Keep Your Business Going During Covid

The effects of the COVID-19 pandemic is seen in every aspect and sector of global activities.

At its core, a credit report is exactly what it sounds like – a detailed account of someone’s credit history that acts as an essential measure of their long-term financial responsibility. But more than that, a credit report can be used in a wide array of different situations – from determining whether or not someone can get approved for a credit card to helping them with major financial purchases like buying a house. In some cases, a credit report may even be used when someone is applying for a job – thus making it one of the most important records in a person’s life whether they realize it or not.

All told, credit reports are important for a wide array of different reasons, all of which are more than worth exploring.

Make Your Payments On Time

Paying your bills on time is the most important thing you can do to help raise your score. FICO and VantageScore, which are two of the main credit card scoring models, both view payment history as the most influential factors when determining a person’s credit score. For lenders, a person’s ability to keep up with their credit card payments indicates that they are capable of taking out a loan and paying it back.

But your credit score isn’t just impacted by your credit card bills. You need to pay all your bills on time. That includes all your utilities, student loan debt and any medical bills you might have.

Who Can Access Your Credit Report Or Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

With;lots of personal data available online, you might suspect that your credit history is accessible to anyone with a slight aptitude for Google search. Although;you arent the only person who can see your credit scores and;reports, you can feel secure in knowing that this financial information is given only to those who legitimately need it.

That said, your credit;can be checked in many situations when you apply for a loan or credit card, a job, utilities, student loans and more. Monitoring your own credit helps you watch out for trouble and build your profile.

Also Check: Is 779 A Good Credit Score

Why Isnt My Credit Card On My Credit Reports

If youve checked your credit reports and found that a credit card or other account is missing, it could either be an error or your lender may not report to the credit bureaus. With the major card issuers, if your card isnt showing up on your reports its more likely an error than a reporting policy.

Every lender and creditor has its own reporting policies, but most include some sort of regularly scheduled automatic update that transmits your account information electronically to the credit agencies every 30 days.

Based on the individual lenders policies, it may report to all three major credit reporting agencies, or it may only report to one or two. This is one reason why credit reports and credit scores can vary from bureau to bureau.

Smaller credit unions and financial institutions may not report to all three bureaus, but you wont run into this problem when youre dealing with major lenders and card issuers, like American Express, Chase, Citi, and others. If youre not sure, you can simply call customer support and ask.

If your lender isnt reporting an account, you can contact it directly to request that it begins doing so.

Legally, however, you cant force your lender to report an account. Credit reporting is completely voluntary, although theres legislation that governs information once its reported. Unfortunately, if the lender wont honor your request, theres really not much you can do other than find a different company to do business with.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Read Also: How To Get My Free Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Check Your Credit Report

It’s easy to check your credit report:

- Request your free credit report from Experian at any time.

- Check your at any time

- Visit annualcreditreport.com to request one free credit report from each of the 3 major credit reporting agencies every 12 months.

Who Can Check My Credit Report?

The Fair Credit Reporting Act limits who can view your credit report and for what reasons. Generally, the following people and organizations can view your credit report:

Recommended Reading: How To Get Charge Offs Off Of Your Credit Report

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

My Report Has Old Or Outdated Information

You may have to wait between 4-6 weeks for new or updated information to be added to your ClearScore account. This is because the lender has to report to the first, and then they have to update their records.

Each lender has its own reporting procedure. For example, some lenders report at the start of the month, while others report closer to the end. ClearScore pulls your report from Equifax around the monthly anniversary of your sign-up date. So, if you signed up on the 8th but your lender reports on the 20th, youâll have to wait for your next report for new accounts to appear and information on closed accounts to be updated.

Similarly, any balance on your report is the balance on the date your lender reports. If your lender reports on the 15th but issues your statement on the 28th, your credit report will always show your balance halfway through the month, and the figures wonât align with your statement.

Also Check: Can Student Loans Be Removed From Credit Report

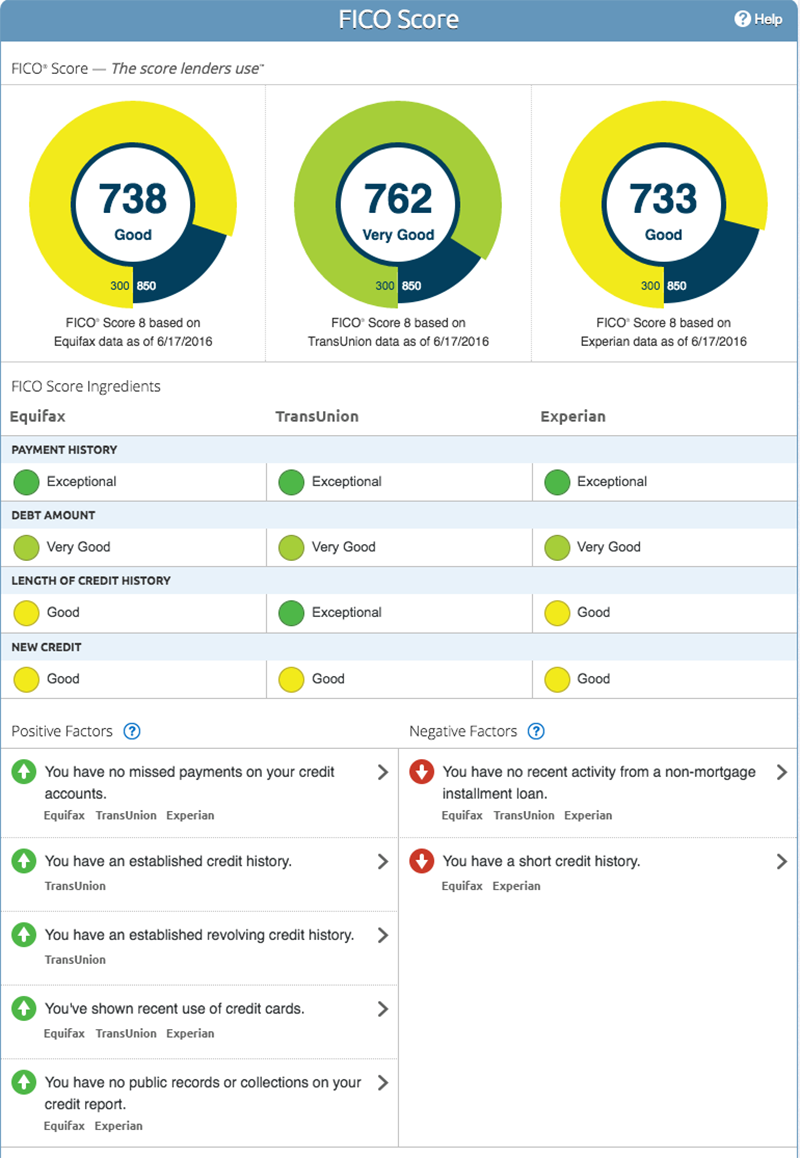

How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring systemmuch less their credit scoreuntil they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.;

Each individual has his or her own credit score. If you’re married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you.;In other words, you will pay more to borrow money.

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering “Where do I stand?” To answer this question, you can request your credit score or free credit report from 322-8228 or www.annualcreditreport.com.;

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.;

Why Arent My Credit Scores On My Credit Reports

Thanks to the Fair Credit Reporting Act , were entitled to one free copy of each of our credit reports every 12 months from the three national credit reporting agencies: Equifax, Experian and TransUnion.

But credit scores arent a part of credit reports theyre calculated separately, based on the information in those reports.

Since credit scores arent a component of credit reports, they arent required by law to be given for free . There are also hundreds of different credit scoring models so which should be the free score that everyone can see?

As part of the credit report ordering process, each of the three credit bureaus will offer you the option to add a credit score when requesting your free annual credit reports for a fee.

The right to access your credit reports for free wasnt granted until 2003, with the Fair and Accurate Credit Transactions Act FACTA for short which officially amended the FCRA to give us the rights we know today. Still, the New York Times reported in 2018 that only 36% of consumers were checking their credit reports. But that was better than in 2014, which saw only 29%.

Before you cry foul at the unfairness of it all, things are getting better for the consumer. Thanks to amendments to the FCRA from the Dodd-Frank Act, consumers are entitled to see certain credit scores for free, but only when theyve been denied credit or received less attractive loan terms as a result of those scores. This is known as an adverse action notice.

You May Like: Does Checking Your Credit Score Affect Your Credit Rating

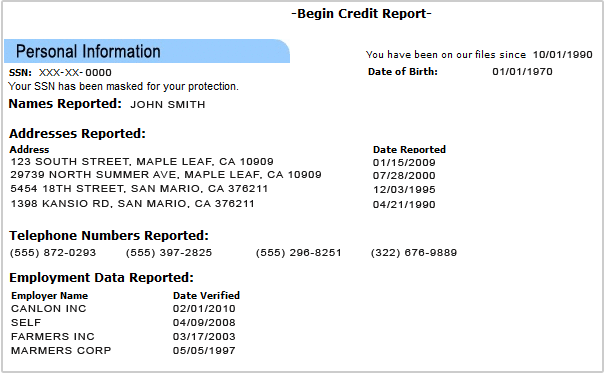

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit;history. Your credit history describes how you use money:

- How many;credit cards;do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.;

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

Common Mistakes Big Problems

For about 1 in 10 people in the CR study, errors like the one Ross faced were related to their financial data: unrecognized payments, payments wrongly reported as late, or debt in collections mistakenly listed in their name.

Those sorts of errors could easily lower a persons credit score, Ejaz says. And in some cases, such as when debt is reported as in collections or payments are reported as late, the drop in a score could be tremendousas many as 100 points.;

Mistakes in personal information were even more common. Joseph Pedulla of Boston says that after his bank account was hacked several years ago, a fraudulent mailing addressa location in Ohio where hed never livedwound up on his credit reports. It took several years, he says, to get the address removed on all three reports.

Particularly troubling were errors in reports among some people who had sought financial help during the COVID-19 pandemic. Legislation passed in the early days of the crisis offered forbearance to people with certain student loans and mortgages, meaning they could put off payment for several months with no penalty. But 15 percent of the people in CRs study who said they had an account in forbearance also said their accounts were reported as not current.;;

You May Like: What Is A Good Credit Score For My Age

What Does Your Credit Report Show

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance.;He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer.;His background in tax accounting has served as a solid base supporting his current book of business.

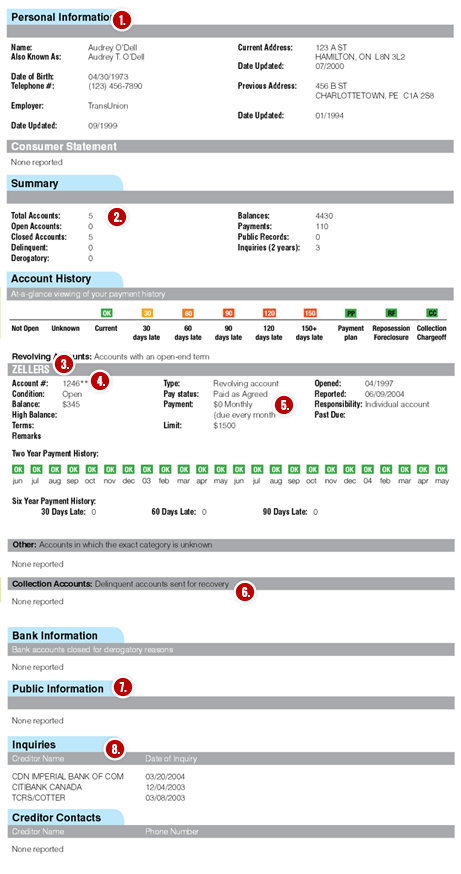

When you’re reading your credit report;for the first time, it can be overwhelming, especially if you’ve had a lot of accounts over a long period of time. Knowing what types of things appear on your credit report can make it much easier to read and understand.

What Information Is On A Credit Report

by Kailey Hagen | Dec. 2, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Everyone should know about their credit report information.

You probably think you’re done with report cards once you’re finished with school, but there’s one that follows you from the day you open your first credit card or loan account until the day you die — your credit report. Your credit report information is a record of how you manage borrowed money, and it can affect your chances of getting loans, , apartments, and even jobs.;

It’s a pretty big deal, so you ought to know what yours is saying about you. Here’s everything you need to know about your credit report information and how you can check yours.

Don’t Miss: How Much Does A Hard Inquiry Affect Credit Score

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.;

If the information is wrong, you can try to fix it. If the information is right but not so good ;you can try to improve your credit history.

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

Read Also: Does Paypal Credit Report To Credit Bureaus

Reporting A Death Of A Loved One To Transunion

There can be a lot to take care of when a loved one passes away, but its important to take the time to notify credit reporting agencies so the individuals credit report can be marked as deceased. We will periodically receive notification from the Social Security Administration about those who have passed away. However, notifying us on your own can be faster and is an important step in the care of your loved one to help protect their credit report from fraud.

Commonly referred to as ghosting, fraudsters sometimes use the personal information of someone who has passed away and use it to open up new credit accounts or file faulty tax returns. Follow the steps below to update your loved ones credit report and give yourself peace of mind:

What If Someone Illegally Looked Up My Credit Report

The Federal Fair Credit Reporting Act, along with some state laws, limits who has the right to view your credit report and for what reason. If someone breaks the law by looking at your report without a legitimate purpose, you can sue for any money you lose as a result and possibly for more than you lost.

Also Check: How Much Does Transunion Charge For Credit Report

Why Get A Free Annual Credit Report

Well, unless someone is absolutely perfect in every way, they may wonder why on earth they would even want to see a copy of their credit report. The answer to that is as simple as it is frightening. Credit reports often contain significant errors, and the only person likely to catch these errors is the one that the report is about.

How To Get A Credit Report

The Fair Credit Reporting Act requires Experian, Equifax and TransUnion to provide you a free copy of your credit report once, every 12 months.

There is a charge for credit scores, but the credit report is free.

To get a free credit report, go online to www.annualcreditreport.com or call 1-877-322-8228 and request it. This is the only website authorized to fill orders for free credit reports. Once there, each agency must supply you one credit report every 12 months. You could receive all three reports at once, or spread them out over 12 months depending on the purpose you have.

If you want to examine the three together and compare all the information contained in each report to be sure its accurate , you should request all three at the same time.

Since the information on all three should essentially be the same, you may want to ask for one report every four months and verify each time that the information remains accurate.

If you already received a free report from each of the bureaus and want to check your credit report again, you can contact any of the three reporting agencies and order one for a small charge, usually under $10.

Also Check: Which Credit Score Matters The Most