What Is Credit Card Interest

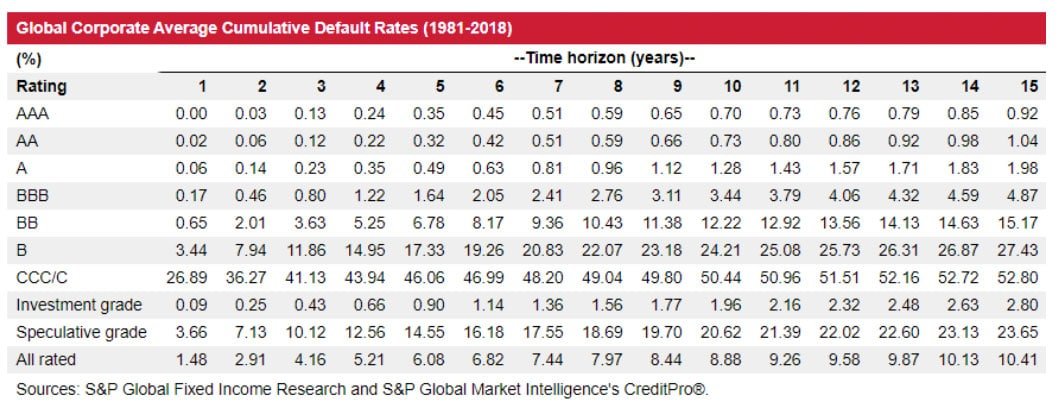

is the amount that lenders charge you on your credit card balance. Think of it as the cost for using someone else’s money. If you pay off your entire balance within your grace period and have no pending prior interest charges, then you will not have to pay interest during that period. The APR can vary from person to person, even when two people have exactly the same type of credit card. That’s because lenders take your credit score and credit history into consideration when determining how creditworthy you are, in addition to other factors such as yearly income, location, and more. This means that maintaining a good credit score could result in lenders offering you lower interest rates on credit cards and loans than if your credit score were low or recently took a hit.

When it comes to credit cards, an APR and the interest rate charged is basically the same. The APR is the annual rate, and the interest rate that you are charged each day is the daily periodic rate, based on your APR.

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

What Are Variable Interest Rate Credit Products

With variable rate credit products, the interest rate can move up or down. These movements are tied to changes in an underlying index , and your interest rate may reset on a monthly, quarterly or annual basis depending on the terms of your loan or your credit card agreement.

When interest rates reset, so does your monthly loan payment or the amount you owe on your credit card balance. This can make it extremely difficult to develop a monthly budget that you can follow consistently. Variable rate loans tend to have lower initial interest rates than fixed rate options because of the risk that rising rates will increase your borrowing costs.

Don’t Miss: Paypal Credit Help Credit Score

Uses For Lines Of Credit

Did we mention personal lines of credit can be used for almost anything, but failing to repay them on schedule can precipitate lasting financial trouble? Still true.

Home improvement projects are the most common use for personal LOC, but there are other situations where the interest rate and flexible repayment options make lines of credit worth considering.

Some of those options include:

- Projects with funding challenges: Your daughters marriage comes at the same time the roof needs replacing. A line of credit could meet the challenge of paying for both.

- People with irregular incomes: You are self-employed or work on commission and the next paycheck isnt coming for another month. Drawing from a line of credit allows you to pay your regular monthly bills until the next paycheck arrives.

- Emergency situations: Tax bill comes the same time the credit card bills are due along with college tuition for your child. Consolidate your debt with a line of credit.

- Overdraft protection: If you are a frequent check writer with unstable income, a LOC can serve as a backup when you need overdraft protection.

- Business opportunity: A line of credit serves as collateral if you want to buy a business, or spark growth through advertising, marketing or participating in trade shows.

Worth repeating: As with all cases of borrowing, make sure you have a strategy for repaying the money with interest and fees before you take a loan.

Fixed Vs Variable Student Loan Interest Rates

If youre comparing a fixed vs. variable interest rate on a student loan, its important to consider your overall repayment strategy to choose the most optimal rate for your needs. Here are a few important points about both rate types to keep in mind:

| May go up or down | ||

| Monthly payment | Can go up or down with rate | |

| Loan type | Federal or private student loans | Private student loans |

| Same rate and monthly payment for life of the loan |

|

|

| Cons | Higher rate than a variable-rate loan with same repayment term |

|

No matter if you choose a fixed- or variable-rate student loan, its important to shop around and compare as many lenders as possible. This way, you can find the right loan for your needs.

Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Compare student loan rates from top lenders

- Multiple lenders compete to get you the best rate

- Get actual rates, not estimated ones

- Finance almost any degree

Don’t Miss: Sync Ppc On Credit Report

Compare Offers To Find The Best Loan

As you begin to search for a personal loan, it can be helpful to compare several different offers to find the best interest rate and payment terms for your needs. This comparison tool asks you 16 questions, including your annual income, date of birth and Social Security number in order for Even Financial to determine the top offers for you. The service is free, secure and does not affect your .

Editorial note: The tool is provided and powered by Even Financial, a search and comparison engine that matches you with third-party lenders. Any information you provide is given directly to Even Financial. Select does not have access to any data you provide. Select may receive an affiliate commission from partner offers in the Even Financial tool. The commission does not influence the selection in order of offers.

The Disadvantages Of A Fixed

- Expensive energy if wholesale energy prices fall, you could end up paying more than with a variable tariff.

- Locked in fixed-rate plans are on a fixed contract, meaning you cant change your mind without incurring a cost.

- Cancellation fees if you do want to cancel your contract, you might be charged an exit fee on both fuels.

Read Also: What Bank Is Syncb Ppc

Examples Of Fixed Costs

Fixed costs include any number of expenses, including rental lease payments, salaries, insurance, property taxes, interest expenses, depreciation, and potentially some utilities.

For instance, someone who starts a new business would likely begin with fixed costs for rent and management salaries. All types of companies have fixed cost agreements that they monitor regularly. While these fixed costs may change over time, the change is not related to production levels but are instead related to new contractual agreements or schedules.

When You Might Not Want A Variable

Although a variable rate might be appealing in some cases, here are a few drawbacks to think about:

- Interest rate could change: A variable rate can rise or fall along with market conditions. This could make it difficult to estimate your overall repayment cost.

- Unpredictable payments: Any changes in your variable rate will also mean shifts in your monthly payments.

- Potentially more expensive overall: Depending on how quickly you pay off your student loan, you might find yourself paying much more over time with a variable rate compared to a fixed rate.

Keep in mind:

This can help keep your interest costs lower as well as offer some peace of mind. However, you might still end up paying more in interest with a capped variable-rate loan than you would with a fixed-rate loan especially if you cant pay off your loan before your rate has a chance to change.

You May Like: What Credit Report Does Comenity Bank Pull

Pros Of Fixed Interest Rates

- With loans youll always know how much you have to pay in interest as the payments remain the same.

- With mortgages,your rate wont change even if the Bank of Englands base rate increases.

- Its easy to compare products.

- Youll never pay out more in interest than the set amount.

- With savings accounts you are likely to get a higher rate of interest if you are prepared to go for a fixed-rate account.

- With savings accounts your fixed rate will look more attractive if the interest rates offered go down.

Home Loan Interest Rate Scenarios

The graph below shows an example of the first five years of a $300,000 variable rate loan over a 30-year term. The grey, blue and orange lines show the variable interest rate starting at 5.7% while the teal line shows the fixed interest rate at 7.7%. If the borrower considers fixing initially for five years at 7.7% and the variable rate doesnt change from 5.7% during that fixed term then, in addition to the borrowers annoyance at fixing at a higher rate, the borrower would pay $30,000 in extra interest over the five years.

If the variable interest rate rose in a straight line from 5.7% to 7.7% over the five-year fixed term, the extra interest paid if the borrower had fixed their interest rate would be $15,000.

To break even, the initial interest rate of 5.7% would need to rise along the grey line to reach a rate of 9.7% after five years in order to pay the same amount of interest as if the loan had been fixed at 7.7% for the same five year period.

You May Like: Aargon Com

Fixed Rate Car Finance

To help you budget accurately, car finance agreements usually have a fixed interest rate. This is agreed by your lender at the start of the agreement, based on the strength of your .

Your interest rate can often have a big impact on the cost of your loan. If you have an excellent credit score, youll likely be eligible for a much lower rate compared to someone with a history of Bad Credit.

How Much Do Personal Loans Cost

Some lenders charge origination, or sign-up, fees, but none of the loans on this list do. All personal loans charge interest, which you pay over the lifetime of the loan. The lenders on our list do not charge borrowers for paying off loans early, so you can save money on interest by making bigger payments and paying your loan off faster.

Read Also: What Credit Report Does Comenity Bank Pull

Why Is Inflation Rising

Inflation the cost of general goods and services is being driven up by worldwide supply shortages following a return to trading after the Covid lockdowns.

The shortage of microchips, which has caused supply issues for items ranging from games consoles to on-board tech for new cars, has been a prime example. A shortage of new cars has, in turn, impacted the used car market which, according to figures from AutoTrader, were 21% more expensive in September compared to the previous month.

Meanwhile, soaring wholesale gas prices have translated into a sharp rise in household energy costs just in time for the colder weather, and the regulators price cap rose by 12% in October. Cheaper fixed rate energy tariffs have disappeared from stock entirely, meaning there are no savings to be gained from shopping around for a better deal.

Advantages Of A Closed Mortgage

Despite prepayment penalties, a closed mortgage has advantages to the right borrowers. If a borrower does not intend to sell the property in the foreseeable future, has no intention of prepaying any portion of the mortgage over an above what is allowed in the pre-payment privileges or has no intent to refinance the mortgage during the term, a closed mortgage may make financial sense. This is because closed mortgages usually come with a lower initial mortgage rate than fully open mortgages. If the borrower does not intend any type of prepayment for a number of years, it may be best not to pay the higher interest of an open end mortgage.

In addition, many closed mortgages are fixed rate mortgages, and if the prevailing mortgage rates are low when the mortgage is issued, the borrower has then locked in at a low interest rate, a good protection against rising interest rates.

Recommended Reading: Affirm Com Walmart

Student Loan Refinancing: Better To Get A Fixed Or Variable Rate

Student loan refinancing is the process of paying off your old loans with a new private student loan, leaving you with just one loan and payment to manage.

If you choose to refinance your student loans, youll also typically have a choice between a fixed or variable rate this means you can switch the kind of rate you currently have.

Keep in mind:

Fixed Rate Vs Variable Rate Credit Products: Everything You Need To Know

When you apply for a personal loan or credit card, the lender may give you a choice between a fixed rate vs. variable rate. Each of these options comes with pros and cons, and your selection can impact how much interest youll pay over the life of your loan.

So how do you decide? Heres an overview of the differences between fixed and variable rate loans and credit cards, including how they work and how to determine whats right for you.

Also Check: Kohls Credit Bureau Reporting

Definition Of A High Ratio Mortgage

A high ratio mortgage is a mortgage in which a borrower places a down payment of less than 20% of the purchase price on a home.

Another way of phrasing a high ratio mortgage is one with a loan to value ratio of more than 80%. A mortgage with more than a 20% down payment is called a conventional mortgage.A high ratio mortgage will require mortgage insurance. Mortgage insurance is usually purchased by the lender through one of Canadas three default insurers:

The cost of the premium is added on to the mortgage and amortized over the length of the mortgage. It can also be added to the closing costs, however this is not the norm.

Example

Mr. McGillicuddy desires to purchase a home with a purchase price of $250,000. He has $30,000, available in cash for a down payment. Since the amount of the down payment is less than 20%, the mortgage is classified as a high ratio mortgage and Mr. McGillicuddy will be required to purchase mortgage insurance.

Related Terms

How Interest Rates Work

If youre borrowing money, interest is the amount you pay to your lender for the use of the money.

Financial institutions set the interest rate for your loan. Interest rates rise and fall over time. The interest rate is used to calculate how much you need to pay to borrow money.

The interest rate for your loan is included in your loan agreement. Find out what your financial institution must tell you about interest rates when you borrow.

You May Like: Removing Hard Inquiries Off Credit Report

What Is Installment Credit

Installment credit is simply a loan you make fixed payments toward over a set period of time. The loan will have an interest rate, repayment term and fees, which will affect how much you pay per month.

Common types of installment loans include mortgages, car loans and personal loans. Like other credit accounts, timely payments toward installment loans can help you build and sustain strong credit scores. Your credit scores will dictate whether you qualify for an installment loan, and your interest rates and terms if you do.

Here’s what you need to know about installment loans, how they work and how they affect your credit.

If I Switch Suppliers Will My Energy Be Interrupted

Switching is easy. Once youve chosen your new energy supplier, theyll do everything for you, with no interruption to your service. The switch usually takes 21 days, so make sure you switch before the end of your contract, for the best possible rates. You dont even have to inform your old supplier that youre leaving. Phew!

View more from these categories

You May Like: Usaa Credit Check Monitoring Review

Best For Smaller Loans

Who’s this for? PenFed is a federal credit union that offers membership to the general public and provides a number of personal loan options for debt consolidation, home improvement, medical expenses, auto financing and more.

While most lenders have a $1,000 minimum for loans, you can get a $600 loan from PenFed with terms ranging from one to five years. You don’t need to be a member to apply, but you will need to sign up for a PenFed membership and keep $5 in a qualifying savings account to receive your funds.

While PenFed loans are a good option for smaller amounts, one drawback is that funds come in the form of a paper check. If there is a PenFed location near you, you can pick up your check directly from the bank. However, if you don’t live close to a branch, you have to pay for expedited shipping to get your check the next day.

Ability To Afford A More Expensive Home

You may be able to afford a more expensive home if you opt for a 30-year term. When your lender evaluates your loan, theyll consider how your new mortgage payment fits in with your debt-to-income ratio .

If you can afford a $150,000 mortgage on a 15-year term, you might be able to get a larger mortgage such as a $200,000 loan with a 30-year term.

Read Also: Whats A Good Paydex Score

What Happens When A Person Has A Poor Credit Score

A persons credibility as a borrower is in question when he/she has a poor credit score. Banks and creditors will think twice before extending a line of credit. Even if they do approve the credit, there may be a higher interest rate that will be charged to you and no one wants that.

It might be difficult to get a place to live in, find employment, rent a car, or get a cell phone, if the credit score is low since so many entities check your credit score. People with a bad credit score might also need to pay security deposits for services and utilities.

Insurance might become expensive due to higher premiums. Debt collectors might call and harass you constantly to recover payments. Overall, a bad credit score will undermine your quality of life.