How Can I Get My Credit Re

If youre trying to raise your credit score a few points to get approved for a loan or to qualify for a better interest rate, your mortgage lender might be able to pay a fee for a rapid re-score that updates your credit report in two or three days. But only if theres proof of a credit report error or youre able to pay off an account right way and need the balance to reflect on your credit report.

Consulting Businesses And Employees

As part of his dedication to proactive legal counsel, Mr. Biggerman also offers employment consulting and training for businesses, as well as private and public sector employees. This legal advice includes a wide range of supervisory training, including discipline, management and sexual harassment.

Schedule a free consultation in Beachwood to discuss your legal challenges with a seasoned attorney. Call or reach out online to get started.

Employment Attorney For Ohio Employees

Despite all the statutory legal protections for employees, in some cases, no employment law statute will cover the unique facts of an employees case. It is in those situations that the skill and experience of the employment law attorney you hire can make the difference between whether you will be able to recover or not.

If an employment law statute does not protect an employee, the employee might be able to bring a claim under Ohio common law for violation of public policy. Such a claim prohibits employers from firing employees for reasons that would jeopardize a clear public policy contained in Ohio or United States law. These claims, however, are notoriously complex. An employee needs the help of a skilled employment attorney to have the best chance of winning a public policy claim.

Recommended Reading: What Is Syncb Ntwk On Credit Report

When Does Discover Report To The Credit Bureaus Instant Credit Boost

Im sure youve heard the term in the past. Its that 3 digit number that follows you & your financial life every where you go. You require it to get authorized for loans, credit cards, houses, home loans & more! And since you never ever really see it, its generally out of sight, out of mind however this number is something that requires to be taken major.

Though none of us like it, the fact that a credit score is so essential to almost whatever we do economically is exactly why we said it has to be taken serious. It can take years to build up a great score and only a day or 2 to bring the entire thing crashing down.

Fortunately, theres things you can do to safeguard and educate yourself on the topic. From techniques to offer you a near-instant boost to your score to comprehending what a credit score even is from a basic level, were going to stroll you through this step by step. Get ready to take control of your financial liberty at last!

Some Credit Cards For Bad Credit

Some credit card issuers take advantage of people with bad credit by offering them credit cards that charge outrageous fees and interest and dont help them build credit.

In general, try to avoid credit cards that charge fees to process your application or open your account. Also, stay away from cards that charge APRs higher than 30%.

Finally, double check with a credit card issuer before you apply to make sure it reports your account activity to all three credit bureaus. Most issuers that do will list that on their website. But dont be afraid to call if you cant find it anywhere.

Also Check: Does Cashnetusa Report To Credit Bureaus

When Does Discover Report To Credit Bureaus Instant Credit Boost

Im sure youve heard the term previously. Its that 3 digit number that follows you & your financial life every where you go. You require it to get approved for loans, credit cards, homes, mortgages & more! And since you never actually see it, its generally out of sight, out of mind but this number is something that requires to be taken serious.

Though none people like it, the fact that a credit score is so essential to nearly everything we do economically is exactly why we stated it needs to be taken major. It can take years to develop a great score and only a day or more to bring the whole thing crashing down.

Thankfully, theres things you can do to safeguard and educate yourself on the subject. From tricks to offer you a near-instant boost to your score to understanding what a credit score even is from a essential level, were going to stroll you through this step by step. Prepare to take control of your financial freedom once and for all!

Get Help With Employment Overtime And Wage & Hour Disputes In Ohio And Elsewhere

If you are being abused or treated unfairly at work, call our office for a free consultation with an employment attorney. Well let you know if we think you have a case and how we can help you. We take cases on a contingency fee basis, meaning our fees are generally based on the size of the monetary award we obtain for you or they are otherwise paid from the employer directly. If we arent successful, then you dont pay. Also, many employment laws allow us to recover our fees from the other party, enabling you to keep most, if not all, of your damages award. Call our Columbus Ohio overtime attorneys and employment lawyers at 614-949-1181, or contact us online to schedule your free consultation, and get started today holding your employer accountable for their harmful mistakes and illegal acts. We fight for your rights to proper pay and employment consistent with state and federal laws.

You May Like: Does Credit Limit Increase Hurt Score

Know Your Rights Call Us Fight Back

The law protects you against these and other workplace issues. You deserve justice for what you have gone throughyou need a lawyer who will help you fight back. We focus on labor and employment laws. Most law firms cant say that. We know labor and employment laws. We work with them every day, and we will help you fight for your rights against your employer.

For problems in the workplace, call us. We understand your issues.

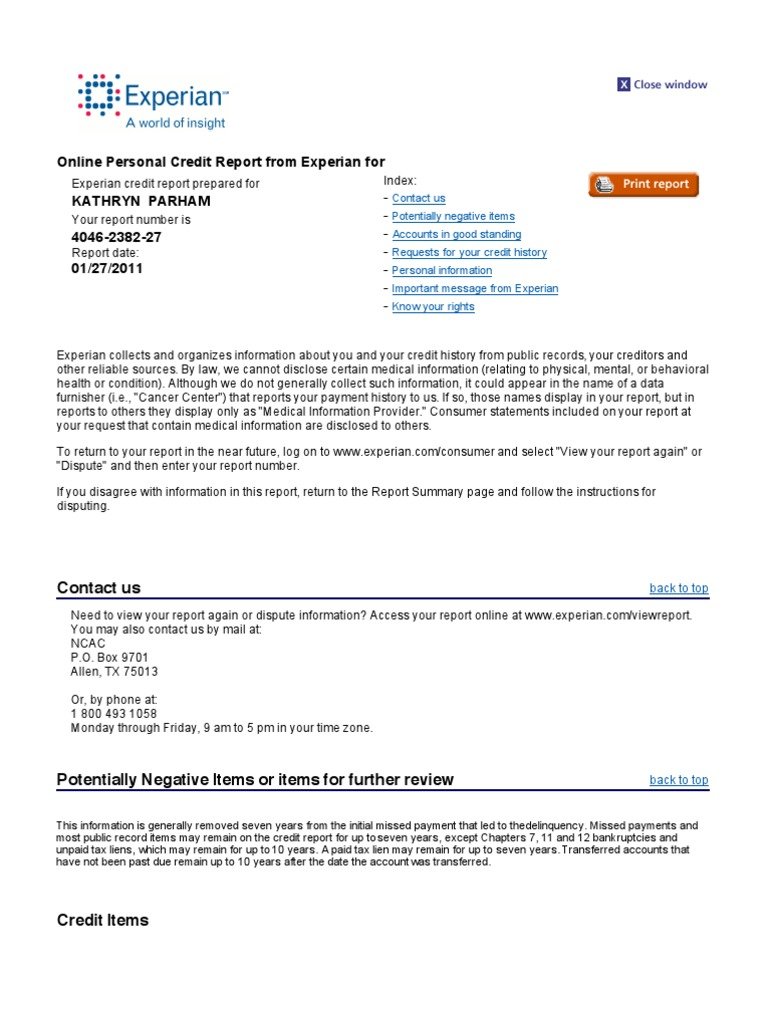

What Happens If You Have A Card That Doesnt Report To All Three

If you have a card that doesnt report your activity to any of the three credit bureaus, youll get no benefit from using it responsibly. And if it reports to only one or two, the credit benefit of using the card will be limited.

For example, lets say you have a credit card that reports to Experian and TransUnion, but not to Equifax. Over time, youve used your card responsibly and established a good history on your credit reports with those bureaus.

But if you go to apply for a loan or a new credit card and the lender calculates your credit score based on your Equifax credit report, it will be as if you never had the credit card. Again, youll get no benefit.

You May Like: How To Remove Repossession From Credit Report

We Fight For Justice In Stark County

You have rights in the workplace in Massillon . Those rights include, but are not limited to, the right to not be subject to unlawful harassment, discrimination or retaliation. The right to protected medical leave, if you qualify. The right to a reasonable accommodation – including unpaid leave – for a qualifying disability. The right to be paid for all of the hours you worked, including overtime.

If you believe your rights were violated at work, contact us. We can help. We offer a free case evaluation with one of our experienced employment law attorneys. That attorney will answer all of your questions and explain the employment laws that apply to your circumstances.

Nilges Draher LLC7266 Portage Street NW, Suite DMassillon, OH 44646330-470-4428

Ohio state and federal laws governing wrongful termination, discrimination and other employment law matters are complex. They dictate where you can file your claim, when you have to file your claim, and the relief you can ask for, among other things. There are also a number of factors to consider when assessing your claim and determining the best evidence to support your claim. Chances are your employer has hired expensive lawyers to defend its interests. They are not concerned with your interests. But we are.

Schedule an appointment to speak with an attorney at Nilges Draher LLC today. We have an office in Massillon and serve clients throughout Ohio and beyond.

Re: When Does Discover Report Your Account Opening To Credit Bureaus

Opened 1/24

Received and activated card 1/29

First statement cut 2/6

Reported 2/7 just in time for my monthly 3b pull.

Sidenote – Amex was opened the same day, claimed 2-3 business days to get the card whereas Disco said 3-5, i got the Disco first…. and Amex still hasnt cut a statement yet or reported

Received and activated card 1/29

First statement cut 2/6

Reported 2/7 just in time for my monthly 3b pull.

Sidenote – Amex was opened the same day, claimed 2-3 business days to get the card whereas Disco said 3-5, i got the Disco first…. and Amex still hasnt cut a statement yet or reported

AMEX reports after the second statement.

And, OP my Discover reported after the first statement cut.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

What Does Discover Report To Credit Bureaus

Hi, I just recently got accepted for a Discover It credit card, with a limit of $500. This is my first credit card, and I had some questions regarding the way Discover reports to credit bureaus.

- Does Discover report to the 3 major bureaus ?

- Does Discover report to the bureaus on my statement date ?

- I want to keep my % utilization below 10%, as I am building credit. Say I use $200 out of my $500 limit in the month of December, from December 5th 2013 to January 3rd 2014. That mean’s I have a 40% utilization. However, let’s say I still use $200 out of the $500, but on January 2nd, I pay the amount I owe down to $45, which is 9% utilization. Would Discover report that I used 9% or 40%? Also, would the credit analysts at the bureaus see that I paid it down, as in, would they only see 9% utilization, or would they see my original 40% utilization, and then see that I only owe 9% left by the statement date?

Thank you very much to all who answer!

Whats The Bottom Line

Becoming an authorized user can be a way to build a credit history, but there are risks should the strategy not go according to plan. Your best bet is to evaluate the primary account holder do they make timely payments each month? and find out if the creditor reports authorized users activity to the major credit bureaus. Not all of them do, and its important that you know this information before taking a step that may not serve you in the long run.

Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice. The material on this site is not intended to provide legal, investment, or financial advice and does not indicate the availability of any Discover product or service. It does not guarantee that Discover offers or endorses a product or service. For specific advice about your unique circumstances, you may wish to consult a qualified professional.

Don’t Miss: How Long Before Collections Fall Off Your Credit Report

Secured Credit Cards And Student Credit Cards

You cannot add authorized users to secured credit cards or student credit cards. Because these cards have low credit limits, they are a less-risky way to build credit. Only making small purchases and paying your balance in full each month are the best way to maximize these card options. These two types of credit cards can improve your credit score quicker than being an authorized user on another credit card.

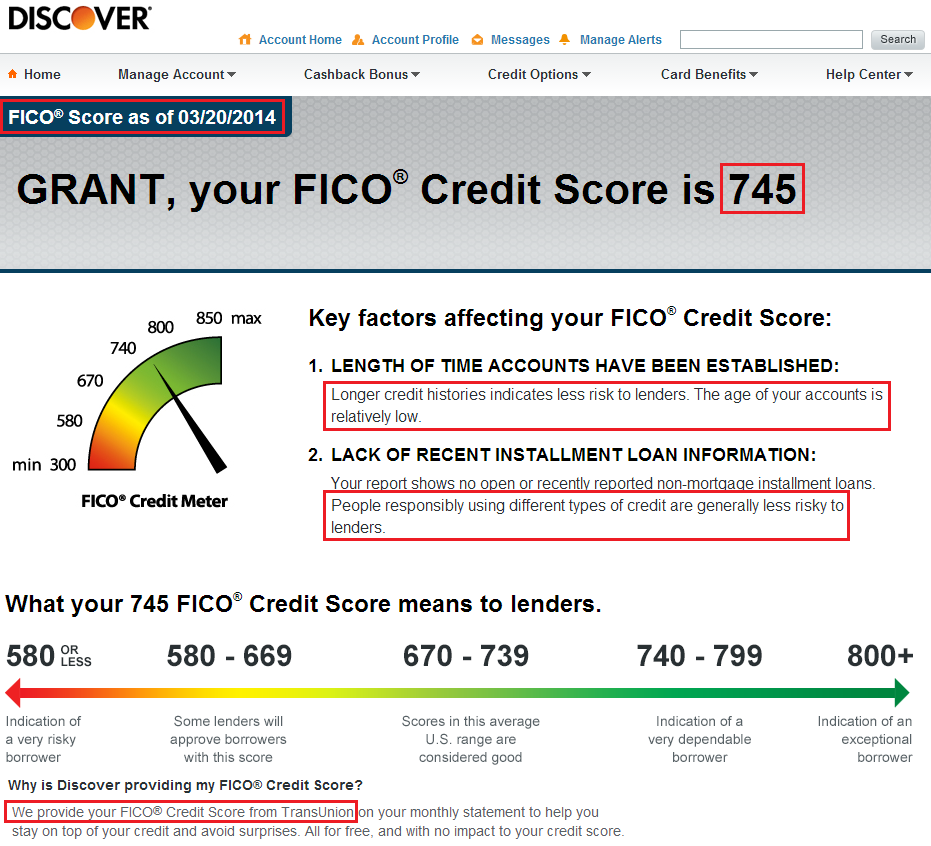

Why Timing Is Important

This is why understanding when the information on your credit card usage shows up on your credit report is important.

The reason your score has dropped in the suggested scenario is a high the balance you carry on your credit card compared with that cards credit limit. This ratio is expressed in a percentage and considered the second most influential factor in credit scoring after payment history.

Its generally recommended to utilize less than 30% of your credit to avoid damage to your scores. Ideally, you want to keep the ratio in the single digits.

Reported drastic changes in credit utilization can affect your credit score immediately and significantly. For example, if you havent been carrying a lot of credit card debt and then maxed out a credit card, your scores could take a hit. On the other hand, if your credit issuer has reported that you paid down a large part of your debt, you may see immediate positive results.

Fluctuations in your credit score can also be crucial when youre shopping for a loan, such as a mortgage or car loan. If your credit score is close to a FICO score threshold, even a small negative change can push you into a higher credit risk profile, which could increase your interest rates or even hurt your approval chances.

Recommended Reading: How To Add Utility Bills To Your Credit Report

Re: What Does Discover Report To Credit Bureaus

Whatever is on your statement is what is reported. Example Your statement cuts on the 4th and you have a balance of $25. That is what is reported.

wrote:

Hi, I just recently got accepted for a Discover It credit card, with a limit of $500. This is my first credit card, and I had some questions regarding the way Discover reports to credit bureaus.

- Does Discover report to the 3 major bureaus ? Yes

- Does Discover report to the bureaus on my statement date ? Usually within 5 days YMMV especially new accounts with Discover could take 45 days

- I want to keep my % utilization below 10%, as I am building credit. Say I use $200 out of my $500 limit in the month of December, from December 5th 2013 to January 3rd 2014. That mean’s I have a 40% utilization. However, let’s say I still use $200 out of the $500, but on January 2nd, I pay the amount I owe down to $45, which is 9% utilization. Would Discover report that I used 9% or 40%? Also, would the credit analysts at the bureaus see that I paid it down, as in, would they only see 9% utilization, or would they see my original 40% utilization, and then see that I only owe 9% left by the statement date? Doesn’t matter how much you use it as long as before statement cuts it’s paid down to 1-9%

Thank you very much to all who answer!

The statement closing date is the date shown on your statement. On my Discover statement, it shows the following in the upper left hand corner:

Current Scores: EQ 775 , EX 756 , TU 760

Types Of Late Payments On A Credit Report

For creditors, a single late payment may signify a broken trust. A missed payment can identify you as more of a credit risk than before. Thats why payment history is usually the most heavily weighted factor in calculating FICO® credit scores, accounting for about a third of the formula. FICO® puts late payments into various categories, including how severe it is, how recent it is and how frequently youve paid late. The more severe the category, the more damaging it is to your score. Generally, a late payment from many years ago wont hurt as much as the one reported today.

Recommended Reading: Personal Loan 580 Credit Score

A Creative Approach To Employment Issues

While some attorneys merely threaten to take a case to court, Mark Biggerman explores all the options available to ensure he pursues the best strategy for your success. Some of his most notable victories are the result of thinking outside of the box to find alternative solutions many lawyers would not consider.

This problem-solving mentality has helped Mr. Biggerman find success for clients throughout the greater Cleveland area not only in employment law but also in cases involving personal injuries, civil disputes and civil rights violations.

How Old Do I Have To Be To Become An Authorized User

There is no set age, but often people under 18 can be added as authorized users on their parents accounts. Authorized users receive their own credit card that they can use to make purchases. However, its worth noting that the primary account holder is responsible for making all payments toward the cards balance.

Read Also: Cbcinnovis Inquiry

Summary On Banks Reporting Authorized Users

There are many times when its good that banks report authorized users accounts to the credit bureaus. If you get a credit card from any national bank, your account information automatically populates. You should always make sure the account remains in good standing to makes sure being an authorized user doesnt start to hurt your credit score.

The comments on this page are not provided, reviewed, or otherwise approved by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Editorial Note: The editorial content on this page is not provided by any bank, credit card issuer, airlines or hotel chain, and has not been reviewed, approved or otherwise endorsed by any of these entities.