How To Find Your Credit Score

You can request a free copy of your credit report once a year.

Its important to have a general understanding of your credit score since it impacts all types of lending. If you plan on buying a car with an auto loan or taking out a mortgage to buy a home, having an idea of what your credit score is can help you determine what your loan may look like and how much you can afford to borrow.

You can request a free copy of your credit report once a year from each of the major credit bureaus. If you check your report and see any incorrect information, you can contact the credit bureau directly to have it removed.

What Other Factors Do Landlords Look At

In addition to looking at your credit score, landlords also want to review your credit reports for red flags. Landlords want to be able to accurately assess the risk of renting to you, so theyll likely look at more than just your credit score to rent to you. Other facts they might look at include:

- Late payments

- High debt payment amounts

How Landlords Should Use Credit Scores

All Cook County landlords should be aware of the Just Housing Amendment to the Human Rights Ordinance, which went into effect on January 1, 2020 and which seeks to remedy unfair housing discrimination against individuals with criminal records. Weve written about the requirements of the new law and while researching the issue, we started thinking more holistically about the purposes and efficacy of tenant screening methods. Generally, landlords screen tenant applicants to determine whether they have the resources to pay the rent, whether they will respect the property, and whether they will cause trouble with neighbors or otherwise detract from the landlords goals of maximizing rental income and minimizing hassles. What are the most reliable sources of information available to landlords to assess these qualities? Generally, credit checks, employment records, and references from prior landlords.

You May Like: How To Get Inquiries Off Your Credit

Can Multiple Credit Checks For Rentals Affect My Credit Score

Since most credit checks for renting are considered soft checks, they wont negatively impact your credit score. The FICO® credit-scoring model, one of the most popular credit scores, ignores inquiries made within 30 days of scoring. Regardless of how long your apartment search takes, your credit score should not be impacted by your apartment credit checks.

Other credit scores, like the VantageScore credit scoring model, consider all inquiries made within 14 days of rate shopping as a single inquiry, no matter the type of credit application. So if you apply for multiple apartments within that time frame, theyll all show up as a single soft inquiry.

Whats Expected In 2022

According to an outlook on the U.S. rental market published by the property management platform ManageCasa, demand for rentals will grow in the coming year. In fact, ManageCasa writes that the rise in rents for the rest of 2021 and 2022 might be surprising to some.

The report indicates that the U.S. rental property market is currently experiencing severe shortages, heightened demand and high property prices, while those looking to rent are competing with a wealthier pool of renters. This is driving up prices.

Further compounding the situation is the fact that housing prices are so inflated that the percentage of people who can afford a home has already dropped off and likely will continue to do so, according to Forbes predictions . This could lead to a rental market that is even more competitive, which may not bode well for those with less than stellar credit.

Don’t Miss: Synch Ppc

Why Do They Want To Know My Credit Score

It may not seem so obvious how credit cards and loans have anything to do with getting a home or an apartment, but they do.

Your credit rating will tell the landlord if you are a good payer–meaning someone who will not only pay the rent every month without fail but also pay on time for the full length of the lease.

A broker, landlord, or management company will use a third-party credit service to pull up not only your FICO score but also a detailed credit report.

They will be able to see any open collections or payment delinquencies and then judge whether you are a good or risky candidate.

Are Landlords Looking At Credit Scores Or The Whole Report

Your credit score is impacted by payment history, the type of accounts you have, recent activity, and the length of time you’ve had your accounts opened.

Simple things such as opening a new credit account or missing a single payment can have a significant impact on your credit score. Your score may dramatically over the course of a month.

That said, a low credit score will rarely be enough to completely remove you from consideration as a prospective tenant. However, the additional information on your credit report must indicate your financial stability and ability to pay your rent on-time.

You May Like: How Long Can Eviction Stay On Your Credit

How Long Do Evictions Stay On Your Credit Report

Evictions can be found in a separate rental history report, which can be obtained through a tenant screening company. The eviction will typically remain on your rental history report for seven years.

Although your credit report will not show whether you have been evicted, any unpaid rent or fees owed to a landlord or apartment complex may be sold to a collection agency or secured by a court judgment. That collection agency can then report the collection account to Experian. Collection accounts and money judgments remain on the credit report for seven years from the original delinquency date.

For your reference, this is a general guideline on how long certain negative items may remain on your credit report:

- Late and missed payments: 7 years

- Collection accounts: 7 years

- Chapter 13 bankruptcy: 7 years

- Chapter 7 bankruptcy: 10 years

Renting Apartments And Credit: A Guide To Credit Scores And Reports

Whether you are renting an apartment for the first time or are a seasoned renter, you know that the state of your credit score plays a major role in the leasing approval process. However, what you might not know is all of the details when it comes to accessing and understanding the state of your credit. Use these tips from ApartmentSearch.com as guidelines to learn about your own credit and make sure that the application and approval process when renting is a much better experience. Here are some of the most common questions renters might have about credit scores and credit reports.

What is a credit report?

First, its important to note that there is a difference between your credit report and your credit score. Your credit report is a history, while your credit score is a specific numerical value . Credit reports document your credit history and the status of your credit accounts, which can include bill payment, loans, credit cards, and outstanding debt.

Where can I get my credit report?

If you want to get a free credit report, you can order a free credit report from each of the three major credit bureaus for free once every 12 months. AnnualCreditReport.com is the only source authorized by Federal law to give you this free annual score.

What is my credit score?

Why do apartments check your credit? What do they look for?

How can I improve my credit score?

For more help managing your finances as a renter, visit the ApartmentSearch.com Moving Center.

Read Also: Who Is Syncb/ppc

How To Get An Apartment With Bad Credit

There are many reasons you might have a bad credit score at the moment, but your credit score shouldnt mean that you dont have the same opportunities as other renters in this great country. That being said, one of the essential questions to ask when looking at an apartment is “What credit score is required to rent the place?”.

Fortunately, as you work to rebuild your credit score, there are rental options out there. It might feel like your only option is moving in with a friend or relative, but this guide is designed to help you find an apartment, even with bad credit. With your own apartment, you have more independence and can take the next steps to move forward from the circumstances that lowered your credit score in the first place.

Get Letters Of Recommendation

With a low credit score, one of the best things you can do is seek letters of recommendation from anyone you have a financial association and a good relationship with. The best options are your landlord or bank, both of whom can vouch for your good habits now even if your credit history indicates some past financial missteps.

Another alternative is to ask your direct supervisor at work, or, if youve recently graduated, your professors and college advisor. These people are in a position to understand your personal responsibility, which can build trust with a new landlord.

Avoid references from friends and family members, because they can give the impression that you dont have more professional relationships and references to call on.

If you must use family or friends, try to select people who also have a financial relationship with you, like cosigners on a past lease.

You May Like: 623 Credit Score Credit Card

Have A Clear Picture Of Your Finances

You’ll have to show proof of income when you apply for an apartment, which normally means a pay stub and/or tax returns.

But in addition, you should also be prepared to provide statements for both your checking and savings accounts. It’s not always required, but it never hurts to show proof that you’ve got savings set aside for your security deposit and incidentals like facility fees, parking fees and maintenance fee .

Top 10 Cities With The Highest And Lowest Credit Scores Needed To Rent An Apartment

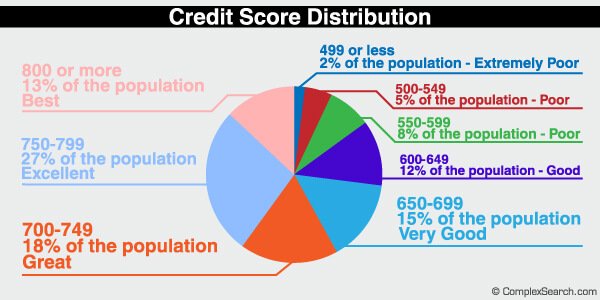

According to data from the top 50 largest cities, credit scores of apartment renters range from more than 700 in some of the most competitive markets like San Francisco, Boston, New York, Seattle and Oakland, CA to less than 600 in Arlington, TX, Memphis, TN, Las Vegas, Indianapolis and Baltimore.

More precisely, San Francisco is the most competitive city to rent in. Renters here boast credit scores of no less than 719. Its followed by cities of the same caliber, such as Boston , New York and Seattle . In this way, Minneapolis, MN is the surprise among the top 10, with this citys average credit score sitting at 688 higher than Los Angeles renters credit score of 682 and San Diegos 680, and similar to Washington D.C.s 689.

Also Check: Coaf On Credit Report

Why Do You Need A Good Credit Score To Rent An Apartment

Nick Meyer, a certified financial professional and financial influencer, shared with us the relationship between credit and the apartment applciation process.

“Your credit score acts as your financial report card: it’s a number that tells banks, landlords, and even employers how likely you are to pay off your debts. The lower this number is, the less likely landlords are to approve your rental applications.”

So what should you do if you have a low score?

Tips For Renting An Apartment With Bad Credit

If you don’t have time to improve your credit score for renting an apartment, here are a few tactics you can also try to persuade your potential landlord to rent to you.

Recommended Reading: What Mortgage Company Uses Factual Data

How A Renter’s Credit Score Might Help

Your renters credit score can help to offset past mistakes you may have made credit-wise.

For example, lets say you left an old medical bill unpaid because you didnt have the cash to cover it. The account was sent to collections and its been sitting on your credit report ever since.

If you have a positive history of paying your rent on time, that could take some of the sting out of the black mark caused by the collection account.

Your lender may look more favorably at your application if youve shown that youre able to keep up with your rent.

A renters credit score could also help with establishing your credit history if you dont have any loans or lines of credit in your name.

If youre fresh out of college, for example, and youre hoping to become a homeowner one day, having a positive renters score could make it easier to qualify for a mortgage down the line.

How Landlords And Property Managers Check Credit

A credit check can mean a lot of different things. It ranges from finding out whether a tenant meets a landlord’s internal criteria to poring over pages of account histories. There’s no one specific score that’s your ticket in. Score requirements can vary among apartments, and it’s sometimes possible to rent with no credit history at all.

As a property manager, you have a fiduciary duty to your clients, Akin said. You have to go through the data and pull as much as you can.

Akin described running background and credit checks on potential tenants, looking at credit scores as well as social media, county records and bank statements, among other things, to check for consistency. There’s not necessarily a minimum credit score that is your ticket in it’s even possible to rent an apartment with no credit in some cases. Here are a few other ways landlords and property managers may check credit:

Read Also: Remove Inquiries In 24 Hours

Can You Get An Apartment Without A Credit Check

Yes, you can get an apartment without a credit check. Some complexes dont run credit checks at all, others will be understanding if you talk to them about why your credit is poor.

Regardless, unless you are going with a super high-end apartment in a downtown area, if you have the will, there is probably a way. Landlords dont want to take unnecessary risks, which is why they run the background and credit checks in the first place, but they also want to keep their units full as well.

Even with bad credit, you can still get an apartment. You may have to do some atypical things such as paying several months upfront or getting a cosigner for the lease, but most landlords are willing to work with you on that.

They are wanting to limit their risk with bringing you on as a tenant, you just have to alleviate those worries of theirs by doing things a bit out of the box.

What Are No Credit Check Apartments

No credit check apartments are apartment units that don’t require a credit check as part of the rental process.

This is a shift from the traditional rental process, where landlords perform a credit check during the tenant screening process.

In theory, any apartment could be a no credit check apartment. However, finding an upscale or luxury no credit check apartment unit is almost impossible. These apartments are usually rented out by landlords in search of eager renters.

For prospective renters, there are several risks involved.

Its important to be critical and wary of no credit check apartments. Usually, landlords choose to forego a credit check because they are desperately looking for tenants to fill the space.

In some cases, no credit check apartments may be undesirable, your landlord may be unprofessional, or you may be the victim of a scam.

You May Like: How Long Will A Repo Stay On My Credit

What Landlords Look At On Your Credit Report

When your landlord reads your credit report, they will be looking for clues about your financial health and habits.

Of much importance is your debt-to-income ratio. In a nutshell, this is the amount of your monthly pre-tax income that gets spent on debt payments. Its certainly not news to you that filing for bankruptcy can have a negative impact on ones credit. A landlord also may be spooked if you have hefty credit card balances.

Your credit history disclosed on your credit report also may include your rental history as some landlords and rental property managers share your business to the credit bureaus. This can be plus if youve been doing the right thing if not, this can work against you.

Too many hard inquiries also can raise red flags for a landlord. This is because frequently applying for different types of credit could suggest financial instability, which increases risk in the eyes of lenders as well as landlords.

Steer Clear Of New Credit Inquiries

If you can avoid it, don’t apply for new credit cards, auto loans or other kinds of credit products right before you apply for an apartment.

When any lender performs a credit check, it leads to what’s called a hard inquiry into your credit history. Hard inquiries appear on the credit report pulled by the lender and may result in a temporary decrease in your credit score.

While the decrease is usually insignificant, roughly five points or so, it can send up red flags to potential landlords. Its negative impact decreases over time, despite inquiries remaining on your credit report for two years.

You May Like: Opensky Credit Increase