How Is Technology Integrated Within The Social Credit System

New innovations in technology are poised to play a large role in the countrys social credit system. Artificial Intelligence facial recognition software is said to be currently utilized in tandem with over 200 million surveillance cameras in China.

Some argue that the purposes of large-scale surveillance measures is to give Chinese officials the ability to track their citizens in every facet of everyday life: In turn providing masses of data to determine whether an act worthy of being blacklisted has occurred.

Along with these physical surveillance measures, the Chinese government continues to track the online behaviors of its citizens. There are a plethora of violations Chinese officials may be looking for, including evidence of writing and sharing anti-government ideologies.

The AI software is able to do the majority of this work on behalf of the government and alert officials when a violation has occurred. The technology has advanced to a place where the AI can identify videos of anti-government protests and block users from viewing them.

Businesses must be cautious when navigating Chinas compliance laws as well, as their internet data may be used against them in the event of a violation. Data that reveals a companys lack of compliance in regards to contractual obligations are factored into and can play a significant role in determining the companys social credit score.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

How Does The China Social Credit Work

The China social credit system rates individuals based on the aggregation and analysis of data. In some trials, this has involved a single numerical score , or a letter grade .

This information is acquired from a range of sources including individual businesses and government entities. Some of the information is siloed, and accessible only by the individual regional or central government authority. But in many cases the information is shared with other regulators through a centralized database, such as NCISP.

For example, some of the factors that can be considered in giving a corporate social credit rating include:

- Whether the business has paid taxes on time

- Whether the business maintains necessary licenses

- Whether the business fulfills environmental-protection requirements

- Whether the business meets product quality standards

- Whether the business meets requirements specific to their industry.

It is important to note is that businesses scores may decrease based on the behavior of their partners. This means enterprises need to think very carefully about who they do business with in China.

Don’t Miss: Does Pre Approval Hurt Credit Score

Whats Your Social Credit Score

WebFX Team

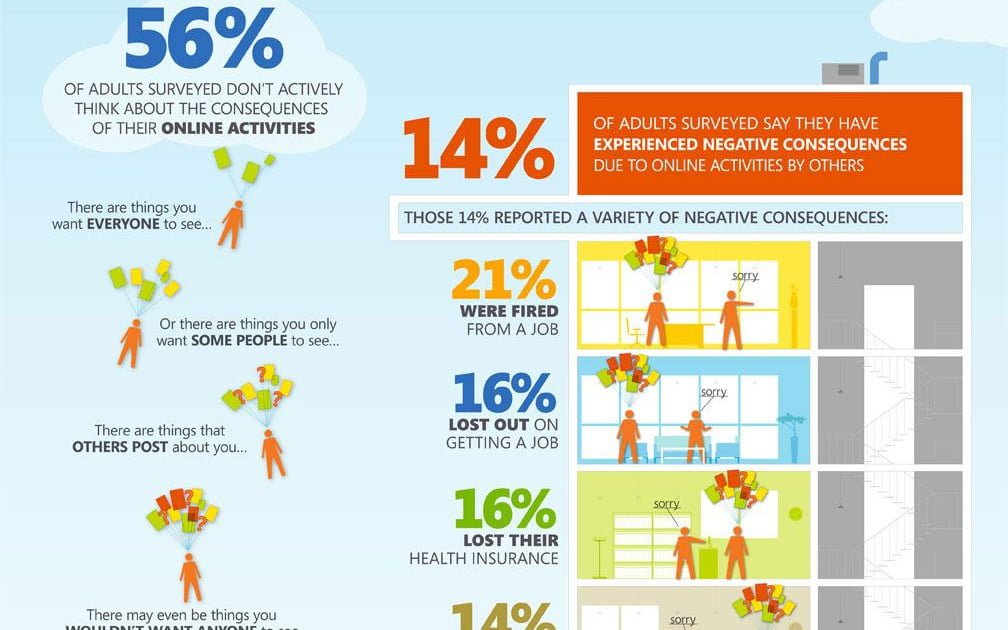

Can your social media activity play a role in determining your credit score? At the moment, credit scores in the US are determined by five factors, none of which have anything to do with your online activity. However, according to a report from the Wall Street Journal, some lenders are beginning to use Facebook and other social media sites to verify the identities or worthiness of loan or credit applicants.

Surprisingly, for some lenders, this kind of behavior is nothing new. Read on to learn how some companies are using your social media profiles or activity to determine whether or not you have a high social credit score and are worth the risk of a loan.

< img alt=How is Your Social Credit Score Calculated? src=https://www.webfx.com/wp-content/uploads/2021/10/social-credit-score-infographic-scaled.jpg /> < br /> < br /> Created by < a title=WebFX href=https://www.webfx.com/> WebFX< /a> According to research done by The Wharton School of the University of Pennsylvania, there are a growing number of credit companies using social media data to assess the credit risk of applicants. Kabbage, Neo Finance, Wonga, and Kreditech are only a few of the lenders that have adopted this practice.

Curious to know what role your social media activity plays in determining your creditworthiness? Heres how it works: lets say you apply for a loan with one of these four companies. Theyll begin by checking traditional factors .

How is your websites SEO?

WebFX Careers

What Does This Mean For China

The full extent of the impact on social credit to Chinese citizens is impossible to say, simply because the system doesn’t fully exist yet. Zeng suggests the reality is somewhere between the government’s claims and the Western media’s description of horror-filled dystopias. “It’s a very like a baby step,” she said of the work that’s happened so far.

Ohlberg agrees that early reporting had multiple errors that led to misunderstandings of the system but that doesn’t mean social credit isn’t dangerous. “It’s somewhere between the people who say the media coverage is inaccurate and that means it’s not so bad and the people who see this huge dystopia,” she says. “You have to find this space between that were you can explain it is actually quite scary, even if it’s not quite the way it’s portrayed.”

Because of that, no other country should be considering this idea, says Hoffman. “The west should not copy any aspect of social credit,” Hoffman says. “Often comparisons are drawn between private applications like Uber and its rating system for customers and drivers. While these private company systems are extremely problematic in my view, they are fundamentally different. The Peoples Republic of China is an authoritarian country, the Chinese Communist Party is responsible for gross human rights violations for decades just look at the example of Xinjiang now. There is nothing any liberal democratic society should even think about copying in the social credit system.”

You May Like: 24 Hour Inquiry Removal

Chinas Social Credit System Was Due By 2020 But Is Far From Ready

Six years after the government announced plans for a national social credit score, Chinese citizens face dozens of systems that are largely incompatible with each other. The central government is planning an overhaul.Pedro Serapio Pixabay

Research and planning for a national credit score in China started in 1999, according to Lin Junyue, one of the most important minds behind the system. It began as a research project led by the World Economics and Politics Institute of the Chinese Academy of Social Sciences.

China needed a social credit system, Mr Lin explains in an article, in order to regulate counterfeiting and fraud on the market. It would help Chinas transition to a credit economy, where non-cash based tools like credit cards would be essential.

The System Has Been Likened To Dystopian Science Fiction

China’s social credit system incorporates a moral edge into the program, which is why many have compared it to some level of dystopian governance, such as in George Orwell’s “1984” in which the state heavily controls every aspect of a citizen’s life.

But despite that Human Rights Watch called the system “chilling,” while Botsman called it “a futuristic vision of Big Brother out of control” some citizens say it’s making them better people already.

A 32-year-old entrepreneur, who only gave his name as Chen, told Foreign Policy in 2018 that “I feel like in the past six months, people’s behavior has gotten better and better. For example, when we drive, now we always stop in front of crosswalks. If you don’t stop, you will lose your points. At first, we just worried about losing points, but now we got used to it.”

Don’t Miss: What Card Is Syncb/ppc

Social Credit System And The United States

The precursors for social credit are alive and well in the United States. There are punishments socially and legally for those who do not comply with the increased secularization and acceptable political viewpoints. You can be punished if you do not affirm gender fluidity and LGBTQ with losing a job, having your social media accounts suspended, bank accounts denied, etc. It goes on and on.

- For more such headlines, see the CARM article List of news media articles categorized by topics.

One Country Two Credit Systems

However, in 2012, Chinas National Development and Reform Commission , one of the central governments most powerful administrations, rode on the credit system wave to create a social integrity score . This project was not limited to financial credit but covered thoroughly the social and political realms as well. At the same time, Chinas central bank was building a financial credit system, akin to a credit bureau. It formed a pattern of parallel construction of two systems, Mr Lin wrote in another article.

In 2014, the central government published the first major announcement about the social credit system. The document reflected the two dimensions of the project, moral and financial. It said that China in a critical period of economic and social transformation. The construction of a social credit system is an effective means of enhancing social integrity, promoting mutual trust and reducing social conflicts, and is an urgent requirement for building a harmonious socialist society. Conflating the two dimensions without offering more detailed guidelines left ample room for interpretation.

Meanwhile, both NDRC and the central bank kept on working on their respective projects. NDRCs political-social score garnered much criticism in European and US media, which often conflated it with the overall governmental project.

Don’t Miss: Usaa Experian Credit Monitoring

Coming Soon: America’s Own Social Credit System

The new domestic War on Terror, kicked off by the riot on Jan. 6, has prompted several web giants to unveil predecessors to what effectively could become a soft social credit system by the end of this decade. Relying on an indirect hand from D.C., our social betters in corporate America will attempt to force the most profound changes our society has seen during the internet era.Chinas social credit system is a combination of government and business surveillance that gives citizens a score that can restrict the ability of individuals to take actions such as purchasing plane tickets, acquiring property or taking loans because of behaviors. Given the position of several major American companies, a similar system may be coming here sooner than you think.

Peer pressure, trendy movements, and the ability to comply with the new system with the click of a mouse combine all of the worst elements of dopamine-chasing Americans. As it grows in breadth and power, what may be most surprising about our new social credit system wont be collective fear of it, but rather how quickly most people will fall in line.

Historical Background To The China Social Credit System

While the introduction of a unified China social credit system was formally announced in 2014, precursors to the proposed social credit system have operated within China for centuries arguably millennia. The idea, or philosophy, behind social credit, might be traced back to the warring states period of Chinese history. At that time, various schools of thought competed for dominance:

- Confucianism

- Confucius advocated a holistic conception of human nature where individual well-being was connected to good character, and the proper functioning of society as a whole.

- Mohism

- Mozi suggested that all humans should care for each other equally, and advocated a society where all were treated impartially.

- Legalism

- This school, , emphasized the importance of laws, strictly enforced from above, in order to preserve social order.

Though arguably legalism won out, all three of these schools influenced the first imperial Qin dynasty . It is within this dynasty that a meritocratic assessment and promotion system was applied across the imperial bureaucracy in order to achieve a well-functioning Chinese state. Arguably, this was a rudimentary social credit system, albeit one applied only to civil servants, and without a precise score.

This file has been used for a range of decisions affecting an individual, such as promotions and access to passports.

You May Like: Credit Score Serious Delinquency

Progress On The China Social Credit System In 2021

2020 was the original target year for implementation of the China social credit system. However, a range of factors, including the impact of Covid-19, has delayed the full establishment of the system.

Throughout the course of 2020, there were four significant variations to the social credit system in response to the pandemic. Note, these changes were not applied nationally, but regionally and by municipal governments, depending on how they were impacted by the Pandemic. These included:

- 1. Exemptions from Penalties

- Individuals or corporations that could show that breaches of contractual or tax obligations were due to Covid-19, were made exempt from the penalties for doing so.

- 2. Social Credit Rewards for Entities Contributing to Containment of Covid-19

- Companies which could demonstrate a decisive contribution to the fight against Covid-19 were eligible for certain rewards. This included inclusion on a green list which streamlines administrative issues for that business.

- 3. Penalties for Companies Exploiting the Pandemic or Breaking Restrictions

- Any businesses that could be demonstrated to have exploited the pandemic , or the breaching of Quarantine and other Coronavirus restrictions, were penalized.

- 4. Simplified Loan-Granting Procedures

- In certain cases, individuals or entities in industries heavily impacted by Covid-19 had simplified and speedier access to credit.

- Registration

Digital Vision Meets Analogue Reality

SoCS implementation in the 28 model cities has highlighted how many of the fundamentals needed for a genuinely high-tech system e.g., a shared information system, consistent data formatting, etc. are incomplete. Instead, the SoCS relies heavily on human information collection and low-level digitisation often little more than the use of Excel worksheets or the WeChat app.

Municipal scoring systems remain rudimentary and resemble incentivised loyalty programmes like those run by airlines. Participation is fully voluntary, and there are no negative incentives beyond losing access to minor rewards. For fear of overreach and pushback, central authorities have banned punishments for low scores and minor offences.28

A tiny percentage of people have taken part over the three years of development. In Xiamen, only 210,059 users activated their account Wuhu has 60,000 , and Hangzhou 1,872,316 and even fewer regularly use them.29 Scores are also not shared between cities as each one uses different scoring criteria and mechanisms, though some cities have signed conversion agreements.30

Data-inflation exists on a huge scale. Many model cities have reported collecting over a billion pieces of information , but much of it is low-quality data or irrelevant to social credit, even in its broadest notion. Our investigation shows that even model cities generate at most one to two pieces of actual credit data per capita .32

Recommended Reading: What If My Credit Score Changes Before Closing

Ensuring That All Societal Actors Play By The Rules

From the start, the SoCS had a wide remit to target individuals, enterprises, social organisations, and government organisations . Only CCP organisations are exempt. However, the main target group has been companies, in line with the overall policy goal of increasing public trust in commercial products and services and in Chinas market economy.

Ensuring companies comply with law and regulation is achieved through both centralised tracking of violations and a patchwork of sector- and region-specific rating systems.

Foreign enterprises with a registered presence in China are included in the SoCS system on equal terms with their Chinese counterparts. Social organisations remain a small group in numerical terms, but their inclusion is important to note as it also affects foreign NGOs with representative offices in China.

In dealing with individuals the SoCS is largely focused on debt repayment. Despite this, major violations of laws are also tracked and sanctioned. Foreign individuals with residence in China have occasionally been affected, especially in their function as legal representatives of a company or for debt default.12 Government agencies are also a target group, especially in cases of local government debt and contract defaults, but overall efforts have focused on assessing their performance and incentivising them, rather than sanctions. Ultimately, the different target groups of the SoCS should be considered as pillars of one, albeit fragmented system.

The Credit Scores Of Tomorrow

Lenders could soon use data from your browsing, search and shopping history to create a more accurate credit score, researchers say.

Much of that information is publicly accessible, while some might need to be provided to credit bureaus. Taken together, that data forms your digital footprint.”

The working paper cites other studies showing that combining credit information and your digital footprint improves loan default predictions.

That doesn’t mean you’d have a dedicated spy watching your every click. Instead, artificial intelligence and machine learning would be needed to scrape this data and convert it into useful information in a credit report.

You May Like: Does Paypal Report To The Credit Bureaus

What’s Considered An Eligible Expense For The Child Care Credit

The law defines expenses based on child care providers, but there’s some wiggle room that also accounts for expenses like transportation. Any organization or person providing care for your dependent counts as long as you’re paying them.

The IRS has relatively relaxed rules about care providers, according to Elaine Maag, principal research associate at the Urban Institute. However, you’ll likely have better luck claiming child care credits for people and groups operating in an official capacity, such as nursery schools and day care centers, opposed to the $40 you paid a teenager to watch your child for an afternoon.