Manage Credit Cards Better

Sometimes, possessing too many cards can throw CIBIl scores off the rails as an idle unused card could result in default upon non-payment of annual charges, thus causing a red mark in the report. It is due to this very reason that you must check all old cards, and preferably close ones that are not in use. However, you must retain the oldest card to hold on to its detailed history.

Do You Already Know Why You Need To Clean Up Your Credit Record

On the other hand, you might very well know why no one will lend to you. Perhaps:

- You have County Court Judgements against you

- Youre bankrupt

- Or you have done an IVA .

If youve learnt your lesson, or your circumstances have changed so that you have more money now and you know what to do with it, youll want to clean up your credit record so that you can make your money work for you.Its still worth getting your free credit report from the three agencies even if you know why youre struggling to get credit. There may be other errors or old defaults that you arent aware of, which will affect your credit score too.

How To Know If Your Name Is In Cibil Defaulter List

There is no CIBIL defaulter list as such. No credit rating agency or CIBIL issues a defaulter list. Hence, whenever you apply for credit of any kind, the credit body will ask for your score from the credit bureau. If you have a poor credit score, you will not get credit due to a bad repayment record.

Recommended Reading: What Is Aargon Agency

Can I Reduce The Impact Of A Default

Although the default will remain on your credit file for six years, there are a few things you can do to slightly lessen the impact.

- Pay off what you owe although this wont remove the default from your file, once the debt is paid off it will be marked as satisfied. Although it doesnt completely negate the negative impact, it will look better to lenders.

- Offer an explanation it is possible to get in touch with a credit referencing agency and ask them to add a note explaining the circumstances around your default, for instance being made redundant.

- Wait it out if you get your finances back on track, the negative impact of the default will reduce over time. So, after a few years, you may find you have more credit options again.

What Is A Default Notice

A default notice is a notification from a lender asking you to catch up with your payments or else have your account closed. Itâs your chance to stop a default from happening. You should try and pay the amount you owe immediately to avoid a default. Note that lenders donât have to send a default notice when you miss payments, although itâs considered good practice.

Read Also: Credit Score For Affirm Approval

How To Find Out If You Have A Default On Your Credit Report

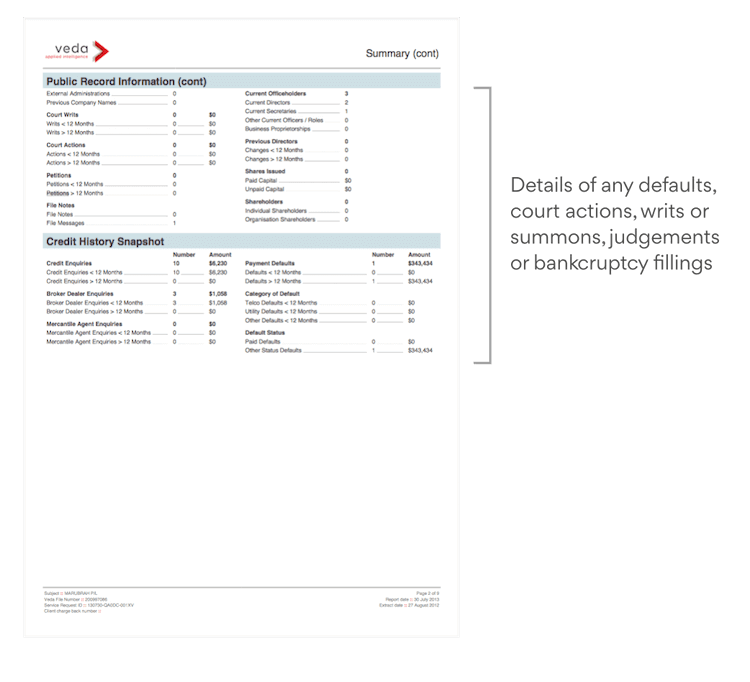

Several methods exist for determining if you have any defaults on your credit report. The important thing is to check all three credit bureaus rather than just one. Some people only check one bureau, and thats why they dont find out about the problem.

You can check and get more information from the three credit bureaus, Experian, Equifax, and Illion

The Bank Didnt Send Me A Default Notice Under The Consumer Credit Act 2006 Can They Still List A Default On My Credit File

In most cases, the answer is likely to be yes, provided that the default recorded is an accurate reflection of events and that when you opened the account you were told that this may happen. It is unlikely that recording the default, even if you dont recall receiving a default notice, would breach data protection law.

A default on your credit file simply means that the lender considers that the relationship between you has broken down. Therefore, while it may be a requirement of the Consumer Credit Act to issue a default notice, there is no data protection obligation on a lender to issue a default notice to individuals before marking an account as being in default on their credit file.

Further information on filing defaults with the CRAs can be found in the Principles for the reporting of arrears, arrangements and defaults at credit reference agencies. The principles in this document have been drawn up by the credit industry in collaboration with the ICO.

Recommended Reading: Aargon Payment

My Partner And I Are Financially Linked Because We Have A Joint Account And Are Both Named On The Mortgage If He Applies For Credit Will The Lender Look At My Credit File As Well As His Will I Be Notified Of This

In short, yes, the lender can have full access to your credit file in the same way it could if it were you applying for credit. This is because your financial situation may have a bearing on whether your partner is offered credit or not. Because you are financially linked they are, effectively, looking at your credit history and ability to repay the loan as a couple rather than as an individual.

You should only be linked to someone who you have a joint account with or in some situations, have agreed to act as a guarantor for . You should not be linked to anyone just because you live at the same address.

When a joint account is closed you can write to the CRAs to request a disassociation from that individual.

If you find a financial link to someone you dont know, or you believe to be inaccurate you should raise this with the CRA and ask that they investigate this for you.

There Are Many Different Types Of Defaults On A Credit Report The Most Common Default Types Include:

-Bankruptcy

Unable to pay current debts, a person or company files for bankruptcy. The debtor or creditors file a petition to start the bankruptcy process. It is possible to use some of the debtors assets to pay down some of the debt.

-Foreclosure

It is a legal procedure wherein a lender seizes and sells the mortgaged property to recover the outstanding debt. Default often occurs when a borrower fails to make a certain amount of monthly payments, but it may also occur when the borrower violates other provisions of the mortgage instrument.

-Judgment

Generally, judgments resolve a debt case in your favour or that of a creditor. Judgments are public documents and may be accessed by prospective creditors, employers, or anybody doing credit checks on you.

It is highly uncommon for one to completely wipe from the public record, and creditors may pursue you for the judgment amount for up to ten to twenty years via the courts.

-Tax Lien

Tax liens are claims or legal rights made against real estate. Liens offer security, enabling an individual or organization to seize property or pursue other legal remedies to fulfil debts and obligations.

Liens are often public documents that warn prospective creditors and others about outstanding obligations.

-Repossession

Repossessions are a negative item on your credit record that may negatively affect your credit score. Repossessions are when assets are seized due to late or missed payments.

-Charge Offs

-Unpaid Debts

Recommended Reading: Credit Score Of 611

Removing Court Listings From Your Credit File

It is important to note that the removal of court listing such as a Judgment or Writ is almost always dependent on the payment or settlement of the debt. This is due to the fact that the removal of a court listing is less about fault and error and more about the cooperation of the plaintiff. The line of least resistance to achieve the removal of such a listing is to have the plaintiff agree to execute a legal document that allows the matter to be reheard and set side with the court. You will appreciate that a plaintiff is highly unlikely to consent to this if they feel they are owed money because following the matter being set aside, the plaintiff waves their claim and their legal action is no longer active.

There are credit repair companies that try to bully and intimidate credit providers into submission. In our experience this approach seldom leads to a positive result and can alienate the credit provider, making effective communication impossible. It is this kind of behavior that is drawing unwanted attention to the industry in general by organisations such as the ASIC which is a great shame. When administered correctly, is a highly valued and needed service that has the potential to change peoples lives in a very positive way.

It is important to understand that honest and effective credit repair is often about reaching a positive outcome for all concerned including the credit provider.

How To Get A Default Removed From Your Credit File

Once a default has been recorded on your credit file, it will remain for six years, but there are steps you can take to reduce the impact it has on your credit.

If youve looked at your credit report using one of the free checks and find a default on your credit file that you think is incorrect, dont worry, you can ask for it to be updated or removed from your credit file.

Youll need to raise a credit report dispute with each of the credit reference agencies, by getting in touch with them and explaining why it should be changed. They will speak to the original lender to check their records and/or Lowell. While the original lender investigates, you can rest assured that any other companies or lenders who need to run a credit check on you will know that the default on your file might not be accurate.

Can Lowell remove a default from my credit file?

If youre concerned that Lowell have added a default to your credit file that shouldnt be there, you can get in touch with us to let us know. Our team will investigate the issue and assess how it needs to be resolved.

Don’t Miss: Prime Visa Card Credit Score

How Do Defaults Work

A default is a financial term, used when a credit agreement has been broken. If youre unable to make payments or you don’t pay the right amount, your creditor may send you a default notice. If the default is applied, it could affect your credit file. Even if you have a default on your file, you can reduce the impact it has on your credit by working with Lowell on an affordable and reasonable payment plan. Find out more about defaults, including how long a default stays on your credit file, how to have a default removed and how working with Lowell can help with a default.

In this guide:

- What is a default on a credit file?

- How to get a default removed from your credit file

- Can I reduce the negative impact of a default?

What Else Do The Cras Do With Personal Data

All of the CRAs have different business functions running through them.

As well as credit referencing, CRAs also operate other activities such as direct marketing and lead generating functions. The data they sell in this area of their business may include information which the CRAs have bought from local authorities about individuals who had not previously opted-out of the full or open electoral register and information from other sources, such as lifestyle questionnaires and competition entries.

Read Also: What Is The Ideal Credit Score To Buy A House

Does Your Credit Score Go Up When A Default Is Removed

When a default is registered on your credit report, it reduces your score. Thus, once a default is removed, no matter why it was removed, your score will increase. But having a default removed is not the only thing you need to consider to improve your credit score. You can build it up in other ways.

You should also keep in mind that the negative impact of having a default will dwindle as time goes on. Lenders will put less scrutiny on a default on a credit report from a date over five years ago than they will one that was added last month.

Someone Else Has Used My Details To Try To Get Credit Fraudulently And There Have Been Lots Of Searches Carried Out In My Name Can I Get These Removed From My Credit File

Searches on your credit file should not have a negative impact on your credit history. Lots of searches in a short space of time however can imply that you are having problems getting credit which, in itself, can impact an organisations decision about whether it will give you credit or not.

If you believe you have been a victim of fraud you should report it to the relevant fraud departments of the organisations involved. As fraud is a crime, you should consider reporting this issue to the police if they are not already aware. You may wish to report the suspected fraud to Action Fraud as well.

The ICO cannot investigate matters of fraud as this falls outside of our remit, and we do not have the power to make a decision on whether or not an account has been opened and/or operated fraudulently.

Recommended Reading: Opensky Payment Due Date

What Is A Credit Enquiry

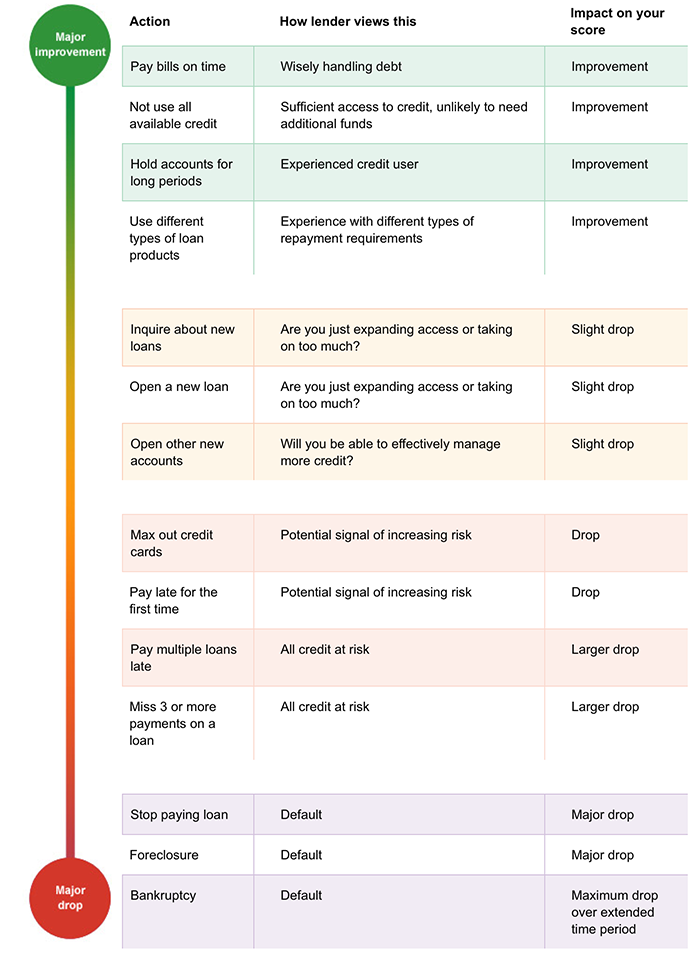

There are two main types of credit enquiries: “soft” enquiries and “hard” enquiries.

A soft enquiry is recorded any time you request a copy of your credit file and doesn’t really have an impact on your credit score.

A “hard” enquiry refers to any request for your credit file that’s made by a third party, such as a lender. For instance, every time you apply for a line of credit, such as a card or personal loan, the lender you’ve applied with will submit a request for your credit file. This request is recorded on your credit history as a “hard credit enquiry”. While a few of these enquiries is usually fine, too many hard enquiries on your credit file can suggest to lenders that you are not able to manage credit accounts responsibly. This may lead to a declined application.

How do I know if I have “too many credit enquiries”?

If you’re concerned about the number of enquiries on your credit history, the first step is to get a copy of your credit file. You can check your credit report and credit score for free with finder and we’ll notify you when something on your report changes, such as a credit enquiry.

When you get your free credit report and look at your credit enquiries, it’s important to note that it’s not so much about the total number of enquiries as it is about the time between them. Less time between credit enquiries increases the chances that they will have a negative impact on your credit score.

Six Years Is The Important Date

A defaulted account will drop off your credit record six years after the default date.

It doesnt matter what happens after the default whether you pay the account in full, start paying it, agree a partial settlement or dont pay anything at all, the account will still be deleted after six years.

So find out what all your default dates are. If you think one is too late, read What Should the Default Date Be? which explains how to get an incorrect date changed.

Read Also: Aargon Agency Las Vegas

What To Do If Your Name Is Still In Cibil Defaulter List

Check your credit report – There could be an error causing your name to be defaulted. Always check on the report and make sure all your details are properly mentioned, like Date of Birth, Name, PAN number, Address, etc.

Another frequent reason why names pop-up in default, is late and incomplete payments on monthly EMIs

How Can I Find Out What Is In My Credit Report

There are a number of ways to find out what is in your credit report. You have the right:

- To get a free copy of your credit report once every 3 months. A credit reporting body cannot charge for this, unless you obtained a copy of your credit report from them in the previous 3 months

- To get a free copy of your credit report within 90 days of having an application for credit rejected

For more information see:

You May Like: Does Paypal Credit Build Credit Score

Where Can I Look Up My Credit File

Credit files can be found on a credit reference agency website. Only use one that is authorised and regulated by the Financial Conduct Authority, such as Experian. The companies offering this service usually offer a free trial where you can consult your credit report for so many days but then have to pay thereafter.

They are useful if you want to access your credit file for free just to check whats there and look for mistakes, and then cancel straight after so you never have to pay.

Can I Remove An Enquiry From My Credit Report

You can’t remove a legitimate enquiry from your credit report. In most cases, you will have to wait until the five years has passed. After this, they are removed from your history.

In general, the only details that can be removed from your credit report are those that are incorrect or erroneous. This includes if a lender made an enquiry without proper authorisation from you. Another example is if your name was attached to an account you never opened or if an account was incorrectly listed as “in default”. In these cases, you can submit a request to have the incorrect details removed from your file.

Read Also: Les Schwab Credit Score Requirements