How Long Does A Credit Check Take At Rentprep

At RentPrep, the most common turnaround time for a tenant screening report is an hour or less for our RentPrep Background & Credit Check. This allows an FCRA Certified Screener to review the information and make sure that everything on the report is reportable according to the FCRA.

Our Platinum reports have a turnaround time of up to 24 hours.

For Enterprise customers, you may notice that reports take longer to come back than usual, and you might be wondering why the delay. This is because our screeners are making phone calls to current and previous landlords, as well as the applicants current employer.

If we get a hold of everyone on the first try, we will have the report back within the hour. But we usually end up making several phone calls to the landlords/employer before we connect.

You can see all of our tenant screening packages at this link.

What To Do If Your Application Is Rejected Because Of Your Credit Score

If your application was denied due to your credit score, you should receive an official notification that is actually required by law to be provided. It will be sent by the reporting agency and will show you the score that the landlord saw, as well as instructions on how you can request a copy of your credit report for free.

The reason you have the ability to check your report for free is to ensure you have a chance to review it for errors. That way, if you were rejected due to a mistake, you can reach out to the credit bureau to have the issue corrected.

Unless there was a mistake on your credit report, the landlord isnt required to work from you if you dont meet their minimal cutoff. However, if you have access to a cosigner who can help you cross the threshold, you can certainly ask if theyd be willing to reconsider with a cosigner on the application.

If not, then your best bet is to move on. Luckily, you now know the exact state of your credit score, and that may help you during your search. You can focus on properties where your credit score wont be a disqualifier, or that will let you move forward with a cosigner. You can also choose to work to boost your score before you apply for a place again if you dont have to move right away.

Ultimately, the important part is not to get discouraged. It is possible to recover. Take what you know now and use it to create a new plan. In the end, your diligence will likely pay off.

About

The Difference Between Your Credit Score And Credit Report

There are three credit bureaus that produce : Equifax, Experian and TransUnion. When you open a credit card or loan, the lender will report activity to at least one credit bureau, which will then add it to your credit report. Your credit reports show both current and past credit accounts, as well as legal judgments like liens and bankruptcies.

A credit score is a three-digit number that ranges from 300 to 850. The score is determined by an algorithm that takes all the items on your credit report into account. The higher the score, the more responsible you appear as a borrower.

There are two main companies that produce credit scores: FICO and VantageScore. FICO is responsible for 90% of all credit scores used by lenders, but VantageScore is more common with free credit scoring websites. Both companies use similar scoring models to determine your scores, so there should only be a slight discrepancy between a FICO score and a VantageScore.

There are dozens of credit score iterations, and which one is used depends on the type of lender looking at it. For example, the credit score an auto lender sees may be slightly different than the one a mortgage lender sees.

Also Check: Does Speedy Cash Report To Credit Bureaus

Does Checking Your Credit Score Lower It

Checking your own credit score is considered a soft inquiry and does not lower your credit. There are many free credit score services and out there, and these services do not generally perform hard inquiries on your credit file. If a credit-tracking app or website does make an inquiry into your file as part of its credit monitoring process, it will be a soft inquiry that will have no effect on your credit score.

You also dont need to worry about lowering your credit by checking your credit report. Any time you pull your credit file from Experian, TransUnion or Equifax to assess your credit history and/or dispute credit report errors, it counts as a soft inquiry and wont affect your credit score.

Passing Your Apartment Credit Check

You can improve your chances of getting the apartment by checking your credit report. The Fair Credit Reporting Act allows consumers to receive one free credit report per year from each of the three major credit bureaus. Make sure to check for errors on your report, and get them fixed right away.

While you can’t control how a landlord interprets your credit report, you can prepare to answer any questions that might come up. It’s a good idea to check your report, fix any mistakes, gather your pay stubs and references before going through an apartment credit check.

Don’t Miss: Aargon Com

How Many Points Does A Hard Inquiry Affect Your Credit Score

A single hard inquiry will drop your score by no more than five points. Often no points are subtracted. However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen.

People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. Thats way more inquiries than most of us need to find a good deal on a car loan or credit card.

Realistically, only a narrow group of people has good reason to be cautious about the effect inquiries could have on their FICO score, Watt said.

Heres who might be concerned, according to Watt:

- People who take an unusually long time to shop for a new mortgage or auto loan.

- Consumers who shop around in the same year for several different lines of credit not associated with a mortgage or auto loan.

- People who know before they begin applying for credit presumably from conversations with creditors that their credit score barely qualifies them for their desired credit offering.

Why It Affects Your Apartment Application

If your credit score is below 620, it will signal to the landlord that youre a risky renter. Ultimately, landlords rely on your rent money as income, and they want a tenant who is going to pay them in full and on time every month. So, if your credit score is low or you have a history of late payments, they might be less inclined to choose you as their tenant.

When you submit your application, youre in competition with other renters vying for the same apartment. Put yourself in the landlords shoes for a moment and think about which renter youd pick with the following example:

Andy has a credit score of 550. His credit card payments are chronically late and he recently bought a new car for which he has to make monthly payments.

Emily has a credit score of 660. Her credit card payments are usually on time and she makes student loan payments that are generally on time.

Emilys credit score and history arent perfect, and thats ok. There are going to be instances where you cant make every payment on time, and bills are going to pile up. Nobody is perfect, and landlords know that. In this situation, though, its still easy to see which choice youd make if you were the landlord. Andys credit score would be classified as Very Bad, and his history of late payments combined with his new car payments make him a riskier choice than Emily.

Read Also: How To Dispute A Missed Payment On Credit Report

What Else Can I Do

While its more than likely that your landlord will do a credit check, there are ways to do so as a soft pull.

If the 30-day grace period provided by FICO and the 14-day one for VantageScore doesnt seem like enough, and still makes you antsy, ask your landlord directly if their inquiry approach will result in a hard or soft pull?

If its the former, see if your landlord will allow you to provide your own copy of your credit reportwhich you can download for free on www.annualcreditreport.com, which is a soft pull.

While some landlords might not be open to your providing your own report, it may be worth giving it a shot.

Note that hard credit inquiries remain on your credit report for about two years.

Read on: What Do Landlords Look for in a Credit Check?

Build Up Your Savings

Before you move into a new apartment, prepare for your increased cost of living.

If you have the ability to live rent-free with a family member while working from home, take advantage of it by “practicing” paying your rent in the months leading up to your move. Every month, transfer enough money to cover what your future apartment’s rent will be into a savings account. After six months, you’ll have a nice emergency cushion and you’ll have built up the budgeting muscle to know you can afford your future costs.

For this trick, Ally is a good choice since you can do all your banking in one place. While the Ally Online Savings Account is a good high-yield account on its own, account holders can enjoy even more benefits if they also have an Ally Interest Checking Account. If you have an Ally Savings account, you can create 10 different “buckets” within the same account, organizing your money easily. You can create a designated fund for your security deposit and another called “Emergency Savings” where you can stash those practice rent payments.

-

No monthly maintenance fee

-

Maximum transactions

Up to 6 free withdrawals or transfers per statement cycle *The 6/statement cycle withdrawal limit is waived during the coronavirus outbreak under Regulation D

-

Excessive transactions fee

-

Yes, if have an Ally checking account

Terms apply.

Also Check: Does Paypal Credit Report To Credit Bureaus

What Is A Credit Inquiry

Anytime someone checks your credit report including yourself, lenders, banks or even landlords, its recorded on your report as a soft or hard credit inquiry.

Each of the three credit bureausEquifax, Experian and TransUnionkeep track of the inquiries on your report because it can say a lot about the risk you pose to lenders. While lenders arent too worried about soft inquiries because it doesnt impact your credit score, they do take caution around hard inquiries. In the lenders eye, multiple hard inquiries can indicate youre taking on more credit than you may be able to afford.

For example, according to FICO, People with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy.

Steer Clear Of New Credit Inquiries

If you can avoid it, don’t apply for new credit cards, auto loans or other kinds of credit products right before you apply for an apartment.

When any lender performs a credit check, it leads to what’s called a hard inquiry into your credit history. Hard inquiries appear on the credit report pulled by the lender and may result in a temporary decrease in your credit score.

While the decrease is usually insignificant, roughly five points or so, it can send up red flags to potential landlords. Its negative impact decreases over time, despite inquiries remaining on your credit report for two years.

Read Also: Does Zzounds Report To Credit Bureau

Consider Improving Your Credit Before Applying

If credit issues are consistently preventing you from getting the apartment you want, think about pausing your apartment search and taking time to improve your credit. Of course, this strategy only works if you’re in a position to postpone your move. But if you can waitand work on your credityou may improve your prospects. Several months or a year of making on-time payments, paying off late accounts and paying down debt can help to raise your credit score. And putting more time between any negative events like collections or bankruptcies and your rental application might help your application look more promising.

You might also want to take a look at Experian Boost. The free service from Experian connects to your bank account and adds bills such as utility, cellphone and streaming service payments to your credit report so they can be factored into your scores. The average Boost user who sees an increase improves their credit score by 12 points.

The credit score you need to secure a rental will vary the higher your credit score and the cleaner your credit report, the better. You may be able to work around credit issues by finding a landlord who doesn’t check credit, choosing a more modest place to live, or emphasizing financial strengths like a high income or large upfront payment.

How Applying For Rentals Affects Your Credit Score

Many landlords pull your credit report when you’re approving your rental application. The hard inquiry that comes from a credit check can affect your credit score.

Inquiries are 10% of your credit score, but fortunately, apartment hunting may be treated the same as mortgage or auto loan rate shopping. In an email to The Balance, a FICO executive confirmed that multiple identifiable tenant screening related inquiries are included in the special FICO Score inquiry treatment logic. In other words, multiple apartment-hunting inquiries are treated as just a single inquiry as long as they’re completed in the same timeframe.

Not all landlords or leasing agents pull your credit information to qualify you for a rental. Applying for an an apartment won’t hurt your credit if there’s no credit check in the process. The application also won’t hurt your credit score if the landlord uses a service that does a soft credit check. You can ask the landlord for their process to find out whether there’s a credit review involved.

You May Like: Usaa Credit Repair

When The Wait Is Worth It

More complete reports often take more time because of issues like those mentioned above. Though taking more time to verify employer history may seem to delay the process, it actually saves landlords time. In fact, landlords love this report because it saves them the time of making those verification calls.

Without an FCRA Certified Screener reviewing the informationmost specifically, the criminal and eviction reportsyou could have information on it that is not compliant with the FCRA, and therefore not allowed to be held against the applicant.

Waiting for the report to be reviewed by a certified screener ensures that all information you use is compliant with current regulations. Any information you cannot use to decide about tenants will not be included in your RentPrep reports.

In the end, as long as you are screening all of your applicants, you are doing the right thing, and it doesnt matter which package you choose. Just make sure you are happy with the information received, and that you understand how to read the completed report.

Why Credit Karma Won’t Hurt Your Score

Credit Karma checks your FICO score on your behalf and therefore conducts soft inquiries. Soft inquiries differ from hard inquiries in that they leave your credit scores untouched. Multiple hard inquiries done in a short period of time can knock off as much as five points per inquiry and can stay on the record for upward of two years.

Credit bureaus tend to deduct points, particularly if the person has a short or only a few accounts. Credit bureaus interpret multiple hard inquiries as showing that the person may be a high-risk borrower. The bureaus suspect that the person may be desperate for credit or was unable to get the credit needed from other creditors. MyFICO reports that people with multiple hard inquiries are eight times more likely to declare bankruptcy than other people with no bankruptcies on their reports.

Recommended Reading: Unlocking Credit Reports

A Good Overall Credit Score

Landlords will focus on your actual credit information, beginning with your FICO Score: A score above 670 usually shows a potential landlord that you have a good credit record, but this number can vary depending on where you live, your income, the monthly rent, and how competitive the local rental market is.

Are Landlords Only Looking At Credit Scores Or The Whole Report

In most cases, landlords are going to look at both your report and credit score. In many ways, your credit score is a summary. It lets landlords know at a glance your overall creditworthiness, and may be used to determine if the rest of your application is worth reviewing.

However, if your credit score doesnt automatically disqualify you from renting the apartment, they are likely going to review the rest of the report.

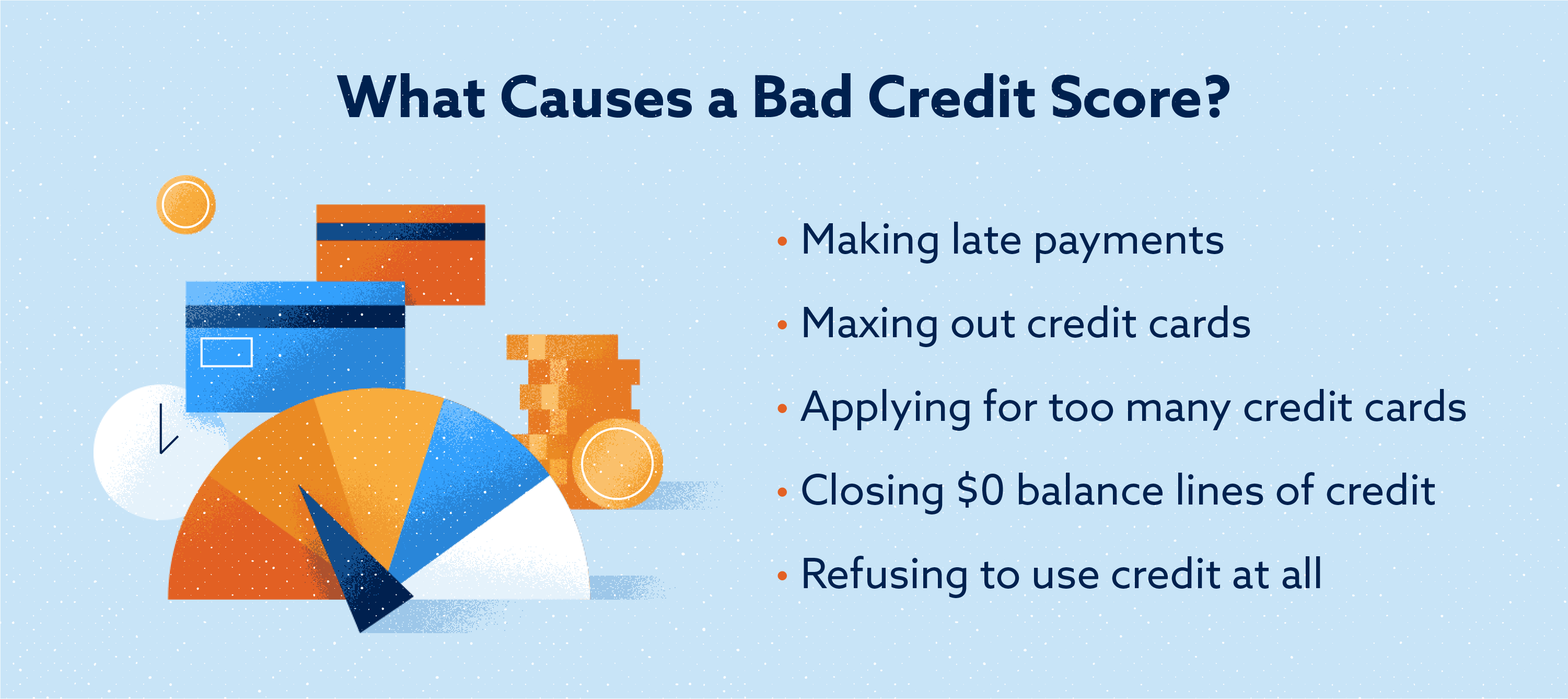

Generally, landlords will want to review your credit reports for potential red flags, such as:

- Late payments

- Bankruptcy history

- High debt payment amounts

Whether any of those details make you ineligible for an apartment may vary from one landlord to the next. Additionally, there may be state laws that prevent landlords from considering certain information that may appear on your credit report, though this can differ depending on your location.

Don’t Miss: Does Getting Married Affect Your Credit Score

What Do Landlords Look For On Your Credit Report

Landlords check your credit for many of the same reasons lenders do: They want to know if you’re likely to pay your bill on time, based on your past history of paying off debt.

In addition to pulling your credit score, landlords may also check your credit report for evictions, bankruptcies, accounts in collections, loan defaults and late payments. Before submitting any rental applications, you’ll want to check your credit report and score. You can do this for free at AnnualCreditReport.com you can also access your Experian credit report and directly through Experian. Looking over your reports and scores will tell you where exactly your credit stands, and will provide clues to what you’ll need to do to increase your scores.

In addition to your credit, landlords may use other types of reports and background checks to screen you as a potential tenant. Tenant screening may also include criminal background checks, a review of your employment history or contacting references. If a landlord has reported your payment history to a credit reporting agency like Experian’s RentBureau, you may have a renter’s credit score that shows whether you’ve paid your rent on time.

Renters in competitive cities like San Francisco, Boston and New York have average credit scores above 700, according to RENTCafé, so you might need to set your sights a little higher if you want to live there.