Is A Credit Score Of 580 Good Or Bad

Almost everyone has a credit score. Its based on your income history, your debt-to-income ratio, how well you pay your bills on time and other factors. Because everyone has a credit score, the credit companies are able to formulate calculations that rate how any particular score is compared to the national average.

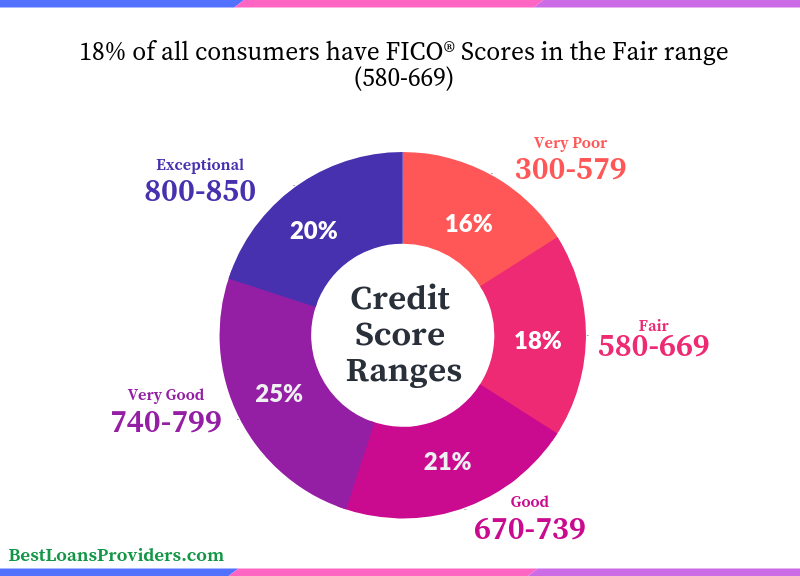

Credit scores range from zero to 850. If youre applying for a personal loan with a credit score of 580, that score is considered fair. Dont be disheartened, though. A score between 300 and 579 is considered very poor. At least you arent in that category! Just so you are well-informed, a credit score between 670 and 739 is considered good credit. A credit score between 740 and 799 is considered very good. A credit score between 800 and 850 is considered excellent. Remember that credit scores change monthly. You have a chance to increase your credit score over time by paying your bills on time and being responsible with your debt.

There are a variety of ways to raise your credit score. One way is to pay off some debt if you can. This will improve your debt-to-income ratio, which is one of the factors that plays into your credit score. This is a reason why getting a personal loan to pay off debt can be such a smart financial move.

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

Q4 Do I Have To Provide Collateral To Get An Auto Loan With Bad Credit

First, you must understand the difference between secured and unsecured loans. A secured loan is the type of loan where you have to provide collateral that acts as security, which can be your home or your car.

However, an unsecured loan does not require any form of collateral. A car loan is a secured loan therefore, you must provide collateral to get the loan. The lender demands collateral to eliminate the risk.

Moreover, the lender has the right to take over your asset if you fail to make payments on time. Therefore, you must ensure sufficient funds or monthly income to make interest payments on time.

Lastly, you must repay your loan on time to avoid penalties or any other repercussions.

Also Check: Does Loan Me Report To Credit Bureaus

Interest Rates And Terms

If you are able to secure a home loan, youre likely to encounter higher down payment requirements, fees and interest rates than someone with a higher credit score.

And youll face the same hurdles if youre looking to refinance your home. Your credit affects your ability to refinance and the rate youll pay if youre approved, just the way it does a mortgage.

What Credit Score Do You Need To Buy A House

Its possible to get an FHA loan with a credit score of 580 or 500, depending on the size of your down payment. VA, USDA, and conventional loans do have a set minimum credit score but lenders will generally require a credit score of at least 620.

Of course, remember that the minimum square will tell you whats required to qualify, but a lower credit score also usually means higher interest rates.

This table outlines the minimum credit scores typically needed to buy a house based on the type of loan: conventional, FHA, VA or USDA.

| Loan Type |

- Co-borrowers who do not plan to live in the home

- Down payment gift money, but no down payment of their own

- Properties that are in need of repair

Without FHA, millions of homeowners would be stuck renting years longer than they should. Yet, there is still room for FHA to expand its capacity to serve more aspiring homeowners.

You May Like: Credit Report Without Ssn Or Itin

Bankruptcy Information Can Be Wrong

You may want to hire a credit repair attorney if your record shows inaccurate financial or bankruptcy information. They can speak with credit reporting agencies, credit card companies, or credit card issuers if you are having personal finance trouble. An attorney can also step in if a company does not discharge your debt correctly or you fall into a credit counseling scam.

Remember: A bankruptcy discharge legally stops creditors from harassing you. You have rights if a company is not following the process or respecting your bankruptcy filing.

Thank you for subscribing!

What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

Also Check: Which Credit Score Does Carmax Use

What Credit Score Do I Need For A Personal Loan

Before you make the decision to apply for a personal loan, it helps to understand what the lender will be looking at when they make their decision. The first thing you should do is to check your own credit history. This will make you feel more in control and let you know where you stand. You can get one free credit report each year from each of the three major credit bureaus Experian, Transunion and Equifax.

To do, just log in to each company and answer a few I.D. verification questions. Depending on your individual circumstances, you may be able to get copies of your credit report online. Otherwise, theyll mail you a copy you can review.

Review your credit reports carefully once you receive them. Look for any errors or omissions. Errors include things like a credit card that you closed out but it shows its still open. Omissions include things like payments you made that arent showing up on the report. If you find issues, contact the account company directly and ask them to correct your credit report.

If you dont get satisfactory restitution that way, contact a credit company that helps consumers resolve debt issues.

See Your Credit Score

Next, find out your credit score. This can be found on your credit reports. You may also be able to view your credit score while logged into one of your credit card accounts online. Many credit card companies are now offering this service to their customers. If you think that you might be able to get a personal loan with a credit score of 580, you can then move on to applying for a personal loan.

The lending company will likely have some guidelines listed for loan applicants. This may include a minimum credit score that they will accept in order to grant a personal loan. Realize that each lender will have their own lending criteria. So if you get turned down for a loan, dont be discouraged. You may be the ideal loan applicant somewhere else! Here is a tool that can help you find a lender for loans with bad credit.

Don’t Miss: Cbcinnovis On My Credit Report

Personal Loans With A 580 Credit Score

You might find it challenging to get approved for a personal loan with poor credit scores.

Given your current scores, you might not have the luxury of shopping for the best personal loans with the lowest interest rates. Instead, you may have to settle for a personal loan with a high interest rate not to mention other fees, such as an origination fee.

This could make a personal loan seem very unappealing to you, especially if your intention with the loan is to consolidate high-interest credit card debt. The APR on your personal loan could be just as high, if not higher, than the interest rate youre currently paying on your credit cards.

On the other hand, if your goal with a personal loan is to finance a major purchase, you should ask yourself whether its something you need right now. If it can wait until after you spend some time building credit, you may qualify for a personal loan with a lower APR and better terms later down the line.

If youre really in a pinch for cash and youre having a difficult time finding a personal loan you qualify for, you might be considering a payday loan. While everyones situation is unique, you should generally be wary of these short-term loans that come saddled with high fees and interest rates. They can quickly snowball into a cycle of debt thats even harder to climb out from.

Dealing With Negative Information On Your Credit Report

Its no secret that negative information can have a huge impact on your credit score and your credit report not to mention moving forward, your ability to get new credit with favorable terms. Negative marks do not last forever. There are several things that can have a negative impact on your credit score:

- Chapter 7 bankruptcy stays on your credit report for 10 years.

- Late payments or past due accounts stay on your credit report for 7 years.

- Accounts that are sent to collections stay on your credit report for 7 years.

- Chapter 13 bankruptcy stays on your credit report for 7 years.

- Hard inquiries stay on your credit report for 2 years.

Research has shown that many US consumers find that their credit reports contain errors. Over time that number has shown a decrease, but with just under 17 percent of Credit Sesame members still finding errors, it is wise to be vigilant.

Percentage of members and non members who found inaccuracies on their credit report from 2014-2018

| Found Inaccuracies on Credit Report | Members |

|---|---|

| 16.5% | 35% |

The first step to improving your credit is to make sure that all the information on your current credit report is accurate. Next:

| Inaccuracies and resolution timeline | ||

|---|---|---|

| Average Time for Credit to be Adjusted | < 45 Days | 45-60 Days |

Don’t Miss: Remove Syncb/ppc From Credit Report

Personal Loans For Poor Credit

If youre shopping around the for the best unsecured loans for bad credit, heres a closer look at three of the lenders most likely to give you the green light.

- 9.95-35.99%

Avant: Avant requires a minimum credit score, however, that score is a very attainable 580. For qualified borrowers, Avant offers loans ranging from $2,000 to $35,000 with interest rates starting as low as 9.95% and going up to 35.99%. Theres also an administration fee to keep in mind, which ranges from 1.50% to 4.75%. On the other hand, there are no prepayment fees with Avant, which many borrowers appreciate.

LendingPoint: If your credit score has been dragged down by derogatory marks, LendingPoint is more likely to approve you than many other lenders. Even if youve , you can still qualify for a loan with LendingPoint. Unlike Avant, LendingPoint never charges any late fees, nor will you get hit with an insufficient-balance fee in case youre ever overdrawn. That said, LendingPoints interest fees are significantly higher than Avants, starting at 15.49% compared to 9.95%. Another drawback is that LendingPoints origination fee can be as much as 6%, while Avants will never exceed 4.75%.

Lenders that Offer Secured Loans

» MORE: Secured Personal Loans

Lenders that Accept Cosigners

» MORE: Personal Loans With Co-Signers

Tips to Get a Personal Loan with a Credit Score of 550 or Less

How to Get a Personal Loan With Bad Credit

Home Loan Options For Buyers With Bad Credit

The two primary types of mortgage loans are going to be loans backed by the government and conventional loans.

The difference between the two is that a conventional loan isnt backed by or insured by the federal government, but government-backed loans are.

You will find that a loan backed by the government will have lower requirements for your down payment, your credit and your debt-to-income ratio.

These loans are also less risky for lenders.

Lets check out some of the loan options available and the average credit score requirements for each of them:

Recommended Reading: Does Carmax Do Credit Checks

Can I Get A Car Loan With Fair Credit

Automobile loans are considered secured loans because, much like a mortgage, the item being purchased acts as the collateral for the loanin this case, the car.

Buying a car can be confusing because auto lenders dont use the same categories or ranges that the credit rating agencies do. While credit rating agencies consider a score of 580 to 669 to be in the Fair category, you are considered to be in the subprime category of car loans once your credit score dips below 600.

This re-categorization of scores and the use of the car as collateral allows auto lenders to offer financing to people who wouldnt otherwise be able to obtain unsecured loans based on their FICO score. However, it also allows auto lenders to charge higher interest rates based on the subprime ranking.

Borrowers with scores of 600 or lower often turn to credit unions for auto loans. Credit unions generally have slightly lower interest rates than banks, and as a result can have more favorable credit terms. Unlike banks, they are not-for-profit institutions. They are also typically smaller than banks and can evaluate your credit situation on a more personal level.

How Bad Is Credit Score Of 5: Passable Or A Disaster

When you are looking to apply for a loan, credit scores play a major role. A good score will give lenders a quick and objective measurement of your credit risk.

Credit scores can often be confusing to understand too. People often wonder how bad is a credit score of 580, so here is a look at what should you be expecting with a score of 580.

And if you want help raising your credit score, check out the top credit repair companies here

Also Check: Does Opensky Report To Credit Bureaus

Tldr How To Get Above The 580 Credit Score Mark

To recap, while a 580 credit score certainly isnt the best score you can have, you still have plenty of options when it comes to your credit . The best thing you can do is to take the proper steps to work to improve your score.

The good news? Time, along with the proper steps and action, can improve even the lowest credit score. The impact of the negative factors on your score lessens, and the negative marks will eventually fall off completely leaving you with a higher score. While youre waiting, good credit habits will help you build positive credit. These behaviors today mean that when the negative reports cycle off of your credit report in the future, youre left with a better score.

Is A Fair Credit Score Good Or Bad

Heres everything you need to know about a Fair Credit Score between 580 and 669. What does it mean for loan applications and your personal finances?

May 4, 2021 Having a 580 credit score can make it more difficult to get approved for unsecured loans. Heres how you can take your credit scores to the

While a 580 credit score may not be the best, we found auto, personal and home loans along with some credit cards, you still may qualify for.

Good credit score: 680 to 699 Average/OK credit score: 620 to 679 Low credit score: 580 to 619 Poor credit score: 500 to 579

The score takes into account various factors in your financial history and behavior, especially how consistent youve been with payments on credit cards, loans

Read Also: Credit Carmax

Best Personal Loans For Bad Credit

Do You Have Bad Credit? You Can Still Get Approved.

If you havent always been a responsible borrower, your credit report likely reflects your less-than-stellar past. But everyone makes mistakes from time to time and even the poorest remarks will fall off your report eventually. But, if you need cash now and cant afford to wait for time to repair your damaged reputation, you might be looking for the best personal loan a bad credit score can qualify for.

What Is a Bad Credit Score For Personal Loans?

Before you begin applying for a personal loan, its good to know where you stand and what constitutes a poor credit score. Both FICO scores and Vantage scores range on a scale from 350 to 850, and, in each case, the average score in the U.S. tends to hover around the mid- to high-600s.

Most lenders would consider a score in this range favorably, whereas scores below 620 would earn approval less frequently. And scores of 580 or less are generally regarded as poor, which makes it difficult for potential borrowers in this category to secure the funds they seek.