The Public Record Entries

First, its essential to understand the three types of public record entries that can impact your credit report.

A tax lien is a law-imposed lien upon property for the payment of taxes. Typically, a tax lien occurs when a person fails to pay taxes owed on property , income taxes or other forms of taxes.

A civil judgment is a legal ruling against a defendant in a court of law. It refers to a judgment on a noncriminal legal matter and often requires the defendant to pay monetary damages.

Bankruptcy is a legal process in which people or other entities who cannot repay debts to creditors try to seek relief from some or all of their debts. In most jurisdictions, bankruptcy is usually imposed by a court and is often initiated by the debtor.

The Fair Credit Reporting Act Public Records And Your Business

Theres an important distinction to be made in the world of public records: FCRA vs. non-FCRA. And when it comes to the consumer reporting solution your business is looking for, you may opt for one, the other, or a bit of both.

What is FCRA?

There are many types of consumer reporting agencies, including credit bureaus and agencies that provide more specialty records such as medical or rental history. The Fair Credit Reporting Act was passed by Congress in 1970 to promote accuracy, fairness, and privacy of consumer information contained in the files of consumer reporting agencies. In fact, it was one of the first instances of data protection law passed in the computer age. Fundamentally, FCRA intends to protect consumers from having their personal consumer reports used against them without their knowledge. It does this by regulating:

1. Consumer reporting agencies2. Users of consumer reports3. Furnishers of consumer information

Many records are used by both FCRA and non-FCRA providers. But its the application of those records by both providers that is crucial. Depending on how your business is utilizing public records, you may want to re-evaluate the type of provider youre using. Lets break down the difference of FCRA versus non-FCRA compliant providers and look at how each can provide benefits for your business.

FCRA

The Fair Credit Reporting Act has two key stipulations:

1. Every consumer has a right to know what is in their report from any of these agencies.

Non-FCRA

One Of My Defaulted Accounts Has Been Sold On To A Debt Collection Company This Debt Is Now Appearing Twice On My Credit File Is This Right

If it is clear from looking at the two entries that they relate to the same account, with the same default date and balances and the original debt is clearly showing as settled then it is likely that we would consider this to be fair in terms of the data protection law. However, if the entries are recorded on your credit file in a way that may look like they are two different debts, or that could make the debt remain on your credit file for longer than six years from the date of the original default it is unlikely that we would consider this to be fair.

Recommended Reading: What Company Is Syncb Ppc

What Is A Credit Report

A credit report is a detailed breakdown of an individual’s credit history prepared by a . Credit bureaus collect financial information about individuals and create credit reports based on that information, and lenders use the reports along with other details to determine loan applicants’ .

In the United States, there are three major credit reporting bureaus: Equifax, Experian, and TransUnion. Each of these reporting companies collects information about consumers’ personal financial details and their bill-paying habits to create a unique credit report although most of the information is similar, there are often small differences between the three reports.

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

Don’t Miss: Does Drivetime Report To Credit Bureaus

Your Credit Can Recover From Derogatory Marks

Having derogatory marks on your credit report is not a life sentence. With sound financial behaviors, your credit score can recover. Youll need to make payments on time, get rid of debts and maintain a good credit utilization ratio. If you dont know where to start, consider

Lexington Law knows how to spot incorrect data on your credit reports and give you helpful credit tips. Credit repair takes time, so its essential you start today.

Reviewed by John Heath, Directing Attorney of Lexington Law Firm. by Lexington Law.

Born and raised in Salt Lake City, John Heath earned his BA from the University of Utah and his Juris Doctor from Ohio Northern University. John has been the Directing Attorney of Lexington Law Firm since 2004. The firm focuses primarily on consumer credit report repair, but also practices family law, criminal law, general consumer litigation and collection defense on behalf of consumer debtors. John is admitted to practice law in Utah, Colorado, Washington D. C., Georgia, Texas and New York.

Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

Don’t Miss: How To Get A Repossession Off Credit Report

How Long Does A Public Record Stay On Credit

. Similarly, it is asked, what is considered a public record on your credit report?

Public records can impact your creditscore in a variety of ways. In the world of , public records can include bankruptcy,judgments, liens, lawsuits, and foreclosures. Anything thatcompanies may consider a legal liability is a matter of publicrecord. It will usually show up on your creditreport.

Additionally, do public records go away? Public records could plague your credit for thebetter part of a decade. Even if you repay the money you owe,public records with negative information typically remain onyour credit reports for seven to 10 years. Public recordswith adverse information may even occasionally wind up on yourcredit reports by mistake.

Similarly, is it true that after 7 years your credit is clear?

What the Seven–Year Mark Means. Afterseven years, most negative items will simply fall off yourcredit report. You still owe your creditor even when thedebt is no longer listed on your credit report. Creditors,lenders, and debt collectors can still use the proper legalchannels to collect the debt from you.

How long does a Judgement stay on your record?

seven years

How Long Does Information Stay On My Credit Report

Positive credit information, like information about paid accounts with no negative history, may remain on your credit report for up to twenty years. By sharing this information with creditors, lenders see the types of credit you managed successfully in the past and recognize your previous good credit history, even when you have limited or no current credit history.

Adverse credit history, collections and defaulted accounts that were not settled through a debt repayment program , are removed automatically from your credit report after six years from the date the account first went delinquent.

Public records such as judgments and bankruptcies may report on your file for 6 to 10 years depending on the province.

In the case of multiple bankruptcies, each bankruptcy will report for 14 years from the date of discharge.

TransUnion may delete credit information reported about you by a data supplier if our relationship with the data supplier comes to an end. The end of a data supplier relationship may impede our ability to maintain a current and accurate credit file and/or carry out our investigation procedures. We delete credit information in these circumstances to ensure that your credit file remains as accurate, complete and up-to-date as possible.

Read Also: How Do I Unlock My Transunion Credit Report

How Does Information Get On My Credit Report And Is It Updated On A Regular Basis

Lenders provide updates on your account activity to at least one of two credit bureaus in Canada TransUnion and Equifax. Since lenders do not necessarily report to both bureaus, the information on your credit reports may vary. Lenders also report activity to the credit bureaus at different times during the month, which may result in slight differences in your reports and credit scores.

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

You May Like: What Credit Score Does Les Schwab Require

Review Your Reports For Mistakes Inaccuracies Items That Shouldn’t Appear

After you get your credit reports, be sure to review them and dispute any inaccurate information you find. If you’re planning to make a big purchase, like a house or a car, or a significant financial commitment, such as refinancing your mortgage, you might want to review information from all three agencies well in advance.

Not A Permanent Change

Its crucial to note that tax liens and civil judgments might not stay off credit reports forever. This is because reporting on them isnt illegal and the credit bureaus only promised to remove them for a time. This could change sometime in the future, so you still want to avoid incurring these types of public records if possible.

You May Like: Open Sky Loans

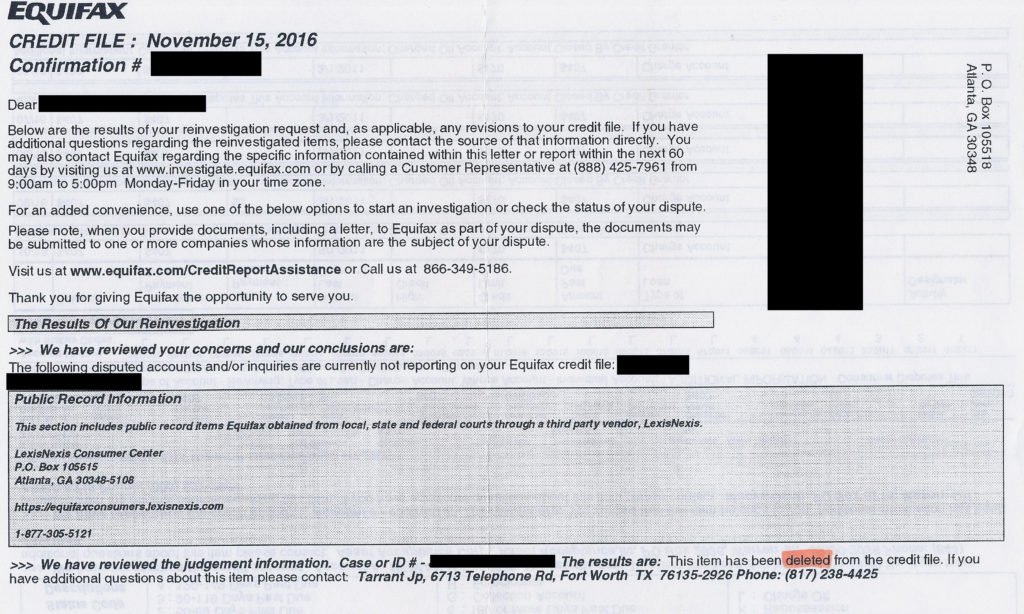

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

I Received A Copy Of My Credit File And There Is No Electoral Roll Information On There I Am Definitely Registered To Vote And This Has Caused My Credit Score To Drop What Can I Do About This

If you find that your electoral roll information is inaccurate, or missing, from your credit file the first thing you should do is raise this as a dispute with the CRA that you obtained your credit file from. They can, in the first instance, try and match you to the correct information. There are easy mistakes to identify such as an obvious mis-keying of a house number or misspelling of a name and in these cases the correct information can be merged, or separated as appropriate. The CRA should reply to let you know that they have resolved the issue or, if they are unable to, explaining why.

If, after raising a dispute with the CRA they have failed to resolve the issue you may want to make a complaint to the ICO. You can find more information about how to make a complaint and the evidence we require in section 5 of our guidance.

You may also wish to contact your local authority as well to ensure that the information regarding your address is correct, for example, the right postcode, flat number, etc.

Also Check: Speedy Cash Debt Collection

Understanding The Updated Public Record Policy

In 2017, the National Consumer Assistance Plan went into effect and changed how data is collected for civil judgments and tax liens before these entries appear as public records on credit reports. The act was initially launched in 2015 by the three major credit bureaus to modify credit reporting rules and set stricter standards. These new standards would ensure that the data found on credit reports are more accurate and up to date.

There are two primary ways this act affects how credit bureaus obtain and report tax lien and court judgment data on consumer credit reports. First, for either of these types of entries to appear on a credit report, the public record must contain a persons:

- Name

- Social Security number or date of birth

This standard applies to both new and existing records that are already on credit reports.

Secondly, public records reported on credit reports must be checked by the credit bureaus for updates every 90 days to ensure their accuracy. If the records are not checked, they should be removed from the credit report.

Bankruptcy records already hold these strict requirements, which is why the changes dont impact this type of public record. However, many tax liens and civil judgments do not uphold these standards, in large part due to different standards of record-keeping at various courthouses.

Applying For Your Credit Report Whilst In Prison

Experian are able to provide free credit reports to anybody in prison. Citizens Advice caseworkers and others who work with people in prison on issues surrounding unmanageable debt can obtain application forms to obtain free credit reports for people in prison by emailing .

A credit report application form must still include proof of identity. You may be able to use the template contained in PSI 35/2009 as identification.

Don’t Miss: How Long Does Negative Information Stay On Chexsystems

There Is An Entry On My Credit File That I Think Is Wrong My Broadband Provider Says I Owe Them Money But I Have Made It Clear That I Am Not Going To Pay For The Month Last Year When Their Service Was Down Can I Have This Entry Amended Because It Is Inaccurate To Show That I Owe Them This Money For A Time When Their Service Wasnt Being Delivered

The ICO cannot decide on issues outside of data protection law. In this instance, while you may consider the data to be inaccurate because you dont think you should have to pay for service you havent received, this is a service complaint which needs to be resolved before we could determine whether this information is accurately recorded on your credit file.

We may be able to look into cases where a repayment agreement is in dispute if:

- You have raised a complaint with the company and have received written confirmation that they agreed not to charge you for the period in question due to poor service.

- You are able to produce substantive evidence the company has acted wrongly. Unfortunately we cannot look into a complaint based on opinion alone.

- You have raised the issue of the dispute with the appropriate regulatory body, such as OFCOM, the Financial Ombudsman Service, or the courts, and they have upheld your complaint.

In the meantime you may wish to request that a Notice of Correction be added to the entry on your credit file. You can find more information about Notices of Correction in our .

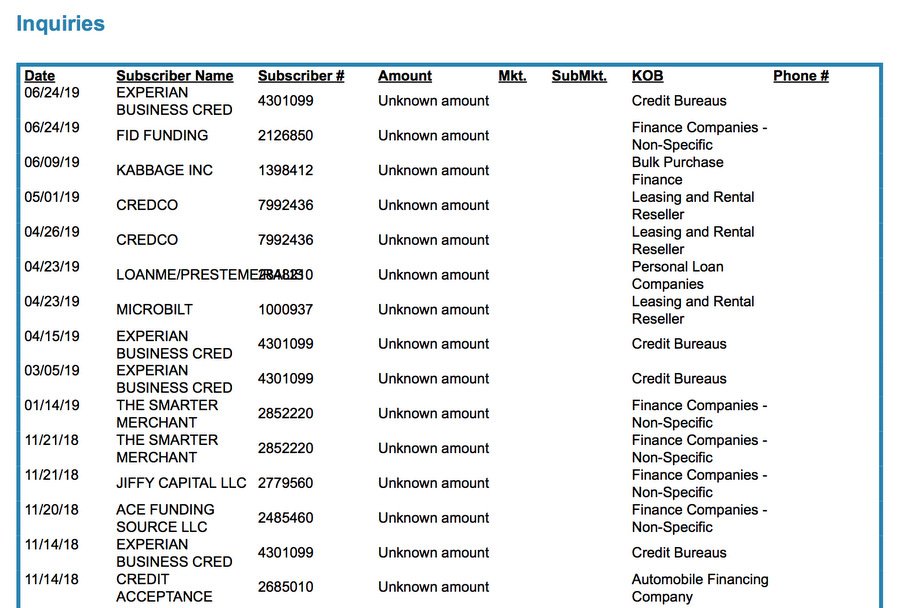

What Is An Inquiry

Provincial and federal laws outline the requirements for what organizations may access your personal credit information. As part of the credit application process, organizations ask for your consent to access information about you. They may also request a credit report when they are looking to collect on a debt, or if you have applied for employment, tenancy, or insurance. Finally, you also have the right to access your credit report.

You May Like: Aargon Agency Complaints

My Partner And I Are Financially Linked Because We Have A Joint Account And Are Both Named On The Mortgage If He Applies For Credit Will The Lender Look At My Credit File As Well As His Will I Be Notified Of This

In short, yes, the lender can have full access to your credit file in the same way it could if it were you applying for credit. This is because your financial situation may have a bearing on whether your partner is offered credit or not. Because you are financially linked they are, effectively, looking at your credit history and ability to repay the loan as a couple rather than as an individual.

You should only be linked to someone who you have a joint account with or in some situations, have agreed to act as a guarantor for . You should not be linked to anyone just because you live at the same address.

When a joint account is closed you can write to the CRAs to request a disassociation from that individual.

If you find a financial link to someone you dont know, or you believe to be inaccurate you should raise this with the CRA and ask that they investigate this for you.

What Is A Credit Score

A credit score is the score that a credit provider will use to help them decide which customers to lend to. Its broadly based on three sets of information:

- your application form

- your credit report

- any information they have about you already.

Guide credit scores are created by credit reference agencies. Theyre based on the information included in your credit record, and are only available to you. Theyre designed to help you understand how firms might use your credit information to decide whether to offer you credit.

Guide scores only offer a general indication of how likely it is that firms might offer credit to you. Having a high score doesnt guarantee any particular lender will actually offer you credit. This is because each firm uses its own criteria, which might vary depending on which credit product youre applying for.

The information held on your credit report and your credit application form might be used to decide:

- whether to offer you credit

- how much credit youll be offered

- how much interest you would be charged.

The most recent information on your report will have the most impact. This is because lenders will be most interested in your current financial situation.

However, information about your financial transactions over the last six years good or bad will still be on record.

Also Check: Does Sezzle Help Build Credit