How A Bad Credit Score Isbad

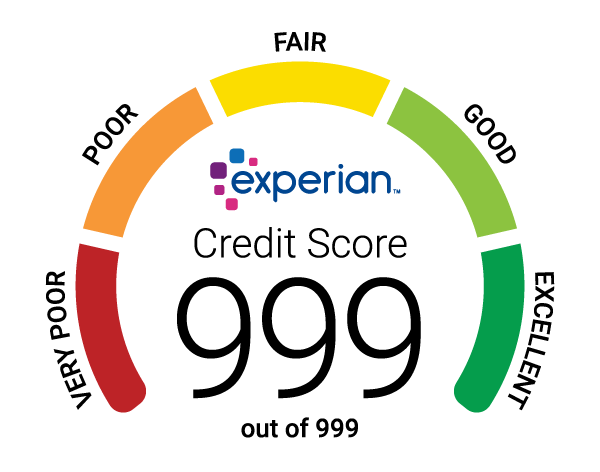

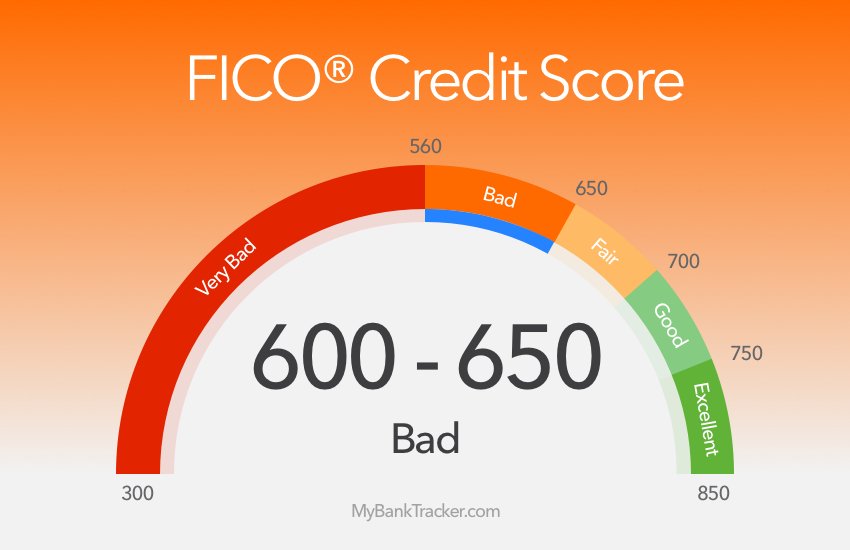

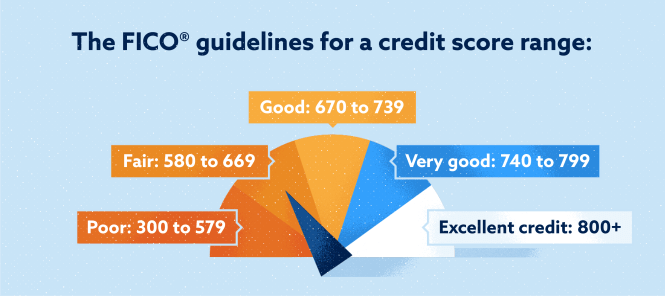

As mentioned formerly, a bad credit score is anything listed below 670. If you wish to get more specific, a score ranging in between 580-669 is considered fair, while anything in between 300 and 579 is thought about bad. This is going off the FICO scoring thats most typically used.

Not sure what your credit score is? . Its free!

Having a bad score can stop you from doing a lot of things. This includes getting approved for much better credit cards, mortgages, houses, personal loans, service loans, and more.

Plus, any loans or credit cards you do get approved for will be much more expensive . This is because loan providers charge much higher interest rates to those they deem high risk in order to offset the additional risk they feel theyre taking by loaning you money.

How do they get more costly? By charging greater rate of interest. If you take out a $10,000, 48 month loan on a car with a 3.4% interest rate, youll pay about $704 in interest over the course of the loan. If you got that exact same loan with a 6.5% rate due to bad credit, you d pay about $1,376 in interest. Thats practically double!

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See what offers you’re eligible for with your credit score.

Have At Least One Gas Or Store Credit Card

For the longest time, I resisted getting a store card, such as a Macys credit card, because I saw no point in opening a new credit account just for one store.

But, now I know better. If you shop at one store a lot, and that store offers its own credit card, consider applying. These cards have some nice perks such as cash back or coupons.

More importantly, a store credit card can boost your credit. I cant document this, but I know getting a Macys card and keeping its balance at $0 each billing cycle boosted my FICO score by 20 points.

Just be sure you dont buy too much and run up a balance you cant clear each month. If you do that, youll be cutting into your available credit which will hurt your credit score.

Recommended Reading: Can You Remove Hard Inquiries

How To Build Your Credit

Some of the steps you should take to build and maintain good credit over time include:

- Monitoring your credit report and reviewing it for mistakes

- Keeping an eye on your credit score

- Paying your accounts in full and on time

- Avoiding opening new accounts at once

- Avoiding several hard inquiries too close together

Building good credit is vital to your overall financial well-being. Having a solid credit score will help you gain access to more opportunities and secure lower interest rates. Moving up from very poor to good can have significant benefits for youitll just take some determination to get there.

Kickstart the comeback on your credit with help from Lexington Law

Using A Mix Of Loan Types To Boost Your Score

Another thing that lenders like to see in a credit report is a mixture of loan types. This proves that you are capable of handling loans with different terms and payment requirements, making it easier to trust that you will pay them back.

One way to take advantage of the value of a credit mix when trying to fix bad credit is to get a loan that you can pay off immediately.

For example, if you need to buy a cheap car or make a purchase at a store that offers it, ask for a no-credit financing deal.

Make sure there are no pre-payment penalties and you can pay the bill in full immediately. This will improve your credit mix, giving your score a small boost.

It is important to remember that you should never pay interest or pre-payment fees in order to boost your credit score.

Carrying a balance on your credit card does not improve your credit score, and in fact, can reduce it by increasing your utilization.

The minor boost provided by improving your account mix is also not worth paying for. Take advantage of the opportunities you can, but the most important factor in repairing your credit will ultimately be time.

Tuesday, 07 Jan 2020 11:11 AM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Also Check: Experian Unlock

Surviving A Foreclosed Home

Foreclosures can be particularly difficult to remove from your credit score. They also have a huge effect, dropping your score by as much as 150 points.

The best way to get a foreclosure removed from your report is to dispute it in writing with the credit reporting agency.

If you can point out errors in the report, or if enough time has passed and youve been making your payments on other loans on time, they may remove it from your report.

Is 540 A Good Credit Score Instant Credit Boost

Im sure youve heard the term in the past. Its that 3 digit number that follows you & your financial life every where you go. You need it to get authorized for loans, credit cards, homes, mortgages & more! And because you never ever actually see it, its normally out of sight, out of mind but this number is something that requires to be taken serious.

None of us like it, the truth that a credit score is so essential to nearly whatever we do economically is precisely why we stated it has to be taken major. It can take years to develop a good score and only a day or 2 to bring the entire thing crashing down.

Luckily, theres things you can do to protect and educate yourself on the subject. From techniques to give you a near-instant boost to your score to understanding what a credit score even is from a fundamental level, were going to walk you through this step by step. Prepare to take control of your financial flexibility once and for all!

Also Check: Synch Ppc

How To Improve A 740 Credit Score

Work on removing all negative accounts such as collections, charge-offs, medical bills, bankruptcies, et al.

Remove as many excess hard inquiries as you can. Get your revolving utilization as low as you can . Ensure you have a good credit mix of installment loans and revolving accounts.

Last but not least, make sure you have at least two revolving accounts older than 2 years

We recommend taking a look at Credit Glory. Give them a call

It’s generally much faster if you worked with Credit Glory, and they happen to have incredible customer service.

Why You Should Be Pleased With An Exceptional Fico Score

Your 840 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates. Credit card issuers are also likely to offer you their most deluxe rewards cards and loyalty programs.

Late payments 30 days past due are rare among individuals with Exceptional credit scores. They appear on just 0% of the credit reports of people with FICO® Scores of 840.

An Exceptional credit score can mean opportunities to refinance older loans at more attractive interest, and excellent odds of approval for premium credit cards, auto loans and mortgages.

You May Like: Report Death To Experian

What Credit Score Is Needed To Buy A Car Without A Cosigner

You don’t need to have a credit score to buy a car without a cosigner. In fact, if you have the cash to pay in full, you won’t have to take out a loan or have your credit checked. You’ll have more options if you have a credit score of at least 670 what lenders typically consider to be good credit.

The Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 540 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Read Also: Eos Cca Bbb

Dealing With Negative Information Which Impacts Your 540 Credit Score

If you have concrete plans to avoid things that ends up winding down your credit score and presents you to a potential lender as a perpetual debtor who just cannot be trusted to handle finances responsibly then you need to be more watchful of how you handle your spending.

Having a low credit score is not an accidental event, there are things that has led to the other or are simultaneously acting in conjunction to make your 540 FICO credit score low thereby denying you the requisite purchasing power to chase your dream.

The following are things you should watch out for if you dont want your credit score to keep reducing:

Keep an eye on your credit report

You need to deliberately request your credit report so that you can by yourself analyze how well you are doing in terms of keeping up with payment of the money you are. This will help you make deliberate steps to avoid having a low credit score.

You have the right to request for your credit report for free and you should take advantage of that to improve your chance of getting loans.

Pay to get the report when necessary

In case you no longer have access to free credit report because you have used up your free credit score report that is free for the year, go ahead to order for it from the bureaus though you may have to pay for it.

When you get the report

Home Foreclosure Property Repossession

The foreclosure of a home or repossession of other property will result in a major credit score drop. A person who has built up great credit can see their score fall by over 100 points after a foreclosure or repossession.

It will be a long time before lenders will consider someone with a foreclosure on their history for a loan or credit card with good interest rates and terms.

What to do: The repossession of property only takes place after repeated attempts to recover missed payments. There are likely to be several negative marks on your credit report that need to be addressed on top of the foreclosure.

Unfortunately, there is no quick fix, as these items will remain on your credit report for seven years. The good news is that you can use that time to pay off your debt and improve your credit management skills.

Read Also: How Do I Unfreeze My Afterpay Account

Plan To Open A New Credit Card Every Six Months Or So

We said earlier you shouldnt apply for several credit cards at once, and thats absolutely true. But once you have a credit card open, and you have a good pay history, it will then be time to apply for a second.

New applications should be at least six months apart. The purpose is so that you can begin building multiple positive credit references. Those will improve your credit score much more quickly than a single credit line.

But apply all the other rules we recommended. Keep your charges low, and pay off your balance each month. Thatll make sure your credit rebuilding efforts work exactly as theyre supposed to.

How Credit Scores Work

Your credit score attempts to offer a numerical representation of your creditworthiness. The idea is that lenders can look at your credit score and quickly know whether youâll pay back a loan.

There are three major credit bureaus in the United States, Equifax, Experian, and TransUnion that track your interactions with credit and debt. They use the information they gather to generate a credit report and then use a proprietary formula, such as the FICO score formula, to produce your credit score.

Read Also: When Does Hard Inquiries Fall Off

Get Better At Managing Your Finances

The answer that nobody wants to hear, but everyone needs to know, is that at the end of the day, if you do not get better at managing your finances, then your score is never going to increase. Sit down and take a hard look at how your income compares to your expenses. If your expenses are higher than your income is, then you need to start saving money!

Additionally, you may need to attempt to close some of your lines if you have too many open credit accounts. Having multiple lines open can be a good thing if you are doing a good job of paying for everything on time. However, it can hurt your score if you have a bunch open and are being irresponsible with your monthly payments. Not only will your score fall, but you will also see a large increase in your interest rates.

How To Improve 540 Credit Score

Once you have understood the pros and cons of having a good credit score. You need to look at practical ways to improve your credit score rating. Do the following things to improve your credit score rating:

- Pay back on time consistently This is the best way to guarantee that your 540 credit score keeps improving.

- Dont just close up an unused account incessantly This will make potential lenders suspect foul play.

- Dont be afraid to negotiate with your creditors Lenders are not monsters. Dont just give a time frame you may end up not being able to fulfill. Your sincerity with them can be a double edged sword that ensures that your credit score rating does not reduce and yet offers you the chance of obtaining the loan you desire at the same time.

- Avoid being bankrupt as much as possible As much as possible, ensure you dont put too much pressure on your finance to the point of running bankrupt. Culture of responsible spending will see to this.

Recommended Reading: How To Get Rid Of Repo On Credit

Open A Secured Credit Card Account

Secured cards are designed for those with no credit history or those who are rebuilding credit.

You can open a secured card when you arent eligible for other cards because this type of credit card requires a deposit. The deposit acts as collateral for the issuer if you stop making payments, so its less risky for them to approve you. Secured card deposits are refundable. Many issuers will upgrade you to an unsecured card upon request after youve demonstrated you can wisely manage the card.

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Also Check: Credit Score Needed For Affirm Financing

Think Carefully Before Closing Old Credit Card Accounts

If you dont use an old credit card much anymore, you might be tempted to close it.

To this we say: Not so fast. Keeping an old credit card account open can increase your age of credit history as well as your credit mix, which could help you build credit.

You might be better off keeping that old account open, assuming you dont have to pay an annual fee. You may even consider putting a small recurring charge like a monthly subscription on the card to ensure the account stays active and the credit card company doesnt close it for you.

Fico Score Vs Vantage Score

The three major credit bureaus created the Vantage Score back in 2006 to compete with Fair Isaac Corporations FICO credit score model. Since then Vantage Score has released several new credit score models, including Vantagescore 3.0 and 4.0.

While the Vantage Score has grown more popular and is easier to check, thanks to free credit monitoring services like Credit Sesame, both your FICO score and your Vantage Score work to reveal your credit behavior.

The credit score ranges are very similar, although Vantage Score does have a category for perfect credit .

If you earn an improvement within one of these credit score models, you will almost always see the same result with the other model, too especially if you have a shaky credit history and have a couple years of work to achieve a good credit score.

Recommended Reading: How Often Does Capital One Report To The Bureaus