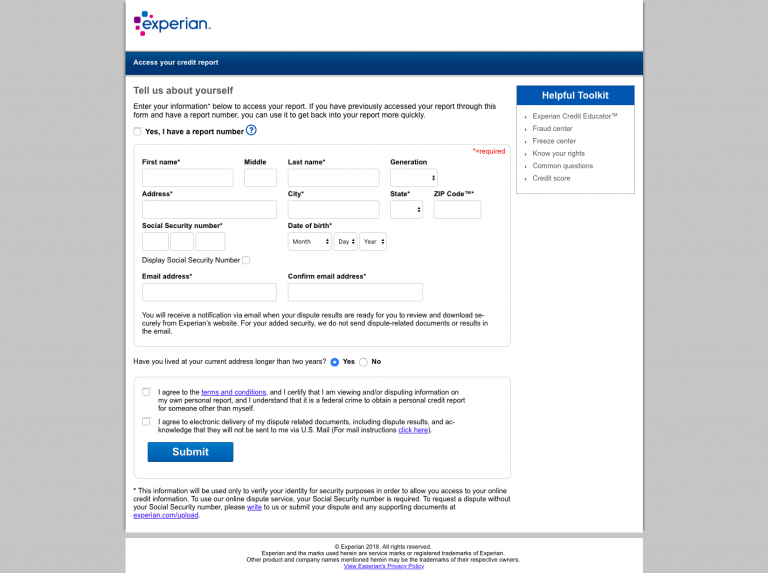

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Don’t Miss: When Does An Eviction Show On Your Credit Report

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

Recommended Reading: How Long Does Repo Stay On Credit Report

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

Starting To Improve Your Credit

When you open a new line of credit, a few immediate changes are usually made to your credit report. Most instantly, a new hard inquiry will probably be added to your report, and your average age of credit history could drop. Due to these factors, opening a new account is likely to drop your credit score in the short term. However, as you begin to diligently pay off your bills, the additional on-time payments, the higher number of total accounts and your now-growing age of credit history will likely outweigh the initial downsides, and your score can benefit in the long term.

Don’t Miss: Does Paypal Credit Report To The Credit Bureaus

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

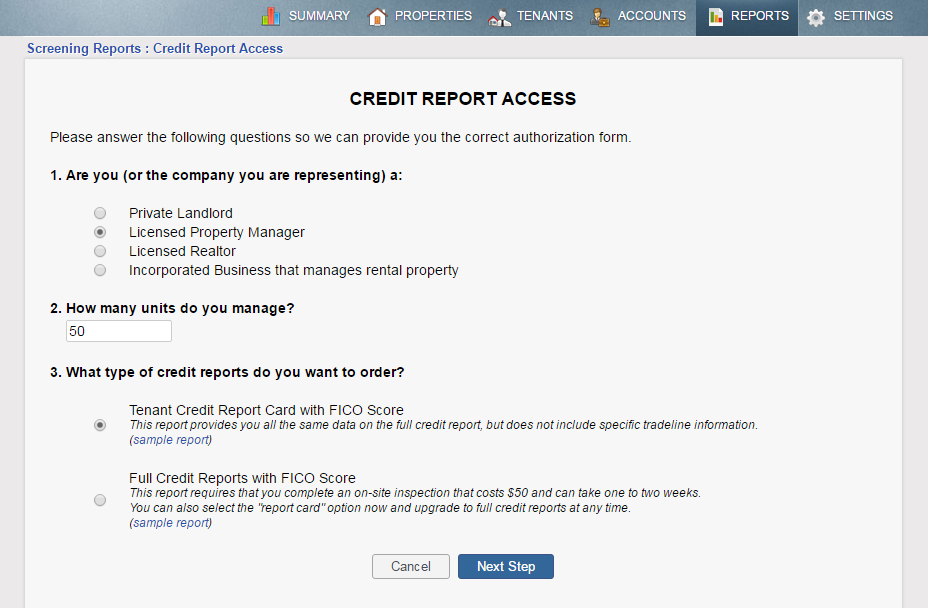

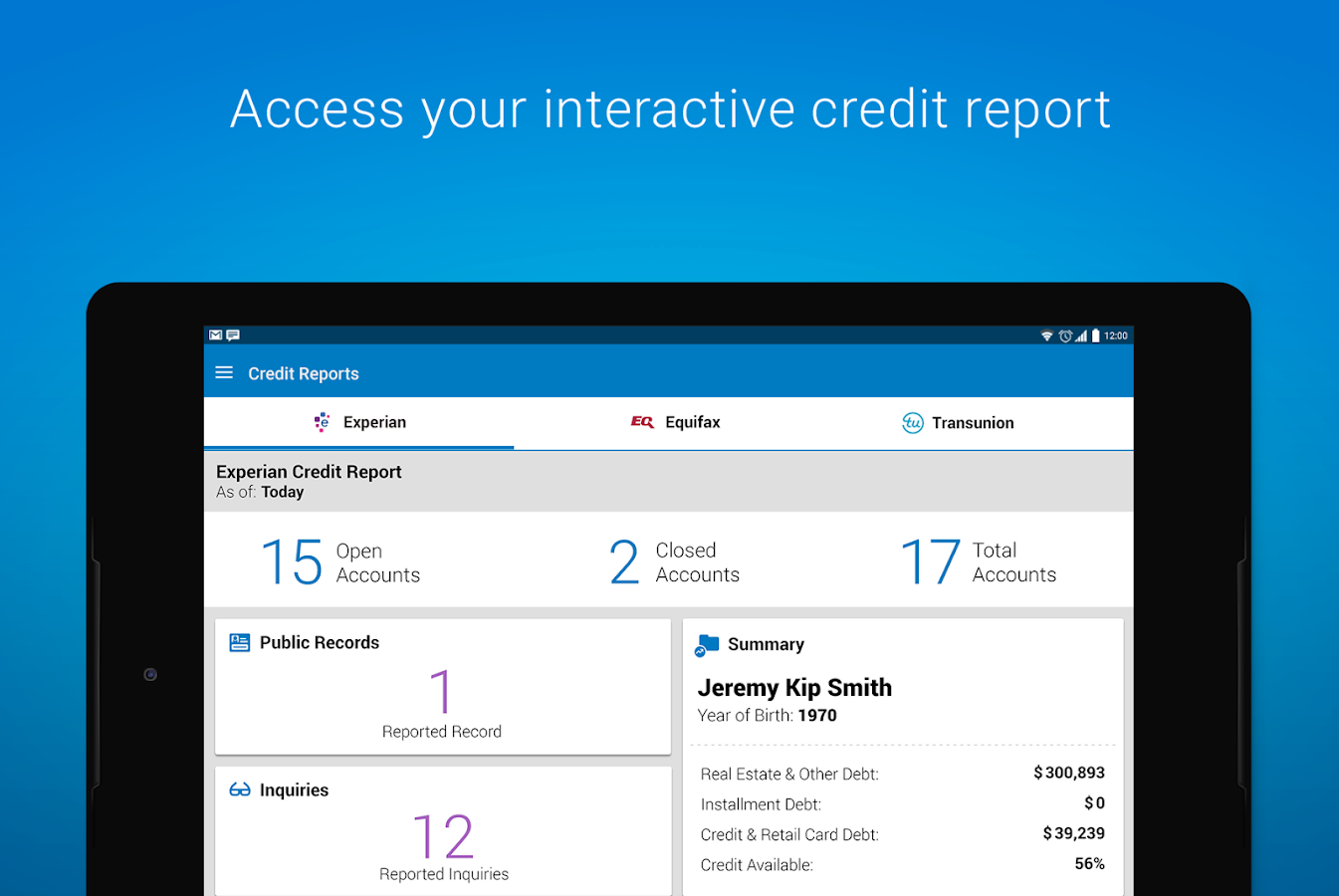

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Recommended Reading: Who Is Syncb Ppc

Where Does The Information On Your Credit Report Come From

The data included in Experians free credit reports comes from credit providers you have borrowed from. Whether its a clothing account, a loan from the bank, or cell phone contract, all credit data gets sent to registered credit bureaus, like Experian, which enables credit bureaus to do credit bureau checks.

Who Can Access Your Credit Report

Current or potential creditors like credit card issuers, auto lenders and mortgage lenders can pull your credit score and report to determine creditworthiness as well. Credit history is a major factor in determining whether to give you a loan or credit card, and the terms of that loan or credit card.

Can anyone see my credit report?

No, not just anyone can look at your credit report. To access your report, an organization must have whats called permissible purpose.

Can someone access my credit without permission? The Fair Credit Reporting Act has a strict limit on who can check your credit and under what circumstance. The law regulates credit reporting and ensures that only business entities with a specific, legitimate purpose, and not members of the general public, can check your credit without written permission.

What organizations can see your credit report?

- Mortgage lenders.

- Employers.

Read Also: Bp Visa Syncb Pay Bill

Is Your Information On The Dark Web

Find out with a FREE Dark Web Triple Scan.

- One-time scan for your Social Security Number, Email and Phone Number

- Free Experian Credit Report and FICO® Score* every 30 days on sign in

- Experian Credit Monitoring and Alerts

No credit card required

*Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

You May Like: Paypal Credit Bureau

Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

You May Like: Does Snap Finance Report To Credit Bureau

How To Access Your Personal Credit Score

Although each of the major credit bureaus Experian, Equifax and TransUnion are required to offer you a free copy of your credit report once a year, the report does not include your credit score. This essential number is a calculation based on factors in your credit report, that helps a lender predict your likelihood of repaying a loan on time.

Technically, each individual with a credit history has multiple credit scores calculated by different entities, in addition to the 3 calculated by the credit bureaus. Most of these scores are considered educational while you gain an idea of your overall creditworthiness, lenders do not use these to determine your eligibility for a loan.

The FICO credit score, developed by the Fair Isaac Corporation, is the most popular scoring system. According to the organization, 90 percent of lenders use FICO scores to evaluate applicants. Scores range from 300 to 850, with higher scores indicating higher creditworthiness. Credit scores calculated by the major credit bureaus are all roughly based on the FICO scale, and on the individuals credit report from that bureau.

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

You May Like: Experian Boost Paypal

Wallethub: Best For Credit Alerts

WalletHub provides you with credit reports from TransUnion and the TransUnion VantageScore. To register, you’ll need to provide your personal details and the last four digits of your Social Security number , and you’ll have to answer a few questions to verify your identity. The site also asks other questions, such as your annual income, monthly expenses, and credit card debt to complete the registration.

The dashboard shows all of your credit accounts and balances while the credit alert section gives you a report card-style letter grade on the factors that influence your score. For example, the site warns you if your debt load is too high relative to your income or if your is too high and hurting your score.

Drop-down menus provide additional details, such as your credit utilization ratio. An easy-to-read version of your credit report shows all of your current and closed accounts, and any negative items, like collection accounts.

A menu bar across the top of the page provides information about financial products and services, such as checking accounts and car loans. WalletHub earns money from some of these companies, which advertise and pay for premium placements on the site.

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

You May Like: Does Paypal Report To Credit Bureaus

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Do I Have To Pay For My Credit Report

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

Also Check: Remove Repossession From Credit Report