Try Not To Move House Too Often

Lenders place less trust in those that keep moving house. When you apply for credit you’ll be asked to list the addresses you’ve lived at in the last three years. Your credit report also lists addresses that you’ve been linked to.

It is also worth checking the report and your application for typos and consistency as any inconsistencies could also damage your credit score.

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The Importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, the following guidelines can help determine if youre on the right track.

How Hard Credit Pulls Affect Your Credit Scores

Hard inquiries show other lenders that youre looking to borrow money. These inquiries usually show up on your reports when a financial institution checks your credit as part of a lending decision like when you apply for a mortgage, auto loan or credit card. According to credit-scoring company FICO, a single hard inquiry may lower your FICO score by up to five points and remain on your credit reports for up to two years.

Recommended Reading: Paypal Credit Hard Pull

Naughty You : Going Insolvent

Oh dear. If youve got a bankruptcy on the books youre the lowest of the low as far as credit scores go. The good thing is that it cant haunt you forever. When you can get credit again, make sure you pay your bills on time every time to resurrect your credit score. Potential mark down: 400 points.

Differences Between Hard And Soft Inquiries

Soft inquiries, also known as soft pulls, which never have any effect on credit scores, often come from:

- Companies obtaining names and addresses from the credit bureaus to make promotional credit offers to qualified consumers.

- Consumers accessing their own credit reports and scores.

- Requests for credit-based insurance scores.

- Rental property applications.

Hard inquiries, also known as hard pulls, which can hurt your score, are most often the result of:

- Follow-up credit evaluations after a promotional credit offer is accepted.

- Rental property applications.

Recommended Reading: How To Get Credit Report Without Social Security Number

Maxing Out Your Credit Cards Each Month

Lets say you pay your bills early every single month and never miss a payment, but you cant help but rack up balances that continue growing every month. This can be a huge problem for your credit since the amounts you owe in relation to your credit limits, called , make up 30% of your FICO score.

Whats the problem? According to myFICO.com, credit score formulas see borrowers who constantly max out their cards as a potential risk. Thats why its a good idea to keep low credit card balances and not overextend your credit utilization, they report.

Whats the best utilization rule? Credit reporting agency Experian says you should strive to keep your credit balances below 25% to 30% of your limits to achieve the best results. This means that, if your total credit limit across all your is $10,000, you should never owe more than $2,500 to $3,000. If you maintain balances higher than that in relation to your credit limits, you should fully expect your credit score to take a hit.

What Is A Bad Credit Score Uk

What is a bad credit score? Its a great question. What were really asking is, is my credit score lower than it should be? and how does my credit score rank? In understanding the answer, we must first appreciate that there are three main credit reference agencies in the UK: Experian, Equifax & Call Credit.

They all have different criteria as to what they consider a good score and apply different weightings, so you might find that you fare better with some credit reference agencies and worse with others. Here are a few rough guides to get you started:

| Experian |

|---|

You May Like: Capital One Authorized User Credit Report

Issues With Your Address Can Cause Mistakes On Your Report

To help make sure all the information on your report is correct itâs important that all your active credit accounts are registered under the same address. Itâs really easy to change your address â it usually just involves giving your lender or bank a call, or logging into their app or online banking site to update your details.

Whats The Best Way To Improve Your Credit

Whether you have a credit score of 850 or 550, there are several steps you can take to prepare yourself to meet with a mortgage lender as you begin your search for a new home. Improving your credit isnt a one-and-done project but rather something you can and should be doing at all times to be better prepared for significant purchases.

Recommended Reading: Syncb Ppc

How Credit Card Debt May Affect The Home Buying Process

Credit card debt can impact your ability to qualify for funding when seeking a mortgage. Thats partially because the cards interest rates can spiral out of control if payments are missed. Getting a mortgage with credit card debt is really all about determining the risk you present to the lender.If youve been paying your bills and credit cards on time every time that will help. Here are the other key factors mortgage brokers consider when exploring your financial history:

- Loan eligibility

- Tax payment history

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.

Don’t Miss: Speedy Cash Change Due Date

Am I On The Electoral Roll

If you want to check if you are registered on the electoral register you will need to contact your local Electoral Registration Office.

Alternatively, you can enter your postcode into The Electoral Commissions website and this will help you find your local Electoral Services office. The website should also give you an email you can use to contact the registration office, and they can let you know if youre registered to vote or not.

How Credit Scores And Credit

Since their development in the 1990s, insurance companies have been able to use to help determine who to offer insurance to and how much to charge in premiums. Similar to the credit scores that lenders use, credit-based insurance scores are based on your credit report and show the relative risk of working with different people. But that’s just about where the similarities end.

The scores that FICO® and VantageScore® develop for lenders predict the likelihood that someone will be 90 days past due on a bill within the next 24 months. But insurance scores predict the likelihood that someone will file an insurance claim.

You May Like: How Bad Is A 500 Credit Score

Does Your Credit Score Follow You To Other Countries

The simple answer is yes or at least, it can do. Remember that your credit score is not a universal thing. In the UK we have three main credit agencies Experian, Equifax and Call Credit. Each of these credit agencies track your credit information separately and they come up with a score based on their own scoring systems.

In the USA, for instance, there is a different credit rating agency who have their own credit scoring algorithm, and most other countries have their own ways of handling peoples credit histories.

In that respect your credit score with Experian is entirely independent of where you live. If you move to France that wont change what information is on your file with Experian. The real question of course is whether your credit information follows you

In principle, your credit history shouldnt follow you overseas. If you go and live in Europe for a year and then come back, there is no reason why credit agencies need to find out.

Your Credit Report ‘influences’ If Youll Be Approved And What Interest Rate Youll Get

MoneyHub’s Top 3 Lenders – Avoid high interest rates and high fees with our top three trusted lenders.

- Our car finance and personal loans research highlighted three leading lenders that reliably and consistently offer fair interest rates to the majority of borrowers.

- We suggest contacting Harmoney, Simplify Loans and Lending Crowd to see what interest rate they will offer.

- Applying takes only a few minutes for each site. There is no obligation to accept any loan offer and your .

- The more you compare , the better chances you have of finding the best deal and financing your car for the lowest price.

- Remember, its the interest rate you agree to now that makes a huge difference when you repay your car loan week after week. Signing up for finance with a car sales person is unlikely to be the cheapest option.

| Lending Crowd |

Don’t Miss: Why Is There Aargon Agency On My Credit Report

The Electoral Register And How It Influences Credit Scores

There are many factors that can affect your credit score and they will vary lender by lender, but there are certain steps you can take that are likely to have a positive impact on the amount of credit you can obtain. Being on the electoral register is one of these steps and is something anyone looking to get a loan, mortgage, a , a mobile phone contract or other financial commitments should know about.

Heres what the electoral register is, the consequences of not being on it, how to get on the register and how it may affect your credit score.

What If I Move Abroad Does My Credit Score Follow Me To Another Country

Unfortunately, no. When you move abroad, your credit data will not be transferred there. So at first, you may find it hard to get approved for credit and some services in your new country. This is because they wonât have much or any credit information about you, and they usually canât ask UK CRAs for access to your data. The exception to this may be if the company is based both abroad and in the UK.

You may want to get a copy of your Experian Credit Report to take with you when you go. You can show this to potential lenders, although itâs up to them whether they take the information into account.

Once youâve built up a credit history in your new country, you should find it easier to get approved by companies as theyâll have enough information to assess you.

Recommended Reading: How Long Does Repossession Stay On Credit Report

Covid + Credit: Steps You Can Take Now

One important thing you can do right now is to ensure your current are accurate and reflect any forbearance or deferred payment agreements you may have reached with your lenders. You can get six free copies of your Equifax credit report each year when you sign up for a myEquifax account. You can also get your free weekly credit report through www.annualcreditreport.com. These reports are included in the free weekly Equifax credit reports currently offered on www.annualcreditreport.com through April 2022. If you see something that appears to be inaccurate, you can dispute the information you believe to be inaccurate or incomplete.

Naughty You : Having No Credit History

You might think youre goody two shoes for never having taken credit out. The reality is that youve not shown that youre good at making repayments. If youve been paying your electricity bill on time for 12 months your score could go up by around 80-100 points.

We know things can go wrong in peoples lives. When it comes to credit scores you can turn it around. But that means taking positive action to change your ways. If you think you can do it, you will. We have faith in you.

Don’t Miss: What Is Factual Data On Credit Report

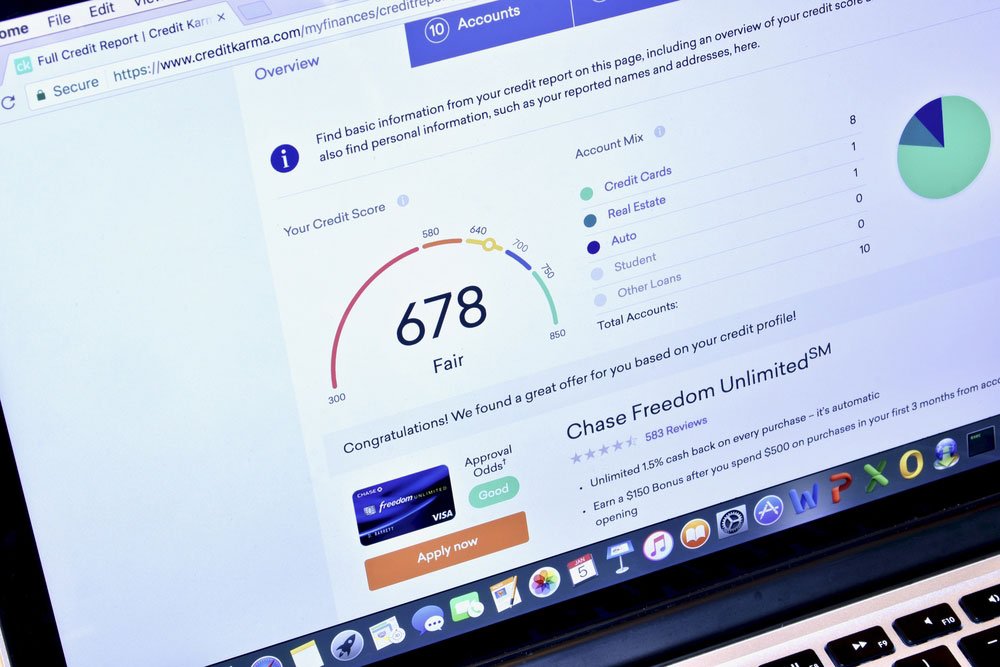

Tracking The Credit Score Trajectory

According to ExperianTM, your credit score can slide by 5 points just by having your lender pull your credit. Thats because a credit check due to an application is known as a hard inquiry.

Then once you actually take out the mortgage, your score is likely to dip by 15 points up to as much as 40 points depending on your current credit. This decrease probably wont show up immediately, but youll see it reported within 1 or 2 months of your close, as your lender reports your first payment.

On average it takes about 5 months for your score to climb back up as you make on-time payments, provided the rest of your credit habits stay strong. Nationally, the average cycle from decline to recovery is just under a year.

Does Changing Address Damage Your Credit Score

No. Moving to a new address does not change your credit score. However, the risk profiles used by lenders do take into consideration the length of time you have been at the same address . Frequently moving from one address to another may not hurt your credit score, but to a lender you may look less like a stable, creditworthy customer.

Experian, for example, are explicit about a change of address having no effect: “Addresses have no impact on your credit worthiness or your credit scores”.

Also Check: Does Paypal Credit Affect Credit

Understand The Terms Of Your Forbearance Or Deferment

Be sure to request a copy of the agreement you make with your lender, as it’s important to fully understand the terms of agreement and have it on hand to refer back to. Your agreement will also explain whether interest will continue to accrue while your account is “on hold.” Your account may not accrue interest in deferment, but a forbearance status may increase the amount you owe because interest may continue to accrue while payments aren’t being made.

Finally, you’ll want to plan for how you will begin repayment once your deferment period ends. Even though you may not be able to make full payments at this time, any money you can set aside towards your mortgage now can help ease the transition once you resume making those payments.

Thanks for asking.Jennifer White, Consumer Education Specialist

This question came from a recent Periscope session we hosted.

Can a Lending Circle Help You Build Credit?

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well.

Resources

Get the Free Experian app:

How To Prepare Your Credit For Heloc

Resolve Other Debts: Too many open credit accounts can decrease your credit score. Its a good idea to pay off other debts before taking out a HELOC. This will help offset overextending your total credit line,negatively affect your credit utilization ratio, and ultimately your credit score.

Existing Equity: One of the most significant factors in obtaining a HELOC, according to Christopherson, is having 15% to 30% of equity already in your home. This is one of the most significant factors in how much you can ultimately borrow, which is usually 85% of your combined loan-to-value ratio, she says.

Your debt-to-income ratio is an indicator of how much debt you can take on and is a figure most lenders look at outside of your credit score. Most lenders prefer a DTI to be lower than 43%. If more than 43% of your income is towards debts owed, you will want to work on lowering that amount first before taking on another loan like a HELOC.

Read Also: 524 Credit Score Good Or Bad