What Affects Credit Score Update Timing

The timing of credit score updates is based on the timing of changes to your credit report. Since your credit score is calculated instantly using the information on your credit report at a given point in time, all it takes to raise your credit score is a positive change to your credit report information.

At the same time, having negative information added to your credit report can offset positive changes you might have seen to your credit score. For example, if you receive a credit limit increase but a late payment is also added to your credit report, you may not see your credit score improve. In fact, your credit score could fall.

Seriously negative information can weigh your credit score down, making it take longer to improve your credit score. For example, it can take longer to improve your credit score if you have a bankruptcy, debt collections, repossession, or foreclosure on your credit report.

The more recent negative information is, the more it will impact your credit score.

The Effect On Other Lines Of Credit

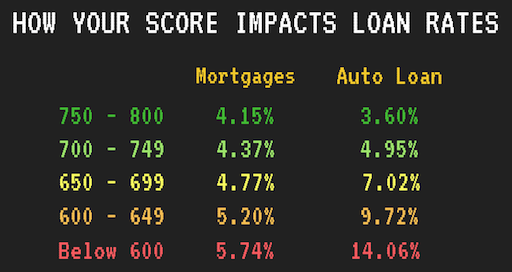

As your score takes this short-lived dip, you want to be wary of how it will affect interest rates on other loans you might be seeking, such as an auto loan. Thats because even though reliably paying off your mortgage month after month proves youre a responsible borrower, that positive activity wont yet be showing up and factored into any money moves you make now.

Therefore, you might want to wait until your credit score has time to recover before seeking another new loan. And by then, it might even rise, given the strength of a mortgage, potentially opening the door to even better rates than you might have qualified for before.

How Can I Improve My Credit Score

Qualifying for a mortgage was the first sign youre on the right path. But as you continue to strive to build your credit score, you might be wondering what factors impact it the most. Here is a breakdown FICO® shares of the model it uses to determine your credit score:

- Payment history : Never miss a payment to receive the full effect of this hefty percentage.

- Keep your revolving credit under 30% for the best results. Remember that this number doesnt take into account your installment credit, like your mortgage or a personal loan, as those will have set repayment terms.

- Length of credit history : Keep those older accounts open, even if youre not using them regularly.

- This refers to the different types of revolving and installment credit you have, including credit cards, vehicle loans, student loans, and now, your mortgage. Lenders like to see that you can manage different types of credit responsibly.

- New credit : Lenders will take into account if youre applying for new cards, which could signal that youre planning a spending spree.

Read Also: Does Paypal Credit Report To Credit Bureaus

What If My Credit Score Changes During The Mortgage Process

- Maxing out credit cards will drop scores

- However, this drop is just a temporary drop

- It will go right back up once credit cards are paid down

- Late payments on any monthly payments will drop credit scores

- Applying for too much credit will have hard credit inquiries on the credit report

- Each hard inquiry can have a 2 to 5 point negative impact on credit scores

- Many borrowers wonder what credit score during mortgage process lender will base their qualifying credit score

- The credit score during mortgage process use will be the middle credit score that is pulled at the time the mortgage applicant signs the application and disclosures

However, some lenders like us can use the higher credit scores if credit score changes during the mortgage process for pricing.

Does A Mortgage Help Your Credit Score

Yes. Having a mortgage on your credit report actually helps your score. Paying on time, diversifying your debt with installment based debt, and extending your credit history all put you on a path towards good credit. So dont think of a mortgage as something that can put your credit in danger, but an investment in the future of your credit score. Just make sure you keep your mortgage, as well as your other debts, in good standing and youll be in great shape.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

What Happens Between Clear To Close And Closing

Buying a home is an exciting affair. And one of the most exciting moments besides getting your house keys is learning that your mortgage has been declared clear to close. Based on the name, you may think that means everything is complete and nothing else is needed.

Unfortunately, thats not 100% accurate. Theres still plenty that needs to happen before you reach the closing table.

Do: Stay In Your Job If You Can

Obviously, this can be a tall order during a pandemic and economic downturn, but another major mistake is changing jobs. This is because mortgage lenders examine your employment history to determine if theres a history of steady jobs and income. Providing additional documentation on employment to a lender can delay the closing.

When the lender needs to verify your employment, it is easiest if they can call an employer that can confirm that you have been employed there for a while, van Faassen says. Getting that confirmation from a brand-new employer or even a prospective employer complicates the situation and can raise additional questions, which then takes more time in the underwriting and verification process.

If you have any control over your job situation, its best to stay put until after you close. A borrower who quits their current job may have to wait a couple of weeks before they can attempt to close again.

You May Like: Aargon Agency Settlement

How Long It Takes To Raise Your Score

The length of time it takes to raise your credit score depends on a combination of multiple aspects. Your financial habits, the initial cause of the low score and where you currently stand are all major ingredients, but theres no exact recipe to determine the timeline. Thanks to studies done by CNBC and FICO, weve compiled the typical time it takes to bring your score back to its starting point after a financial mishap. The following data is an estimate of recovery time for those with poor to fair credit.

| Event | |

|---|---|

| Applying for a new credit card | 3 months |

Can Paying Off Collections Raise Your Credit Score

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you’ve ever received a phone call or a letter from a debt collector, you know it can be stressful. Debt collectors attempt to collect money owed to a landlord, medical service provider or some other creditor. And while paying or settling your collection accounts may certainly look better to future lenders, there’s no guarantee your credit scores will improve as a result.

Read Also: 8773922016

Do Lenders Check Your Credit Again Before Your Mortgage Closes

Most people know that lenders pull your credit report and check your credit score when you submit your mortgage application. Lenders use your credit score to help determine your loan terms including your mortgage rate and they review your credit report for derogatory events such as late payments, collection accounts and more serious credit matters. They also review the active loan accounts listed on your credit report to verify the information you provided on your application and to confirm your debt-to-income ratio.

What many borrowers may not realize is that lenders may check your credit score a second time before your loan closes. Until you reach the “clear to close” phase of the mortgage process the lender may run your credit again to determine if you have opened any new debt accounts or increased your outstanding loan balances significantly.

“Clear to close” means that all of the conditions to close your mortgage have been satisfied, the lender’s underwriter has issued final approval and your loan is ready to close. Until the lender tells you that you are “clear to close” you may have outstanding conditions to address, including a potential secondary credit review.

A soft inquiry should not negatively impact your credit score and allows the lender to determine if there have been significant changes in your credit profile since you applied for the mortgage. Think of it more as a summary review of your credit as opposed to a comprehensive inspection.

Problem: Lack Of Credit History = Low Score

Its a credit Catch-22: You need credit to build credit, says Bill Hardekopf, a senior industry analyst at CardRates.com, a company that evaluates credit card offers. This can be a challenge in communities of color in particular, he says. The Urban Institute found that 32 percent of Black people vs. 18 percent of white people didnt have enough information in their credit reports to generate a score.

One way to build history is to open a checking or savings account. But that can be easier said than done: A 2020 Morgan Stanley report on inequality in homeownership found that there is greater commercial branch scarcity in communities with diverse populations. Minimum deposit rules and high checking fees can be other deterrents.

Be aware that even if you have a credit history, it can become stale if you dont continue to use credit regularly. Thats because some of the scoring algorithms treat recent use of credit as a positive factor in calculating your score, Hardekopf says. In some instances, credit card issuers can close inactive accounts, and your credit score can take a hit.

Also Check: Does Zebit Report To Credit Bureaus

Skipping The Home Inspection

Unless you have a lot of cash to fix up a home and are willing to risk having to pay for unforeseen repairs, waiving a home inspection can be a costly mistake. Home inspections are meant to find major issues with a home, and they are intended to protect the buyer.

If you dont get an inspection, you will have no recourse if a major issue, such as cracked pipes or water damage, surfaces after you close on a home. That means you might be footing the entire bill to fix those issues. When you make an offer on a home, you can include a home inspection contingency that gives you a penalty-free exit from the deal if a major issue is uncovered and the seller is unwilling to fix it before closing.

With that contingency in place, you can withdraw your offer and usually get your full earnest money deposit refunded. The home inspection fee is non-refundable and typically paid by the buyer to the home inspector up-front. It typically ranges from $300 to $500, depending on location and the size of the property. Its a small price to pay when you weigh it against the potential costs of having to replace a furnace, water heater, roof, or other big-ticket itemswhich could mount into the thousands.

You might consider additional inspections, such as a pest inspection, mold or radon inspection, or a sewer scope, for example, if your lender requests it. These and other inspections can help protect your investment and safety.

Do: Put Off Other Big Purchases

If youre about to close on a house, its probably not the best time to get a new car, boat, personal aircraft or other expensive toy. Even furniture or appliances basically anything you might pay for in installments is best to delay until after your mortgage is finalized.

Depending on your credit score and history, these transactions can lower your score, which can impact the interest rate and loan amount you could receive. This could result in a higher interest rate for the next 15 or 30 years, or even having to come up with a larger down payment.

Bottom line: Borrowers should wait to purchase a big-ticket item, because this can ruin their chances of staying qualified for a loan, says Patricia Martinez-Alvidrez, business development officer for Stewart Title in El Paso, Texas.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Any Credit Score Drop Is Likely To Be Minimal

Having said all of that, the credit score drop that results from paying off a car loan is likely to be quite small. Ill share my recent personal example. I monitor my own credit closely, and recently finished paying a 36-month car lease. As soon as the account was updated to “paid loan” on my credit, my FICO® Score dropped by 4-6 points, depending on which of the three credit bureaus I checked.

To be clear, every situation is different. The impact of paying off a car loan is likely to be small, but its important to emphasize that the effect on your credit score could be significantly different from mine. For example, if you have just one or two other items on your , or if your credit file is relatively young overall, most reports indicate that paid-off loans can cause a bit more of a dip in your credit score. On the other hand, if you have many other accounts in good standing, the effect of a paid-off car loan can be extremely minimal, if anything at all. Or, if you have a long-established credit history and most of your other active accounts are even older than your car loan, paying your loan off could potentially improve your length-related scoring factors and could result in a small increase.

Consider Alternatives To Canceling Your Credit Card

Even if closing a credit card wont affect your lifestyle or credit profile too much, it still might be easier not to close the card. In fact, there are several alternatives that could end up being less risky.

Put the card in a drawer. Maybe youve decided you just dont like using credit cards. If thats the case, consider keeping the card and putting it away instead of closing it. This course of action might seem obvious, but keeping the account open while removing the temptation to use the card could be a straightforward way to keep the card without harming your credit. Find another way to handle mounting debt. If youre trying to get out of credit card debt and dont want to add new payments, you might be considering negotiating to close the card account with your issuer. But you might also be able to pay off your debt with a balance transfer credit card or personal loan. These options might offer a more manageable way of paying off your debt. Downgrade your card to avoid an annual fee. If youre paying an annual fee on a card you dont use, you could ask your credit card company if it can keep the account open while downgrading you to another card with no annual fee.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How Long Does It Take For Credit Scores To Go Up After Buying A House

While there is no hard and fast rule for how long it will take your credit score to start improving, one study showed an average of 5 months for it to recover. Fortunately, your credit score may make incremental jumps during that time. For reference, though, it might be interesting to see how other actions affect your credit score on average. Check out this chart that takes into account research from CNBC and FICO®:

|

Applying for a new credit card |

3 months |

If those last three seem a bit strange, that just speaks to the vagaries of credit scores and illustrates why the best thing you can do is control what you can which is making on-time payments as well as some other factors well explore below.

I Just Paid Off My Credit Card Will My Credit Score Go Up

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Paying off credit card debt is smart, whether you do it every month or finally finish paying interest after months or years. And as you might expect, it will affect your credit score.

If you pay on time and are chipping away at a balance or eliminating it with one big payment, your score will likely go up.

Heres how various credit card payoff scenarios are likely to play out.

Recommended Reading: What Credit Score Does Carmax Use

Length Of Credit History

A longer active credit history is usually better for your credit. In general, lenders like to see that you have a track record of managing credit effectively over time.

But when you close a credit card, that card stops aging and cant grow. That will cut into your active credit history for at least as long as it takes to get another account growing.

And if the card youre thinking of opening was also your first credit card, we strongly recommend keeping it open even if you rarely use it. As your oldest line of credit, it will have the biggest impact on the length of your credit history.

What Happens To Your Credit Score If You Pay Off A Car Loan

by Matt Frankel, CFP | July 23, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Are you about to make your last car loan or lease payment, or do you have some extra cash sitting around and are considering paying off your loan early? Or, have you already paid off your car loan and your credit score didnt exactly respond in the way you expected?

Many people expect that their will increase after paying off a car loan. This certainly makes sense — after all, isnt paying off a car loan a responsible credit behavior?

While this is certainly a sign of financial responsibility, a car loan payoff doesnt always have a favorable effect on the borrowers credit score. The reasons for this have to do with how the FICO credit scoring formula works, and how a paid-off loan affects the calculation. With that in mind, heres what you need to know about what to expect once your last payment is made.

Recommended Reading: What Is Cbcinnovis On My Credit Report