When Negative Information Comes Off Your Credit Reports

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

Get Free Credit Reports

Visit annualcreditreport.com to order or download a free credit report from each of the three major credit bureaus.

These reports wont show your credit score, but you can check them for inaccuracies and new credit applications you didnt make all of which affect your credit score.

Federal law gives you the right to one free credit report from each credit bureau each year.

Temporarily, because of the Covid-19 pandemic, you can get one free credit report from each bureau once a week.

This provision is scheduled to expire in April of 2021. After that, youll have access to a free credit report only once a year.

Dispute With The Business That Reported To The Credit Bureau

Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g., the credit card issuer,;bank, or debt collector. You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

When the business determines that theres indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.

Read Also: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Get Rid Of Negative Information

Removing negative information from your credit report can boost your credit score, but erasing things from your credit report isnt easy. You can dispute negative entries that are inaccurate, wait for the credit reporting time limit to pass , or try to get the information furnisher to remove the entry from your credit report with a pay for delete or goodwill offer.

If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. Samples of templates you can use for a credit report dispute letter can be found here at the Consumer Financial Protection Board website.

How To Dispute Credit Report Errors

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Errors on your credit reports can cause your credit scores to be lower than they should be, which can affect your chances of getting a loan or credit card and how much interest you pay. Disputing credit report errors and getting those negative items removed can be a quick route to a better score.

Here’s how to dispute credit report errors and have them removed in four steps.

Read Also: Does Having More Credit Cards Help Your Credit Score

What Are The Effects Of Credit Card Delinquency

The later you are with your payments, the greater consequences you suffer. Getting the delinquent status on your credit card has two main effects: it increases your interest rates, and your credit score suffers.

Increased Interest Rates

As your delinquent status progresses, your regular interest rate is replaced with a much higher penalty rate, making it even harder to pay off.

The penalty rate usually applies after 60 days of delinquency and remains in effect for six months. Once you make six consecutive on-time payments, you can request an interest rate reduction.

Negative Impact on Your Credit Score

This is where credit card delinquency brings the most consequences. It can have a severe impact on your , and that impact grows the longer your credit card is delinquent. Years can pass until the situation gets back to normal, so make it your priority to stop the delinquency from progressing or to avoid it altogether.

Here are some other things that can negatively affect your credit score:

Delayed Payments

Even without venturing into delinquency territory, a delayed payment can affect your credit score. It impacts your credit history, which makes up 35% of your . The longer the payment is delayed, the more substantial effect it has on your credit score.

Getting Reported As Delinquent

Account Going Into Collections

Account Getting Revoked

Account Being Charged Off

You Can Negotiate With Debt Collection Agencies To Remove Negative Information From Your Credit Report

By , Attorney

If you’re negotiating with a collection agency on payment of a debt, consider making your part of the negotiations. You can ask the collector to agree to report your debt a certain way on your credit reports. Here’s how: The three major credit reporting bureausExperian, Equifax, and TransUnionproduce credit reports. Ask the collector to tell the bureaus to remove any negative information about the debt from your credit files. The collector might not agree, it might have to get the creditor’s approval first, or you might have to pay a bit more on the debt; but it doesn’t hurt to ask.

And if you get the collector to agree to accept less than the full amount to settle the debt, be sure the collector also agrees to report the debt as “paid in full” on your report.

Also Check: How To Get Rid Of Inquiries On Your Credit Report

How Do I Get A Serious Delinquency Off My Credit Report

Strategies to Remove Negative Credit Report Entries

Late payments remain in your history for seven years from the original delinquency date, which is the date the account first became late. They cannot be removed after two years, but the further in the past the late payments occurred, the less impact they will have on scores and lending decisions.

Also, how do you get out of delinquency? One minimum will count toward what you owe for the current month and the other will cover one of the payments that you missed. In order to get out of delinquency completely and become current on your account, you must pay the total of your missed minimum payments plus the current month’s minimum.

Also to know, what is a serious delinquency on credit report?

A serious delinquency is a piece of negative information that will damage your . Most of the time, their origin is from a mistake caused by improper use of one’s . The most common example of a serious delinquency would be a late payment.

How long does it take for delinquencies to come off credit report?

seven years

The Debt Is Then Charged Off Or Sold To Collections

Then, the creditor is likely to charge off the debt. Its status will be changed to “charged off” and “sold to collections.” “Charged off” and “sold to collections” are both considered a final status. Although the account is no longer active, it stays on your credit report.

When the debt is sold or transferred to a debt collector, a new collection account is added to your credit history. It appears as an active account, showing that the debt collector bought the debt from the original creditor. If the debt is sold again to another collection agency, the status of the first collection account is changed to show that it was sold or transferred. Once again, the final status shows that the first collection account is no longer active, but that status continues to appear as part of the account’s history.

Read Also: Does Experian Affect Your Credit Rating

Do Late Payments Always Show Up On Credit Reports

No, late payments wont always show up on your credit reports.

When a lender reports a late payment, they also classify the account as delinquent. Lenders are not allowed to report an account as delinquent to the credit bureaus until a payment is a minimum of 30 days;past due. Even then, they may not choose to report the late payment until some more time has passed, basically as a favor to the cardholder.

There is some flexibility in when a payment might be reported as late. However, you should expect to be charged a late fee if your payment is not delivered on time, even if youre only one day late. Card issuers may waive this fee if you call and ask nicely, explaining that the late payment was a fluke . This late fee is separate from the issue of having late payments on your credit reports.

On credit reports, late payments are broken down into several categories. The later a payment is, within these categories, the worse the impact on your credit.

- 30 days late

- 120 days late

- 180 days late

Once your credit card is a full 90 days past due, the lender will often decide to sell the account to a collection agency and mark it as a charge-off. This means that the creditor has declared that the card debt is unlikely to be repaid, and its extremely bad for your credit.

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Recommended Reading: What Does Filing For Bankruptcy Do To Your Credit Score

Dispute Credit Report Errors

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also call, but you may not be able to complete your dispute over the phone. Here’s information for each bureau:

How to dispute Equifax credit report errors

-

Write to;Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on;how to dispute your TransUnion credit report for details.

Is There Anything More Annoying Than A Roommate Who Leaves Their Dirty Dishes In The Sink

Youve asked them to wash their dishes before, and they said they would do it, yet they dont. Then they forget again and a few more dishes are added to the sink. By this point, youre frustrated, but not as angry as when they then do it a third consecutive time. Ultimately, you move out and tell all of your friends what a horrible roommate they were, and your old roommates reputation is ruined.

Dirty dishes might seem irrelevant to your credit reports, but what if the dirty dishes symbolized late credit card payments? Imagine that youre the annoying roommate to your creditors, who are becoming increasingly frustrated with your delinquency. They might tolerate one late payment and give you a second chance. But if you keep making mistakes, you can ruin your relationship with them, in addition to maiming your credit scores.

Don’t Miss: How Long Do Inquiries Last On Your Credit Report

Make Sure Your Credit Limits Are Reported Correctly

Not only does the amount of debt you carry affect;your credit score, but the ratio of your credit card debt to the limit on those credit cards is also a factor. If your credit limits arent reported accurately, it can look like youve maxed out your credit card. You can dispute inaccurate credit limits with the credit bureau or call your creditor to ask why your credit limit isnt reported accurately.

Some people ask for credit limit increases as a way to improve their credit utilization. But be careful requesting your limit be increased. Some credit card issuers do a hard pull where an additional inquiry is placed on your credit report and factored into your credit score. Soft pulls are better, but may not be what the creditor needs to process your credit limit increase;request.

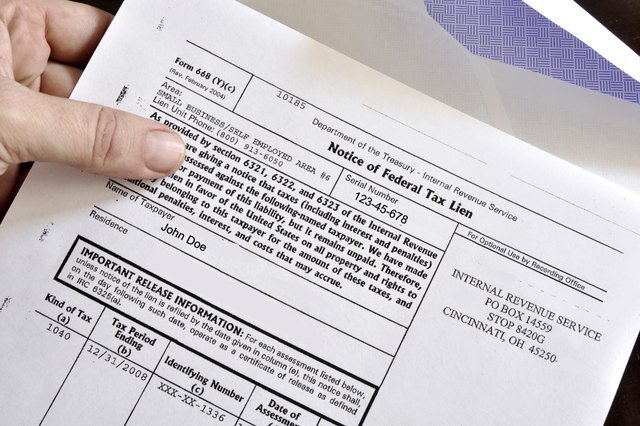

Send Letters To The Credit Bureaus

If the debt really is too old to be reported, its time to write to the credit bureau to request its removal. When you dispute an old debt, the bureau will open an investigation and ask the creditor reporting it to verify the debt. If it cant, the debt has to come off your report.

The Fair Credit Reporting Act requires credit bureaus to correct or delete any information that cant be verified or that is incorrect or incomplete, typically within 30 days. Otherwise, they are in violation and you are within your rights to file a lawsuit, as well as file a complaint with the Consumer Financial Protection Bureau.

Make sure to craft a case so strong that the creditor will have to acknowledge that its correct or present tangible evidence to the contrary. Include copies of anything that supports your claim, such as copies of court filings that show the correct date for a judgment or bankruptcy or a letter from your original creditor showing when the account became delinquent.

If a collection agency is reporting an account as a different debt, include any paperwork showing that the two accounts are really the same debt.

Send this letter certified with a return receipt requested so that you can prove when it was sent and that it was received.

Why this is important: If you can prove that the debt is older than legally allowed to show on your credit report, the bureau can remove it.

Don’t Miss: How To Get Credit Report With Itin Number

How Do I Get A Copy Of My Credit Report

Right now, its easier than ever to check your credit report more often. Thats because everyone is eligible to get free weekly online credit reports from the three nationwide credit reporting agencies: Equifax, Experian, and Transunion. To get your free reports, go to AnnualCreditReport.com. The credit reporting agencies are making these reports free until April 20, 2022.

Each of the three nationwide credit reporting agencies Equifax, TransUnion, and Experian are already required to provide you, on your request, with a free credit report once every twelve months. Be sure to check your reports for errors and dispute any inaccurate information.

In addition to your free weekly online credit reports until April 20, 2022 and your free annual credit reports, all U.S. consumers are entitled to six free credit reports every 12 months from Equifax through December 2026. You can access these free reports online at AnnualCreditReport.com or get a “myEquifax” account at equifax.com/personal/credit-report-services/free-credit-reports/ or call Equifax at .

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

You May Like: Does Paypal Working Capital Report To Credit Bureaus

Strategies That Wont Help Remove Negative Information

So now you know four strategies for getting negative entries off your credit file.

Sometimes, though, it helps to know what wont help remove negative information.

If youre searching for credit repair answers, know that these things wont help fix your credit:

- Paying Off Old Stuff: A lot of people think debt collectors will remove negative information from their credit if they can just pay off the charge-offs, past-due balances, and collection accounts. In reality, paying off these accounts will not help your credit. Lenders will still see you had trouble paying off previous accounts.

- Bankruptcy: Filing bankruptcy could help restore your financial health by reorganizing or dissolving old debts. But it wont help your credit score. In fact, the bankruptcy will pull down your score for up to 10 years. Plus, the road to bankruptcy is paved with late payments, missed payments, and collection accounts all of which will remain on your credit report along with the bankruptcy.

- Closing Delinquent Accounts: A closed account wont look any better to prospective lenders than an open account. In fact, closing accounts could hurt your score since FICO places value on older average ages for credit accounts.

How To Monitor Your Credit To Detect Inaccuracies

Along with inaccurate information about you, that debt collectors may report to Experian, Equifax, and TransUnion, you should also lookout for signs of identity theft on your credit reports.

Identity theft happens more and more now as data breaches and scams keep exposing our sensitive financial data.

Heres how to monitor your credit to make sure its in good standing with all three reporting bureaus:

Read Also: How Long Does Debt Settlement Stay On Your Credit Report

Will Removing Negative Information Fix My Credit Score

Often, negative entries whether accurate or inaccurate lower your credit score and prevent your score from increasing over time.

But every consumers situation is unique. Inaccurate information may not be your credit scores only problem. If thats true, its deletion may not achieve the immediate results youre looking for.

In this case, youll need a more holistic approach to credit repair a way to develop better habits with your lenders so your score can increase organically.