Is Bank Of America A Real Bank

Bank of America. This bank is, of course, owned by the United States government, the real Bank of America, and is unlike any other bank. First of all, your goal is not to make a profit, even if it is calculated on paper, and your loans are to help your borrowers and not shareholders, better known as taxpayers.

How Do You Dispute An Inquiry

In addition to errors, like inaccurate bill payment data, accounts belonging to someone else, or outdated account balances, credit reports may show several hard inquiries, or requests for full reports, including from sources you dont know. Experts say unauthorized hard inquiries could be report errors or could signal potential identity theft. Importantly, too many hard inquiries can hurt credit and decrease your score. So, experts recommend you dispute any hard inquiries that you dont recognize.6

Check All Three Credit Reports For Errors

Through April 2022, youre entitled to free weekly credit reports from the three major credit reporting bureaus: Experian, Equifax and TransUnion. Request them by using AnnualCreditReport.com.

There may be small differences among your reports, because some creditors dont report your account activity to all three bureaus. But if negative information has popped up on one report, its wise to see whether its also on the other two.

There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

Don’t Miss: Usaa Credit Card Credit Score

What Transactions Can Be Disputed

Which transactions can be disputed? If the outcome of the transaction did not meet your expectations, for example if the trader charges an incorrect amount or the transaction is repeated, you can appeal. Fraudulent transactions can also be challenged. A fraudulent transaction is a transaction in which you did not participate.

Your Legal Rights To Dispute Credit Reports

Because inaccurate credit reports can potentially harm you financially, its worth knowing all your dispute-related rights under the Fair Credit Reporting Act , the federal statute that regulates credit reporting and safeguards consumers. The law stipulates your right to:

- One free annual credit report that contains all information on file at the time of your request from each of the three credit bureaus.

- Know who received your credit report in the past year .

- Dispute a report with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the information supplier are legally obligated to investigate your dispute.

- Another free credit report should an application for a loan, credit card, etc., be denied because of information in your credit report. Should you choose to dispute the credit report, you must do so within 60 days of that denial.

- Add your own explanatory note to your credit report if your dispute is not resolved to your satisfaction.8

Don’t Miss: Does Paypal Credit Report To The Credit Bureaus 2019

How To File Dispute With Paypal

- Log in to your PayPal account and go to the Resolution Center.

- Open your dispute. The PayPal Solution Center allows you to message the seller directly to resolve any issues.

- Report a problem with a purchase or an unauthorized purchase.

- Please select a category for your purchase from the drop down menu.

How Do You Dispute A Debit Card Charge

How to dispute a chargeWhat happens when you dispute a charge? Unauthorized or Fraudulent Payments. The credit card company may decide that you owe the disputed amount if you and the merchant cannot agree on the rates it will accept. But in the event that you have not authorized the cancellation, you are better protected.How often do you have to dispute a charge?You have 60 days from the date the disputed charge appâ¦

Don’t Miss: Does Marriage Affect Credit

How Do I Dispute A Transaction On My Td Access Card

If your dispute is related to your TD Access Card, you must submit a dispute resolution request as described in your account agreement within 30 days from the date you receive notification of the transaction. You should know all the information about the problem, including dates, amounts and other information you have.

Do I Have To File A Dispute With Experian Myself

While it is relatively easy to file a dispute with Experian by yourself, the process can be overwhelming and intimidating. As a consumer, you can turn to the best credit repair companies who will hold your hand through the entire process.

Dealing with the credit bureaus is their forte. They know what disputes work and which ones do not. Additionally, they will protect your consumer rights under the Fair Credit Reporting Act . If you want professional help, then give a try.

To date, they have removed thousands of negative items off Experian credit reports.

Recommended Reading: Will Paypal Credit Affect Credit Score

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

How Can I Add A Notice Of Correction To My Account

It’s pretty easy to put a Notice of Correction on your Experian Credit Report if you feel that it’s the right step for you. All you need to do is contact Experian and outline what you want your Notice of Correction to highlight and which transactions on your report it applies to. You’d need to contact the other credit reference agencies to request they add it to their reports too.

Don’t Miss: Does Bank Of America Report Authorized Users To Credit Bureaus

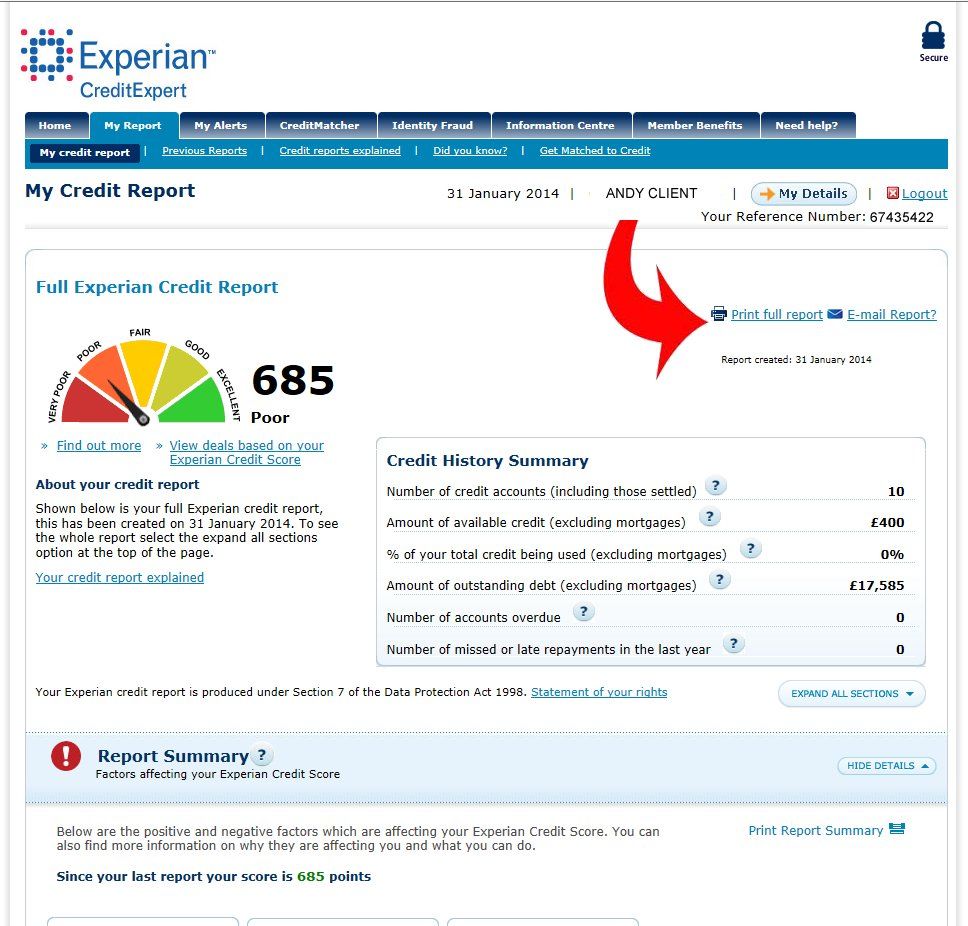

Review Your Credit Reports For Errors

Your are based on information provided by companies to the three major credit bureausExperian, Equifax and Transunion. To identify which credit reports contain errors, you have to review each report separately. You can do this by visiting AnnualCreditReport.com. Due to Covid-19, you can view all three of your reports for free weekly through April 20, 2022.

Disputes Related To Accounts Or Public Records

- The information you disputed has been updated.

- The information you disputed might have been verified as accurate by the data furnisher, but other information on your account unrelated to your dispute has been updated.

Don’t Miss: Is 611 A Good Credit Score

Disputing Inaccurate Hard Inquiries Yourself

It’s important to check your credit reports regularly for accuracy. If, while doing this, you’ve noticed a hard inquiry on your credit report that you believe is the result of identity theft, you can file a dispute with each of the three national credit reporting agencies and petition to have them update the inaccurate information.

The first step is to review your Experian credit report through our Dispute Center and verify your information. Next, confirm that the inquiry was not a result of identity theft.

There may be situations where you don’t recognize the name of a company that checked your credit or you don’t remember applying for a loan with a company you do recognize. Here are a few scenarios when inquiries you don’t recognize may be legitimate:

If you don’t recognize the company name that performed the hard inquiry, contact the company for more information. When you check your credit report through the Experian Dispute Center, the hard inquiry will be accompanied by the company name and typically the mailing address and a phone number.

If you have verified that the hard inquiry is due to identity theft, then the dispute would be handled over the phone with Experian specialists. You can visit our Dispute Center to find out support options. There is no charge to use this service.

Where To Send Your Dispute

You SHOULD ALWAYS mail your dispute to Experian to be able to PROVE they received it .

Mail your dispute to Experian at the following address:

Experian

There are many template dispute letters on the web.

BUT, WE HAVE A SPECIAL TEMPLATE THAT YOU MAY WANT TO USE BELOW.

Submitting your dispute request online is the wrong way to do it.

You May Like: How To Get Public Records Removed From Credit Report

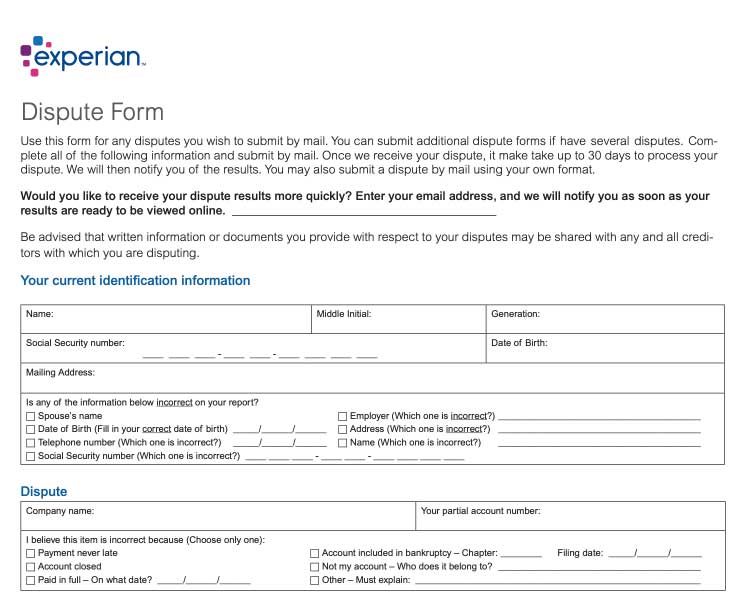

How To File A Dispute

If you need to correct your name on your credit reports, you must file a dispute with each credit bureau that lists the name incorrectly. The process differs somewhat for each of the national credit bureaus. The Experian Dispute Center webpage explains procedures for submitting disputes online, by phone or by mail.

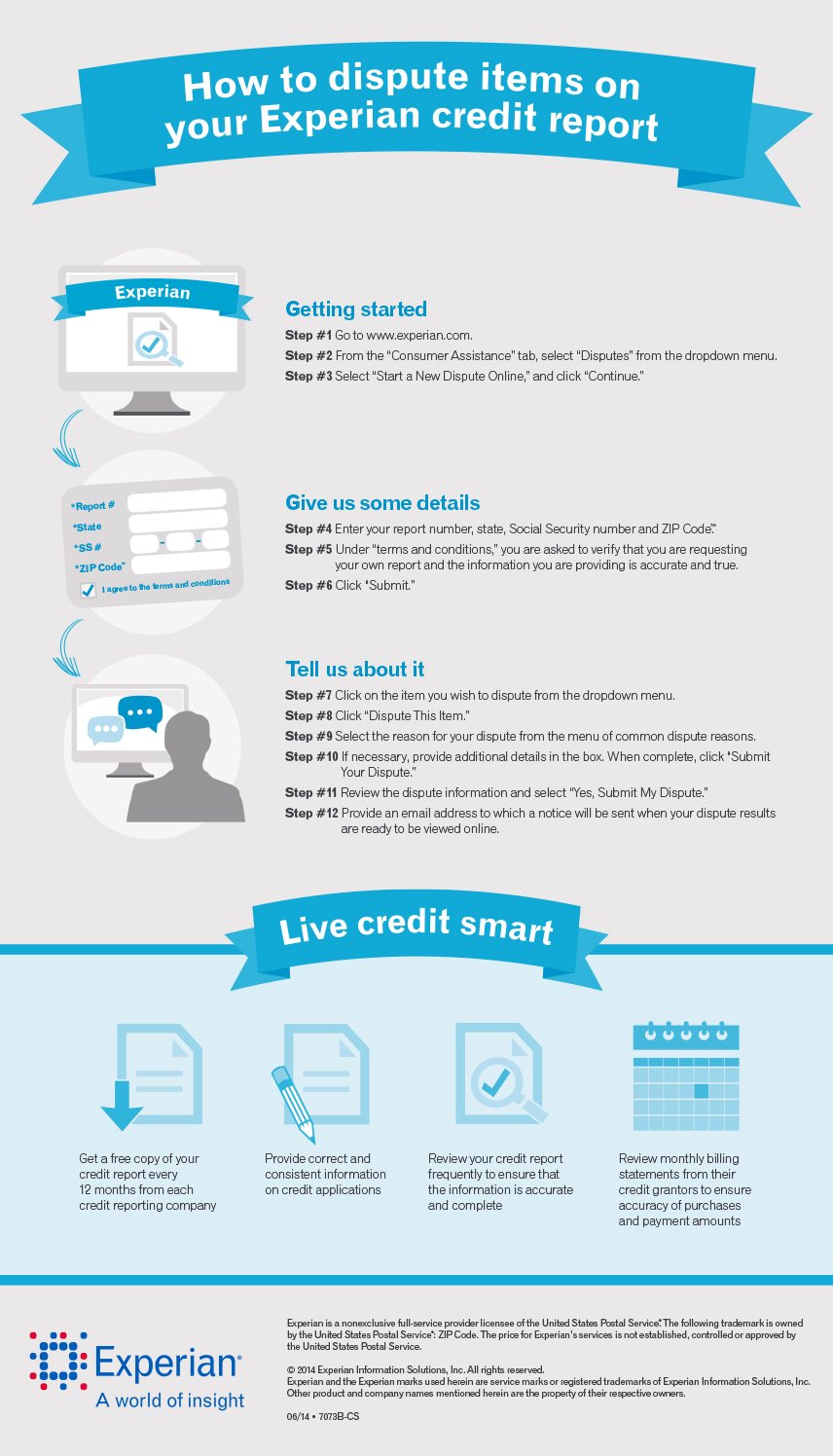

How To Dispute Something On Your Experian Credit Report

If your Experian credit report has any errors, this step-by-step guide will help you through the process of disputing the inaccurate info.

Mistakes on your credit report are far more common than many people are aware of. Unfortunately, errors on your credit report can drag down your credit score. This can be a major problem, since your credit score is used in all sorts of ways.

Lenders use your credit score to determine if you can borrow, and what interest youll have to pay to do so, whether youre applying for a personal loan or a . Utility companies use your score to assess how big of a deposit youll have to make to connect to service, and cell phone companies use it to decide whether to give you a phone on a contract. Car insurers also use it to determine your rates, and employers sometimes check your credit as part of a background check.

Since your credit score is so important, you should be checking your credit reports regularly so you can take action if theres any inaccurate information on your reports. If you do find an error on your Experian credit report, take the following steps to make sure it gets corrected.

Recommended Reading: Aargon Collection Agency Reviews

Recommended Reading: Carmax Installment

Check For Updates To Your Credit Report

Updates to your affected credit reports may take some time to appear. It can depend on the specific credit bureaus update cycle and when the furnisher sends the new information to the credit bureau.

If the update doesnt appear on your credit reports within several months, contact the credit bureaus and the furnisher to verify its reporting your account information to the bureaus.

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, you’ll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didn’t initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

Also Check: Shopify Capital Eligibility Review Changed

A Guide To Credit Report Disputes

Reading time: 4 minutes

- Regularly checking your credit reports can help ensure information is accurate and complete

- If you believe information on your credit reports is inaccurate or incomplete, contact the lender

- You can also file a free dispute with the three nationwide credit bureaus

When reviewing your credit reports, its important to make sure all of the information is complete and accurate. This includes everything from the account information to the other personal information thats on your credit report such as your home address, name, and Social Security number.

Here are some steps you can take to address information you believe is inaccurate or incomplete:

What information can I dispute on my credit reports?

What should I expect after filing a dispute?

Call Or Write To Experian

If youd rather not deal with this issue over the web, you can send your dispute request in writing to:

ExperianP.O. Box 9701Allen, Texas 9701

The Federal Trade Commission offers a helpful sample letter for disputing errors on your credit report in writing.

Or, you can call 1-888-397-3742 to speak with a representative directly.

Read Also: Synchrony Ntwk Credit Card

What Is A Dispute Transaction

Competitive effect. If your bank statement contains a transaction that you want to dispute, for example if the dollar amount does not match the receipt, or if you have not received the goods to which the transaction relates, you have the option to mark that transaction in the system as disputed to mark .

Non-Refundable Tax Credit,How To Define Non-Refundable Tax Credit?A non-refundable tax credit is a tax credit that increases the liability of taxpayers only through e. The taxpayer automatically loses the remaining amount of the credit. Non-refundable credit can also be called non-refundable tax credit, which can be compared to refundable tax credit.A non-refundable tax credit is a type of tax benefit that reduces taxable income by up to one dollar at a time.Non-refundable tax credit caâ¦

What Happens After You Dispute Information On Your Credit Report

Tip

If you suspect that the error on your report is a result of identity theft, visit IdentityTheft.gov, the federal governments one-stop resource to help you report and recover from identity theft.

If the furnisher corrects your information after your dispute, it must notify all of the credit reporting companies it sent the inaccurate information to, so they can update their reports with the correct information.

If the furnisher determines that the information is accurate and does not update or remove the information, you can request the credit reporting company to include a statement explaining the dispute in your credit file. This statement will be included in future reports and provided to whoever requests your credit report.

Read Also: Paypal Credit Hard Inquiry

How We Make Money

We are an independent publisher. Our advertisers do not direct our editorial content. Any opinions, analyses, reviews, or recommendations expressed in editorial content are those of the authors alone, and have not been reviewed, approved, or otherwise endorsed by the advertiser.

To support our work, we are paid in different ways for providing advertising services. For example, some advertisers pay us to display ads, others pay us when you click on certain links, and others pay us when you submit your information to request a quote or other offer details. CNETs compensation is never tied to whether you purchase an insurance product. We dont charge you for our services. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear.

Our insurance content may include references to or advertisements by our corporate affiliate HomeInsurance.com LLC, a licensed insurance producer . And HomeInsurance.com LLC may receive compensation from third parties if you choose to visit and transact on their website. However, all CNET editorial content is independently researched and developed without regard to our corporate relationship to HomeInsurance.com LLC or its advertiser relationships.

When Does A Credit Dispute Hurt Your Credit Score

A dispute doesnt stay on your credit report as a lasting mark unless you request a dispute note after an unsuccessful attempt. However, even that doesnt hurt your credit. The way you see a change in your credit score is after the dispute process, and in many cases, it will be a positive one.

For example, if you correct a large outstanding credit card balance listed on your credit report, youll see a jump in your credit scores because your credit utilization will be lower. The same holds true with inquiries and late payments. The increase may not be enormous depending on the type and number of entries you get removed, but each will contribute to better overall credit history.

Also, be aware of the XB effect. XB is a credit report code used by credit bureaus to indicate that a particular account is currently being disputed. During this time, Experian doesnt include that account as part of your credit score if it happens to be pulled.

So you may end up seeing a significant jump in your credit score because that balance and any associated late payments arent contributing to your score at all. Once the dispute is over, the credit bureau will lift the code. The account is once again included and will also reflect any changes made as a result of the dispute.

Read Also: How To Check Itin Credit Score