Write A Goodwill Letter Asking Creditors To Remove Negative Information

Even a minor black mark on your credit report can make a big impact, especially if it’s a late payment. Unfortunately, sometimes people who are generally pretty good with paying the bills can end up making errors and missing a payment or going over the limit.

If you have negative information on your credit report because of this type of error, it’s worth asking your creditor if they are willing to help you out. Sometimes, writing a goodwill letter requesting the creditor remove the derogatory information will actually pay off for you — especially if you’ve otherwise been a good customer.

Now, card companies aren’t required to remove accurate negative information. But if you ask, many will do so to keep you happy. It may take a few attempts to get the right person, but it’s worth making the effort as removing even a single negative data point from your credit report could make a huge difference in your score.

Longterm Tips For Raising Your Credit Score

Make ontime payments. Try setting up automatic payments through your lender or financial institution, says Gardner. And always pay on time the minimum payment stated on your bill.

If your problem is that you have a limited credit history, heres how to build credit fast. You can get a boost by having family members or friends with great credit add you to their accounts as an authorized user. You dont actually use the account. But its good payment history will appear on your credit report.

Apply for new credit carefully. Dont try applying for more than three new credit accounts in a single month, cautions Millstein. Your credit score is greatly affected by the number of inquiries made to your credit report. Also, choose merchants that are more likely to approve you. Aim for a secured credit card at your local bank, department store or fuel merchant.

Get Id Theft Coverage Before You Need It

These tips can get you on the right track to making payments on time, which can help you plan for your future and work towards your dreams! While youre taking on these tasks, remember to reach out to your American Family Insurance agent and request a quote on identity theft coverage. Youll have more peace of mind knowing youll have the right support when you need it most.

Also Check: When Does Paypal Credit Report To Credit Bureau

The Importance Of Staying On Top Of Your Credit

One of the most important aspects of building a good credit score is consistency. To achieve and maintain a good score, you need to develop good credit habits and stick with them. Remember, building credit is a long-term endeavor and it’s important to always stay on top of what and how things can impact your score.

As you build your credit, understanding the factors that go into score calculations will allow you to monitor your behavior and ensure everything you do it’s helping, not hurting your score. Here are some of the key attributes of your credit scores and areas to watch as you build your credit.

Information on your credit report that can influence your credit scores includes:

- Payment history

- Types of credit accounts you have open

- How long you’ve been using credit

- Your debt balances

Top 10 Things To Know About Your Credit Score

Once indebted, you are under close watch by financial institutions. No transaction made by you in the credit market will go unnoticed, and the same is recorded and maintained in your Credit Score. The scores may range anywhere from 300 â 900, 300 meaning you have an appalling score and 900 meaning that youâre every lenderâs dream customer.

Although simple to comprehend, there are a lot of myths revolving around it. Here are 10 facts regarding Credit Scores.

Read Also: How Long Repo Stays On Credit Report

How Do I Get A Credit

Having poor credit or no credit can be frustrating. It may make it difficult to qualify for a loan or even get an apartment lease. And improving your credit is challenging when you have limited options. That’s where a credit-builder loan can come in handy.

With a , the lender deposits the loan funds into a secured savings account for you while you make payments on the loan. During that payment period, the lender reports your payment history to the three major credit bureaus , helping you build credit history. Once you make all the payments, you get the money.

You can get a credit-builder loan by applying through credit unions, some banks and even online lenders.

Check Your Credit Report

To get a better understanding of your credit picture and what lenders can see, check your credit report and learn more about how to read your Experian credit report. It’s also a good idea to order your free credit score from Experian. With it, you’ll receive a list of the risk factors that are most impacting your scores so you can make changes that will help your scores improve.

If you find information that is incorrect, you can file a dispute with the credit reporting agency on whose report you found it. You should also contact the lender that is reporting the incorrect information directly and ask them to correct their records.

Also Check: Does Carmax Pre Approval Affect Credit

Plan To Resume Paying Federal Student Loans

Since March 2020, federal student loan borrowers have not had to make monthly payments, and interest rates have been set at 0%. That forbearance period ends in February 2022.

The most important factor in your credit score is payment history. Help protect your score from the adverse effects of a missed student loan payment by making sure you understand the exact date when your loan payments come due again , and reviewing your budget to determine whether the resumed payments will stretch you financially. If you’re concerned about your ability to afford your loans long term, talk to your servicer about signing up for an income-driven repayment plan.

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

Don’t Miss: Does Comenity Bank Report To Credit Bureaus

Don’t Take Out Too Many Cards

Sometimes it seems like a good move to open a new credit card with a merchant to get a discount on an item. But try not to go overboard and take advantage of many discount offers over a short period of time. Each new card comes with a “hard inquiry” on your credit report by the merchant, which can have a negative impact on your credit score.

Can I Boost My Credit Score Overnight

Unfortunately, there’s no way to actively increase your credit score overnight. Even our best advice for how to build credit fast can take up to 30 days. Becoming an authorized user, for instance, won’t help your credit until the card company reports the account. This rarely happens within 24 hours of being added. Depending on your credit situation, increasing your credit score could take up to six to 12 months.

Also Check: Ccb Credit Inquiry

What Is A Good Credit Score

A credit score is a 3-digit number that credit bureaus provide to lenders and others who want to assess your creditworthiness. These include banks, mortgage lenders, insurance companies, utility providers, and in some cases, potential employers.

Your credit score can range from bad to excellent. In Canada, credit scores range from 300 to 900, with the following rankings:

- 800 900: Excellent credit score

- 720 799: Very Good credit score

- 600 649: Fair credit score

- 300 599: Poor credit score

In the United States, the range is from 300 to 850.

If your credit score is ranked in the good to excellent range, it makes it easy for you to get loan and credit approvals, and also qualify for competitive rates.

When your credit score falls in the poor to fair category, you may be required to pay sub-par rates on credit lines or be denied outright.

What Is Considered A Good Credit Score

According to the Fair, Isaac and Company , the creator of the three-digit score used to rate your borrowing risk, the higher the number, the better your credit score. The FICO score ranges from 300-850. MyFICO.com says a good credit score is in the 670-739 score range.

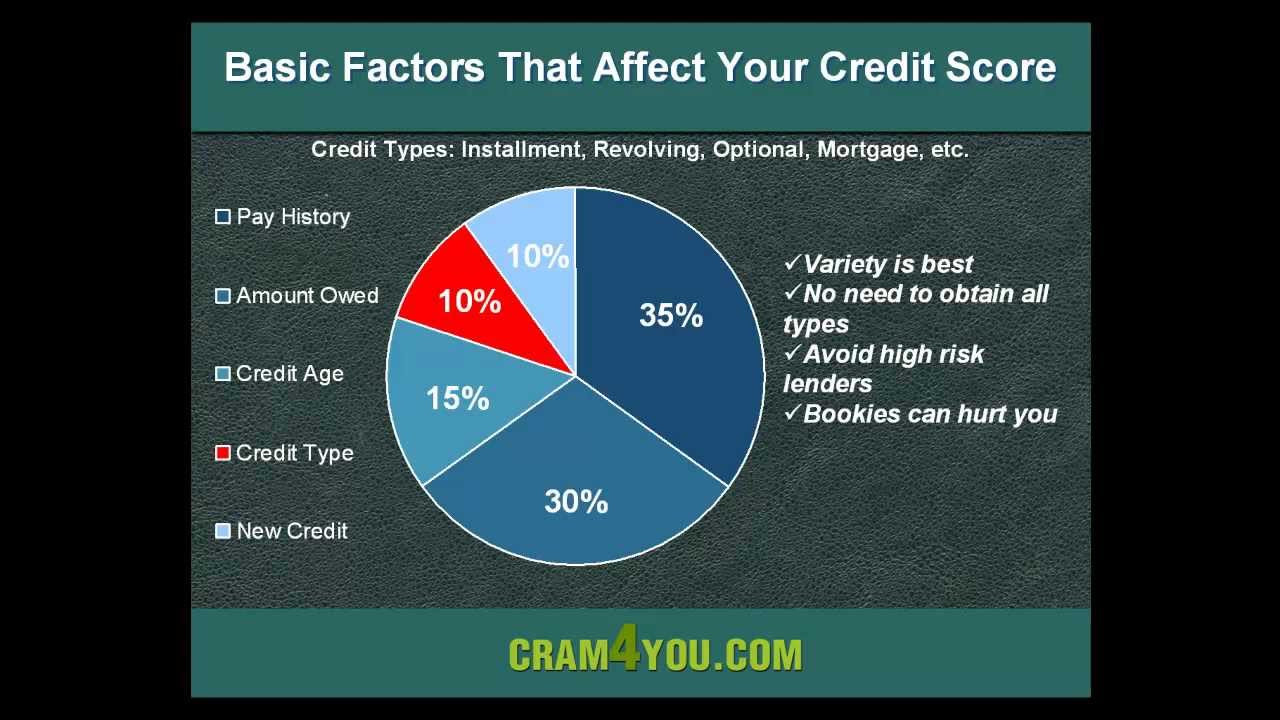

Your credit score is made up of five different factors.

5 categories that make up your credit score

- 35% Payment history: This is a record of your payments on all accounts for the length of the account history. Think of this as a report card for your finances.

- 30% Amounts owed: This is what makes up your credit utilization ratio. To determine your utilization ratio, take the amount of outstanding balances on each account, add them up and divide that by your total credit limit. So a credit card with a $5,000 credit line that has $3,000 in used credit would be a 60% credit utilization ratio not so good.

- 15% Length of credit history: This considers the number of years you have been borrowing. The longer your credit history of positive payments and responsible account management, the better.

- 10% Credit mix: This includes all types of credit, such as installment loans, revolving accounts, student loans, mortgages, etc.

- 10% New credit: Every time you apply for a new credit card or loan, a hard inquiry is reported on your credit report.

Don’t Miss: When Does Usaa Report To Credit Bureaus

Responsibly Add To Your Credit Mix

Lenders look for a mix of accounts in your credit file to show that you can manage multiple types of credit. These include installment loans, for which you pay a fixed amount per month, and revolving credit, which comes with a limit you can charge up to .

If you only have one type of credit in your file, adding something different could improve your credit mix. Credit mix accounts for just 10% of your FICO® Score, however, so don’t apply for credit simply to improve your score. That could put you at risk of taking on debt you can’t repay.

Can You Pay To Have Your Credit Fixed

If your credit file has information you feel is incorrect, credit repair companies may offer to dispute the information with the credit reporting agencies on your behalf. Credit repair companies typically charge a monthly fee for work performed in the previous month or a flat fee for each item they get removed from your reports. However, Experian does not charge consumers or require any special form to dispute information, so this is something you can do on your own at no cost.

If you’re on a monthly subscription, the cost is typically around $75 per month but can vary by company. The same goes for paying a fee for each deletion, but that option typically runs $50 each or more.

That said, it’s important to keep in mind that credit repair isn’t a cure-alland in many cases it crosses the line into unethical or even illegal measures by attempting to remove information that’s been accurately reported to the credit bureaus. While these companies may try to dispute every piece of negative information on your reports, it’s unlikely that information reported accurately by your lenders will be removed.

And again, credit repair companies can’t do anything that you can’t do on your own for free. As a result, it’s a good idea to consider working to fix your credit first before you pay for a credit repair service to do it for you.

Also Check: Credit Score 779

How Can I Raise My Credit Score In 30 Days Top 7 Ways

Jun 24, 2020 Reducing your credit utilization is one of the fastest ways to raise your credit score, and you can do it by paying down debt, spending less, 1 answer · Top answer: There are several ways to raise your credit score in 30 days. Reducing your credit utilization is one of the fastest ways to raise your credit score,

May 5, 2021 We include ways to improve your credit score but also how to remove for ways to raise your score, you may actually be in need of fixing

Improving your credit score is a big step on the road to reaching some of lifes big milestones. But first, it helps to know what credit scores are and how

How Long Does Improving Your Credit Score Take

There is no set minimum, maximum, or average number of points by which your credit score improves every month, and there is no set number of points that each action will gain. How long it takes to improve your credit depends on the specifics for why your credit score is low. If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score.

Also Check: Does Drivetime Report To Credit Bureaus

Ask For A Higher Credit Limit

Call your credit card company and request a higher spending limit. This will lower your credit utilization and make it easier to stay under the 30% spending recommended for card users. Ask the card issuer to do a soft pull on your credit report to make this happen. If you have been a steady payer, this should be an easy way to improve your credit score.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

You May Like: What Credit Score Do You Need To Get Care Credit

How Can I Raise My Credit Score In 30 Days

How to improve your credit score in 30 days Never make a late payment. Decrease your credit utilization. Increase your credit limit. Get a balance transfer credit card or peer-to-peer loan. Use your old cards so theyre not closed. Get a secured credit card. Check your credit report for errors and remove them.

Avoid Credit Repair Scams

Some for-profit companies claim to be able to remove negative information from your credit report for a fee. But the truth is that no company can legally erase information from your file if it’s accurate. Avoid spending money on and take tried-and-true steps to improve your score instead, like lowering debt balances and paying your bills on time.

Also Check: Is A 742 Credit Score Good

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

Cluster Your Hard Credit Inquiries

By grouping your mortgage or credit card applications into the same two-week window, credit reporting bureaus will usually view them as a singular inquiry. But if you apply for a mortgage and five months later apply for a credit card, you may find a drop in your rating due to those multiple inquiries. Those small dings add up and eventually, they can affect your interest rates.

You May Like: Will Eviction Show Up On Credit Report

Is A 690 Fico Score Good

A 690 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Can You Raise Your Credit Score By 100 Points In 30 Days

The bottom line about building credit fast While there are no shortcuts for building up a solid credit history and score, there are some steps you can FICO Score: Rating800 or more: Exceptional credit580 or less: Poor credit580 to 669: Fair credit

Oct 4, 2019 How to Raise Your Credit Score Fast · 1. Check Your Credit Reports for Errors · 2. Get Current on Payments · 3. Pay Down Your Existing

Jul 12, 2021 Use Experian boost to instantly add points · Open a secured credit account · Become an authorized user · Get a co-signer on a small personal loan

Paying off student loans and other debt can help raise your credit score. One smart way to start hacking away at that debt is to make smaller, bi-weekly credit

Don’t Miss: Open Sky Unsecured