Reviewing Your Heloc Credit Score

Building credit and contributing to your credit score doesn’t happen overnight, but with a few adjustments to your personal finances, you can make steady progress and hopefully qualify for a lower interest rate or better terms on your next loan or line of credit.

Here are some quick tips for maximizing your credit score:

1. Make sure your credit reports are accurate. Whether or not you’re applying for a HELOC, everyone should check your credit reports each year. You can get a free credit report from each of the three major consumer credit reporting companies at AnnualCreditReport.comwhich is the official government-approved site. Check your credit report for errors, such as accounts fraudulently opened in your name, or payments that were incorrectly reported as late. If there are errors, you can contact the credit reporting company and ask to have the records removed.

2. Avoid late payments. Payment history makes up a big part of your credit score, so it’s important to pay your bills on time. Even if money is tight and you cannot afford to pay more than the minimum on a credit card, make sure to pay the minimum amount on time.

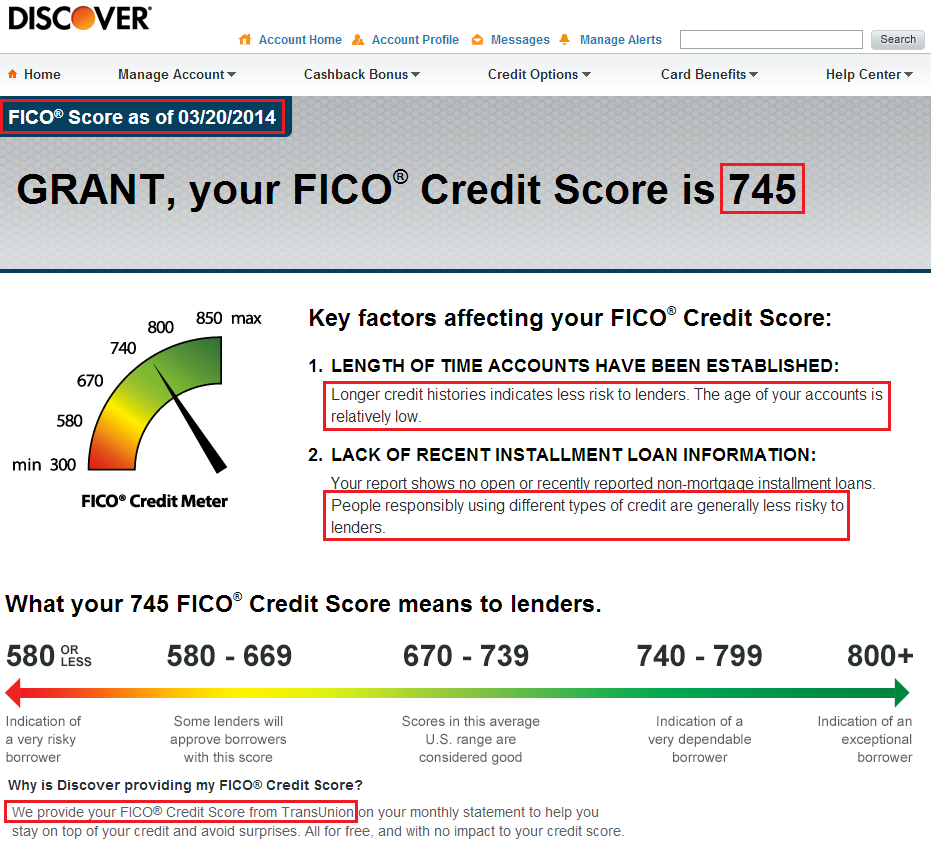

3. Build your credit age. Length of credit history or credit age” is another key factor in your credit score. If you have had a few credit accounts open for several years, don’t cancel them or allow them to lapse keep those accounts active so you have a longer track record in your credit history.

$0 Application Fees.

Discover Credit Line Increase

Requesting a credit line increase from Discover is a pretty easy task. The hard part is predicting what the outcome of your request will be, though.

In this article, Ill break down how to request a Discover credit line increase and also provide you with some data points I found showing you how much of an increase you can expect and what type of credit score you may want to have before applying for an increase.

Do I Need A Credit History To Apply For A Discover Card

Discover markets specific cards to people with little-to-no credit history or credit history in need of repair. Students can consider the Discover it Student Cash Back Card which is geared toward people with short or non-existent credit history. The Discover it Secured card is also a good option to consider if you have a short credit history or need to improve your credit.

Also Check: When You Dispute Credit Report What Happens

Discover It Student Cash Back

The Discover it® Student Cash Back is basically a student version of the Discover it® Cash Back. You’ll earn the same 5% cash back on up to $1,500 spent in rotating quarterly bonus categories after activation, then 1%. You’ll also earn 1% cash back on everything else you buy .

If you’re a student with little or no credit history, check out our guides to the best credit cards for students and best starter credit cards. You can also read about why some parents add their children as authorized users to give their credit scores a boost.

There aren’t many student credit cards that come with an introductory APR, but the Discover it® Student Cash Back offers a 0% intro APR for 6 months on purchases, followed by a 14.49% – 23.49% Variable APR. You might want to take advantage of this if you have big expenses, like textbooks or dorm decor, that you can’t pay off all at once.

How Does A Discover Credit Card Work

Discover credit cards operate just as you would expect. The issuer offers credit cards for every type of credit and allows you to prequalify with no harm to your credit. You can apply online, over the phone, or by responding to a prescreened offer in the mail.

The application process is quick and should provide you with a decision instantly. If you are accepted, Discover will expedite the shipment of your new rewards card so it arrives within five days.

The credit limit on most Discover unsecured credit cards is determined by your credit history, but the secured cards limit depends on the amount of your security deposit.

The two student credit cards do not require you to have any credit history. Your credit limit establishes how much you can charge on your card, withdraw in cash advances, and allocate to balance transfer offers.

As with virtually all credit cards, Discover cards have a grace period of at least 23 days between the statement closing date and payment due date. Pay your full balance before the end of the grace period to avoid interest charges.

If you prefer, you can finance your purchases over multiple billing periods. Just be sure to pay at least the minimum amount by the due date to avoid late fees . The APRs charged by Discover for carrying a balance across billing periods are very competitive with those of rival credit card companies.

Recommended Reading: How To Bring Up Credit Score Fast

Checking My Credit Score Lowers My Credit Score

False. Though 93% of millennials are aware of their credit score, this is probably the most common myth. Monitoring your score helps you track progress when building credit, but it is important to check it the right way.

Checking your credit score is considered a “soft pull,” which doesn’t affect your credit score. Actions, such as applying for a credit card, which requires a “hard pull,” temporarily dings your credit score.

“If you’re checking it from a legit source, like the credit bureaus themselves, then it won’t hurt,” Ulzheimer tells Select. “If you have a buddy who works for a car dealership or a mortgage broker, and they pulled your credit as a favor, everyone is going to think you’re applying for credit and the inquiry could lead to a lower score.”

You can check your credit score for free with most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey, which are available to everyone.

Read more:How to check your credit score for free and Here’s how often your credit score updates.

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Don’t Miss: How To Get A Collection Off Of My Credit Report

Which Credit Bureau Is Most Accurate

In the U.S. Equifax, TransUnion and Experian remain the three largest consumer credit reporting agencies. Credit reports provided to banks, companies and authorized parties by bureaus like these allow lenders and landlords to assess the potential risk of lending or leasing. Each year the industry makes sizable profits by selling credit informationâusually provided to agencies by banks and other lenders.

Reports on the same individual obtained from different bureaus are unlikely to be the same. Reports differ for myriad reasons. This makes it nearly impossible to determine which credit bureau is the most accurate. The FICO credit score system is used by most major lenders to estimate your creditworthiness.

Since each score falls within a range , extreme differences between FICO scores issued by credit bureaus are unlikely. Minor differences may occur due to differences in the way the score is tabulated.

Discover It Balance Transfer: Best For Balance Transfers

- What we love about the Discover it Balance Transfer: After the balance transfer intro offer ends, the card essentially becomes similar to the Discover it Cash Back and earns cash back on its rotating calendar.

- Who this card is good for: Debt reducers who want to take advantage of an 18-month intro 0 percent APR offer on balance transfers and pay off credit card debt.

- Alternatives: If you need longer than 18 months to pay off your balance without interest you might opt for a card with a longer, introductory balance transfer period like the Citi® Diamond Preferred card. Despite the Diamond Preferred cards higher regular APR of 15.24 percent to 25.24 percent variable, cardholders with a large balance to carry may benefit from the additional three billing cycles.

Read our full Discover it Balance Transfer card review.

Also Check: How Do You Find Out What’s On Your Credit Report

What Do The Credit Bureaus Say

As you might expect, the three credit bureaus decline to disclose which card issuers purchase their credit reports. Similarly, the Consumer Data Industry Association, a trade group representing credit bureaus, says it also is unable to shed light on the credit bureaus used by card issuers.

Tip: A hard inquiry lowers your credit score, albeit by a small amount. This is because it can send an uncertain signal to a potential lender. For instance, why did you apply for new credit? Are you going to max out a new credit line? This is why its important to only apply for credit when you need it.

Full Review Of Discover Personal Loans

Discover offers unsecured personal loans that can be used for almost any purpose for borrowers with excellent credit .

The online bank provides a quick and fully digital application process. If approved, Discover can deposit the funds in as little as one business day, and borrowers can manage loan payments from the Discover mobile app.

Discovers rates do not include an autopay discount. However, the lender has other perks, like a wide range of repayment terms, refinancing options, a free monthly credit report and a 30-day loan guarantee.

Also Check: How To Get Credit Cards Off Credit Report

Selecting ‘credit’ While Using My Debit Card For A Purchase Helps Raise My Credit Score

False. If you choose “credit” instead of “debit” next time you’re at the cash register, know that your credit score will not be affected in any way since your debit card activity does not get reported to the credit bureaus. Debit cards have no effect on your credit history nor credit score, so whether you use your debit card as debit or credit, the money is still withdrawn directly from your checking account.

Don’t miss:

Discover Credit Cards Overview

Discover offers a small but powerful collection of mostly consumer credit cards. Unlike many issuers out there, Discover is not known for its high-end travel rewards cards. Instead, Discover features several solid cash-back cards and is well-regarded for its first-year welcome bonus, Discover Cash Back Match. Discover matches cash back earned in a cardholderâs first year of account ownership at the end of the first year.

You May Like: Will Paying Off My Student Loans Increase My Credit Score

A Perfect Credit Score Doesn’t Really Matter

True. While it would be fun to say you are in the elite 850 club, there are no additional benefits of having a perfect score. No loan and credit products exist that are only available for people with perfect scores, and once you reach a certain score, you pretty much get all the same benefits anyways.

“If you have a 760 or above, you’ll likely qualify for the best deals on everything,” Ulzheimer says.

How To Decide Between Earning Cash Back And Transferable Points

Any time you apply for a new credit card, its important to understand how it fits into your broader strategy. When it comes to deciding between earning airline miles or cash back, there are two important facts to be aware of. The first is that, with few exceptions, miles are going to be worth more than the equivalent amount of cash back. Ill take 1 mile per dollar over 1% cash back any day, on just about every airline I fly with. The other fact is that miles take more effort to redeem well , and your time is worth something, too.

If youre willing to put time into studying airline award charts and learning the ins and outs of transferable points, you can get a much higher return on your spending pursuing those rewards, especially for long-haul premium cabin travel. But if youre looking for simplicity, cash back might be a better option.

Of course it doesnt have to be one or the other theres room for both cards in a comprehensive award strategy. No matter how hard we try to keep our travel free using points and miles, there will be some expenses that simply require cash including taxes , tours, food and drink and other expenses that your points cant easily cover. Having some cash-back rewards at your disposal can help you keep your out-of-pocket costs as low as possible when traveling.

You May Like: Is 746 A Good Credit Score

What Do Credit Card Users Say

Melinda Opperman, president and chief relationship officer at Credit.org, a nonprofit agency that provides credit counseling and related services, says her organizations review of online forums and discussion boards indicates American Express, Discover and U.S. Bank rely mostly or solely on Experian, whereas Barclays and Goldman Sachs depend primarily or only on TransUnion.

Heres how the credit-reporting landscape looks for other card issuers, according to Credit.org:

- Bank of America: Experian or TransUnion

- Capital One: Equifax, Experian and TransUnion

- Chase: Equifax, Experian and TransUnion

- Citi: Equifax and Experian

- Wells Fargo: Equifax, Experian and TransUnion

Opperman warned that this information only represents a quick survey of what users report. So it could differ from what you experience when applying for one of our best credit cards.

Nonetheless, visiting online credit card forums and discussion boards can give you a sense of which credit bureau will help decide the fate of your application.

Discover’s Credit Card Application Rules

Discover has a few firm credit card application rules that determine whether you’re eligible for a new card:

- You can have a maximum of two Discover credit card accounts.

- Your first Discover card must be open for at least one year before you can open a second.

- You can only have one student credit card with Discover.

No matter your credit score, you can’t get around these application rules. If you opened a Discover card three months ago, you need to wait another nine months before applying for a new one. And if you have two Discover cards, you can’t get a new one. You would need to cancel one to open another.

Don’t Miss: Does Cancelling Finance Affect Credit Rating

Best For Gas And Dining: Discover It Chrome Card

- No credit score required to apply.

- Intro Offer: Unlimited Cashback Match – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places each quarter like Amazon.com, grocery stores, restaurants, gas stations and when you pay using PayPal, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases – automatically.

- New! Discover helps remove your personal information from select people-search websites. Activate by mobile app for free.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 14.49% – 23.49% applies.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Read Also: Is 738 A Good Credit Score

Why The Data Matters

Whether your credit is poor or pristine, all three of your credit scores from Equifax, Experian, and TransUnion will reflect similar scores, yet differ ever so slightly.

Being on the cusp of fair to good credit could make all the difference in getting accepted or rejected for a loan or credit, especially if, for example, your Equifax report reflected the poorer end of your credit history.

And in the case of Discover, a credit card provider with high approval standards, its imperative to have stellar credit when seeking out a card from their portfolio.

Were here to help you identify which credit report and credit bureau are the most applicable for affecting your approval rate for a provider like Discover.

Noting that, taking the steps to boost your credit through all three credit bureaus keeps your credit healthy, plus greatly improves your chances of approval the most for any loan or credit product you pursue.