What Does A 850 Credit Score Mean Pros And Cons Of Having This Credit Score

Those that have this credit score do not really have any cons, as this is one of the highest scores they can get. Though they are not at the very top of the ladder, they have a couple ways they can improve the score to get it to the top such as paying their payments on time, using the right amount of credit and never defaulting on their loans.

In terms of pros, a 850 credit score shows that you are a trustworthy, reliable borrower and that you would be ideal to loan money too for mortgage loans, vehicle loans, credit cards, lines of credit and a wealth of other money loaning services offered through various financial institutions.

Exceptional Credit Scores: 800 To 850

850 is a perfect credit score, but it is, of course, a difficult one to achieve. Luckily, any score between 800 and 850 is considered excellent. So, if youve got an 804 credit score, you fall well within the lines of exceptional.

There are many advantages of having an exceptional credit score. Apart from finding it easier to borrow from lenders, youre also likely to get excellent interest rates on loans.

An excellent credit score is not so hard to achieve. The easiest way is to ensure you make all your payments on time. Making payments on time is the biggest factor when it comes to credit scores.

You should also aim to borrow less frequently and pay in full whenever possible. To keep your score in the exceptional range, try not to open too many credit accounts. The more credit accounts you have, the more you borrow, and the lesser your credit score is likely to be.

Keep Your Credit Utilization Low

Aim to get your credit utilization ratio as low as possible. According to The Washington Post, FICO data indicates that people with 850 credit scores have an average credit utilization of just 4.1 percent. That means that if you have $10,000 in available credit, youll want to keep your revolving balances below $410. Anything else needs to be paid off in full before your billing cycle closes.

Also Check: How To Remove Repossession From Credit Report

Poor Credit Score: Under 580

Bad credit is any score under 580, which unfortunately includes a 507 credit score. People in this range usually have a history of not being able to pay their bills on time and not following repayment schedules.

Someone who has bad credit may also find it difficult to be able to borrow money at competitive interest rates. Whether you have a 307 credit score or a 507 credit score, you will find it difficult to get a loan or credit card.

Does Age Impact Achieving A Perfect Fico Score

While length of credit history is one of the main factors in calculating your FICO® Score, it is still possible for people from younger generations to attain a perfect score. Baby boomers held the majority of perfect credit scores, accounting for 58% of people with an 850, according to Experian data from the fourth quarter of 2018. Generation X came next, accounting for 25% of people with perfect scores, and the silent generation trailed with 13% of the best scores.

While most of those with perfect scores were in the older generations, millennials made up 4% of those with perfect scores and Generation Y less than 1%proving that it doesn’t take a lifetime to grow to a perfect 850.

Read Also: Does Zebit Report To Credit

What Does A Credit Score Of 800 Mean

Youre still well above the average consumer if you have an 800 credit score. The average credit score is 704 points. If you have a credit score of 800, it means that youve spent a lot of time building your score and managing your payments well. Most lenders consider an 800 score to be in the exceptional range.

If you have a score of 800 points, you should be proud of yourself. You wont have any trouble finding a mortgage loan or opening a new credit card with a score that high. Here are some things your 800 FICO® Score says about you:

An 800 credit score isnt just good for bragging rights. Some of the benefits youll enjoy when you have a higher score include:

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How To Build Credit After Bankruptcy

You can start rebuilding your credit score after the bankruptcy stay stops creditors from taking action. Bankruptcy will show on your record for 7-10 years, but every year you work to improve your credit, the less it will affect you and the financing you seek.

You need to wait 30 days after you receive the final discharge. This means most of your accounts will be at a zero balance, and creditors must stop calling you about debts.

To rebuild your credit score, you should:

Very Poor Credit Score: 0 549

This score spells rookie. Clearly, youre a newbie in the credit bidness and dont have enough credit history, to begin with. Not to panic though, everybody starts somewhere. This can easily be fixed, apply for a loan and credit card and set up a repayment schedule, this will ensure a good record and aid in maintaining a future credit history. Although if your score falls to this range, you might need to take some drastic measures to bring it back up.

Perfection is overrated but aiming for it isnt. Our score doesnt be perfect to get the best terms but our effort should be to achieve an excellent credit score. But if your credit is bad, how do you get there?

You May Like: What Is Cbcinnovis On My Credit Report

Monitor Your Credit Score

Make sure to check your credit score regularly. Many popular provide you with an updated credit score every week, along with an analysis of why your score might have changed. Learn what is likely to raise your score and what is likely to lower it, and avoid anything that might bring your credit score down.

Protect Your Exceptional Credit Score

People with Exceptional credit scores can be prime targets for identity theft, one of the fastest-growing criminal activities.

The average synthetic identity theft loss is $6,000 according to data from Experian.

Credit-monitoring and identity theft protection services can help ward off cybercriminals by flagging suspicious activity on your credit file. By alerting you to changes in your credit score and suspicious activity on your credit report, these services can help you preserve your excellent credit and Exceptional FICO® Score.

Recommended Reading: Minimum Credit Score For Carmax

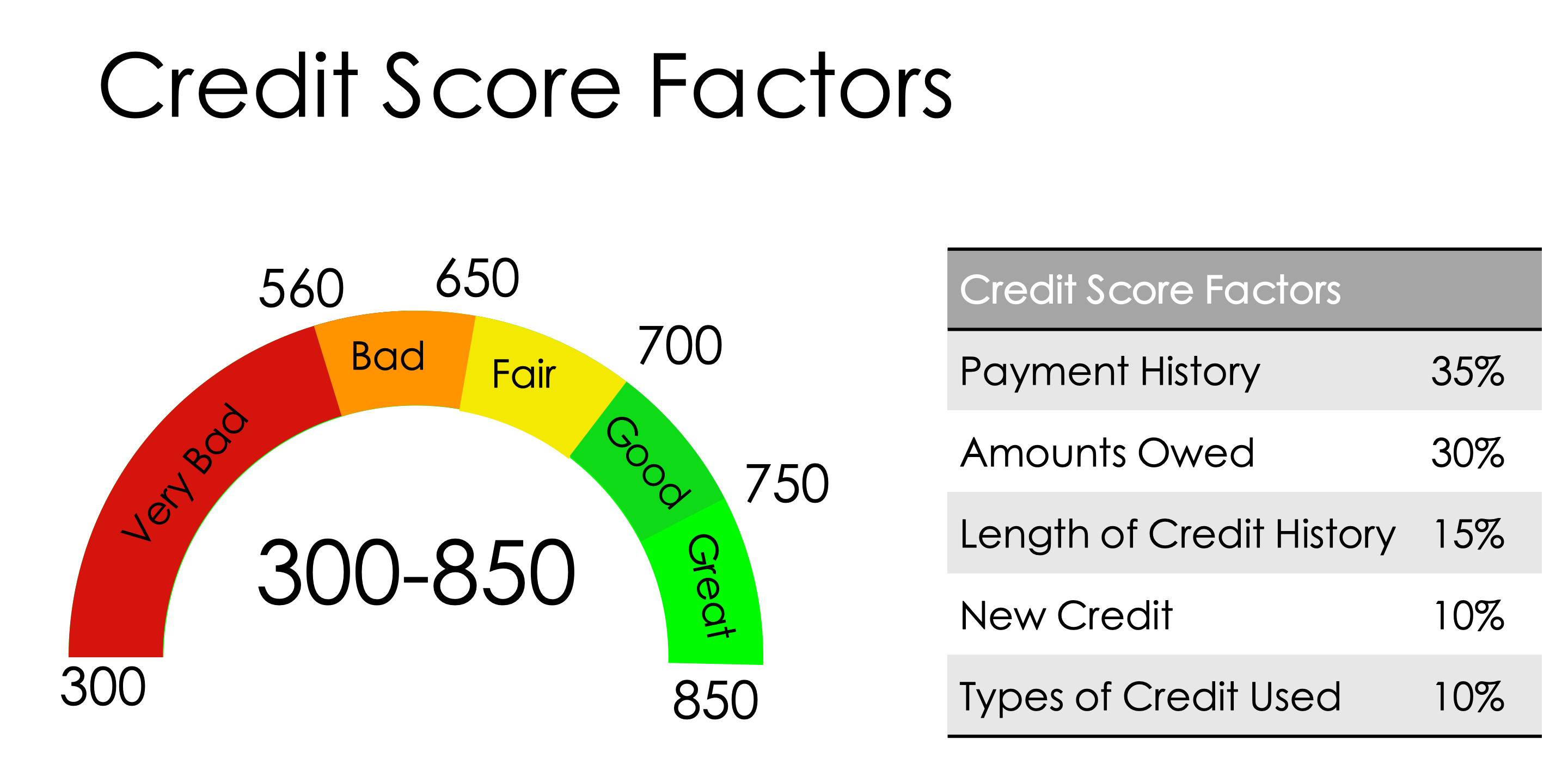

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Recommended Reading: How To Get Credit Report Without Social Security Number

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.

How Do You Get An 850 Credit Score

If you are determined to improve your credit to reach that perfect score for bragging rights, you may have a long journey ahead. There are just a few . If you manage them all well, you can get the best possible 850 credit score.

Start by keeping your revolving credit balances low and consider trying to raise your . These are accounts like credit cards and lines of credit. Some experts a reasonable is when you keep the balance below 20% or 30% of your total available balances. In reality, however, the best balance to get the highest credit score is $0.

At the same time, you should never, under any circumstances, make late payments. You can use automatic recurring payments or sign up for payment reminders to help make sure you dont miss a due date. Just one late payment will keep you from a perfect credit score for at least seven years.

You will also need a large mix of accounts to join the 800+ credit score club. The Self Credit Builder Account counts as one credit line if you are a customer. Perfect credit requires a mix of both revolving credit and installment loans. Installment loans are loans with a fixed payment like student loans, a personal loan, a car loan or a mortgage.

Signing up for new credit can harm your score in multiple ways, and just an application or two in the last two years may keep an otherwise perfect score in the 780-849 range. New stay on your credit report for two years.

You May Like: How Accurate Is Creditwise Credit Score

How To Negotiate Credit Card Payoff

Category: Credit 1. Settling Credit Card Debt | FTC Consumer Information Debt Settlement Companies Debt settlement programs typically are offered by for-profit companies, and involve the company negotiating with your creditors to Feb 17, 2021 How to negotiate debt with your credit card company · Step 1: Understand how

Know The Debt Hierarchy

All debt is not created equally, said Khalfani-Cox. Credit card debt is judged kind of more harshly. You may have heard people refer to credit card debt as the worst kind of debt. Thats because it typically comes with high interest rates and its normally not used to acquire assets, which have the ability to appreciate in value. Lenders look at revolving debt such as credit cards to see the number of cards you have and the balances on those cards to see if you are over-extended or close to maxing out your cards.

The debt that is considered good debt has the ability to help you obtain an asset or make an investment in yourself . That means mortgages and student loans could be considered good debt. Of course, you can still get overextended with a mortgage or student loans. Any debt could be helpful or harmful, depending on your circumstances and how you use the debt.

You May Like: Does Paypal Credit Report To Bureaus

How Good Is A Credit Score Of 750

Youre still well above the average with a 750 credit score, and you wont have trouble opening a credit card or getting a loan. Most lenders consider a 750 credit score to be in the very good range, which is a single step below exceptional.

A 750 score isnt something to worry about, but you may want to work on pushing your score into the 800s. Borrowers with scores in the 800s get the absolute best interest rates and credit card offers. It can be worth the extra effort to improve your score if you want the best of the best. Its usually not difficult to boost your score from 750 to 800. Keep making your payments on time, manage your bills and youll see results.

His Total Credit Limit Is High

Droske’s total available credit limit across his six credit cards was $82,700, according to the credit report he provided. Given Americans have an average credit card limit of $22,751, he has much more available credit to his name yet he’s smart about how he uses it. “You have to use it, but not abuse it,” Droske says.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How Do You Build A Good Credit Score

Building a good credit score requires good credit practices. Heres the five things you will need to do in order to have an excellent credit score.

- Make all your payments on time. Dont miss payments. If you are unable to afford a payment, call your lender and let them know of the situation to see if theyre able to work something out with you. This is a much better option than simply ignoring it!

- Dont take out loans that you cant afford to pay down. This is simple and obvious, but many people miss this and end up in financial straits.

- Use your responsibly. Dont carry large balances month over month. If you can afford to, pay off your credit cards in full every month. Contrary to popular belief, you dont need to carry a balance over to maximize your benefit: you just need to use it and pay the payment when its due.

- Build a good mix of credit over time. This doesnt mean go out and get a student loan, car loan, and a mortgage all at the same time Instead, youll want to take on different types of debt one at a time, while having various types of debt within 7 years.

- Keep old credit card accounts open. If you want a new card with better points or cash back benefits, call your bank and see if theyll upgrade your card on the same account.