How To Get Your Child Tax Credit Money If You Had A Newborn Or Adopted Since Last Filing Your Tax Return

If you had a baby by the end of December — or adopted one — you’ll be eligible for up to $3,600 for that child when you file your taxes. That includes back pay for the July through December advance payments and the chunk coming with your refund.

You should get that money when you claim your child on your tax return, which will let the IRS know about your household changes.

What Is A Credit Rating

A credit rating is a measure of how dependable you are in repaying your debts. Most credit-reporting agencies will give you a rating on a scale of 1 to 9, others will assign letters corresponding to the type of credit you’re using. For example, a rating of “1” means you pay your bills within 30 days of the due date, while a rating of “9” can mean that you never pay your bills at all.

An “R” rating is also included in your credit score. This rating is assigned by lenders based on your past history of borrowing and paying off debts, and it can range from 1 through 9. An R1 rating is the best, meaning you pay your debts on time, within 30 days, and an R9 is the worst.

Your credit rating is not established by the government or by financial institutions – it is established by you. If you don’t pay your bills on time or fail to repay a loan, you may be reported to a credit bureau.

If Your Credit Reports Contain Errors Or Outdated Information Heres How To Dispute Those Items With The Credit Reporting Bureaus

By Amy Loftsgordon, Attorney

A “credit report” is a detailed record of how you’ve managed your credit over time. Credit reporting agencies, like Equifax, Experian, and TransUnion, collect data from creditors, lenders, and public records to produce the reports. The agencies then sell the reports to current and prospective creditors, and anyone else with a legitimate business need for the information. For example, lenders use credit reportsor the that results from the data in itto help them decide whether to grant you credit and, if so, under what terms. The better your credit report, the more likely your credit request will be granted, and the lower your interest rate will be. Many landlords, employers, and insurance companies will also consider your credit history when making a decision.

So, your credit report is either a valuable asset or a liability, depending on its contents. The Fair Credit Reporting Act requires credit reporting agencies to adopt reasonable procedures for gathering, maintaining, and distributing information. It also sets accuracy standards for creditors that provide data to agencies. Even with these safeguards, credit reports often have errors and inaccuracies.

In this article, you’ll learn:

Also Check: Does Square Capital Report To Credit Bureaus

Store Your Child Tax Credit Letter With Other Tax Documents

The IRS said it started sending out Letter 6419 to families in late December and will continue sending it through January. If you haven’t received the letter yet, keep an eye on your mailbox, because you’ll need it when you file your taxes this year. The note contains important information about your child tax credit payments that you’ll need to double-check for accuracy — for instance, the number of dependents used to determine the amount of money you get.

What Will Appear On My Credit Report

- Account Names

- Inquiry information

- Public Records

Account Names – Your current and previous credit accounts are mentioned in this part of the account records. In addition to your business listing, your account will include:

- Current status

- Date the account was opened and closed

- Lender name and account number

- Monthly payment amount

- Payment history

The credit limit is usually reported with the maximum amount on the account.

Identifying information – Personal information such as your name, address, Social Security number, and date of birth can be included in credit reports.

Inquiry information – There are two types of inquiries: “hard” and softSoft inquiries are checks on your credit history conducted by existing lenders, insurance providers, and employers. The soft queries on your credit history do not affect your credit score.When you apply for a credit card, vehicle loan, or an installment loan, you may have a hard inquiry. The long term effects of hard queries stay on your credit record for up to 24 months, although the influence on your credit score diminishes with time.

Public Records – Bankruptcies, federal, state, and county property tax liens, civil judgements, and collection accounts are all examples of information included in the public records area.

Read Also: How To Remove Repo Off Credit Report

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: 688 Credit Score

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Learning Your Credit Scores Shouldnt Be The End Of Your Credit Evaluation

Your credit reports from the three major consumer credit bureaus can help shed light on your credit history by showing information like why you may have been turned down for credit, how negative information may affect your credit, and whether someone tried to fraudulently apply for credit under your name.

Equifax, Experian and TransUnion issue separate credit reports, which may contain information about your credit activity, payment history and the status of your credit accounts based on reporting from creditors and other sources.

So why are these reports important? Because credit card issuers and lenders pull and review them to help determine things like whether youre a credit risk, what interest rate theyll offer you, and the amount of your credit limit. Your credit reports may also be reviewed when youre renting an apartment or purchasing insurance.

With so much information, where do you even start when it comes to reading your credit reports? Lets take a look.

- Address

- Phone number

If you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it. You can also notify the creditor that reported the information and request that it send an update to the credit bureau.

You May Like: Does Pre-approval Affect Credit Score

What Is A Credit Report And What Does It Include

Reading time: 3 minutes

Highlights:

- A credit report is a summary of how you have handled your credit accounts

- It’s important to check your credit reports regularly to ensure the information is accurate and complete

A credit report is a summary of how you have handled credit accounts, including the types of accounts and your payment history, as well as certain other information thats reported to credit bureaus by your lenders and creditors.

Potential creditors and lenders use credit reports as part of their decision-making process to decide whether to extend you credit and at what terms. Others, such as potential employers or landlords, may also access your credit reports to help them decide whether to offer you a job or a lease. Your credit reports may also be reviewed for insurance purposes or if youre applying for services such as phone, utilities or a mobile phone contract.

For these reasons, it’s important to check your credit reports regularly to ensure the information in them is accurate and complete.

The three that provide credit reports nationwide are Equifax, Experian and TransUnion. Your credit reports from each may not be identical, as some lenders and creditors may not report to all three. Some may report to only two, one or none at all.

Your Equifax credit report contains the following types of information:

- Identifying information

- Inquiry information

There are two types of inquiries: soft and hard.

- Bankruptcies

- Collections accounts

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

Read Also: Coaf On Credit Report

How To Check Your Credit Score

Its quick and easy to find out your credit score with MoneySuperMarkets and its free to use. Simply give us some information about yourself, and well show you your personal credit rating. Well also let you know what youre likely to be eligible for, and well send you regular updates on how your score is doing along with tips to help you improve your rating.

It may be possible to check your credit score through your bank, or by going directly to one of the credit reference agencies, such as Equifax or Experian. Credit reference agencies will provide your basic credit file online for free, although some of the other services such as credit score monitoring could carry a small fee.

What’s The Difference Between A Credit Score And A Credit Report

Your credit score is different from your . A credit report is a more holistic view of your credit that shows detailed information about your credit activity and current credit situation. Credit reports detail personal information , credit accounts , public records and inquiries into your credit. The three main credit bureaus who issue reports are Experian, Equifax and TransUnion.

“Your credit scores are a proxy for the health of your credit reports,” says Ulzheimer. “So if you’re not going to take the time to pull and review all three of your credit reports, then at the very least you should check your credit scores.”

Also Check: Aargon Agency Scam

Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year, beginning in January 2020, for the next seven years.

What Is Your Credit Report Used For

Individuals and businesses use credit reports for assessing an individuals risk.

They may check your credit report when you apply for any of the following:

- A loan or credit card: Before a lender approves your application, theyll usually check your credit to determine how likely you are to repay the debt. If your credit history suggests that youre a reliable borrower, lenders are more likely to approve your credit applications. Another benefit of having good credit is that youll be offered lower interest rates or larger amounts of money to borrow.

- An apartment: Landlords check your credit report to determine how likely you are to pay your rent on time. Although theres no universal minimum , some landlords might reject your rental application if you have too many negative marks on your credit report.

- A job: Around 16% of employers run credit checks on all candidates. If theres evidence on your credit report that youre unreliable, it can stop you from getting a job. 5

- Utilities: Utility contractors also sometimes perform credit checks to assess the risk that customers will fail to pay their bills. If you dont have a good credit score, you may be required to pay a security deposit.

- Insurance: Insurance providers often run credit checks because they believe your creditworthiness is an indicator of how likely you are to file an insurance claim.

You May Like: When Does Opensky Report To Credit

What’s In Your Credit Reports

A credit report may include basic information about a consumer’s debts, creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living. The data in the reports from the different credit reporting agencies can vary to some degree, depending on which company produces the report.

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

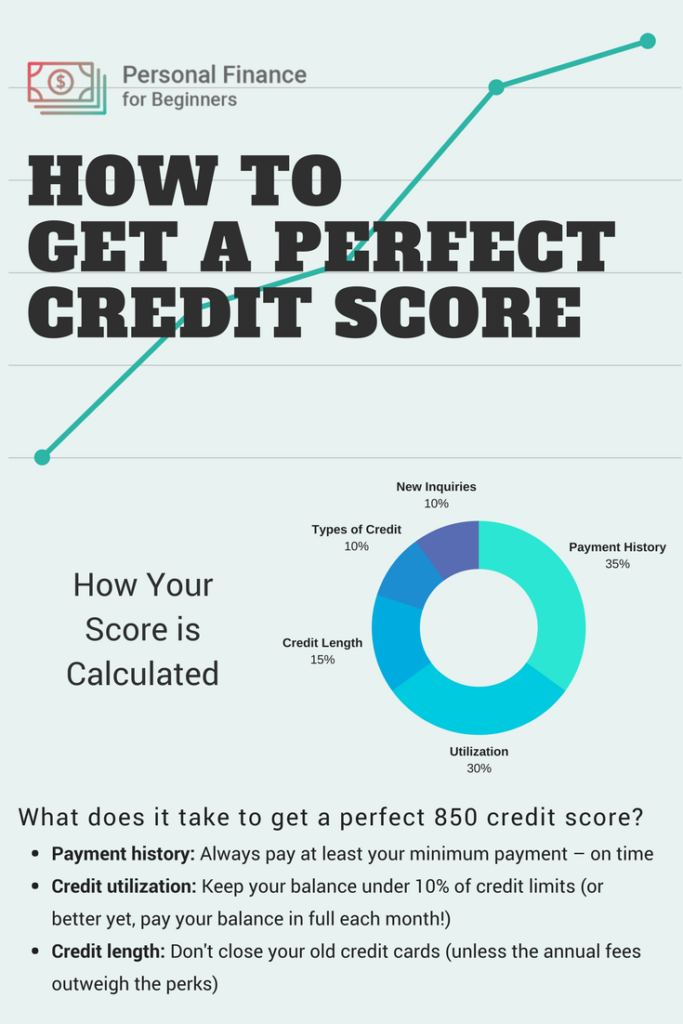

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

You May Like: How To Remove Hard Inquiries From Credit Report Fast

Strategies That Will Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to improve your credit score, there are a number of simple things that you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

Crisil Revises Credit Rating Of Basf India

CRISIL has decided to put the rating of CRISIL AAA to the Non-Convertible Debentures of BASF India under rating watch with negative implications. The move to do so is been seen as an emerging situation which may affect the credit profile of BASF India. It must be noted here that the ratings on Fixed Deposits have been reaffirmed at FAAA/Stable and that of Commercial paper at CRISIL A1+. CRISIL is a global analytical company providing ratings, research, and risk and policy advisory services.

9 April 2020

Read Also: 588 Credit Score Car Loan

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.