Reduce The Amount Of Debt You Owe

Your , or the balance of your debt to available credit, contributes 30% to a FICO Score’s calculation. It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below.

Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score.

Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving debt. In fact, owing the same amount but having fewer open accounts may lower your scores. Come up with a payment plan that puts most of your payment budget towards the highest interest cards first, while maintaining minimum payments on your other accounts.

Don’t close unused credit cards as a short-term strategy to raise your scores.

Don’t open several new credit cards you don’t need to increase your available credit: this approach could backfire and actually lower your credit scores.

How Often Is Your Credit Score Updated

Your credit scores are always based on an analysis of one of your credit reports. Rather than being updated at specific intervals, a credit score is created when you checks your credit report. New information could be added to your credit report at any time, which means the resulting score could change.

You may also see different scores if you’re checking credit reports from different credit bureaus, as it’s not uncommon for there to be differences between your credit reports. Or, even if you’re checking the same report at the exact same time, you could get different scores depending on which scoring model analyzes the report.

Check Your Credit Report For Errors

Carefully review your credit report from all three credit reporting agencies for any incorrect information. Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. Read more about disputing errors on your credit report.

Remember: checking your own credit report or FICO Score has no impact on your credit score.

Also Check: Does Speedy Cash Report To Credit Bureaus

Fico Weighs These Five Components To Come Up With Your Score

The often referred to as a FICO score is a proprietary tool created by FICO, the data analytics company formerly known as the Fair Isaac Corporation. FICO is not the only type of credit score available, but it is one of the most common measurements lenders use to determine the risk involved in doing business with a borrower. Here’s a look at what FICO examines to come up with its credit scores.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Don’t Miss: Zzounds My Account

What Goes Into A Credit Score

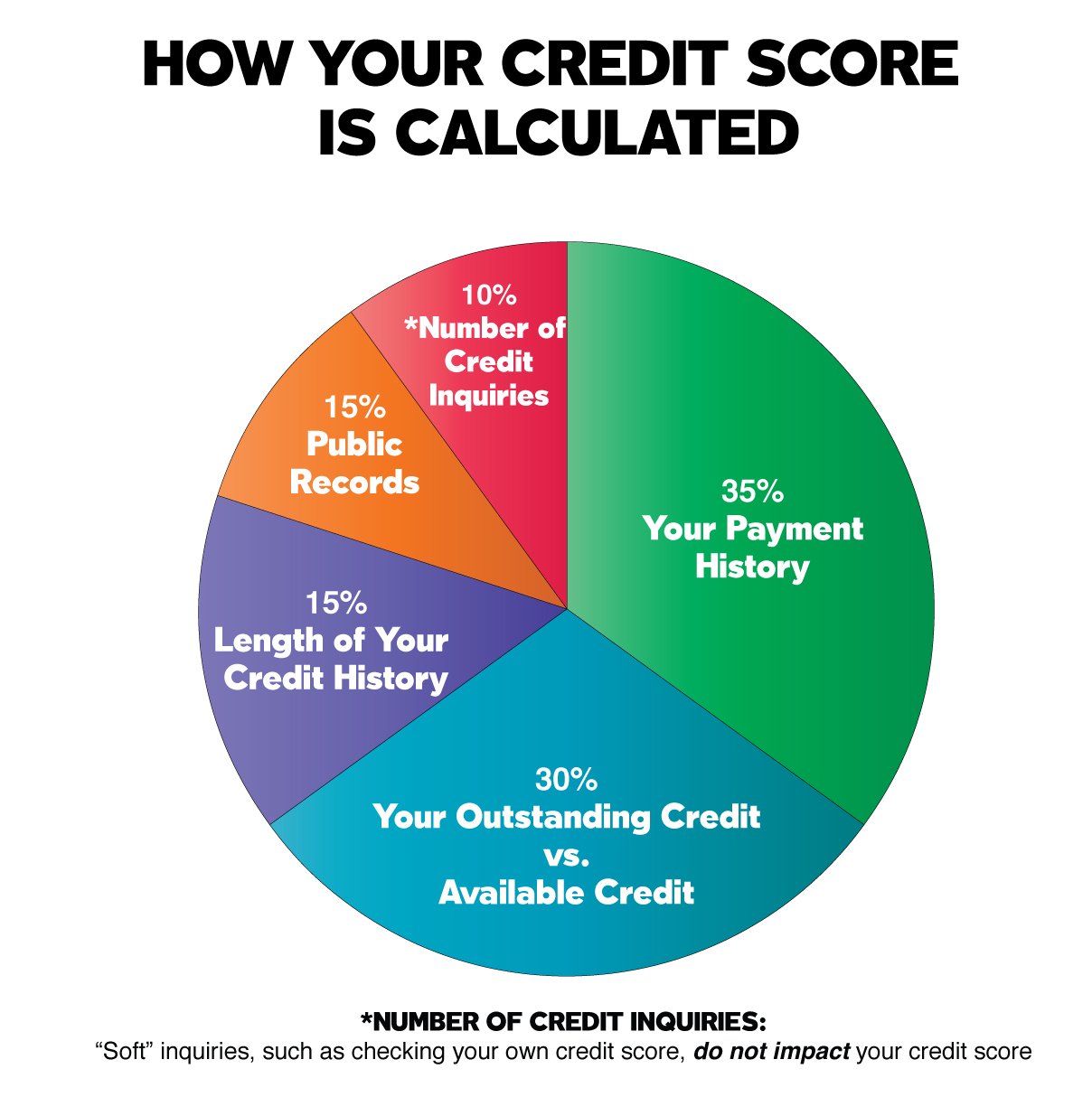

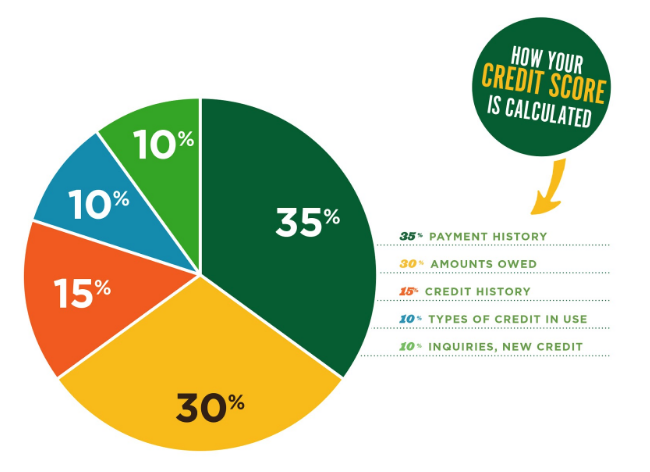

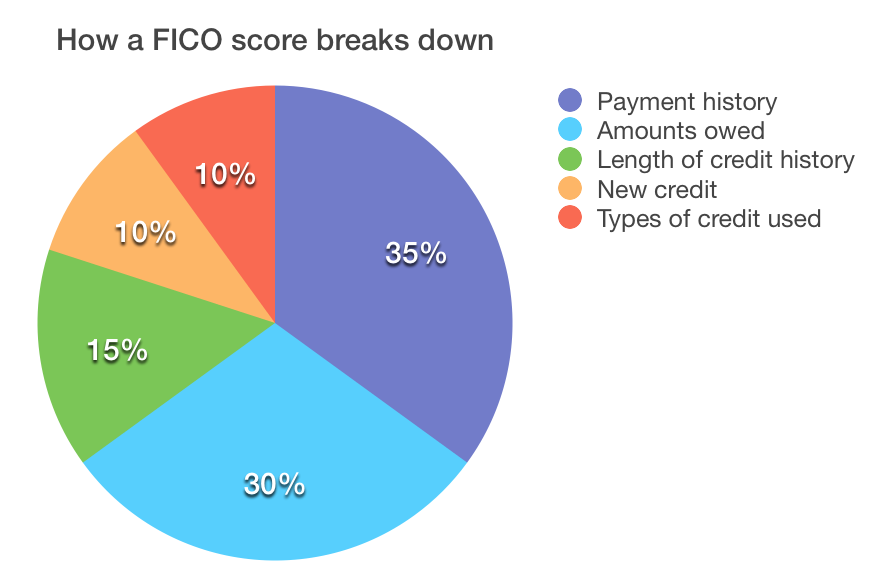

Because some parts of your bill-paying history are more important than others, different pieces of your credit history are given different weights in calculating your credit score.

Even though the specific equation for coming up with your credit score is proprietary information owned by FICO, we do know what information is used to calculate your score.

| What Makes Up Your FICO Credit Score | |

|---|---|

| Payment history | |

| New credit | 10% |

Payment history: Lenders are most concerned about whether or not you pay your bills on time. The best indicator of this is how youve paid your bills in the past.

Late payments, charge-offs, debt collections, and bankruptcies all affect the payment history portion of your credit score. The better your history of paying debtssuch as loan payments or credit card billson time, the higher your credit score.

More recent delinquencies hurt your credit score more than those in the past.

Amounts owed: The amount of debt you have in comparison to your credit limits is known as . The more money you already owe, the less flexible your spending is, which makes it riskier for you to take on new debt, which lowers your credit score.

Keep your credit card balance at about 30% of your or less to improve your credit score.

Length of credit history: Having a longer credit history is favorable because it gives more information about your spending habits. A longer history of reliable borrowing means your score will be higher.

Used Credit Vs Available Credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

You May Like: Bp Visa/syncb

How Is Your Credit Score Determined

Your credit scores are determined by credit scoring models that analyze one of your consumer credit reports and then assign a score using complex calculations.

FICO® and VantageScore®, the two main consumer credit scoring models, look for information that indicates if someone is more likely or less likely to miss a payment. A higher score means there’s a lower chance that the person will miss a payment, which is why having a higher credit score can help you qualify for favorable rates and terms from lenders.

Specific factors and how they’re weighted when determining your credit scores differ according to the credit model calculating them. They also vary depending on the type of credit score and which credit report from the three national credit bureaus is used when calculating the scores. Read on to find out which factors determine your credit score.

Where Can I View My Credit Score

Your credit score is actually not available on your credit report. Many credit card issuers provide access to your credit score to their cardholders. Please note that issuers may provide different credit scores from each other. Generally you can check your credit score by accessing your issuers website or app and finding the section for credit score. There are also some free credit score resources that are available through some issuers that dont require you to a cardholder. These free resources include CreditWise from CaptialOne, Discover Credit Scorecard, and Chase Credit Journey.

Recommended Reading: Can You Remove Hard Inquiries Off Your Credit Report

Check Your Credit Score For Free

FICO® and VantageScore create the most widely used credit scoring models in the U.S., and each company creates multiple scoring models. Fortunately, consumer credit scores tend to move together, as they’re using the same underlying information to try and predict similar outcomes.

If you have a good credit score generated by FICO® and based on your Experian credit report, you’re unlikely to then have a bad score generated by another scoring model based on a credit report from one of the other bureaus. With Experian, you can check your FICO® Score 8 for free, track it over time and get a breakdown of the factors that are most impacting your score.

How Many Credit Scores Do You Have

While there are several different versions of the , the most commonly used version is the FICO score. Developed by FICO, formerly Fair Isaac Company, the FICO score is used by many creditors and lenders to decide whether or not to extend credit to you. According to myFICO.com, the consumer division of FICO, there are at least 10 different FICO scores used for varying purposes.

The VantageScore, which was created by the three credit bureaus, is another common credit score. Many free credit score services offer the VantageScore 3.0.

Read Also: Usaa Credit Check Monitoring Review

Minimum Requirements For A Fico Score

FICO Scores are the most common brand of credit score lenders use in the United States. In order for a FICO Score to be generated, your credit report must meet the following minimum requirements:

- Your credit report must have at least one account thats been open for six months or longer. It only takes one account to qualify for a FICO Score. Your credit report must have at least one undisputed account that has been updated in the last six months. If you only have one account, and the account is in dispute, you wont have a FICO Score.

- Your credit report must be free of deceased indicators including accounts that you might possibly share with another person that has been reported as deceased to the credit reporting agencies. If there is any record of you or a joint account holder being deceased, a FICO Score will not be generated.

Whats A Good Credit Score Or A Bad Credit Score

The question of who determines a good or bad score has all sorts of incorrect answers. Its not the credit bureaus, its not FICO, and its not VantageScore. None of these companies use credit scores to lend money.

Lenders use credit scores to help predict risk, and their opinions are the ones that matter most in the end. Every lender is going to have a slightly different definition of a bad, fair, good, and excellent credit score.

This is a breakdown currently used by FICO:

| No credit history | Limited/No Credit |

For basic FICO scores, good typically starts at 670 for VantageScore, good scores start at 700.

Scores below 670 arent necessarily bad, but theyre unlikely to score you the best available credit card deals. The best interest rates are reserved for consumers who have great credit history. So, even if youre approved for a card you may get better terms if you have better credit.

Excellent credit scores can lead to:

- Easier approval for loans

- No down payment on utilities

- And much more

If your scores are below 660, which is the generally recognized dividing line between prime and subprime, then youre in a position to either be denied credit or find yourself saddled with very high interest rates. If you have poor or no credit, consider using secured credit cards to help build up your credit history.

Recommended Reading: Carmax Financing 650 Credit Score

How Is Your Credit Score Calculated

Each credit reference agency has a different method for working out your credit score, but they all use your personal information , along with your financial history to see how likely it is youll pay back any money you borrow. Even small things, like how often you apply for credit cards and loans, can affect the rating on your credit report.

How To Boost Your Credit Score The Traditional Way

The best way to improve your credit score is to focus on its two most important factors: payment history and amounts owed. Consistently paying your bills on time is the most important way to improve your credit score.

Thankfully, most lenders wont report delinquencies less than 30 days old and many wont even report payments that are 30 to 60 days late. But once you get beyond 60 days, each late payment will have a dramatic effect on your credit score.

Thats why its vital that you use every necessary resource to make all of your payments on time. This includes setting up alerts and reminders, as well as implementing automatic payments from credit card issuers and other lenders. Nearly all credit cards offer these features.

Related: 6 things to do to improve your credit in 2021

Next, you want to lower your debt-to-credit ratio. This is the total amount of debt you have, divided by the total amount of credit that youve been extended, across all accounts. The two ways to decrease your debt-to-credit ratio are to decrease your debt and to increase your credit.

Related:

Recommended Reading: Does Paypal Credit Build Your Credit

Too Much Credit Card Debt

The idea that late payments damage credit scores is an easy concept for most consumers to understand. However, the fact that having too much credit card debt can also lower a consumers credit scores is often surprising. The assumption is that as long as you make your payments on time then all is well.

Yet credit card debt is capable of lowering a consumers credit scores almost as much as late payments. Around 30% of the points in your FICO and VantageScore credit scores come from the debt category. While not all of that 30% is based on credit card utilization, your credit card balance-to-limit ratio is a significant factor within the category. Credit scoring models reward consumers for maintaining low balances relative to their credit limits.

How New Credit Can Increase Fico Scores

If the new line of credit helps diversify the types of accounts you currently have, this can increase the “credit mix” factor of your credit score. It shows lenders you can obtain and manage different kinds of credit, which can lower their risk of lending you money.

Let’s say you open a new credit card account and then don’t use that card for any new purchases. Over time, this can lower your credit utilization which could mean an increase in your credit score.

If you have a bad “payment history” and are starting from scratch to create a positive one, then opening new credit can help with that. If you can prove to lenders that you can pay your bills on time, this will help increase your score in the long run.

You should carefully consider if you need a new credit account. In the next section, you can learn about how to improve your FICO Score.

You May Like: Does Speedy Cash Report To Credit Bureaus

How Many Recent Inquiries You Have

An inquiry is when a lender makes a request for your credit report or score. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years. FICO Scores have been carefully designed to count only those inquiries that truly impact credit risk, as not all inquiries are related to credit risk.

There are 3 important facts about inquiries to note:

- Inquiries usually have a small impact

- Many types of inquiries are ignored completely

- The score allows for “rate shopping”

Remember: It’s OK to request and check your own credit report.

Checking your credit report won’t affect your FICO Scores, as long as you order your credit report directly from the credit reporting agency or through an organization authorized to provide credit reports to consumers, such as myFICO.

What Is A Good Credit Score

The exact range of what is considered a good credit score depends on who you ask, but we generally consider any credit score between 680 and 739 to be a good credit score, with scores between 740-799 as very good. are considered .

People with good credit scores are generally not hindered in any way by their creditworthiness. They can often qualify for most credit offers and can get good interest rates.

Read Also: When Does Usaa Report To Credit Bureaus

What Makes Up Your Credit Score

For example, your bank account balance doesnt appear on your credit report. Neither does your income or your net worth. None of these factors play a role when a scoring model calculates your credit score.

Factors that do impact your FICO Score fall into one of the following five categories.

- Payment History: 35%

- Length of Credit History: 15%

- New Credit: 10%

In each category, a scoring model will ask questions about your credit report. For example, Does the report show any late payments? These questions are known as characteristics in the credit scoring world. The answers to these questions, called variables, determine the number of points you earn. When the scoring software adds all of those points together, you get your credit score.

Related: Understand The 5 Cs Of Credit Before Applying For A Loan

Ways To Check Aecb Credit Score

The only way to check your credit score is through AECB. You can either visit their office located in Abu Dhabi or Dubai with your emirates ID and other valid documents or apply for the same online.

For individuals, charges for getting a credit score is AED 31.50. However, if you also require a detailed credit report, you will have to pay AED 105.00. Companies can also get their score and credit report for AED 31.50 and 178.50, respectively.

Don’t Miss: When Does Usaa Report To Credit Bureaus

Is A Reasonable Credit Score: What Does That Mean

A fair credit score means that the borrower has a credit score that is below the median, but is not considered a particularly high-risk borrower. People with reasonable credit scores can still get loans, but they may not be able to get good interest rates. A reasonable credit score is generally between 580 and 679, but the range will vary.

For those interested in getting government mortgages, you need a credit score of 580 to qualify for an FHA home loan.

How Is A Fico Credit Score Calculated

What exactly does a credit score measure? FICO does not reveal its proprietary credit score calculator formula, but it is known that the calculation incorporates five major components, with varying levels of importance. These categories, with their relative weights, are:

- Payment history

- Length of credit history

- New credit

All of these categories are taken into account in your overall score, which can range from 300 to 850. No one factor or incident determines it completely.

3 Important Credit Score Factors

You May Like: Syncb Ppc